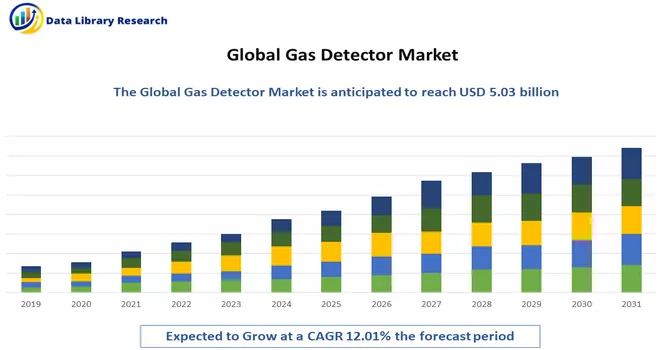

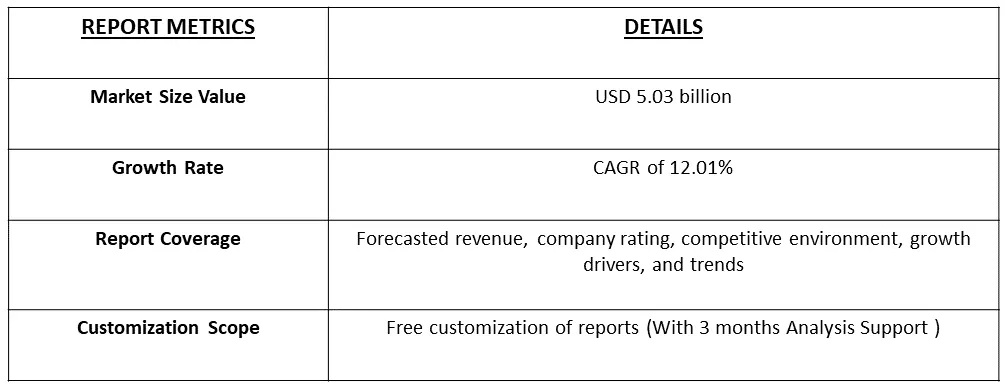

The global gas detection equipment market size was valued at USD 5.03 billion in 2023 and is expected to register a compound annual growth rate (CAGR) of 12.01% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Gas detection equipment is comprised of compact, handheld devices engineered to monitor and identify hazardous gases across diverse environments. These instruments play a vital role in safeguarding personnel in industries where the existence of harmful gases poses potential health and safety risks. Equipped with specialized sensors, portable gas detectors can discern specific gases and issue immediate alerts or alarms when gas concentrations approach hazardous levels. The primary function of these devices is to ensure a proactive response to potential gas-related threats, thereby mitigating risks and promoting a secure working environment for individuals.

The growth of the portable gas detection equipment market is fueled by stringent safety regulations, especially in industries like oil, gas, and Power Generation and Transmission. Increasing industrial activities, technological advancements, and a global emphasis on workplace safety contribute to rising adoption. The expansion of oil and gas exploration, coupled with a growing focus on environmental monitoring, further drives market growth. The imperative response to industrial accidents underscores the importance of effective gas detection systems. Wireless technology adoption, accelerated by the COVID-19 pandemic, streamlines installation, and maintenance processes, boosting market expansion. As emerging economies prioritize safety standards, the demand for portable gas detection solutions is anticipated to rise, ensuring sustained market growth. Thus, all these growth driving factors mentioned above are contributing to the growth of the studied market.

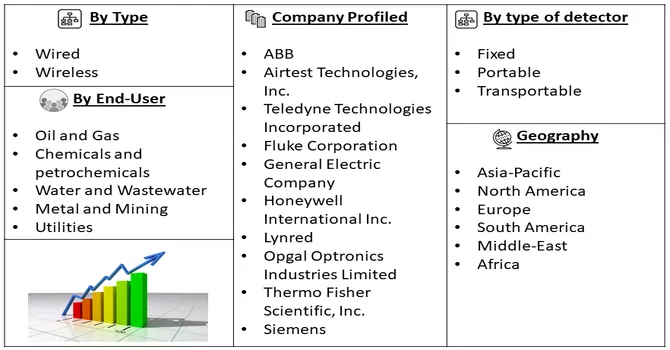

Market segmentation: The report covers Global Gas Detectors Market Growth, and it is segmented by communication type (wired and wireless), type of detector (fixed, portable, and transportable), end-user industry (oil and gas, chemicals and petrochemicals, water and wastewater, metal and mining, utilities), and geography (North America, Europe, Asia Pacific, Middle-East and Africa, and South America). The market values are provided in terms of (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The continuous expansion of global industrialization and infrastructure development, especially in emerging economies, unveils significant business prospects. With the establishment of new facilities and projects, there emerges a heightened demand for portable gas detectors, essential tools in the mitigation and monitoring of potential hazards. This burgeoning market is driven by the imperative to ensure workplace safety and regulatory compliance in the dynamic landscape of burgeoning industrial activities. The increasing need for reliable gas detection solutions aligns with the imperative for risk mitigation in the face of expanding industrial operations, thereby positioning portable gas detectors as pivotal instruments in the strategic planning and execution of safety protocols for new ventures and developments.

