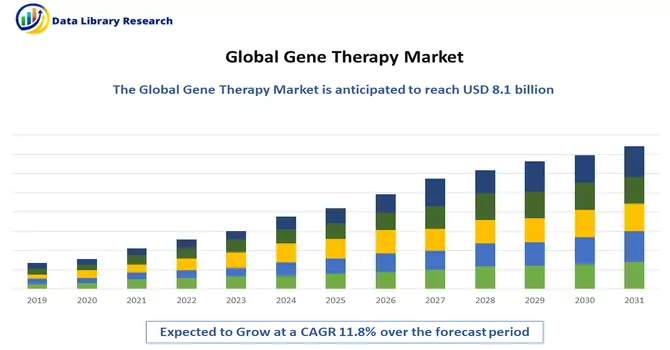

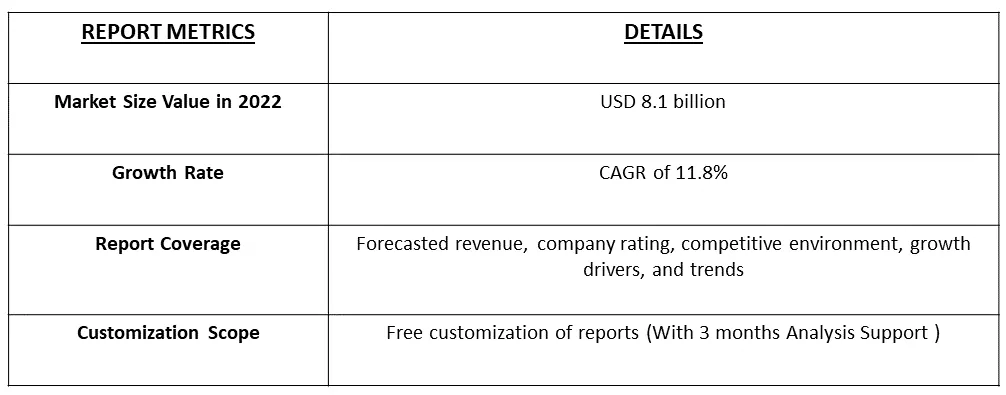

The Gene Therapy Market is currently valued at USD 8.1 billion in the year 2022 and is expected to register a CAGR of 11.8% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Gene therapy is a technique that modifies a person’s genes to treat or cure disease. Gene therapies can work by several mechanisms: replacing a disease-causing gene with a healthy copy of the gene, inactivating a disease-causing gene that is not functioning properly, and introducing a new or modified gene into the body to help treat disease. Gene therapy products are being studied to treat diseases including cancer, genetic diseases, and infectious diseases.

The studied market's growth is attributed to factors such as expanding the area of advanced therapies along with gene delivery technologies and developing progressive competition among key players focused on the commercialization of their therapies. The biotechnology companies are investing in acquisitions, mergers/collaborations, and expansions as key strategies to increase in-house expertise and strengthen product pipelines.

As the widespread applications of gene therapies and the potential patient pool grow, there is a move toward regulators increasing requirements across the industry, seeking both broader efficacy data, as well as more robust, long-term safety data even in earlier phases of clinical study. This reflects regulatory authorities’ increasing understanding of the field and an increased focus on how a gene therapy program fits into the context of the broader treatment landscape.

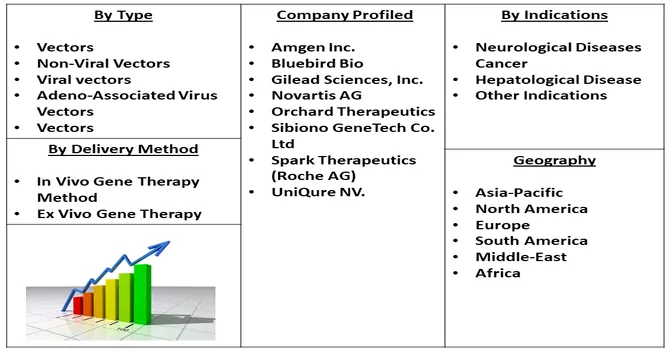

Segmentation:

The Gene therapy Market is Segmented by.

