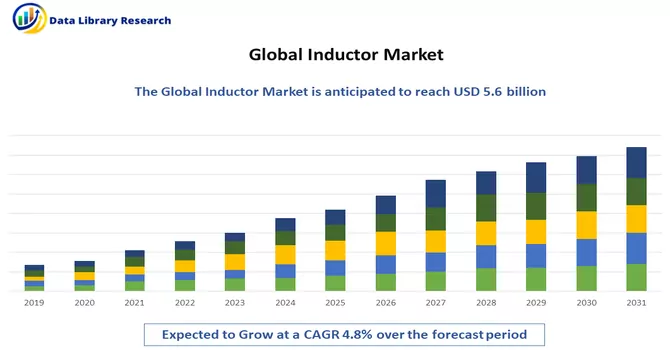

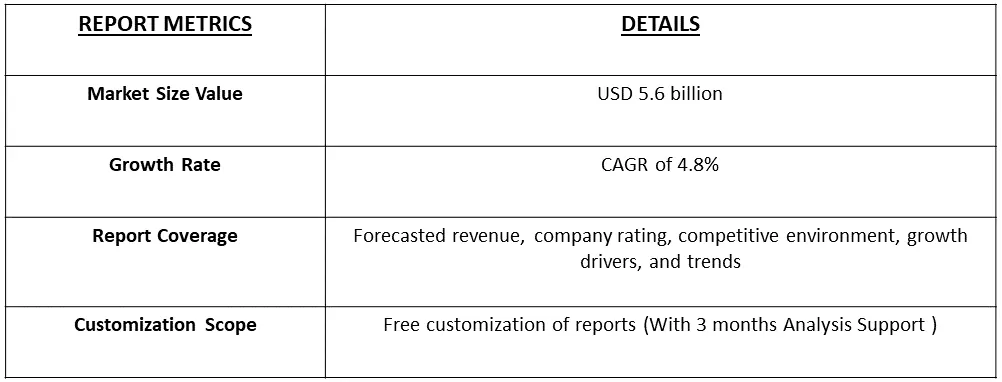

The Global Inductor Market size was valued at USD 5.6 billion in 2023 and is expected to grow at a CAGR of approximately 4.8% over the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Inductors are passive electronic components that store energy in a magnetic field when an electric current flows through them. Consisting of a coil of wire, they resist changes in current, inducing a voltage opposing the flow. The basic structure includes a core, often made of ferromagnetic material, to enhance inductance. Inductors find extensive use in electronic circuits for filtering, energy storage, and creating magnetic fields. Their ability to store and release energy makes them essential in applications ranging from power supplies and transformers to radio frequency circuits and telecommunications equipment.

The global inductors market is experiencing significant growth driven by several key factors. The rising demand for electronic devices, including smartphones, laptops, and IoT devices, is a primary driver. As these devices become more advanced and compact, the need for smaller, high-performance inductors has surged, fostering market growth. Additionally, the expanding electric vehicle (EV) market and the increasing adoption of renewable energy sources contribute to the demand for inductors in power electronics. The rapid deployment of 5G technology and the continuous evolution of telecommunications infrastructure also play a crucial role. Moreover, the emphasis on energy efficiency and the growing trend of miniaturization in electronics are propelling the inductors market forward. As industries continue to advance technologically, the demand for inductors is expected to persist, driven by their essential role in various electronic applications.

The inductor market is undergoing significant trends shaped by technological advancements, industry shifts, and evolving consumer demands. Miniaturization remains a dominant trend, driven by the demand for smaller, lighter, and more efficient electronic devices. This push towards smaller form factors has led to innovations in inductor design and manufacturing processes, focusing on achieving higher power density and energy efficiency. The surge in demand for electric vehicles (EVs) and the ongoing transition towards renewable energy sources have fueled the need for inductors in power electronics. The inductor market is witnessing a growing emphasis on high-performance magnetic components to support energy-efficient applications and meet sustainability goals. Furthermore, the proliferation of Internet of Things (IoT) devices and the rapid expansion of 5G networks are contributing to increased demand for inductors in the telecommunications sector.

