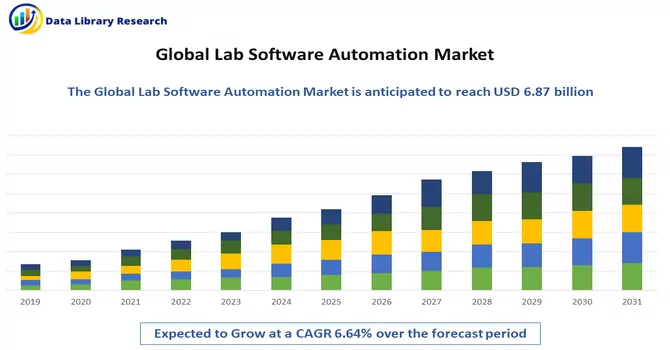

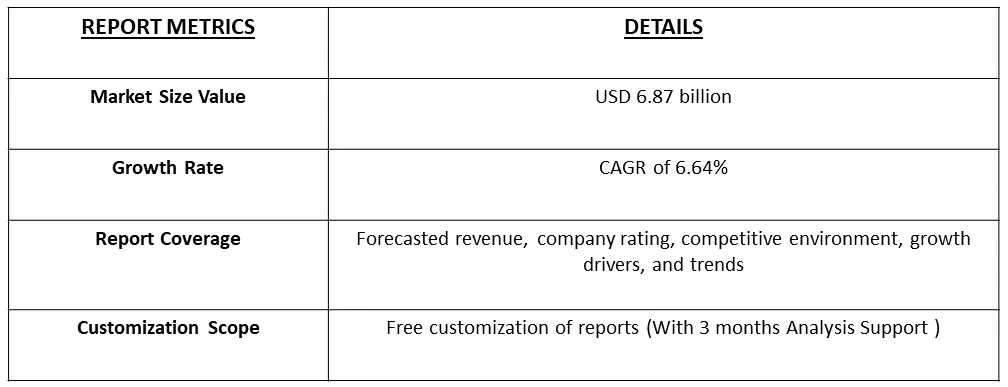

The estimated global lab automation market size reached USD 6.87 billion in 2022, and it is projected to experience a compound annual growth rate (CAGR) of 6.64% from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Lab automation software refers to a specialized category of software designed to streamline and enhance the processes involved in laboratory operations and research. This type of software is developed to automate, control, and manage a wide range of tasks and instruments within a laboratory setting. Lab automation software is used to improve efficiency, accuracy, and reproducibility in various scientific and research processes. Integration with laboratory instruments such as robotic systems, liquid handling devices, analytical instruments, and other equipment. This allows seamless communication and coordination between different instruments.

Lab automation involves the use of specialized technology to streamline or replace manual manipulation of methods and equipment in laboratory processes. The extent and degree of automation are determined based on the laboratory workflow. Increased adoption of automated instruments is particularly notable in academic and research institutes, aiming to enhance productivity and reduce the time spent on various time-consuming tasks.

Lab automation software increasingly integrates AI and ML capabilities, enhancing data analysis, pattern recognition, and decision-making in optimizing workflows. The surge in adopting cloud-based solutions provides flexibility, scalability, and remote accessibility for managing and analyzing data. This shift fosters collaboration among geographically dispersed teams, ensuring real-time access to crucial information. The ongoing evolution of lab automation software emphasizes seamless integration with various laboratory instruments and systems, promoting interoperability. This approach enables a holistic management approach, connecting diverse aspects of research processes and overall efficiency enhancement.

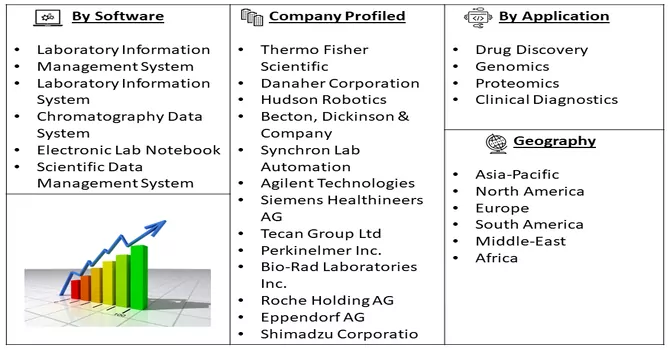

Market Segmentation: The Lab Automation Software Market is segmented by Software (Laboratory Information Management System, Laboratory Information System, Chromatography Data System, Electronic Lab Notebook, Scientific Data Management System), Field of Application (Drug Discovery, Genomics, Proteomics, Clinical Diagnostics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The value is provided in (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers :

Increasing Research and Development by Pharmaceutical and Biotech Companies

The increasing focus on research and development (R&D) by pharmaceutical and biotech companies is a driving force behind the adoption of lab automation software. As these industries strive to accelerate the drug discovery and development process, enhance efficiency, and reduce costs, automation becomes a crucial component. Lab automation software streamlines various laboratory processes, from sample preparation to data analysis, enabling researchers to handle large volumes of data more efficiently. Pharmaceutical and biotech companies are leveraging lab automation to expedite experiments, improve reproducibility, and ensure data accuracy. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), further enhances the capabilities of lab automation software. These technologies aid in data interpretation, identification of patterns, and decision-making, contributing to more insightful and efficient research outcomes. The automation of routine and repetitive tasks allows scientists and researchers to focus on more complex aspects of their work, fostering innovation and accelerating the pace of discovery. The continuous investment in R&D initiatives by pharmaceutical and biotech firms aligns with the adoption of lab automation software, emphasizing its pivotal role in advancing scientific breakthroughs. As a result, the synergy between increasing research and development activities and the integration of lab automation software is expected to shape the future landscape of life sciences and drug discovery.

Growing Demand from Drug Discovery and Genomics

The growing demand from drug discovery and genomics is a significant driver for the increased adoption of lab automation software. Drug discovery and genomics involve complex and data-intensive processes that require precise and efficient handling of samples, experiments, and analyses. Lab automation software provides a systematic and streamlined approach to these tasks, contributing to enhanced productivity and accelerated research timelines.

In drug discovery, where the identification and development of new therapeutic compounds are paramount, lab automation software plays a crucial role in expediting high-throughput screening, compound synthesis, and data analysis. The software enables researchers to manage vast libraries of compounds, automate assays, and analyze results with greater speed and accuracy, ultimately facilitating the identification of potential drug candidates. Similarly, in genomics research, which involves studying the structure, function, and mapping of genomes, lab automation software supports the handling of large-scale sequencing and analysis. The automation of sample preparation, DNA sequencing, and data interpretation streamlines genomics workflows, allowing researchers to handle complex genomic data more efficiently. Thus, the market is expected to witness significant growth over the forecast period.

Market Restraints :

Higher Initial Setup Costs Can be Expensive for the Overall Module

The higher initial setup costs associated with lab automation software can pose a challenge to its widespread adoption and overall market growth. Implementing lab automation solutions requires a significant upfront investment in terms of software licenses, hardware infrastructure, and customization to align with specific laboratory workflows. Laboratories, especially smaller or resource-constrained ones, may find the initial costs prohibitive, leading to hesitancy in embracing lab automation software. The expenses related to acquiring, installing, and configuring the necessary hardware and software components can be a barrier for organizations with limited budgets. To address this challenge, industry stakeholders and solution providers need to explore strategies to make lab automation software more cost-effective, perhaps through flexible pricing models, modular implementations, or incentives for smaller laboratories. As the technology evolves and competition in the market increases, efforts to mitigate the perceived high setup costs could contribute to the broader adoption of lab automation software across diverse laboratory settings. Thus, these factors are expected to slow the growth of the studied market.

The COVID-19 pandemic has significantly impacted the lab automation software market, leading to both challenges and opportunities. The crisis brought about changes in the priorities and operations of laboratories, influencing the dynamics of the automation software market. Many laboratories faced operational disruptions due to lockdowns, travel restrictions, and safety concerns. This affected the regular workflow and slowed down the adoption of new technologies, including lab automation software. Research priorities shifted towards areas directly related to understanding and combatting the virus. Laboratories working on COVID-19-related projects sought automation solutions to expedite their research, leading to increased interest and adoption of lab automation software in specific domains.