Indications

Delivery Method

Geography

The report offers market size and values in (USD million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Drivers:

Gene Therapy Market High Incidence of Cancer and Other Target Disease.

Gene transfer is a new treatment modality that introduces new genes into a cancerous cell or the surrounding tissue to cause cell death or slow the growth of the cancer. This treatment technique is very flexible, and a wide range of genes and vectors are being used in clinical trials with successful outcomes. Thus, the high incidence of cancer cases is fuelling the growth of the studied market. For instance, the recent data updated by the American Cancer Society in January 2023, reported that worldwide, an estimated 19.3 million new cancer cases (18.1 million excluding nonmelanoma skin cancer).

There have been recent advancements in treating spinal muscular atrophy (SMA) with gene therapy. Gene therapy for SMA is called onasemnogene abeparvovec-xioi (brand name Zolgensma). Zolgensma delivers a new, working copy of a human SMN gene that is administered in a one-time infusion to children under 2 years old. Thus, the rising incidence of SMA is expected to fuel the growth of the studied market. For instance, an article published by NCBI reported that the estimates of SMA genotype prevalence at birth reported in the literature are consistently in a range from 8.5–10.3 per 100,000 live births or ~1 per 10,000 live births globally.

Rising Investments in Research and Development in Gene Therapy.

Research and development (R&D) investment is also expected to affect the market significantly. Several companies aim to build a gene therapy platform with a strategy focused on establishing a transformational portfolio through in-house capabilities and enhancing those capabilities through strategic collaborations, expansion of R&D activities, and potential licensing, merger, and acquisition activities.

For instance, in January 2022, the Cystic Fibrosis Foundation reported investing in SalioGen Therapeutics to support the company's preclinical research into novel gene therapy for cystic fibrosis. Salonen's Gene Coding approach is designed to turn on, turn off, or modify the function of any gene in the genome. Furthermore, in March 2021, ElevateBio, one of the leading biotech companies focused on gene-based therapies, raised USD 525 million to advance its cell and gene therapy technologies. In addition, the rise in approvals for gene therapies from international regulatory agencies is expected to drive market growth.

For instance, in August 2022, the USFDA approved Zynteglo (betibeglogene autotemcel), the first cell-based gene therapy for treating adult and pediatric patients with beta-thalassemia. Such approvals are expected to drive market growth due to the rise in the development of gene therapies.

Restraints

Lack of Standard Regulations and the High Price of Products Hinder Gene Therapy

Cell and gene therapies cost much more because producing, handling, and controlling the cells or viral vectors required to make them is far more complicated than working with the chemicals used to make traditional pharmaceuticals and even biopharmaceuticals. Thus, due to the high price of gene therapy treatment, only a few people can afford it as a result, the growth of the market is expected to slow down over the forecast period.

The COVID-19 pandemic had a significant impact on the gene therapy market. Gene and cell therapy technology were extensively used in developing vaccines to treat COVID-19. For instance, in January 2021, vaccine candidates developed by Mass General Brigham were made by utilizing gene therapy technology that elicited robust immune responses in animal models for the treatment of COVID-19. The vaccine candidate was named AAVCOVID, and the researchers received a USD 2.1 million grant to further develop the technology from the Bill & Melinda Gates Foundation.

The developed vaccine was far more convenient than the ones sold on the market, as it had a single dose and could be stored at room temperature. Also, per a January 2021 published article in Hindawi Journal, the treatment of coronavirus from the perspective of RNA interference-based gene therapy offered a more direct approach to combating viral genes and has a promising future. Thus, the COVID-19 pandemic led to an increased demand for gene-based therapy for COVID-19.

The Russian war led to a disturbance in gene therapy-related clinical trial conduct and that has become extremely challenging due to damage to the healthcare infrastructure and patient displacement. An article published by Sage journal in December 2022, reported that the invasion of Ukraine may result in the underpowering of international clinical trial results with the loss of future recruitment sites for both countries. As a result, the growth of the studied market may be hampered over the forecast period.

Segmental Analysis of Gene Therapy Market.

