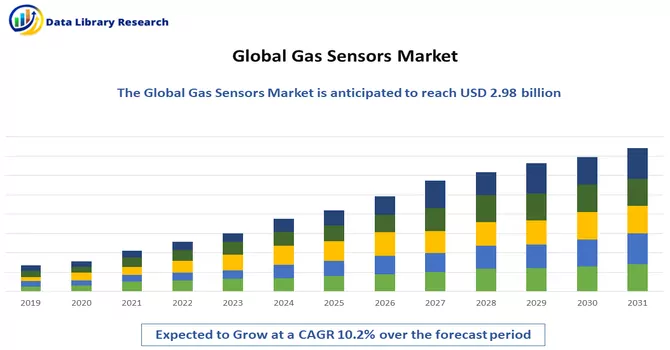

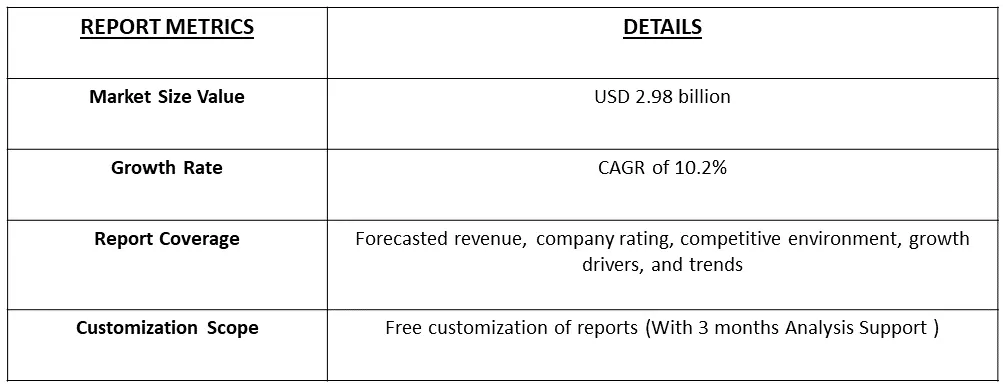

The global gas sensor market size was valued at USD 2.98 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Gas sensors are devices crucial for detecting and measuring the presence and concentration of gases in the surrounding environment. They operate on various principles, such as chemical reactions, electrochemical detection, catalytic combustion, infrared absorption, and semiconductor-based methods. By utilizing these principles, gas sensors provide a means to monitor air quality, ensure safety in industrial environments, and detect potentially harmful or explosive gases. For example, some sensors undergo specific chemical reactions with the target gas, leading to changes in properties like conductivity or color, which are then measured to determine gas concentration. Infrared gas sensors, on the other hand, identify gases by measuring their unique absorption of infrared light at characteristic wavelengths. Semiconductor-based sensors rely on changes in the electrical conductivity of semiconductor materials when exposed to specific gases.

The primary force propelling market growth is the advancement in miniaturization and wireless functionalities, complemented by enhancements in communication technologies that facilitate seamless integration into diverse devices and machinery for the remote detection of toxic gases. Gas sensors find continuous applications in overseeing and managing gas emissions across a spectrum of industrial processes, spanning both domestic and industrial sectors. Moreover, the increasing necessity to regulate detrimental emissions from pivotal industries further contributes to the favorable trajectory of market expansion.

The rising awareness of air quality issues, particularly in urban areas, is fostering the adoption of gas sensors for effective air quality management. Additionally, the integration of gas sensors with IoT and smart technologies is creating more intelligent and connected systems capable of providing real-time insights. An emerging trend involves the development of wearable gas sensors, catering to the need for personalized gas exposure monitoring in various industries. Overall, these trends underscore the dynamic nature of the gas sensors market as it evolves to meet the demands of modern industries and environmental concerns.

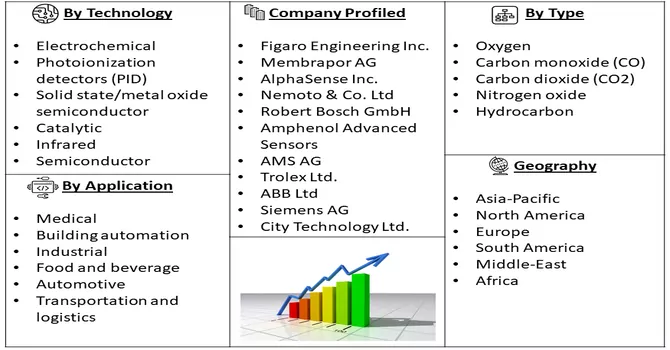

Market Segmentation: The report covers global gas sensor market demand and is segmented by type (oxygen, carbon monoxide (CO), carbon dioxide (CO2), nitrogen oxide, hydrocarbon), technology (electrochemical, photoionization detectors (PID), solid state/metal oxide semiconductor, catalytic, infrared, semiconductor), application (medical, building automation, industrial, food, and beverage, automotive, transportation, and logistics), and geography (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa). The market size and forecasts are provided in terms of value (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increased Demand for Gas Sensors in Automobiles for Compliance with Governmental Regulations