These devices require compact and high-performance inductors to enable seamless connectivity and efficient power management. Cost-effective and environmentally friendly materials are gaining traction in the inductor market, reflecting a broader industry shift towards sustainability. Manufacturers are exploring alternative materials and production processes to align with environmental regulations and cater to the growing demand for eco-friendly solutions. Overall, the inductor market is evolving to meet the demands of a technologically advanced and environmentally conscious landscape. The trends indicate a continued focus on innovation, efficiency, and sustainability, positioning the inductor market at the forefront of key technological developments across various industries.

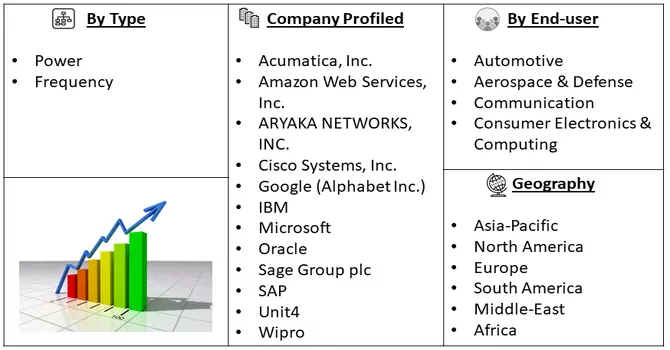

Market Segmentation: The Global Inductor Market is Segmented by Type (Power, and Frequency), End-user Vertical (Automotive, Aerospace & Defense, Communication, Consumer Electronics & Computing), and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa). The market size and forecasts are provided in terms of value (in USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increase in Demand for Inductors in Automobiles

The automotive industry is witnessing a substantial increase in the demand for inductors, marking a significant trend in electronic component adoption within vehicles. As the automotive sector undergoes a transformative shift towards electric and hybrid vehicles, inductors play a crucial role in power electronics, supporting functions like motor drives and charging systems. The demand surge is particularly prominent in Electric Vehicles (EVs) due to the intricate power management requirements. Additionally, the proliferation of advanced driver-assistance systems (ADAS) and in-vehicle connectivity features further contributes to the heightened need for inductors in modern automobiles. These electronic components facilitate efficient energy transfer, reduce electromagnetic interference, and enhance overall performance. With the growing emphasis on fuel efficiency, emission reduction, and the ongoing evolution towards electric mobility, the automotive industry's reliance on inductors is expected to continue rising. This trend underscores the integral role inductors play in shaping the electronic architecture of contemporary vehicles, contributing to the development of more energy-efficient, connected, and environmentally friendly automotive solutions. As automotive technologies advance, the demand for inductors is set to be a driving force in shaping the future of the automotive electronics landscape.

Adoption of Advanced Consumer Electronic Devices

The widespread adoption of advanced consumer electronic devices has significantly driven the demand for inductors, playing a pivotal role in shaping the modern technology landscape. As consumer electronics continue to evolve, with the emergence of smartphones, tablets, wearables, and IoT devices, the need for compact, high-performance inductors has surged. These electronic components are integral to power management, filtering, and energy storage within these devices. The miniaturization trend in consumer electronics, coupled with the quest for enhanced energy efficiency, has propelled the utilization of inductors for optimal space utilization and power optimization. Inductors facilitate efficient energy transfer and play a crucial role in maintaining stable currents, reducing electromagnetic interference, and ensuring the reliability of electronic devices. Moreover, as consumer preferences drive the demand for more feature-rich and energy-efficient gadgets, inductors become indispensable components in the design and functionality of these devices. The advent of wireless charging technologies, advancements in audio devices, and the proliferation of smart home applications further contribute to the increasing prominence of inductors. As the consumer electronics market continues to expand, the role of inductors in powering, stabilizing, and enhancing the performance of these devices is poised to remain pivotal, making them indispensable in the ever-evolving landscape of advanced consumer electronics.

