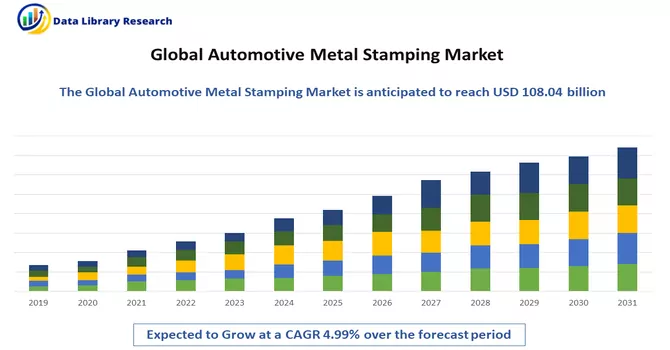

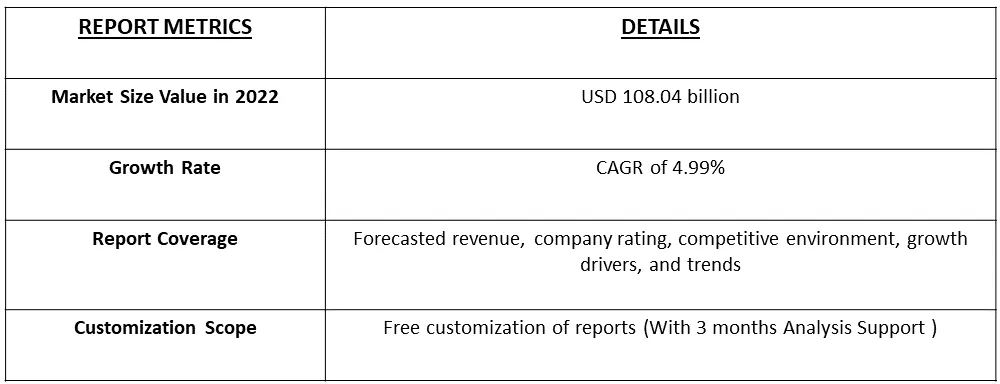

The Automotive Metal Stamping Market size is estimated at USD 108.04 billion in 2022, and is expected to register a CAGR of 4.99% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

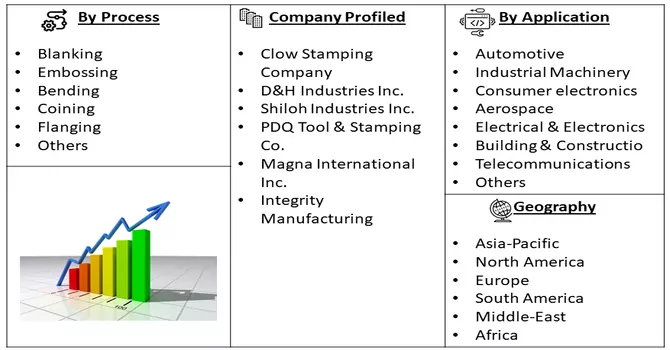

Automotive Metal Stamping refers to a manufacturing process used in the automotive industry to transform flat sheets of various metals, such as steel, aluminum, and other alloys, into three-dimensional parts and components. These components can range from simple brackets and panels to more complex parts like car body panels, engine components, and structural elements. The metal stamping process typically involves several steps, including blanking, where flat metal sheets are cut into specific shapes or "blanks." These blanks are then subjected to various operations, including bending, deep drawing, and piercing, using specialized dies and presses. These operations are carefully designed to create precise and intricate shapes while maintaining structural integrity.

The steady expansion of the automotive industry, driven by rising global population, urbanization, and increasing consumer demand for vehicles, plays a significant role in the growth of the Automotive Metal Stamping Market. The ongoing emphasis on lightweighting vehicles to improve fuel efficiency and reduce emissions boosts the demand for advanced, lightweight stamped components, such as aluminum and high-strength steel parts.

The automotive industry is increasingly focused on reducing vehicle weight to improve fuel efficiency and reduce emissions. This trend drives the demand for advanced lightweight materials like high-strength steel, aluminum, and composites in metal stamping processes. As electric vehicles (EVs) gain popularity, the demand for stamped components specific to EVs, such as battery enclosures, motor housings, and lightweight structural components, is on the rise. These trends collectively shape the Automotive Metal Stamping Market, reflecting the industry's evolving needs, environmental concerns, and technological advancements. Manufacturers in this sector must stay agile and adapt to these trends to remain competitive and meet the demands of the ever-changing automotive industry.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Automotive Industry Growth and Customization and Design Flexibility

The automotive industry has witnessed remarkable growth over the years, evolving into a global economic powerhouse. One of the key drivers of this growth is the increasing demand for vehicles across the world, driven by factors such as rising global population, urbanization, and improving economic conditions. As the automotive industry expands, several critical trends have emerged, including the emphasis on customization and design flexibility. Environmental concerns and regulatory pressures have led to the development of cleaner and more fuel-efficient vehicles. Manufacturers are increasingly focusing on producing environmentally friendly cars, which has contributed to the growth of the electric vehicle segment. he use of digital design and simulation tools empowers manufacturers to experiment with various design elements and conduct virtual testing, saving time and resources in the development process. Thus, the market is expected to witness significant growth over the forecast period.

Market Technological Advancements

Innovations in stamping technology, including automation, simulation software, and Industry 4.0 integration, enhance the efficiency and productivity of metal stamping processes. For instance, in November 2021, Magna International partnered with Ford to supply battery enclosures to Ford’s F-150 Lightning, with aluminum extrusions and stampings assembled together. Similarly, in October 2021, Autoneum announced its expansion of aluminum sheet forming technology. The company’s stamped aluminum components prevent electromagnetic interface into electric vehicles and provide cost-efficient shielding of batteries.