Market Drivers:

Increasing Demand for Infrared (IR) Camera-Based Gas Detectors

The collaboration between infrared camera-based gas detectors and portable gas detectors proves exceptionally beneficial in situations where a dual emphasis on widespread area monitoring and individual safety is crucial. Industries derive advantages from adopting a holistic approach to gas detection, safeguarding not only valuable assets but also prioritizing the well-being of personnel. The increasing adoption of these advanced technologies reflects a growing recognition of the significance of early gas leak detection and the proactive implementation of preventive measures. Consequently, the market for both infrared camera-based and portable gas detectors is witnessing expansion, driven by the urgent need to elevate safety protocols and mitigate the risks associated with incidents related to gas leaks.

Increasing Awareness & Demand for Monitoring and Controlling Pollution Levels

There is a notable upswing in awareness and a consequent surge in demand for monitoring and controlling pollution levels, coinciding with a parallel trend in the increased utilization of portable gas equipment. The growing recognition of the profound impact of pollution on environmental and human health is steering individuals, communities, and industries toward proactive measures. The integration of portable gas equipment into pollution monitoring strategies is particularly evident in urban areas and smart city initiatives. These technologies enable swift and precise detection of hazardous gases, contributing to rapid response measures and effective pollution control strategies. Thus, increasing the demand for portable gas equipment, thereby driving the growth of the studied market.

Market Restraints:

High Initial Cost

The initial expenses linked to the procurement of portable gas detection equipment, particularly those integrated with cutting-edge technologies, pose a considerable obstacle for certain organizations. This financial impediment has the potential to restrict widespread adoption, especially among smaller businesses or those functioning within stringent budgetary constraints. The upfront costs associated with acquiring such advanced equipment may create challenges, hindering accessibility for organizations that might otherwise benefit from enhanced gas detection capabilities.

The COVID-19 pandemic has left a profound impact on the gas detector market across various dimensions. Disruptions in manufacturing and supply chains ensued as lockdowns and travel restrictions impeded normal business operations. While certain industries deemed essential experienced heightened demand for gas detection solutions to ensure worker safety and compliance with health regulations, others faced reduced investments and project delays. To adapt to the new normal, gas detector manufacturers pivoted toward emphasizing remote monitoring and IoT integration, allowing for real-time tracking and alerts. The pandemic underscored the critical importance of occupational health and safety, prompting organizations to invest in advanced gas detection technologies to mitigate risks and protect employees. As economies recover, there is a growing recognition of the need for resilient safety infrastructure, leading to increased investments in advanced gas detection systems. Additionally, the preference for contactless technologies gained momentum, with manufacturers incorporating touchless interfaces to address hygiene concerns. In essence, the gas detector market has witnessed both challenges and opportunities arising from the global response to the pandemic, influencing trends such as remote monitoring, heightened safety prioritization, and innovations for a post-pandemic era.

Segmental Analysis:

Wireless Gas Detector Segment is Expected to Witness Significant Growth Over the Forecast Period

Wireless gas detectors stand at the forefront of industrial safety, introducing a revolutionary approach to gas monitoring. Operating without the constraints of physical cables, these detectors utilize wireless communication technologies to provide real-time monitoring of gas concentrations in various environments. Their ease of installation and flexibility in deployment make them particularly advantageous, allowing for cost-efficient solutions that can be easily relocated or expanded to meet changing operational needs. With features like remote access and control, data logging, and scalability, wireless gas detectors offer a comprehensive safety solution. Their integration with smart technologies and the Industrial Internet of Things (IIoT) further enhances their capabilities, enabling advanced analytics and predictive maintenance. Particularly beneficial in hazardous industries, wireless gas detectors contribute to enhanced safety by ensuring continuous monitoring without exposing personnel to unnecessary risks. Overall, these detectors represent a sophisticated and adaptable tool for proactive gas detection, addressing the dynamic challenges of industrial environments. Thus, such factors are expected to drive the growth of the growth of the studied market over the forecast period.

