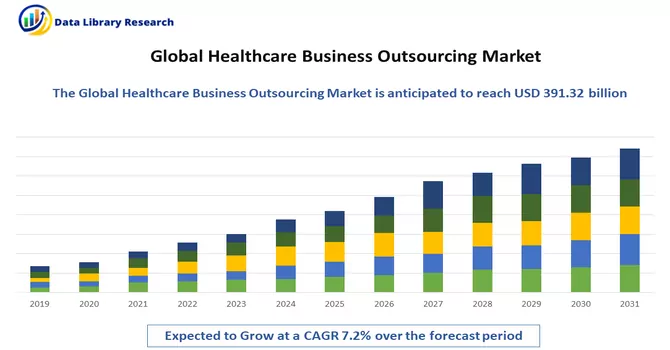

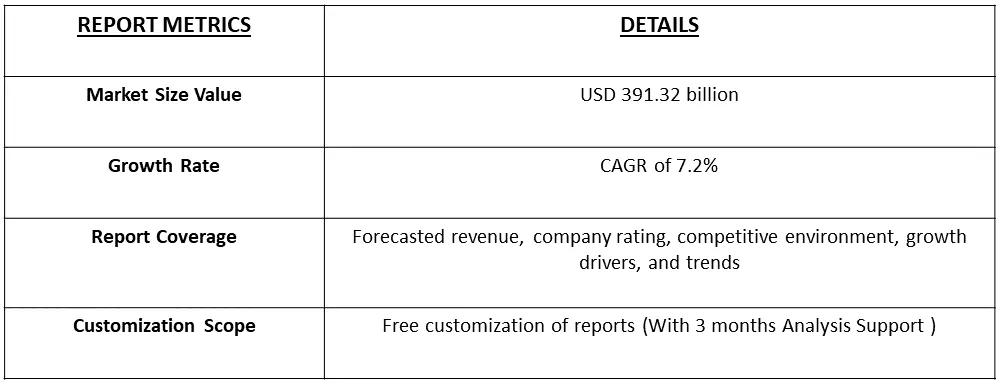

The global healthcare BPO market size was valued at USD 391.32 billion in 2023 and is expected to register a CAGR of 7.2% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Healthcare Business Process Outsourcing (BPO) refers to the practice of contracting specific business tasks and processes related to the healthcare industry to external service providers. These outsourcing services can encompass a wide range of non-core functions, including but not limited to, revenue cycle management, medical billing and coding, claims processing, customer support, data entry, medical transcription, and IT services. By outsourcing these functions to specialized service providers, healthcare organizations aim to improve efficiency, reduce costs, and streamline their operations, allowing them to focus more on core aspects such as patient care and strategic initiatives. Healthcare BPO leverages external expertise and resources to enhance overall productivity, compliance, and quality in the rapidly evolving and complex healthcare landscape.

The Healthcare Business Process Outsourcing (BPO) market is propelled by several growth-driving factors. One key factor is the increasing complexity of healthcare processes and the need for specialized expertise in areas such as medical billing, coding, and claims processing. The quest for operational efficiency and cost reduction in the healthcare industry further fuels the demand for outsourcing non-core functions to specialized service providers. The adoption of advanced technologies, such as artificial intelligence and robotic process automation, enhances the efficiency and accuracy of healthcare BPO services. Additionally, the focus on patient-centric care compels healthcare organizations to leverage outsourcing for back-office tasks, allowing them to prioritize core functions. Furthermore, regulatory changes, evolving reimbursement models, and the constant need for compliance contribute to the demand for specialized BPO services. As the healthcare landscape continues to evolve, the Healthcare BPO market is expected to experience sustained growth driven by these multifaceted factors.

