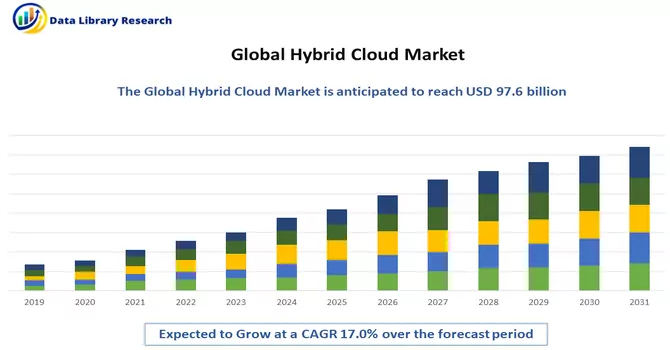

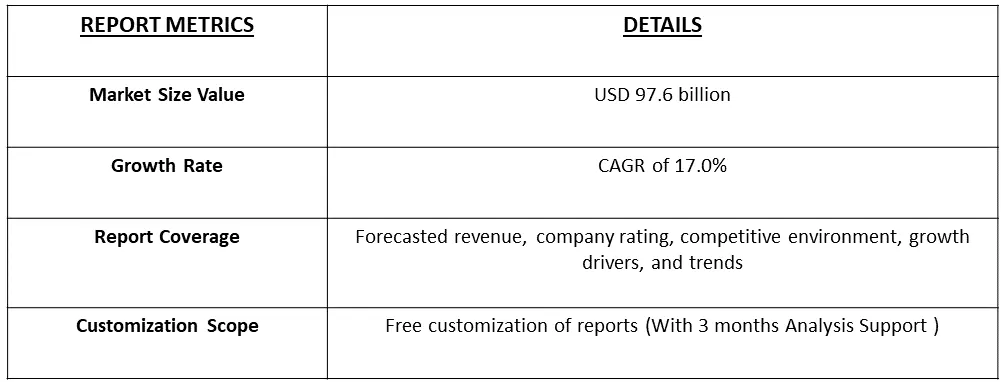

The Hybrid Cloud Market is currently valued at USD 97.6 billion in 2023, growing at a CAGR of 17.0% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The hybrid cloud market involves deploying computing resources across various environments, seamlessly combining on-premises data centers with public or private cloud services. This approach grants organizations greater flexibility and scalability by leveraging the strengths of both on-premises infrastructure and cloud services. In a hybrid cloud environment, applications and data can fluidly transition between private and public clouds, establishing a dynamic and efficient IT infrastructure. This model enables organizations to scale IT resources based on fluctuating workloads, using on-premises infrastructure for stable demands and tapping into cloud scalability for peak requirements. The appeal of the hybrid cloud lies in achieving a harmonious balance, allowing organizations to benefit from the scalability of the cloud while retaining control through on-premises infrastructure. This strategic fusion empowers businesses to navigate modern IT complexities, adapting to changing workloads while maintaining oversight over critical operations.

The adoption of a multi-cloud strategy was on the rise among organizations, as they increasingly embraced the utilization of services from multiple cloud providers. This strategic approach served as a means to steer clear of vendor lock-in, optimize costs, and cherry-pick the most suitable solutions for diverse workloads. Notably, hybrid cloud solutions were undergoing advancements to streamline the integration and management of resources across a spectrum of cloud environments.An emerging trend within this landscape was the amalgamation of edge computing with hybrid cloud architectures, gaining significant traction. This innovative integration empowered organizations to process data in close proximity to its source, effectively reducing latency and catering to the real-time processing requirements of various applications. The synergy between edge computing and hybrid cloud solutions presented a compelling proposition, allowing businesses to meet the demands of distributed computing more effectively. In response to this evolving landscape, hybrid cloud providers were actively enhancing their capabilities to robustly support edge computing. This strategic evolution aimed to offer organizations a more comprehensive solution, catering to the intricacies of distributed computing needs. The symbiotic relationship between multi-cloud strategies, hybrid solutions, and the integration of edge computing showcased a dynamic shift in how organizations approached and optimized their digital infrastructures for greater flexibility, efficiency, and real-time processing capabilities.

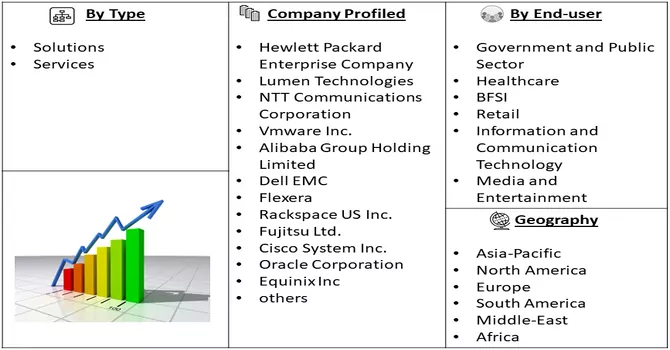

Market Segmentation: The Report Offers Hybrid Cloud Market Analysis and is segmented by Type (Solutions, Services), End-user Industry (Government and Public Sector, Healthcare, BFSI, Retail, Information and Communication Technology, Media and Entertainment), and Geography (North America, Europe, Asia Pacific, South America, and Middle East & Africa). The report offers market size and values in (USD Million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Digital Transformation Initiatives