The automotive industry is experiencing a notable surge in the demand for gas sensors, driven by stringent governmental regulations aimed at enhancing environmental standards and ensuring public safety. As governments worldwide intensify their focus on reducing vehicular emissions and improving air quality, automakers are compelled to integrate advanced gas-sensing technologies into vehicles. These sensors play a pivotal role in monitoring and controlling exhaust emissions, ensuring compliance with regulatory standards. As a result, there is a growing need for gas sensors that can accurately detect and measure pollutants such as carbon monoxide (CO), nitrogen oxides (NOx), and hydrocarbons emitted from internal combustion engines. The increased adoption of electric and hybrid vehicles has further intensified the emphasis on gas sensors, as these vehicles still utilize combustion engines or fuel cells. Thus, such market factors are expected to drive the growth of the studied market over the forecast period.

Growing Awareness of Occupational Hazards across Major Industries

There is a notable and growing awareness of occupational hazards across major industries, marking a significant shift toward prioritizing workplace safety and employee well-being. Industries such as manufacturing, construction, healthcare, and mining are increasingly recognizing the importance of identifying and mitigating potential risks to protect workers from occupational hazards. This heightened awareness is driven by factors such as evolving regulations, a greater emphasis on corporate responsibility, and a deeper understanding of the long-term impacts of exposure to various workplace risks. Companies are investing in advanced safety measures, including the deployment of sophisticated sensors and monitoring systems designed to detect and address occupational hazards promptly. These hazards encompass a range of concerns, including exposure to harmful gases, noise levels, ergonomic issues, and other occupational health risks.

Market Restraints:

High Cost of Gas

The deployment of advanced gas sensing technologies is frequently hindered by substantial upfront costs, encompassing the acquisition of high-quality sensors and the requisite infrastructure. While these technologies offer unparalleled accuracy and efficiency in detecting and managing gas emissions, the financial investment involved can pose a significant restraint, particularly for smaller businesses or industries operating within constrained budgets. The initial expenses related to procuring cutting-edge sensors and establishing the necessary supporting systems can be a deterrent for entities with limited financial resources. This financial barrier may impede the widespread adoption of advanced gas sensing technologies, potentially leaving certain industries or businesses at a disadvantage in terms of comprehensive environmental monitoring and regulatory compliance. Thus, such factors are expected to slow the growth of the studied market over the forecast period.

The COVID-19 pandemic had a dual impact on the gas sensors market. Initially, widespread lockdowns and disruptions in industrial activities led to a temporary slowdown in demand, affecting the market due to supply chain challenges and reduced production. However, the pandemic underscored the critical role of gas sensors in monitoring indoor air quality for virus control, fostering increased interest in these technologies. As industries adapted to new safety norms, there was a renewed focus on workplace safety, driving demand for gas sensors in industrial settings. The crisis accelerated trends like remote monitoring and IoT integration, making the ability to monitor gas sensors remotely crucial. In the long term, the pandemic heightened awareness about environmental monitoring, potentially driving sustained growth in the gas sensors market as industries prioritize resilient and adaptable systems for enhanced safety and risk mitigation. Despite initial challenges, the pandemic also created opportunities for innovation and advancement in gas sensing technologies.

Segmental Analysis:

Carbon Dioxide (CO2) Segment is Expected to Witness Significant Growth Over the Forecast Period

Carbon dioxide (CO2) gas sensors are pivotal in various applications, playing a crucial role in monitoring and controlling CO2 levels for safety and environmental considerations. Widely employed in indoor air quality monitoring, industrial processes, HVAC systems, and research settings, these sensors help prevent the buildup of CO2 in enclosed spaces, ensuring human comfort and well-being. In industrial contexts, such as food production and chemical processing, CO2 sensors facilitate real-time monitoring for maintaining safe working conditions. Additionally, these sensors contribute to energy efficiency in buildings by optimizing ventilation systems based on air quality data. The technology behind CO2 sensors, including non-dispersive infrared (NDIR) sensors, chemical absorption sensors, and solid-state sensors, enables accurate and reliable measurements. Overall, gas sensors for carbon dioxide are instrumental in creating safer and more sustainable living and working environments. Thus, owing to such factors the segment is expected to witness significant growth over the forecast period.

Solid State/Metal Oxide Semiconductor Segment is Expected to Witness Significant Growth Over the Forecast Period

Solid-state gas sensors, specifically those based on Metal Oxide Semiconductor (MOS) technology, have emerged as key components in various applications for gas detection and monitoring. Unlike traditional gas sensors that rely on chemical reactions, solid-state gas sensors operate by detecting changes in the electrical conductivity of metal oxides in the presence of target gases. Metal oxide semiconductor gas sensors are known for their high sensitivity, rapid response times, and durability. They find extensive use in environmental monitoring, industrial safety, and indoor air quality applications. These sensors are capable of detecting a range of gases, including carbon monoxide (CO), methane (CH4), and volatile organic compounds (VOCs). The MOS gas sensors' compact size and low power consumption make them suitable for integration into portable devices and wireless sensor networks. However, challenges such as selectivity and stability under varying environmental conditions are areas of ongoing research and development to enhance the overall performance and reliability of solid-state gas sensors, ensuring their continued contribution to advancements in gas detection technologies.