Portable Gas Detector Segment is Expected to Witness Significant Growth Over the Forecast Period

Portable gas detectors serve as crucial instruments in upholding workplace safety, offering a mobile and adaptable solution for the real-time detection of potentially hazardous gases. Designed to be easily carried by individuals, these devices provide immediate feedback on gas concentrations, enabling swift identification and response to potential dangers. Their compact and lightweight design enhances usability, making them convenient for extended wear and ensuring workers can seamlessly integrate them into their daily activities. With the capability to detect multiple gases simultaneously, portable gas detectors cater to a wide range of industries, from manufacturing to petrochemicals, providing comprehensive monitoring in dynamic work environments. Equipped with audible and visual alarms, these detectors alert users to the presence of hazardous gas levels, prompting timely action to mitigate risks. User-friendly interfaces, data logging features, and robust battery life contribute to the overall effectiveness of these devices.

Portable gas detectors are particularly well-suited for confined space entry, offering a reliable means of monitoring gas levels in areas with limited access. In essence, these instruments play a pivotal role in ensuring the safety of personnel across diverse industries, combining mobility, immediate hazard response, and user-friendly features to create a comprehensive gas detection solution. Thus, such factors are expected to drive the growth of the growth of the studied market over the forecast period.

Chemicals and Petrochemicals Segment is Expected to Witness Significant Growth Over the Forecast Period

North America Region is Expected to Witness Significant growth Over the Forecast Period

Gas detectors are experiencing notable growth in North America, driven by the presence of major vendors and stringent government regulations aimed at limiting gas emissions. The enforcement of industrial safety standards by regulatory bodies such as the Environmental Protection Agency (EPA) and the U.S. Occupational Safety and Health Administration (OSHA) is a key factor propelling the adoption of gas detectors in the region. The impact of OSHA standards is particularly significant for businesses across various industries in the United States, as nearly all are subject to these regulations, affecting both employers and employees. The EPA has introduced the New Source Performance Standards to monitor and restrict methane emissions from new, reconstructed, or modified facilities.

Moreover, the EPA mandates the use of gas detectors in the mining industry, emphasizing the importance of safety measures. Carroll Technologies Group, a USA-based company, is at the forefront, offering specialized handheld gas detectors tailored for the mining sector, including products like the Mine Safety Appliances (MSA) Altair 4X Detector, designed to rapidly alert miners within 15 seconds of gas detection. North America boasts one of the most active mining industries globally, with Canada ranking among the top 5 global producers of various minerals and metals, as indicated by the Mining Association of Canada. Additionally, data from the U.S. Geological Survey reveals a substantial increase in the capacity utilization of the United States' mining industry, reaching an estimated 87 percent in 2022, up from 81 percent in 2021. These favorable conditions are poised to create lucrative opportunities for the expansion of the gas detector market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive environment is characterized by a high degree of fragmentation. Companies within the market are actively engaging in strategic initiatives such as forming partnerships, driving product innovation, expanding their geographical reach, and investing in research and development. These efforts are aimed at fortifying their market positions and gaining a competitive edge in the industry. Some of the prominent players in the global gas detection equipment market are:

Recent Development:

1) In October 2023, SLB's End-to-end Emissions Solutions (SEES) business introduced its next-generation methane point instrument, a self-installed continuous monitoring system employing IoT-enabled sensors, to swiftly and cost-effectively detect, locate, and quantify emissions across oil and gas operations. Thus, such product launches are contributing to the segment’s growth.

2) In December 2023, CO2Meter, headquartered in Florida, introduced a novel industrial gas detector designed to measure oxygen or carbon dioxide (CO2), providing essential protection for personnel operating in proximity to hazardous gases. Named CM-900, this innovative detector boasts an environmentally adaptive industrial enclosure, offering distinct advantages in harsh and wash-down environments. The device includes audible and visual alarms that promptly notify individuals of unsafe conditions, enhancing safety measures. The environmentally adaptive industrial enclosure ensures the durability and reliability of the detector, making it suitable for challenging conditions, which is a crucial aspect in the realm of portable gas detection. The inclusion of audible and visual alarms further strengthens its utility, providing real-time alerts to personnel working near hazardous gases. As a result, the CM-900 not only expands the capabilities of portable gas detection but also sets a precedent for enhanced safety features and adaptability in the evolving landscape of gas monitoring equipment.

Q1. What was the Gas Detector Market size in 2023?

As per Data Library Research the global gas detection equipment market size was valued at USD 5.03 billion in 2023

Q2. At what CAGR is the market projected to grow within the forecast period?

Gas Detector Market is expected to register a compound annual growth rate (CAGR) of 12.01% over the forecast period.

Q3. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Q4. Who are the key players in Gas Detector Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model