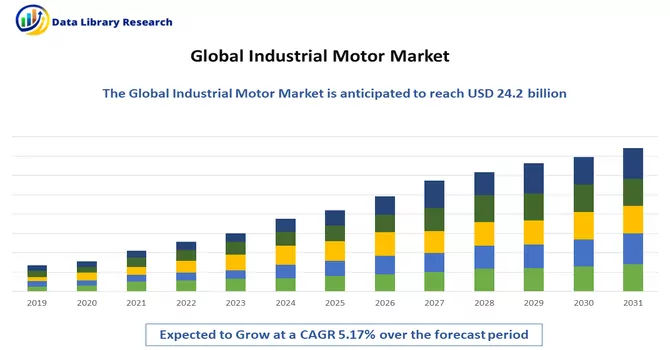

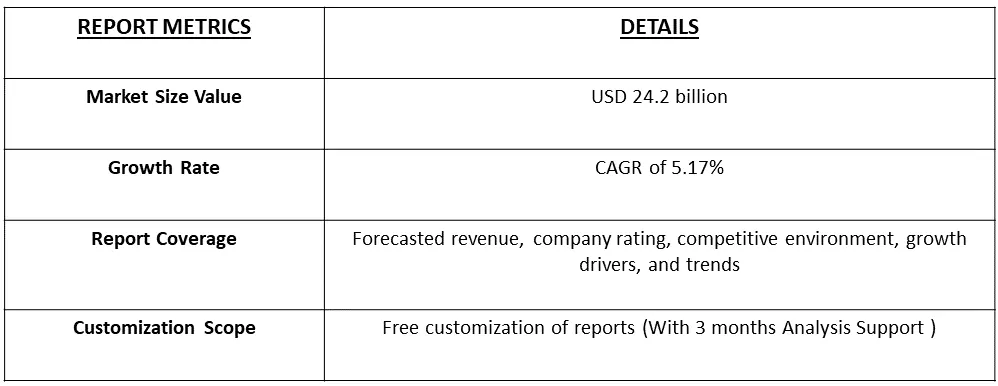

The Industrial Motors Market size is estimated at USD 24.2 billion in 2023 and is expected to reach a CAGR of 5.17% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Industrial motors, also known as industrial electric motors, are electromechanical devices that convert electrical energy into mechanical energy. These motors are specifically designed for use in industrial applications, where they are used to drive machinery, equipment, and other mechanical systems. Industrial motors are characterized by their robust construction, high efficiency, and ability to operate in demanding environments. They are used in a wide range of industries, including manufacturing, oil and gas, mining, and utilities, to power various types of machinery and equipment essential for industrial processes.

Motors play a pivotal role in driving industrial production, and there is a growing emphasis on advanced approaches to designing and developing them. These approaches include considerations such as alignment, motor monitoring, connections, testing, and cost and time savings, all while enhancing safety and security. Energy-saving motors and intelligent drives are also becoming more prevalent, boosting efficiency and performance while simplifying troubleshooting processes. The increasing focus on Industry 4.0 is a key driver for the industrial motor market. This shift towards smart manufacturing and industrial automation is leading to greater productivity in various regions, driving demand for industrial motors. According to the Industrial Energy Accelerator, a significant portion of electrical energy consumed by industries globally is attributed to millions of electrical motors in operation. This has prompted a focus on innovations in industrial motor technology to improve energy efficiency and reduce overall energy consumption in industrial operations.

The industrial motor market is experiencing several key trends that are shaping its evolution. These include a heightened focus on energy efficiency, leading to increased demand for high-efficiency motors, and the rise of smart motors with IoT integration for remote monitoring and predictive maintenance. Additionally, the transition to electric vehicles is driving the need for specialized industrial motors used in EV manufacturing, while the growing adoption of renewable energy sources is boosting demand for motors in renewable energy systems. The expansion of automation is driving demand for motors in automated systems, and the digitalization of manufacturing is increasing the need for motors that can integrate with digital systems. Lastly, there is a growing focus on sustainability, leading to increased demand for environmentally friendly and energy-efficient motors.