Adeno-Associated Virus Vectors Segment is Expected to Witness Significant Growth Over the Forecast Period

Adeno-associated viruses are small viruses that infect humans and some other primate species. They belong to the genus Dependoparvovirus, which in turn belongs to the family Parvoviridae. Also, adeno-associated virus (AAV) vector-mediated gene delivery was recently approved for the treatment of inherited blindness and spinal muscular atrophy and long-term therapeutic effects have been achieved for other rare diseases, including hemophilia and Duchenne muscular dystrophy.

Furthermore, the recent developments are expected to fuel the growth of the studied market. For instance, in August 2022, Merck, a leading science and technology company, launched the VirusExpress 293 Adeno-Associated Virus (AAV) Production Platform, making it one of the first CDMOs and technology developers to provide full viral vector manufacturing offerings including AAV, Lentiviral, CDMO, CTO, and process development. This new platform enables biopharmaceutical companies to increase the speed of clinical manufacturing while reducing process development time and costs. Thus, due to the above-mentioned reasons the market is expected to witness significant growth over the forecast period.

Cancer Segment by Indication is Expected to Witness Significant Growth Over the Forecast Period.

Gene therapy replaces a faulty gene or adds a new gene in an attempt to cure disease or improve your body's ability to fight disease. Gene therapy holds promise for treating a wide range of diseases, such as cancer. Also, the rising cancer cases and the recent developments of gene therapy in cancer treatment are expected to fuel the growth of this segment. For instance, in February 2023, Pfizer reported the positive results from the Phase 3 TALAPRO-2 study of TALZENNA (talazoparib), an oral poly ADP-ribose polymerase (PARP) inhibitor, in combination with XTANDI (enzalutamide), demonstrating a statistically significant and clinically meaningful improvement in radiographic progression-free survival (rPFS) compared to placebo plus XTANDI in men with metastatic castration-resistant prostate cancer (mCRPC), with or without homologous recombination repair (HRR) gene mutations.

North America Dominates the Market and is expected to Witness Significant Growth over the Forecast Period

North America is expected to witness significant growth over the forecast period due to the increasing number of investments by the government, advancements in research and development about gene therapy, and the growing prevalence of target diseases.

For instance, as per the United States Center for Disease Control and Prevention article on spinal muscular atrophy (SMA) updated in December 2021, SMA is a genetic disorder that affects around 1 in every 10,000 people. Therefore, it is one of the most common rare diseases. The numbers indicate the growing demand for gene therapy in the United States. In May 2022, the FDA approved the drug, Evrysdi for babies under two months old with spinal muscular atrophy. Evrysdi is an SMN-enhancing therapy that works by targeting the SMN2 gene. Such product approvals in the region are adding to the growth of the market.

In addition, rising investments from the Government of the United States are also expected to drive the growth of the market growth. For instance, the NIH funding on Gene Therapy in the United States is USD 403 million and USD 481 million in the year 2020 and 2021 respectively. The rising investment in gene therapy in the United States will lead rise in the development of gene therapies in this region, driving the market growth.

Thus, due to the above-mentioned developments, the market is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The gene therapy market is highly competitive and consists of several significant players. They have various strategic alliances, such as collaborations and acquisitions, along with the launch of advanced products to secure their position in the global market. Companies that hold a substantial market share are:

Key Players :

Recent Development:

1) In October 2022, Sarepta Therapeutics applied to the US FDA to grant accelerated approval to the gene therapy S (delandistrogene moxeparvovec) for the treatment of Duchenne Muscular Dystrophy (DMD).

2) In August 2022, the US FDA approved Zynteglo (betibeglogene autotemcel), the first cell-based gene therapy for treating adult and pediatric patients with beta-thalassemia who require regular red blood cell transfusions.

Q1. What is the current Gene Therapy Market size?

The Gene Therapy Market is currently valued at USD 8.1 billion.

Q2. What is the market size of the Gene Therapy Market?

Gene Therapy Market is expected to register a CAGR of 11.8% over the forecast period.

Q3. Which are the major companies in the Gene Therapy Market?

Amgen Inc., Bluebird Bio, Gilead Sciences, Inc. & Novartis AG are some of the major companies in the Gene Therapy Market

Q4. Which region has the largest share of the Gene Therapy Market? What are the largest region's market size and growth rate??

North America was the largest region in the Gene Therapy Market in 2022. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model