Automotive Segment is Expected to Witness Significant Growth Over the Forecast Period

Gas sensors play a pivotal role in the automotive industry, contributing significantly to vehicle safety, emissions control, and overall operational efficiency. In the context of automotive applications, gas sensors are primarily utilized for monitoring and controlling various gases emitted by the vehicle. One crucial aspect is the detection of harmful pollutants such as nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons, aiding compliance with stringent emission standards. These sensors are integrated into the exhaust systems to measure pollutant levels, enabling the engine control unit (ECU) to optimize combustion processes and reduce emissions. Additionally, gas sensors contribute to passenger safety by detecting the presence of gases like methane or propane, preventing potential fuel leaks or fire hazards. In modern vehicles, advancements in gas sensing technologies, such as semiconductor-based sensors and infrared sensors, enhance accuracy and responsiveness. The integration of gas sensors aligns with the automotive industry's commitment to environmental sustainability, regulatory compliance, and the development of cleaner and more fuel-efficient vehicles.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, the utilization of gas sensors spans a diverse range of applications, reflecting the region's commitment to safety, environmental monitoring, and industrial efficiency. The automotive sector in North America extensively employs gas sensors to monitor and control emissions, ensuring compliance with stringent environmental regulations. These sensors contribute to the development of cleaner and more fuel-efficient vehicles, aligning with the industry's emphasis on sustainability. Additionally, gas sensors play a crucial role in industrial settings, where they are employed for monitoring air quality, detecting hazardous gases, and ensuring workplace safety. The region's stringent safety standards and regulations drive the adoption of advanced gas sensing technologies. In smart cities and building management systems, North America incorporates gas sensors for efficient HVAC (Heating, Ventilation, and Air Conditioning) operations, optimizing energy consumption while maintaining indoor air quality. The presence of leading manufacturers and innovators in the gas sensor industry within North America further contributes to the region's role as a hub for advancements in gas sensing technologies. Overall, gas sensors in North America play a vital role in addressing environmental concerns, ensuring occupational safety, and fostering technological innovation across various sectors.

Get Complete Analysis Of The Report - Download Free Sample PDF

The gas sensors market exhibits a fragmented landscape attributed to the presence of numerous players in the industry. Moreover, these companies offering diverse types of gas sensors distinguish themselves through technological product differentiation. In response to this competitive environment, market participants are strategically adopting competitive pricing strategies as a means to secure and expand their market share. By leveraging pricing as a tool, these companies aim to position themselves favorably in the market, enticing customers with competitive offers while highlighting the distinctive technological features of their gas sensor products. This competitive pricing approach serves as a key strategy for navigating the market dynamics and gaining a competitive edge in a sector characterized by technological diversity and a multitude of players. Some of the key market players working in this segment are:

Recent Development:

1) In November 2023: Daikin's groundbreaking laser-based technology for detecting R32 refrigerant leaks is poised to impact the gas sensor market significantly. This innovation addresses the critical need for improved leak detection in air conditioning systems, potentially driving a surge in demand for gas sensors tailored to refrigerant detection. Emphasizing safety and environmental compliance, the development is expected to lead to increased adoption of advanced gas sensing solutions across industries dealing with refrigerants. The breakthrough has the potential to expand the market within the air conditioning sector, fuel technological advancements, and raise awareness about the importance of effective gas detection. Given the global use of R32 refrigerant, Daikin's technology could inspire industries worldwide to invest in advanced gas sensing solutions to meet safety standards. Moreover, this development may pave the way for integrating gas sensors with IoT frameworks and smart monitoring systems, thereby enhancing overall gas detection capabilities.

2) In June 2023, QLM Technology Ltd has officially launched its Quantum Gas Lidar (QGL) along with the QLM Cloud, an analytics platform designed for the measurement and quantification of emissions. The Quantum Gas Lidar utilizes cutting-edge quantum photonics detection, telecom tunable lasers, and robust lidar technology to capture detailed, 360-degree images of equipment up to 200 meters away, offering precise visualization of methane emissions. The obtained gas lidar images are then analyzed, stored, and processed through the QLM Cloud, providing accurate reporting of significant emissions events. This comprehensive solution, offered as a Software-as-a-Service (SaaS), allows users to customize alerts and reports for emissions surpassing specific thresholds.

Q1. What was the Gas Sensors Market size in 2023?

As per Data Library Research the global gas sensor market size was valued at USD 2.98 billion in 2023.

Q2. At what CAGR is the Gas Sensors market projected to grow within the forecast period?

Gas Sensors Market is expected to grow at a compound annual growth rate (CAGR) of 10.2% over the forecast period.

Q3. What are the factors on which the Gas Sensors market research is based on?

By Type, By Application, By Technology and Geography are the factors on which the Gas Sensors market research is based.

Q4. Which region has the largest share of the Gas Sensors market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model