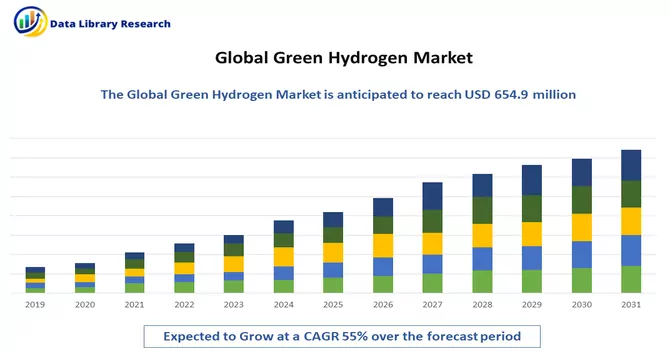

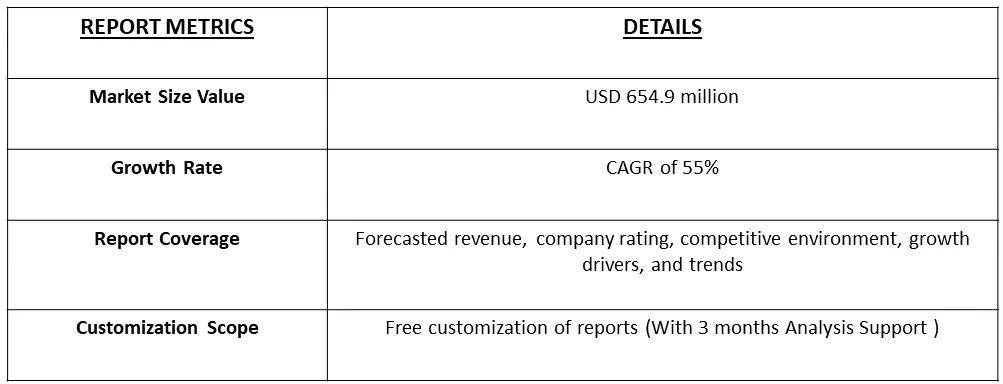

The green hydrogen market is currently valued at USD 654.9 million in the year 2022 expected to register a CAGR of 55% over the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Green hydrogen is a type of hydrogen gas produced through a process that utilizes renewable energy sources and emits little to no carbon dioxide (CO2) or other greenhouse gases. It is considered "green" because its production methods are environmentally friendly and sustainable. The primary method of producing green hydrogen involves electrolysis, which separates water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2), using electricity. The electricity used in this process is generated from renewable sources such as wind, solar, or hydroelectric power, making it a low-carbon or carbon-free method of hydrogen production.

The urgent need to reduce greenhouse gas emissions and combat climate change is a significant driver for green hydrogen. Hydrogen produced from renewable sources emits little to no carbon dioxide during its production and use, making it a clean energy option that can help decarbonize various sectors. Green hydrogen can be stored for extended periods and used when needed, which addresses the intermittency and variability of renewable energy sources. This is crucial for creating a reliable and flexible energy system.

The development of green hydrogen production and infrastructure can lead to job creation and economic growth in regions with abundant renewable resources and a hydrogen-focused industry. Many governments around the world are implementing policies and incentives to promote the production and use of green hydrogen. These policies include subsidies, tax incentives, and carbon pricing mechanisms. Thus, these market trends are expected to fuel the growth of the studied market.

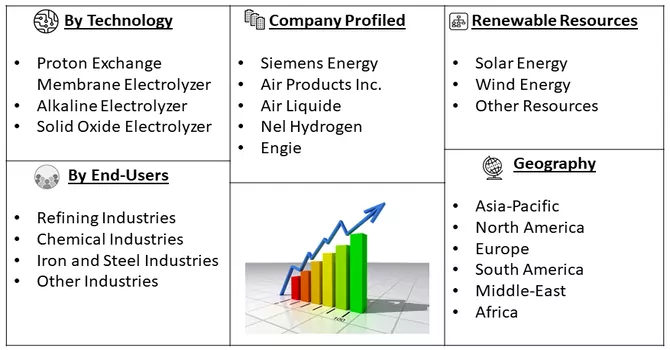

Segmentation: The Green Hydrogen Market is Segmented by the Technology Type (Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, and Solid Oxide Electrolyzer), Renewable Resources (Solar Energy, Wind Energy, and Other Resources), End-Users (Refining Industries, Chemical Industries, Iron and Steel Industries and Other Industries) and Geography (North America, Europe, Asia-Pacific, Middle East, Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Driver :