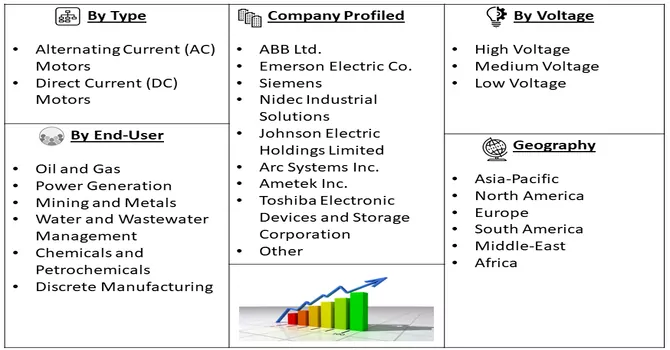

Market Segmentation: The Report Covers Industrial Motor Market Manufacturers and is Segmented by Type of Motor (Alternating Current (AC) Motors, Direct Current (DC) Motors), by Voltage (High Voltage, Medium Voltage, Low Voltage), by End-User (Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing), and by Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Industrialization and Infrastructure Development

The industrialization and infrastructure development in emerging economies are significant drivers of the industrial motor market, as these countries increasingly require industrial motors to power various industries and infrastructure projects. An example illustrating this trend is Suzuki Motor's decision in October 2023 to position its India operations as an export hub for electric vehicles (EVs) and export these vehicles to Japan starting in 2025. This move indicates a shift toward electric vehicle production, which typically requires different industrial motors compared to traditional internal combustion engine vehicles. As Suzuki ramps up its EV production in India, there is likely to be a corresponding increase in the demand for specialized industrial motors used in the manufacturing process of these electric vehicles. This surge in demand could benefit Japanese industrial motor manufacturers that produce these specialized motors, potentially leading to increased production and sales for these companies. Furthermore, Suzuki's focus on electric vehicles aligns with the global trend toward sustainability and green technology. This alignment could further drive the adoption of electric vehicles and, consequently, the demand for industrial motors in Japan and other regions. Overall, Suzuki's strategic decision highlights the interconnected nature of the industrial motor market, where developments in one region can have ripple effects across the globe, influencing market dynamics and driving innovation.

Renewable Energy Integration:

The integration of renewable energy sources, particularly wind and solar power, into industrial applications is a key aspect of the global shift towards sustainable energy practices. Industrial motors play a crucial role in this transition by enabling the conversion of renewable energy into mechanical power, which is essential for driving various industrial processes. In wind energy systems, industrial motors are used in wind turbines to convert the kinetic energy of the wind into mechanical power. This mechanical power is then converted into electricity through a generator. Industrial motors are used in various components of a wind turbine, including the pitch system, yaw system, and generator, to ensure efficient operation and energy production. Similarly, in solar energy systems, industrial motors are used in solar tracking systems to orient solar panels towards the sun, maximizing their exposure to sunlight and optimizing energy generation. Industrial motors are also used in solar water pumping systems, solar thermal systems, and other solar applications to convert solar energy into usable mechanical power. The integration of renewable energy sources into industrial applications not only reduces reliance on fossil fuels but also helps industries reduce their carbon footprint and comply with environmental regulations. As the demand for renewable energy continues to grow, the demand for industrial motors used in renewable energy systems is expected to increase, driving further innovation and growth in the industrial motor market.