The Global Healthcare Business Process Outsourcing (BPO) market is characterized by several noteworthy trends shaping its trajectory. One prominent trend is the increasing adoption of robotic process automation (RPA) and artificial intelligence (AI) in healthcare BPO services, enhancing operational efficiency and reducing errors. Another significant trend is the growing demand for end-to-end outsourcing solutions, encompassing a comprehensive range of healthcare processes, from claims processing to patient engagement services. The industry is witnessing a rise in strategic partnerships and collaborations between healthcare organizations and BPO service providers to leverage combined expertise for improved outcomes. Additionally, the ongoing digital transformation in the healthcare sector, driven by the need for data analytics and interoperability, is influencing the adoption of BPO services to manage and streamline healthcare data. The COVID-19 pandemic has accelerated the trend of remote healthcare services, impacting the BPO market by increasing the demand for telehealth support and digital healthcare solutions. Furthermore, there is a noticeable shift towards value-based care models, prompting healthcare organizations to seek BPO services that align with these evolving reimbursement structures. Overall, these trends underscore the dynamic nature of the Global Healthcare BPO market, highlighting the industry's adaptation to technological advancements and changing healthcare paradigms.

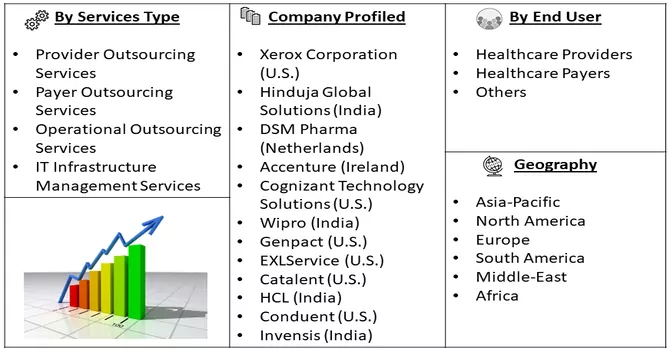

Market Segmentation: The Global Healthcare Business Process Outsourcing (BPO) Market Companies and it is Segmented by Payer Service (Human Resource Management, Claims Management, Customer Relationship Management (CRM), Operational/Administrative Management, Care Management, Provider Management, Other Payer Services), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market size and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Rise of Nearshore Outsourcing Destinations and Access to Technology

The Global Healthcare Business Process Outsourcing (BPO) market is witnessing a notable trend with the rise of nearshore outsourcing destinations and increased access to technology. Nearshore outsourcing, characterized by outsourcing services to neighboring or nearby countries, is gaining prominence in the healthcare sector due to its advantages such as geographical proximity, cultural alignment, and reduced communication barriers. This trend is particularly significant as healthcare organizations seek to enhance collaboration and ensure timely and efficient communication with outsourcing partners.Additionally, access to advanced technologies is playing a pivotal role in shaping the dynamics of the Healthcare BPO market. The integration of technologies such as artificial intelligence (AI), robotic process automation (RPA), and data analytics is transforming healthcare outsourcing processes. AI and RPA are streamlining tasks like claims processing and medical coding, improving accuracy and efficiency. Data analytics is being leveraged for insights into healthcare trends, patient behaviour, and operational performance. The adoption of technology not only enhances the quality of services but also facilitates compliance with evolving healthcare regulations. The combination of nearshore outsourcing and technology access is proving to be a strategic advantage for healthcare organizations outsourcing their business processes. As healthcare BPO services become more sophisticated and interconnected, the market is experiencing a shift towards efficie Robotic Process Automationnt and tech-driven outsourcing models, ensuring that global healthcare organizations can effectively navigate the evolving landscape of healthcare services and data management.

Rapid Increase in Clinical Process Outsourcing (CPO)