The pervasive digital transformation initiatives spanning various industries play a pivotal role in propelling the widespread adoption of hybrid cloud solutions. In the quest to stay competitive and enhance agility, organizations are vigorously modernizing their IT infrastructure to align with the demands of a swiftly evolving digital landscape. Hybrid cloud architectures emerge as a linchpin in this transformative journey by providing a seamless integration framework for both legacy systems and cutting-edge, cloud-native technologies. This harmonious coexistence empowers organizations to harness the advantages offered by both on-premises and cloud environments, facilitating a smooth and effective transition to digital business models. The adoption of hybrid cloud solutions becomes instrumental in not only modernizing IT but also in fostering the adaptability and innovation necessary for organizations to thrive in the dynamic realms of the digital era.

Data Security and Compliance Requirements

Elevated apprehensions surrounding data security, privacy, and regulatory compliance are compelling organizations to embrace hybrid cloud solutions. Industries with stringent data protection regulations, such as finance, healthcare, and government, find hybrid models particularly enticing for adeptly managing sensitive information. The attractiveness lies in the capability to maintain critical data on-premises, thereby adhering to regulatory mandates, while concurrently harnessing the advantages of cloud services for less sensitive operations. This dual-faceted nature of hybrid cloud architectures not only addresses the intricate demands of security and compliance but also furnishes organizations with a nuanced and balanced approach to data governance. By seamlessly integrating on-premises infrastructure with cloud capabilities, hybrid cloud solutions emerge as a strategic choice for industries navigating specific regulatory constraints, ensuring a harmonious coexistence between data protection measures and the operational efficiencies derived from cloud services.

Market Restraints:

Complexity and Integration Challenges

Navigating the intricacies of integrating on-premises infrastructure with diverse cloud environments, particularly within a multi-cloud configuration, presents a substantial challenge. The deployment of hybrid cloud architectures demands meticulous planning, specialized expertise, and thorough considerations of compatibility. Organizations may encounter obstacles in achieving a smooth interoperability among the different components of their hybrid infrastructure. This complexity can lead to prolonged implementation timelines, elevated costs, and the possibility of disruptions to existing workflows. Effectively managing the integration process requires a strategic approach to address compatibility issues, ensuring seamless communication between on-premises and cloud-based components. As organizations strive to optimize their hybrid cloud setups, careful attention to planning and execution becomes paramount to overcome challenges and unlock the full potential of a seamlessly integrated and efficiently functioning hybrid infrastructure.

The COVID-19 pandemic has significantly influenced the hybrid cloud market, prompting organizations to expedite the adoption of flexible and scalable IT infrastructure. The sudden shift to remote work emphasized the importance of hybrid cloud solutions, offering a balance between on-premises infrastructure and cloud services for seamless workload transitions and operational adaptability. The pandemic also accelerated the integration of edge computing with hybrid cloud architectures to address the growing need for real-time data processing and reduced latency. Financial considerations, driven by economic uncertainties, further fueled the adoption of multi-cloud strategies within the hybrid cloud framework. Overall, the pandemic has transformed hybrid cloud solutions from advantageous to indispensable, shaping the market to better meet the dynamic demands of the evolving digital landscape.

Segmental Analysis:

Government and Public Sector Segment is Expected to Witness Significant Growth Over the Forecast Period