Surging Demand in the Renewable Energy

The factors driving the growth of the studied market are surging demand for renewable energy and growing government support. Renewable energy sources are intermittent in nature, their generation is all dependent on weather conditions. Energy storage becomes crucial for balancing intermittent supply and demand. Green hydrogen can be produced during periods of excess renewable energy generation and stored for later use. It can be converted back to electricity through fuel cells or used as a feedstock in industrial processes, providing a reliable energy storage solution and contributing to grid stability. Thus, the benefits offered by renewable resources are surging the demand for green hydrogen and thus fueling the market’s growth. For instance, in September 2022 Siemens commissioned green hydrogen plants in Germany. It is one of the largest green hydrogen generation plants in Germany which has been planned digitally. It will demonstrate the key role in the country's energy future.

Growing Government Support

Worldwide governments are focused on setting up renewable energy targets, focussing on reduction of emission goals, and implementing carbon pricing mechanisms, all of which incentivize the demand for green hydrogen. Furthermore, the growing government regulations promote the integration of green hydrogen into existing energy systems, such as blending it with natural gas in pipelines or supporting fuel cell technology, this element drives market growth. For instance, in March 2023, the Canadian Prime Minister and Minister of Finance introduced the ‘Made in Canada Plan’ in the House of Commons. This plan through Budget23, for the year 2023 revolves around clean energy investment. With the plan, the government stated it supports the production of clean and green hydrogen in the country. Thus, such regulations are expected to fuel the growth of the studied market.

Market Restraints:

High Cost of Green Hydrogen

The primary method of producing green hydrogen is through electrolysis, a process that uses electricity to split water into hydrogen and oxygen. The cost of electrolyzer technology, which is a key component in the production process, has historically been high. Although there have been cost reductions in recent years, electrolyzers still account for a substantial portion of the overall production cost. The cost of electricity from renewable sources, such as wind and solar, is another significant factor affecting the cost of green hydrogen. While renewable energy costs have decreased, they can still be relatively high, especially in regions with limited renewable resources or inadequate grid infrastructure. Thus, these factors are slowing down the growth of the studied market.

The COVID-19 pandemic moderately impacted the growth of the global green hydrogen market. For instance, an article published by the journal Energy Research and Social Science in February 2022, reported that the COVID-pandemic struck at a time of heightened concern about environmental sustainability and climate change, many policy organizations and academics advanced an opportunity narrative focused on a ‘green recovery’ that would stimulate the economy and drive low-carbon transitions. The COVID-19 crisis provided an opportunity to the governmental in response to the socio-economic crisis could use parts of the stimulus packages to support low-carbon innovations with high economic multiplier effects (for jobs and GDP growth) such as renewable electricity (wind, solar-PV), batteries, hydrogen, electricity grids, building insulation, heating technologies, electric vehicles, and recharging infrastructure, cycling infrastructure, low-carbon industrial options, and natural capital. In the current scenario, the benefits offered by green hydrogen are expected to drive the growth of the studied market over the forecast period.

Based on the technology, the alkaline electrolyzer segment dominates the green hydrogen market during the forecast period.

The advantages offered by the alkaline electrolysis technology over other manufacturing technologies are responsible for its rapid expansion and market dominance. Alkaline electrolysis makes use of a wide range of electrolytes that are both readily available and inexpensive to generate.

Furthermore, the launch of the new products is expected to fuel the growth of the studied market. For instance, China’s Longi claims that its new ALK Hi1 electrolyzer can produce hydrogen with an energy content of 4.3 kWh per normal cubic meter. It says the levelized cost of hydrogen could be up to 2.2% lower than other electrolyzers on the market. The new ALK Hi1 series can directly reduce 10% of DC electricity use in hydrogen generation, for a levelized cost of hydrogen (LCOH) reduction of between 1.8% to 2.2%. Thus, the launch of such products and technologies is expected to contribute to the growth of the studied market over the forecast period.

Solar Energy segment dominates the green hydrogen market during the forecast period.