Market Restraints:

High Initial Investment and Environmental Concerns

Setting up or upgrading a metal stamping facility with modern equipment, automation, and skilled labor can require a substantial upfront capital investment. Moreover, many small and medium-sized manufacturers may find it challenging to access the necessary funding for such investments, which can hinder market entry and expansion. High initial investments can also impact the competitiveness of existing companies, making it difficult for them to adopt the latest technologies and remain efficient. Thus, these factors may slow down the growth of the studied market.

The COVID-19 pandemic had a profound impact on the Automotive Metal Stamping Market. Supply chain disruptions, reduced consumer spending, and factory closures led to decreased demand for automotive components. However, the post-pandemic recovery, driven by the need for resilient supply chains and increased demand for personal vehicles, is expected to support the market's resurgence. The economic impact of the pandemic placed financial strain on metal stamping companies. They had to navigate declining revenues while managing fixed costs such as labor, equipment, and facilities. In response to the pandemic, many companies explored ways to make their operations more resilient. This involved enhancing supply chain diversification and adopting digital tools for remote work and process optimization. As lockdowns and restrictions began to ease and vaccination efforts were underway, the automotive industry started to recover. Pent-up demand for vehicles and a desire for personal transportation led to a resurgence in vehicle production and, subsequently, increased demand for metal-stamped components.

Segmental Analysis:

Automotive Metal Stamping Industry Market Blanking Process is Expected to Witness a Faster Growth

The increased adoption of metal stamping in the automotive industry is experiencing substantial growth in the market. Within this context, the blanking process has emerged as a key method capable of handling extended production runs with minimal adjustments to machinery or base materials. This method is highly favored by major automotive manufacturers for mass component production. The surging demand for more efficient vehicles has prompted the development of innovative and aerodynamically efficient outer body structures. Blanking metal stamping technology plays a pivotal role in shaping metal into smaller, more manageable pieces that can be intricately integrated into and around vehicles.

Furthermore, the market is witnessing a significant rise in partnerships among manufacturers, which is driving growth in the metal stamping sector. For instance: in September 2021, Toyota Tsusho and SteelSummit Holdings, a subsidiary of Sumitomo Corp. of Americas, unveiled their collaborative venture, Madison Metal Processing (MMP), involving a substantial investment of USD 40 million. This venture is positioned to cater to the steel blank requirements of the automotive industry, with a specific focus on serving Toyota's vehicle manufacturing needs. Thus, due to the above-mentioned reasons the segment is expected to witness significant growth over the forecast period.

Automotive Metal Stamping Industry Market Sheet Metal Forming Segment is Expected to Witness a Faster Growth

Sheet metal forming is the core process in automotive metal stamping. It involves shaping flat sheets of metal into complex three-dimensional parts using various techniques such as bending, deep drawing, and hydroforming. The quality and precision of sheet metal forming influence the durability, safety, and aesthetics of automobiles. The Automotive Metal Stamping Market relies heavily on advancements in sheet metal forming processes and materials to meet the evolving requirements of the automotive industry.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America boasts a significant presence of automobile manufacturers, contributing to the heightened demand for metals like aluminum, steel, and iron, which are the predominant materials utilized in the automotive industry's metal stamping processes. According to the American Automotive Policy Council, the automotive sector stands as the largest manufacturing segment in the United States, home to production facilities of major vehicle manufacturers, including industry giants like Ford, Chrysler, and General Motors, strategically situated within the region. These automotive leaders are actively investing in the market to bolster their forthcoming projects. As a case in point, General Motors announced a substantial investment exceeding USD 46 million in its Parma, Ohio, metal stamping operation in November 2021.

This investment aims to facilitate equipment upgrades and lay the groundwork for the facility's capability to support future product initiatives. The United States is host to a significant concentration of automotive stamping industries, and this sector is presently experiencing substantial expansion throughout the nation. Notably, in July 2020, Challenge Manufacturing, a global provider of automotive structural components based in Walker, Michigan, disclosed its acquisition of Great Lakes Metal Stamping's Cusseta, Alabama location. This strategic acquisition enabled Challenge Manufacturing to extend its reach into the Southeastern region. Over the course of the past four decades, the company has grown significantly, employing 3,500 individuals across 10 locations in the United States and Asia. Thus, due to the above-mentioned reasons the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The automotive metal stamping market has a presence of several players, such as:

Recent Development:

1. In May 2021, Nissan Motor announced the all-new Qashqai vehicle built using an extensive number of lightweight aluminum panels. Nissan announced that the hood, doors, and front fenders, all unique in shape, will be stamped using this technology, making the vehicle 60 kilos lighter than the previous version, improving efficiency, and accommodating new technology.

2. In May 2019, Schuler, a metal pressing machinery company, manufactures metal parts using sheet metal forming techniques to cater to the body panel and component needs of the United Kingdom’s automotive industry. In line with this, the company installed a new fabricating line dedicated to manufacturing body panels and parts for the Mini Cooper vehicle line-up.

Q1. What was the Automotive Metal Stamping Market size in 2022?

As per Data Library Research Automotive Metal Stamping Market size is estimated at USD 108.04 billion in 2022.

Q2. At what CAGR is the Automotive Metal Stamping Market projected to grow within the forecast period?

Automotive Metal Stamping Market is expected to register a CAGR of 4.99% during the forecast period.

Q3. What are the factors driving the Automotive Metal Stamping Market?

Key factors that are driving the growth include the Automotive Industry Growth and Customization and Design Flexibility and Market Technological Advancements

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model