Market Restraints:

Economic Uncertainty and High Initial Costs

During economic downturns, businesses across industries often prioritize cost-cutting measures and operational efficiency to weather financial challenges. In such times, investments in new industrial infrastructure, including high-efficiency motors, may be postponed or reduced to conserve capital. The high upfront costs associated with these motors can act as a deterrent, particularly when companies are facing uncertain economic prospects. Additionally, during periods of economic uncertainty, demand for industrial products and services may decline, leading to lower production levels and reduced need for industrial motors. This reduction in demand further contributes to the reluctance of companies to invest in new motors, as they may already have sufficient capacity to meet reduced production requirements. Furthermore, economic instability can impact the availability of financing for capital investments, making it more challenging for businesses to fund new motor purchases. This can further delay investment decisions, as companies may prioritize immediate financial stability over long-term efficiency gains. Thus, fluctuations in economic conditions can have a significant impact on the industrial motors market, leading to reduced investment, lower demand, and a challenging business environment for manufacturers and suppliers in the industry.

The COVID-19 pandemic has had a significant impact on the industrial motor market, disrupting supply chains, reducing demand, and affecting production and sales. The pandemic led to temporary closures of manufacturing facilities and disruptions in logistics, which hampered the production and delivery of industrial motors. One of the major impacts of the pandemic was the slowdown in industrial activities across various sectors. Many industries scaled back or halted production due to lockdowns and social distancing measures, leading to a decrease in the demand for industrial motors. This decline in demand has affected the sales and revenue of industrial motor manufacturers. The pandemic also highlighted the importance of automation and digitalization in industrial processes. As companies look to minimize human contact and improve efficiency, there is a growing demand for smart industrial motors that can be monitored and controlled remotely. This trend is expected to drive the adoption of advanced industrial motors in the post-pandemic era. Furthermore, the pandemic has prompted companies to reassess their supply chains and sourcing strategies. Many companies are now looking to diversify their suppliers and reduce their reliance on single-source suppliers to mitigate the risk of future disruptions. Thus, while the COVID-19 pandemic has had a negative impact on the industrial motor market in the short term, it has also accelerated trends towards automation and digitalization, which are expected to drive growth in the market in the long term.

Segmental Analysis:

Alternating Current (AC) Motors Segment is Expected to Witness Significant Growth Over the Forecast Period

AC motors, comprising synchronous and induction types, play a vital role in industrial applications due to their efficiency, reliability, and controllability. Synchronous motors operate at a fixed speed determined by the frequency of the AC power supply and the motor's construction, making them ideal for applications requiring precise speed regulation, such as in industrial processes and timekeeping devices. In contrast, induction motors, the most prevalent type, operate at a speed slightly below synchronous speed, making them suitable for a wide range of applications, including fans, pumps, compressors, and conveyor systems. Industrial motors also encompass specialized variants like servo motors, tailored for applications demanding precise speed, position, and acceleration control, commonly used in robotics and CNC machines. Additionally, DC motors find their place in certain industrial applications where specific speed control is necessary, such as steel rolling mills and paper machines. These motors are designed to withstand harsh industrial environments, providing high performance, reliability, and longevity, making them indispensable components in various industrial processes.

Medium Voltage Segment is Expected to Witness Significant Growth Over the Forecast Period

The medium voltage industrial motor market, which includes motors operating within the 1 kV to 11 kV range, plays a crucial role in powering various industries such as oil and gas, mining, and power generation. These motors are essential for driving pumps, compressors, fans, and other heavy-duty machinery used in industrial processes. One of the key factors driving the growth of this market is the increasing demand for energy-efficient motors. Industries are seeking ways to reduce their energy consumption and operating costs, leading to a higher adoption of efficient motor systems. Additionally, stringent regulations regarding energy efficiency and emissions are also driving the demand for these motors. In terms of motor types, induction motors, especially squirrel cage motors, are the dominant choice in the market due to their reliability, ruggedness, and cost-effectiveness. However, synchronous motors are gaining popularity, especially in applications where high efficiency and power factor correction are crucial. The market is also being driven by the industrialization and infrastructure development in emerging economies. Countries like China, India, and others are witnessing rapid industrial growth, leading to an increased demand for industrial motors to support their manufacturing and infrastructure development activities. Thus, the medium voltage industrial motor market is witnessing significant growth due to the demand for energy-efficient and reliable motor systems, driven by stringent regulations and industrialization in emerging economies.

