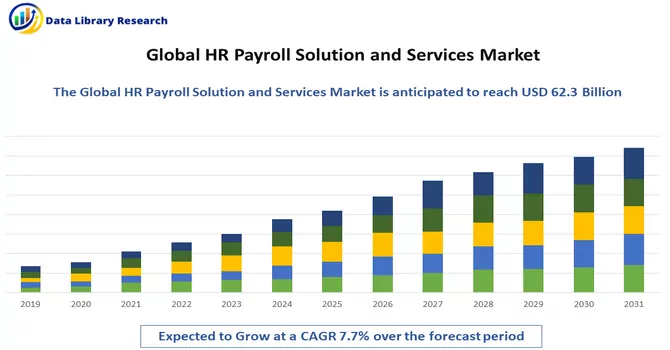

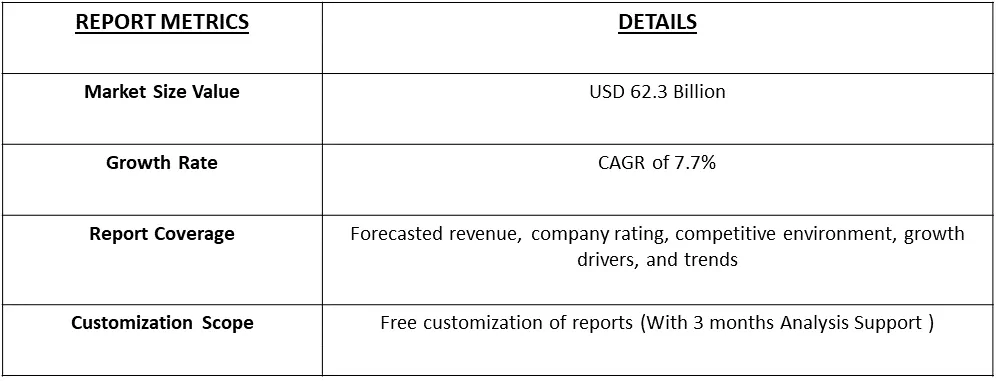

The global payroll and HR solutions and services market is expected to garner USD 62.3 Billion in the year 2023 and is expected to a CAGR of 7.7% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Payroll solutions encompass software and services designed to automate payment processes, calculate wages, deduct taxes, and manage other payroll-related tasks. These systems streamline financial transactions related to employee compensation, improving accuracy and compliance. On the other hand, HR solutions and services constitute a comprehensive array of tools and technologies that facilitate efficient human resource management. The growth of the Payroll and HR solutions market is driven by digital transformation, remote work trends, and a focus on enhancing employee experience. Compliance management, data analytics, and the adoption of cloud-based solutions are pivotal factors shaping the market. Integrated HR ecosystems and a strong emphasis on talent management contribute to the demand for comprehensive solutions. As businesses globalize, the need for HR platforms with multi-country payroll capabilities becomes increasingly vital. Overall, these trends highlight the evolving landscape of workforce management, with organizations seeking advanced, integrated solutions to navigate complexities and drive efficiency.

The global payroll and HR solutions and services market is propelled by a confluence of factors driving transformative changes in workforce management. The relentless march of digital transformation compels organizations to adopt sophisticated HR solutions, facilitating streamlined processes and leveraging modern technologies for enhanced efficiency. Managing increasingly diverse and global workforces, including remote and contingent workers, contributes to the complexity that comprehensive HR solutions address. Stringent regulatory compliance requirements underscore the need for accurate payroll processing, tax adherence, and dynamic adjustments to changing labor laws globally. The focus on improving the overall employee experience has become a pivotal driver, with HR solutions offering self-service portals and mobile applications to empower employees and foster engagement. The integration of cloud computing provides organizations with the agility and real-time data access required for seamless payroll processing and workforce management across different geographical locations. The trend towards remote and hybrid work models, accentuated by global events, reinforces the importance of HR solutions capable of effectively supporting distributed workforces.