The Healthcare Business Process Outsourcing (BPO) market is experiencing a rapid increase in Clinical Process Outsourcing (CPO), marking a significant trend within the industry. Clinical Process Outsourcing involves outsourcing specific clinical tasks and processes to external service providers, allowing healthcare organizations to focus on core medical functions. This surge in CPO is driven by the growing complexity of clinical operations, increasing clinical trial activities, and the need for specialized expertise in areas such as clinical data management, pharmacovigilance, and regulatory affairs. The heightened demand for CPO services is closely tied to the pharmaceutical and life sciences sectors, where clinical trials and drug development processes are intricate and resource-intensive. Outsourcing clinical processes enables organizations to access specialized skills, reduce costs, and accelerate the overall drug development timeline. Moreover, the integration of advanced technologies like artificial intelligence and data analytics in clinical processes enhances efficiency and accuracy, further fueling the adoption of CPO services. This trend is contributing significantly to the overall growth of the Healthcare BPO market, expanding its scope beyond traditional administrative functions. As the healthcare industry continues to embrace specialized outsourcing services to navigate complex regulatory landscapes and expedite clinical research, the market is poised for continued expansion with Clinical Process Outsourcing playing a pivotal role in shaping the industry's trajectory.

Market Restraints:

Complex Regulations

The Healthcare Business Process Outsourcing (BPO) market is intricately intertwined with the challenges posed by complex regulations in the healthcare industry. The sector operates in an environment governed by stringent regulatory frameworks and compliance standards, making it essential for healthcare organizations to navigate these complexities effectively. The complexities arise from a multitude of factors, including privacy laws, data security requirements, and evolving healthcare policies. Healthcare BPO services play a crucial role in assisting organizations to adhere to these intricate regulations. Service providers specializing in healthcare BPO possess the expertise to interpret and implement regulatory changes, ensuring that processes such as medical billing, claims processing, and patient data management comply with the latest standards. This is particularly crucial as non-compliance can lead to legal consequences, financial penalties, and reputational damage for healthcare entities. The dynamic nature of healthcare regulations, with constant updates and amendments, necessitates a proactive approach in outsourcing to stay compliant. Healthcare BPO providers invest in staying abreast of regulatory changes, incorporating them into their processes, and offering solutions that help healthcare organizations adapt swiftly to new requirements. As the healthcare industry continues to evolve with the introduction of new technologies, treatment modalities, and patient-centric care models, the role of Healthcare BPO in managing complex regulations becomes increasingly vital. The ability of BPO services to provide regulatory agility and expertise positions them as indispensable partners for healthcare organizations striving to deliver quality patient care while maintaining compliance with the intricate regulatory landscape.

The impact of the COVID-19 epidemic on the analyzed market is evident, particularly in its hindrance of the healthcare industry's expansion during the initial stages of the pandemic. The mandatory lockdowns and shutdowns had a profound effect on research and development efforts, causing a temporary cessation. Although there is a gradual recovery, hospitals are still grappling with the lasting repercussions of the pandemic. A July 2022 report by Quorum Health Resources, LLC highlighted the enduring impact on hospital revenue cycle management, stating that both the healthcare system and its stakeholders continue to grapple with a chronic, cumulative state of overload due to the challenges of the past two years. This persistent condition does not fully subside in the brief intervals between COVID-19 waves. Consequently, the demand for revenue cycle management, a vital service in Healthcare BPO, has suffered from the cumulative burden of the previous years and is anticipated to face ongoing challenges, exerting a significant influence on the market.

Segmental Analysis:

Claims Management Segment is Expected to Witness Significant Growth Over the Forecast Period