Water and Wastewater Management Segment is Expected to Witness Significant Growth Over the Forecast Period

Water and wastewater management is a critical aspect of modern infrastructure, and industrial motors play a vital role in ensuring the efficient operation of water and wastewater treatment facilities. These motors are used in various applications within these facilities, including pumps, blowers, mixers, and compressors, among others. The demand for water and wastewater management solutions is being driven by population growth, urbanization, and industrialization, leading to increased water consumption and wastewater generation. This has put pressure on existing water and wastewater treatment infrastructure, driving the need for more efficient and reliable equipment, including industrial motors. Industrial motors used in water and wastewater management applications need to meet specific requirements, such as corrosion resistance, reliability, and energy efficiency. Motors used in these applications are often subjected to harsh operating conditions, including exposure to chemicals and varying load conditions. Therefore, selecting the right motor for these applications is crucial to ensure optimal performance and longevity. Advancements in motor technology, such as the development of more efficient motor designs and the integration of variable frequency drives (VFDs), have helped improve the energy efficiency of motors used in water and wastewater management. These advancements not only reduce energy consumption but also contribute to cost savings and environmental sustainability. Thus, industrial motors play a crucial role in water and wastewater management, ensuring the efficient and reliable operation of treatment facilities. As the demand for water and wastewater management solutions continues to grow, the importance of selecting the right industrial motors for these applications will only increase.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a significant market for industrial motors, driven by the region's diverse industrial base and technological advancements. The industrial motor market in North America encompasses various types of motors used in industries such as manufacturing, oil and gas, mining, and utilities. The key drivers of the industrial motor market in North America is the region's focus on energy efficiency and sustainability. Regulations and incentives promoting energy-efficient motor systems have led to the adoption of high-efficiency motors and variable frequency drives (VFDs) in industrial applications. This trend is expected to continue, driving the demand for energy-efficient industrial motors in the region. Another factor contributing to the growth of the industrial motor market in North America is the region's strong manufacturing sector. Industrial motors are essential components in manufacturing processes, driving machinery and equipment used in production. The growth of industries such as automotive, aerospace, and electronics in North America has contributed to the demand for industrial motors in the region. Additionally, technological advancements in industrial motors, such as the integration of IoT and smart technologies, are further driving market growth. These advancements allow for improved motor performance, efficiency, and predictive maintenance, enhancing the overall productivity of industrial operations. Key players in the industrial motor market in North America include Siemens AG, ABB Ltd., General Electric Company, and Nidec Motor Corporation, among others. These companies are focusing on product innovation and technological advancements to meet the evolving needs of industrial customers in the region. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In July 2023, Honda Motor Co., Ltd. partnered with SCSK Corporation to enhance software development capabilities for automotive applications. This collaboration aims to meet the demands of electrification, automation, and connectivity in the automotive industry. By combining Honda's expertise in system and safety control with SCSK's IT technologies, the partnership seeks to develop competitive software solutions for next-generation mobility products and services. Additionally, the collaboration will focus on cultivating a talent pool of software engineers to support future software development needs. This initiative is expected to drive growth in industrial motor software development in Japan by promoting innovation and advancing technological capabilities in the automotive sector.

2) In August 2023, Tata Technologies' partnership with AUTOSAR aims to address the rising complexity of automotive software, particularly in software-defined vehicles (SDVs). This collaboration will focus on developing new standards and software architectures for future vehicle systems. By promoting the adoption of AUTOSAR standards globally, Tata Technologies aims to support the growth of industrial motor software development in Japan and worldwide.

Q1. What was the Industrial Motor Market size in 2023?

As per Data Library Research the Industrial Motors Market size is estimated at USD 24.2 billion in 2023.

Q2. At what CAGR is the Industrial Motor market projected to grow within the forecast period?

Industrial Motor Market is expected to reach a CAGR of 5.17% during the forecast period.

Q3. What are the factors driving the Industrial Motor market?

Key factors that are driving the growth include the Industrialization and Infrastructure Development and Renewable Energy Integration.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model