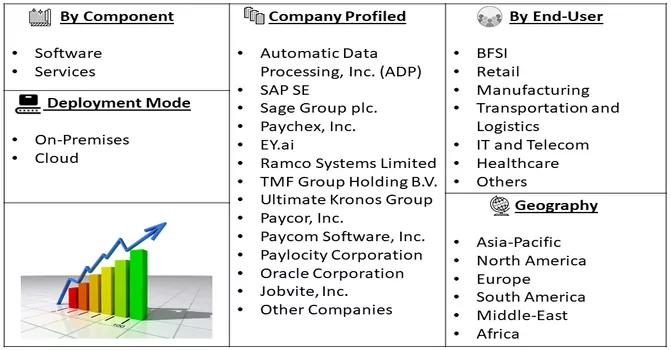

Market Segmentation: The global payroll and HR solutions and services market by Business Size (Small and Medium Sized Enterprises and Large Sized Enterprises), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market size and forecasts are provided in terms of value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global payroll and HR solutions and services market are witnessing significant trends that reflect the industry's dynamic evolution. A prominent shift toward cloud-based solutions prevails, offering organizations agility and accessibility. Employee well-being has taken centre stage, with HR solutions integrating wellness programs and mental health support. The infusion of artificial intelligence and automation is reshaping HR processes, automating tasks, and providing data-driven insights. Heightened concerns for data security drive the incorporation of advanced security measures within HR solutions, ensuring compliance with data protection regulations. Mobile applications are becoming essential for on-the-go access, aligning with the trend of a more mobile workforce. Integrated talent management, agile payroll models, and continuous learning and development features characterize the evolving landscape. People analytics is gaining prominence, empowering organizations with data-driven decision-making capabilities. Moreover, the integration of ESG metrics within HR solutions aligns with the growing emphasis on corporate responsibility and sustainability. These trends collectively illustrate the industry's commitment to addressing contemporary workforce challenges and embracing innovations to enhance organizational efficiency and employee well-being.

Market Drivers:

Growing Emphasis on Data-Driven Decision-Making in HR Management

The escalating emphasis on data-driven decision-making in HR is driving heightened demand for solutions with robust analytics and reporting capabilities. Organizations actively seek platforms capable of providing valuable insights into workforce trends, performance metrics, and other critical HR-related data. This increased demand stems from the acknowledgement that leveraging data in HR decisions not only enhances operational efficiency but also plays a pivotal role in strategic planning for the future. As businesses prioritize the integration of analytics tools into their HR solutions, the objective is to gain a comprehensive understanding of workforce dynamics, enabling more informed and strategic decision-making processes. In October 2021, Chilean company Buk, the developer of a human resources management platform for Latin American companies, announced a significant achievement in raising USD 50 million in a Series A funding round. This funding round marked one of the largest Series A rounds ever secured by a Latin American startup and positioned Buk as the third most valuable startup in Chile, following Cornershop and NotCo in terms of valuation. Thus, such factors are expected to witness significant growth over the forecast period.

Increasing Digital Transformation

The ongoing digital transformation sweeping across various industries is prompting a widespread adoption of HR technologies. Companies are making strategic investments in Payroll and HR solutions with the aim of streamlining operations and automating traditionally manual processes. The primary objectives behind this strategic adoption include elevating the accuracy levels of data management and enhancing overall operational efficiency. The driving force behind these investments is the realization that modern HR technologies not only automate routine tasks but also play a pivotal role in optimizing various workforce management processes. The targeted investments are geared towards establishing a more agile and technologically advanced HR landscape, positioning organizations to adeptly navigate the complexities of the contemporary business environment. This strategic embrace of HR technologies reflects a forward-looking approach by companies to leverage innovation for increased efficiency and effectiveness in managing their human resources.

Restraints:

Security Concerns and High Implementation Costs

Despite the enticing prospects of automation and enhanced efficiency, concerns surrounding the security of sensitive employee data and the high costs associated with widespread adoption pose significant challenges to the growth of Payroll and HR solutions. To surmount these hurdles and fully unlock the transformative potential of these technologies, it is imperative to prioritize robust security measures, develop cost-effective solutions, and ensure user-friendly experiences. By addressing these critical aspects, the industry can instil confidence among users and organizations, fostering a more seamless integration of Payroll and HR solutions into their operations. Failure to effectively address these concerns may impede the anticipated growth of the studied market during the forecast period. Hence, a comprehensive approach that addresses both security and cost considerations is essential for realizing the true potential of these transformative technologies in the realm of Payroll and HR solutions.

The COVID-19 pandemic has had a profound impact on the Payroll and HR solutions landscape. The sudden shift to remote work necessitated agile HR solutions capable of supporting dispersed workforces, emphasizing the importance of flexible payroll processing and employee engagement tools. Economic uncertainties led to budget reassessments, affecting planned investments in HR technologies as organizations prioritized cost-cutting measures. However, the pandemic highlighted the crucial role of HR solutions in addressing employee well-being and mental health concerns, prompting a renewed focus on communication and support mechanisms. The accelerated adoption of cloud-based HR solutions for remote access and the increased emphasis on data security are lasting outcomes. As organizations continue to adapt to the new normal, the lessons learned during the pandemic are shaping a future where advanced HR solutions play a central role in fostering agility, supporting remote work, and prioritizing employee well-being.