Market Restraints:

Fluctuating Raw Material Prices

The global inductor market may face challenges and a potential slowdown in growth due to the impact of fluctuating raw material prices. The production of inductors involves the use of various materials such as copper, aluminum, and magnetic cores. Fluctuations in the prices of these raw materials can significantly influence manufacturing costs for inductors. Sudden price increases can pose challenges for manufacturers in maintaining competitive pricing and profit margins. Additionally, it may lead to increased production costs, impacting the overall supply chain dynamics. Manufacturers and stakeholders in the inductor market may face uncertainties and cost pressures, potentially affecting investment decisions and market expansion strategies. The ability to absorb or pass on these increased costs to consumers becomes a critical consideration. Strategies like strategic sourcing, hedging, and alternative material exploration may become essential for industry players to mitigate the impact of fluctuating raw material prices and sustain growth in the global inductor market. The market's resilience and adaptability in navigating these challenges will play a crucial role in determining its trajectory amid the complexities of the raw material pricing landscape.

The COVID-19 pandemic has had a discernible impact on the Inductor Market, introducing both challenges and opportunities. The initial disruptions, including supply chain constraints and factory closures, led to a temporary setback in production and distribution. However, as industries adapted to new norms, the market exhibited resilience and agility. The surge in remote working, increased reliance on technology, and the growing demand for electronic devices stimulated certain sectors of the inductor market, particularly those related to telecommunications and consumer electronics. The pandemic-induced economic uncertainties prompted cost-conscious strategies, influencing procurement decisions and supply chain resilience. The inductor market witnessed fluctuations in demand across various industries, with automotive and industrial sectors experiencing temporary downturns, while the renewable energy sector showed increased resilience. Additionally, the need for miniaturization and technological advancements in electronics gained prominence during the pandemic, driving innovation in inductor designs. The growing focus on energy efficiency and the transition towards electric vehicles also contributed to shifts in inductor market dynamics. In conclusion, while the initial phase of the pandemic posed challenges to the Inductor Market, it also spurred innovation and highlighted the importance of adaptability. As industries navigate the post-pandemic landscape, the inductor market is expected to rebound, driven by evolving technology trends and an increasing emphasis on resilient and efficient supply chains.

Segmental Analysis:

Power Segment is Expected to Witness Significant Growth Over the Forecast Period

The power segment plays a crucial role in driving demand and influencing the dynamics of the global inductor market. Inductors are fundamental components in power electronics, and their significance is particularly pronounced in applications related to power generation, distribution, and conversion. The demand for inductors in the power sector is driven by various factors, including the growing need for energy efficiency, the increasing adoption of renewable energy sources, and the evolution of electric power infrastructure. In power generation, inductors are utilized in generators and transformers to manage currents and facilitate efficient energy transfer. In power distribution systems, they play a critical role in stabilizing voltage levels and reducing electromagnetic interference. Furthermore, in power conversion applications such as inverters and converters, inductors contribute to the efficient transformation of electrical energy. The ongoing global transition towards renewable energy sources, such as solar and wind, further amplifies the role of inductors in power applications. As the power industry embraces smart grids, electric vehicles, and other advanced technologies, the demand for high-performance inductors continues to rise. In conclusion, the power segment significantly influences the growth and evolution of the inductor market. The continuous advancements in power technologies and the increasing emphasis on energy efficiency ensure that inductors will remain integral components in various power-related applications, shaping the future of the global inductor market.