Green hydrogen production primarily relies on the process of electrolysis, which splits water into hydrogen and oxygen using electricity. Solar photovoltaic (PV) panels can provide the necessary electricity for this process. When solar panels are directly connected to electrolyzers, the electricity generated from sunlight can be used for on-site hydrogen production, creating a sustainable and renewable source of green hydrogen. olar panels and green hydrogen systems can be deployed together in off-grid or remote areas where a reliable power supply is challenging to establish. Solar power can generate electricity during daylight hours, and any excess energy can be used to produce and store hydrogen for use when the sun is not shining. This combination provides a consistent energy supply, even in isolated locations. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Refining Industries segment dominates the green hydrogen market during the forecast period.

The refining industry utilizes hydrogen in various processes, primarily for hydrocracking and hydrotreating to remove impurities from crude oil and upgrade heavy hydrocarbons. Traditional hydrogen production methods, such as steam methane reforming (SMR), release significant CO2 emissions. Green hydrogen, produced through renewable-powered electrolysis, offers a clean alternative for these processes, reducing the carbon footprint of the industry. The integration of green hydrogen can substantially reduce carbon emissions in refining operations. By replacing carbon-intensive hydrogen production methods with green hydrogen, refineries can lower their overall carbon emissions and align with global climate goals. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

Europe is Expected to Dominate the Protein Purification and Isolation Market Over the Forecast Period

The research article published by National Centre for Biotechnology Information (NCBI), in July 2020, reported that Hydrogen is key in Europe's energy transition to a sustainable environment with net zero emissions over the next 2 decades. There are multiple ways green hydrogen can displace fossil fuels in the industrial, power, and transportation sectors. It can be used as a feedstock for steel-making instead of highly polluting coking coal and it can also be replaced by natural gas in the petroleum refining sector.

The demand for decarbonized electricity systems in the region is increasing the demand for green hydrogen which is likely to fuel the growth of the studied market. Also, in 2019 the German Ministry of Economy and Climate Action, reported that the demand for green hydrogen is anticipated to reach 90–110 TWh in 2030 and is projected to exceed 600 TWh in 2050. Up until 2030, industrial demand growth is likely to be the primary driver of demand, but after 2050, transportation is anticipated to have the highest demand.

Furthermore, technological developments are expected to fuel the growth of the studied market. For instance, in January 2022, Yara International signed a contract with Linde Engineering for the construction and delivery of a green hydrogen demonstration plant at Yara’s ammonia production facility at Herøya Industripark in Porsgrunn, Norway. The project, which is supported by a NOK 283 million grant from Enova (announced in December 2021), will demonstrate that ammonia produced using renewable energy can reduce the impact of carbon dioxide in fertilizer production. The project will be realized by water electrolysis which will produce green hydrogen to partially replace the hydrocarbon-based hydrogen production in Yara’s plant, using proton exchange membrane (PEM) technology.

Thus, the above-mentioned factors are expected to fuel the growth of the studied market over the forecast period in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global green hydrogen market is partially consolidated, with a few major players dominating a significant portion of the market. Some major companies are:

Recent Developments

1) January 2023: Nel and Statkraft, Europe’s largest supplier of renewable energy, signed a contract for delivery of 40 MW electrolyzers and will thus collaborate to create a strong value chain for the production of green hydrogen in Norway.

2) September 2022: ENGIE has taken the final investment decision in the development of one of the world’s first industrial-scale renewable hydrogen projects, to be located in the Pilbara region of Western Australia. This will be key to developing a “Pilbara Green Hydrogen Hub”, serving local and export markets, and building on existing export infrastructure and abundant renewable energy resources in the region

Q1. What was the Green Hydrogen Market size in 2022?

As per Data Library Research the green hydrogen market is currently valued at USD 654.9 million in the year 2022.

Q2. At what CAGR is the green hydrogen market projected to grow within the forecast period?

Green Hydrogen Market is expected to register a CAGR of 55% over the forecast period.

Q3. What are the factors driving the Green Hydrogen market?

Key factors that are driving the growth include the Surging Demand in the Renewable Energy and Growing Government Support.

Q4. Which region has the largest share of the Green Hydrogen market? What are the largest region's market size and growth rate?

Europe has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model