Segmental Analysis:

Small and Medium-Sized Enterprises (SMEs) Segment is Expected to Witness Significant Growth

The Small and Medium-Sized Enterprises (SMEs) payroll and HR solutions and services market is witnessing significant growth driven by the increasing recognition among smaller businesses of the transformative benefits offered by advanced HR technologies. SMEs are increasingly turning to integrated payroll and HR solutions to streamline their operations, automate manual processes, and enhance overall workforce management. The demand is fueled by a growing understanding that these solutions not only improve operational efficiency but also contribute to strategic decision-making. Cloud-based solutions have become particularly popular among SMEs, providing them with cost-effective and scalable options for managing payroll, employee data, and compliance. As these businesses seek to stay competitive and adapt to dynamic market conditions, there is a rising emphasis on solutions that offer user-friendly interfaces, flexibility, and compliance with evolving regulatory requirements. The SME payroll and HR solutions market is poised for further expansion as technology providers tailor offerings to meet the specific needs and constraints of smaller enterprises, contributing to the overall modernization of HR practices in this sector.

Cloud-based Segment is Expected to Witness Significant Growth

The Cloud-based Payroll and HR solutions and services are revolutionizing the way businesses handle their human resources and payroll tasks. These solutions utilize cloud technology, offering a host of advantages. They provide scalability, enabling organizations to easily adapt their HR and payroll systems to accommodate growth or changes. Cloud solutions also ensure real-time updates and automatic software upgrades, keeping organizations in sync with the latest features and compliance requirements. Robust security measures in reputable cloud platforms enhance the protection of sensitive employee data. Moreover, the cost-effectiveness of cloud-based solutions, eliminating the need for extensive on-site infrastructure, makes them highly attractive for businesses of all sizes, fostering efficiency and adaptability in HR and payroll management. In September 2023, Chase Payment Solutions is teaming up with Gusto, a payroll and HR software company, to offer payroll solutions to its business payment customers. The goal is to create an all-in-one financial services hub for small and medium-sized businesses (SMBs) by integrating payments, banking, and payroll on a single platform. With this collaboration, Chase aims to provide its customers with a more straightforward and efficient payroll experience. The incorporation of Gusto's payroll services will enable businesses to easily handle tasks such as running payroll, calculating taxes, filing with relevant agencies, and generating paystubs. Moreover, employees will benefit from a secure portal for self-onboarding, viewing pay stubs, and accessing tax documents. Thus, such developments are boosting the segment’s growth.

North America Region is Expected to Witness Significant Growth

The North American payroll and HR solutions and services market is characterized by robust growth and widespread adoption of advanced technologies in workforce management. Organizations in the region are increasingly recognizing the strategic value of integrated payroll and HR solutions, driving the demand for comprehensive platforms that streamline processes, enhance data accuracy, and support compliance. The market in North America is propelled by factors such as the dynamic regulatory landscape, the need for efficient payroll processing, and the rising focus on employee experience. Cloud-based solutions have gained prominence, providing flexibility and scalability for businesses of all sizes. The COVID-19 pandemic has further accelerated the adoption of remote work models, amplifying the importance of cloud-based HR solutions for seamless management of dispersed workforces. The region's market is characterized by the presence of key players offering a diverse range of solutions, from payroll processing and benefits administration to talent management and analytics. As organizations prioritize digital transformation and workforce optimization, the North American payroll and HR solutions market is poised for sustained growth, with continual innovations and advancements shaping the future of HR practices in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape.

Recent Developments:

1) In September 2023, Berlin-based HRtech startup Kenjo has secured EUR 8.8 million in a Series A funding round led by Hi Inov, with participation from Lightbird, Innovation Nest, and existing investors Redalpine and The Delta. The new funding will support Kenjo's expansion of its HR and employee engagement software solutions, with a specific focus on meeting the needs of frontline workers in SMBs across sectors such as manufacturing, healthcare, logistics, and retail. Beyond product development, Kenjo has plans to extend its presence beyond Europe, eyeing further expansion into the Latin American (LATAM) region, including Chile, a strategic move that was initiated last year.

2) In September 2023, IRIS Software Group (IRIS), a prominent global software provider specializing in accountancy and payroll solutions, is unveiling an extended range of human resource services for the Americas. The enhanced offerings feature Global HR consultancy (HRC) and upgraded HR software, empowering organizations based in the Americas to effortlessly expand their HR operations while ensuring confidence in meeting global compliance standards. AI can significantly enhance Global HR consultancy (HRC) by automating processes such as talent acquisition, workforce planning, and performance management, making these operations more efficient and data-driven. Machine learning algorithms can analyze vast datasets to provide valuable insights into HR trends, enabling organizations to make informed decisions. In the realm of enhanced HR software

Q1. What was the HR Payroll Solution and Services Market size in 2023?

HR Payroll Solution and Services is expected to garner USD 62.3 Billion in the year 2023.

Q2. At what CAGR is the HR Payroll Solution and Services market projected to grow within the forecast period?

HR Payroll Solution and Services Market is expected to a CAGR of 7.7% from over the forecast period.

Q3. What are the factors driving the HR Payroll Solution and Services market?

Key factors that are driving the growth include the Growing Emphasis on Data-Driven Decision-Making in HR Management and Increasing Digital Transformation.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model