Electronics and Computing Segment is Expected to Witness Significant Growth Over the Forecast Period

The electronics and computing sectors are key drivers of the global inductor market, with inductors serving as fundamental components in various applications within these industries. As electronic devices become more advanced and compact, the demand for smaller, high-performance inductors has surged. In computing applications, such as servers, laptops, and desktops, inductors are integral to power delivery, voltage regulation, and signal processing, contributing to the overall efficiency and performance of electronic systems. Moreover, the proliferation of IoT devices, smart appliances, and wearable technologies in the electronics sector has further fueled the demand for inductors. These devices often require miniaturized components, and inductors play a crucial role in power management and signal integrity. The advent of 5G technology has also significantly impacted the inductor market. As the telecommunications industry evolves to accommodate higher data speeds and increased connectivity, inductors are essential in radio frequency (RF) applications and antenna systems. In summary, the symbiotic relationship between the electronics, computing, and inductor markets is evident, with inductors serving as critical components in powering, regulating, and enhancing the performance of a wide array of electronic devices. As technological advancements continue to drive innovation in electronics and computing, the demand for efficient and compact inductors is expected to remain a driving force in the evolving landscape of these industries.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America significantly influences the global inductor market, driven by its thriving electronics industry and technological innovation. The region's focus on electric vehicles, advanced driver-assistance systems, and clean energy initiatives propels the demand for inductors in automotive and renewable energy applications. In telecommunications, the rapid deployment of 5G technology and North America's leadership in IoT adoption contribute to the increasing need for high-performance inductors. With a strong emphasis on research, development, and manufacturing capabilities, North America plays a pivotal role in shaping inductor market dynamics, ensuring its continued growth and prominence in the ever-evolving landscape of electronics and technology.

Get Complete Analysis Of The Report - Download Free Sample PDF

The competitive dynamics within the Inductor Market have witnessed a noteworthy transformation in recent years, leading to heightened competition and a fragmented landscape. The industry now features a multitude of inductor manufacturers vigorously competing for expanding market shares. This fragmentation has empowered Original Equipment Manufacturers (OEMs) with substantial buying influence, providing them the flexibility to select an inductor manufacturer that aligns seamlessly with their business model. Moreover, the emphasis is not only on securing competitive prices but also on ensuring a delicate equilibrium between quality and cost-effectiveness. This shift in the competitive landscape underscores the evolving nature of the inductor market, where manufacturers are compelled to differentiate themselves not just through pricing strategies but also by delivering superior product quality, thereby offering OEMs an array of options for optimizing their supply chains and enhancing overall operational efficiency.

Recent Development:

1) In March 2021, Vishay Intertechnology Inc. introduced a new Automotive Grade through-hole inductor designed to deliver a saturation current of 420 A, resulting in a 30% reduction in inductance within a compact 1,500 case size. The shielded, composite construction of this AEC-Q200 qualified device allows for a compact size of 38.1mm by 38.1mm by 21.9mm, supporting continuous DC of up to 235A.

2) In July 2021, TDK Corporation expanded its range of coupled inductors with the introduction of the new EPCOS series. Featuring nine different series types designed for maximum rated currents, these compact and robust components have proven valuable in various applications. They are particularly well-suited for use in galvanically non-insulated DC/DC converter topologies such as SEPIC, Cuk, and Zeta. Additionally, the coupled inductors can serve as transformers in flyback and multi-output buck topologies, providing a second output voltage. Their versatility extends to functioning as common-mode chokes in power supply lines. This expansion in the range of coupled inductors further enhances TDK's offerings for diverse applications requiring reliable and efficient inductor solutions.

Q1. What was the Inductor Market size in 2023?

As per Data Library Research the Global Inductor Market size was valued at USD 5.6 billion in 2023.

Q2. What is the Growth Rate of the Inductor Market?

Inductor Market is expected to grow at a CAGR of approximately 4.8% over the forecast period.

Q3. What are the Growth Drivers of the Inductor Market?

Increase in Demand for Inductors in Automobiles and Adoption of Advanced Consumer Electronic Devices are the Growth Drivers of the Inductor Market.

Q4. Which region has the largest share of the Inductor Market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model