The COVID-19 pandemic brought about an unprecedented disruption to global workplaces, necessitating swift adaptations to ensure business continuity and public service delivery. Government agencies, traditionally bound by bureaucratic processes and on-premises infrastructure, found themselves at the forefront of a transformative shift as the pandemic accelerated the adoption of remote work. In response to the challenges posed by the crisis, hybrid cloud solutions emerged as a critical enabler, playing a pivotal role in facilitating secure access to government systems, data, and applications from various locations. The sudden surge in remote work posed a unique set of challenges for government agencies. Ensuring that employees could securely access sensitive information and essential systems remotely became imperative. Hybrid cloud solutions, characterized by their ability to seamlessly integrate on-premises infrastructure with cloud services, proved to be a key facilitator in this transition. By leveraging hybrid cloud architectures, government agencies were able to establish secure and scalable frameworks that allowed employees to access government systems and data securely from diverse locations. The impact of this shift was profound, with governments witnessing an unprecedented demand for digital services. As citizens adhered to lockdowns and social distancing measures, online platforms became the primary means for various transactions and interactions with government agencies. Hybrid cloud solutions, with their inherent scalability and agility, played a crucial role in meeting this surge in demand for digital services efficiently. One of the key advantages of hybrid cloud architectures in the context of digital government services is their ability to scale resources dynamically. As the demand for online services skyrocketed, governments needed a solution that could quickly adapt to varying workloads. Hybrid cloud environments, with the combination of on-premises infrastructure and cloud scalability, provided the flexibility needed to scale resources up or down based on demand. This ensured that government services remained accessible, responsive, and resilient in the face of unprecedented demand.Moreover, the agility offered by hybrid cloud solutions allowed governments to rapidly deploy and expand digital services. Traditional on-premises infrastructure often involves lengthy procurement and implementation processes, which can be a bottleneck in times of urgent need. Hybrid cloud environments, on the other hand, enabled government agencies to swiftly launch new digital initiatives, roll out updates, and scale services to meet evolving citizen requirements. This agility proved instrumental in enhancing the overall responsiveness of government agencies to the changing dynamics of service delivery during the pandemic. However, the adoption of hybrid cloud solutions in the government sector was not without its challenges. Security and compliance considerations were paramount, given the sensitivity of government data. Ensuring that remote access to government systems was not only convenient but also secure became a top priority. Hybrid cloud architectures, when implemented thoughtfully, addressed these concerns by incorporating robust security measures, encryption protocols, and compliance frameworks to safeguard government information. In conclusion, the COVID-19 pandemic acted as a catalyst for the accelerated adoption of remote work in government agencies, with hybrid cloud solutions emerging as a linchpin in this transformative journey. The impact was profound, leading to an increased demand for digital services and necessitating a rapid and agile response from government organizations. Hybrid cloud architectures not only facilitated secure remote access to government systems but also empowered governments to scale and deliver digital services efficiently. As the world continues to navigate the challenges posed by the pandemic, the lessons learned from the adoption of hybrid cloud solutions in the government sector will likely shape the future of public service delivery and digital transformation initiatives.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America, comprising the United States and Canada as key players, has been at the forefront of hybrid cloud adoption. The hybrid cloud market in the region has seen significant growth due to a variety of factors, including the need for flexible and scalable IT solutions, increased data security concerns, and a growing recognition of the benefits offered by hybrid cloud architectures. One of the key drivers of hybrid cloud adoption in North America is the diverse and dynamic nature of businesses in the region. Enterprises across various industries, including finance, healthcare, manufacturing, and technology, have recognized the advantages of hybrid cloud solutions in balancing the scalability of the cloud with the control provided by on-premises infrastructure. This versatility makes hybrid cloud particularly appealing for organizations with varying workloads and regulatory requirements.

In North America, particularly in the United States, there has been a notable surge in the adoption of hybrid cloud solutions in the government sector. Government agencies at the federal, state, and local levels have embraced hybrid cloud architectures to enhance their IT capabilities, streamline operations, and improve citizen services. The flexibility of hybrid cloud models allows government organizations to maintain sensitive data on-premises while leveraging the cloud for scalable and cost-effective solutions. The region has witnessed the active involvement of major technology and cloud service providers in shaping the hybrid cloud market. Companies such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) have played a crucial role in offering hybrid cloud solutions and services to enterprises. Their investments in data centers, network infrastructure, and innovative technologies contribute to the growth and maturity of the hybrid cloud market in North America. The COVID-19 pandemic has further accelerated the adoption of hybrid cloud solutions in North America. With the sudden shift to remote work, organizations sought agile and resilient IT infrastructures, leading to an increased reliance on hybrid cloud models. The ability of hybrid clouds to support remote access, data security, and business continuity became paramount during these challenging times. Security and compliance have been focal points in the North American hybrid cloud market. As organizations handle sensitive data and adhere to regulatory frameworks, ensuring robust security measures within hybrid cloud architectures has been a top priority. Compliance with industry standards and data protection regulations has influenced the design and implementation of hybrid cloud solutions in the region. Thus, the region is expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the major players working in this market segment are:

Recent Development:

1) In April 2023, DXC Technology made headlines with the introduction of DXC Secure Network Fabric, a cutting-edge hybrid cloud-optimized data center platform. Developed in collaboration with Hewlett Packard Enterprise and AMD, this comprehensive software-defined data center system aims to streamline and secure networks while also automating and modernizing operations, all at a reduced cost.

2) In January of 2023, Cloudian, a prominent vendor specializing in hybrid cloud data management and storage technology, successfully concluded a fundraising round, securing a substantial USD 60 million. The funds were earmarked to facilitate the company's expansion to cater to a growing number of use cases. This financing round garnered support from various investment firms, including Intel Capital, as well as other strategic investors, pushing Cloudian's total funding to an impressive USD 233 million.

Q1. What was the Hybrid Cloud Market size in 2023?

As per Data Library Research the Hybrid Cloud Market is currently valued at USD 97.6 billion in 2023.

Q2. At what CAGR is the Hybrid Cloud market projected to grow within the forecast period?

Hybrid Cloud Market is growing at a CAGR of 17.0% over the forecast period.

Q3. Who are the key players in Hybrid Cloud market?

Some key players operating in the market include

Q4. What are the Growth Drivers of the Hybrid Cloud market?

Digital Transformation Initiatives and Data Security and Compliance Requirements Growth Drivers of the Hybrid Cloud market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model