Claims management is a critical component of Healthcare Business Process Outsourcing (BPO), playing a pivotal role in streamlining the reimbursement process and ensuring accurate financial transactions within the healthcare industry. Healthcare BPO providers offer specialized claims management services to assist healthcare organizations in navigating the complexities of medical billing and claims processing. Outsourcing claims management to BPO providers allows healthcare entities to enhance operational efficiency, reduce administrative burdens, and improve overall revenue cycle management. BPO providers leverage advanced technologies and experienced personnel to handle tasks such as claims submission, verification, adjudication, and follow-up. This ensures that claims are processed accurately and efficiently, minimizing the risk of errors that could lead to delays or denials.Healthcare BPO providers also stay abreast of the constantly evolving healthcare regulations and coding guidelines, ensuring that claims adhere to compliance standards. This is particularly crucial in an industry where adherence to regulatory requirements is paramount to avoid legal repercussions and financial penalties. Moreover, the utilization of data analytics and automation in claims management by BPO providers enhances the accuracy of claims processing, identifies trends, and facilitates predictive modelling for future financial planning. The transparency and accountability brought about by outsourcing claims management contribute to improved financial performance and customer satisfaction for healthcare organizations. In conclusion, claims management within Healthcare BPO is instrumental in optimizing revenue cycles, improving operational efficiency, and ensuring compliance with regulatory standards, ultimately facilitating the delivery of quality patient care.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The healthcare BPO market is currently spearheaded by North America, and this dominance is projected to persist in the coming years. Within North America, the United States commands the largest market share. The U.S. healthcare system is a rapidly expanding industry encompassing pharmacies, pharmaceutical companies, medical equipment manufacturers, and healthcare facilities, relying on specialized professionals to manage its intricate operations. The region's robust market growth can be attributed to high awareness levels regarding the outsourcing of healthcare IT services and the strong presence of key market players. Government initiatives in the United States further fuel the anticipated growth of the healthcare BPO market. Notably, in February 2022, the Department of Health and Human Services (HHS) allocated nearly USD 55 million to 29 Health Resources and Services Administration (HRSA)-funded health centers, aiming to enhance healthcare access and quality for underserved populations through virtual care. The significant role played by virtual care, especially during the pandemic, is expected to be a driving force for market growth.

In a strategic move, in March 2022, healthcare solutions company CPSI acquired Healthcare Resource Group Inc., based in Spokane, Washington. This acquisition added value to the market as Healthcare Resource Group is a leading provider of customized revenue cycle management (RCM) solutions and consulting services, contributing to the efficiency, profitability, and patient satisfaction of hospitals and clinics.Several factors contribute to the growth of the U.S. healthcare BPO market, including the increasing number of people seeking insurance, the imperative to reduce healthcare delivery costs, the consolidation of the healthcare system, pharmaceutical companies grappling with patent cliffs, and the mandatory implementation of ICD-10 codes. These factors collectively propel the expansion of the healthcare BPO market in North America, making it a key region for ongoing and future market developments.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive terrain within the healthcare Business Process Outsourcing (BPO) market encompasses an evaluation of key factors including business profiles, financial standings, product portfolios, and strategic approaches employed by major companies. The market exhibits fragmentation, characterized by the presence of numerous significant players. However, a handful of major players currently wield substantial market share, establishing their dominance. The emergence of a growing demand for mobile health solutions and continuous advancements in healthcare systems create opportunities for smaller players to enter the market and secure a noteworthy share. This dynamic landscape highlights both the established dominance of key players and the potential for newer entrants to contribute significantly to the evolving healthcare BPO market.

Recent Development:

1) In October 2022, Performant Healthcare Solutions, a prominent provider of technology-driven services for payment integrity, eligibility, and analytics, initiated a strategic partnership with Priority Health. This collaboration aims to deliver a tailored, comprehensive solution covering all facets of payment integrity within the healthcare domain.

2) In September 2022, Surgical Solutions, a leading provider specializing in on-site operating room and sterile processing support, secured a group-purchasing agreement for outsourced surgical services through Conductiv. Conductiv, a renowned third-party spend improvement company, orchestrates an alliance of buyers and suppliers to revolutionize service acquisition processes. This agreement underscores Surgical Solutions' commitment to delivering high-quality outsourced surgical services through an efficient and streamlined procurement approach facilitated by Conductiv.

Q1. What was the Healthcare Business Outsourcing Market size in 2023?

As per Data Library Research the global healthcare BPO market size was valued at USD 391.32 billion in 2023.

Q2. What is the Growth Rate of the Healthcare Business Outsourcing Market?

Healthcare Business Outsourcing Market is expected to register a CAGR of 7.2% over the forecast period.

Q3. Which region has the largest share of the Healthcare Business Outsourcing market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What are the factors driving the Healthcare Business Outsourcing market?

Key factors that are driving the growth include the Rise of Nearshore Outsourcing Destinations and Access to Technology and Rapid Increase in Clinical Process Outsourcing (CPO).

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model