Segmental Analysis :

Laboratory Information Management System Segment is Expected to Witness Significant Growth Over the Forecast Period

A Laboratory Information Management System (LIMS) is a specialized software solution designed to streamline and manage laboratory workflows, data, and information. LIMS serves as a central hub for organizing, tracking, and analyzing data generated in a laboratory setting. It plays a crucial role in enhancing the efficiency, accuracy, and overall productivity of laboratory operations. LIMS allows laboratories to efficiently track the life cycle of samples, from collection to analysis and disposal. This feature helps prevent sample mix-ups and ensures data integrity. LIMS enables role-based access control, ensuring that only authorized personnel have access to sensitive data. This enhances data security and confidentiality. Thus, the integration of software automation in drug discovery has revolutionized the pharmaceutical industry, expediting the identification of novel therapeutics, reducing costs, and increasing the overall success rate of bringing new drugs to market. Advances in informatics, computational modeling, and data analytics continue to drive innovation in drug discovery processes.

Drug Discovery Segment is Expected to Witness Significant Growth Over the Forecast Period

Drug discovery, a complex and resource-intensive process, has witnessed transformative advancements with the integration of software automation. The convergence of cutting-edge technologies and innovative software solutions has significantly accelerated and optimized various stages of drug discovery, offering unprecedented efficiency and precision. Software automation tools streamline the identification and validation of potential drug targets. Advanced algorithms analyze biological data, genomics, and proteomics to prioritize targets with higher therapeutic potential. The predictive modeling and bioinformatics software assist researchers in understanding target interactions, pathways, and potential side effects, enabling informed decisions during the early stages. Thus, the integration of software automation in drug discovery has revolutionized the pharmaceutical industry, expediting the identification of novel therapeutics, reducing costs, and increasing the overall success rate of bringing new drugs to market. Advances in informatics, computational modelling, and data analytics continue to drive innovation in drug discovery processes.

Asia-Pacific Region is Expected to Witness significant Growth Over the Forecast Period

The Asia-Pacific region is experiencing robust growth in the lab automation software market, primarily driven by the expanding pharmaceutical sector. This growth is fueled by significant investments in pharmaceutical research and development across the region. Notably, Pfizer, a prominent US pharmaceutical company, established its inaugural global drug development center in Asia at the Indian Institute of Technology-Madras Research Park, India, with a substantial investment of USD 20 million. The center aims to pioneer innovative formulations, small molecules, and active pharmaceutical ingredients (APIs).

In a similar vein, Beroni Group, an Australia-based biopharmaceutical company, embarked on a venture to construct a new research and development center in China's Zhuhai National High-Tech Industrial Development Zone in February 2022. These strategic expansions and financial commitments are anticipated to propel market growth in the Asia-Pacific region. The region's attractiveness for pharmaceutical research is underlined by its diverse and sizable population groups, distinguishing it from other continents. The presence of a skilled labor force and relatively lower development costs make this region the preferred destination for outsourcing pharmaceutical research projects. Thus, such factors are fueling the studied market growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The Lab Automation Software Market exhibits a balanced competitive landscape, characterized by a diverse range of players and ongoing advancements in technology. The market is not overly saturated, allowing for the emergence of newer technologies that focus on automating routine laboratory processes, including testing and screening. These automation tools are designed to handle multiple requests simultaneously in real time, leading to noticeable enhancements in productivity and throughput. Some of the key market players working in this market segment are:

Recent Development:

1) In March 2022, Scispot, a life science lab informatics startup backed by Y Combinator, introduced Labsheets. Labsheets is a no-code relational database product tailored for life science labs, aiming to move them beyond non-scientific spreadsheets and outdated lab information management systems. The platform supports data management, sample tracking, audit trails, automated report creation, and integration requirements. Scispot's objective with Labsheets is to empower life science labs, enabling professionals to reduce time spent on spreadsheet management, automate workflows, and expedite scientific breakthroughs to market.

2) In September 2021, Veeva Systems launched Veeva Vault LIMS, a cloud application designed to modernize quality control (QC) lab operations. Integrated into the Veeva Vault Quality Suite, this application enables manufacturing organizations to seamlessly connect lab operations with the broader quality ecosystem. The incorporation of Vault LIMS accelerates batch release, reduces inventory costs, and streamlines sample management, test execution, and lab investigation processes.

Q1. What was the Lab Software Automation Market size in 2022?

As per Data Library Research the estimated global lab automation market size reached USD 6.87 billion in 2022.

Q2. At what CAGR is the Lab Software Automation market projected to grow within the forecast period?

Lab Software Automation market it is projected to experience a compound annual growth rate (CAGR) of 6.64% over the forecast period.

Q3. Who are the key players in Lab Software Automation market?

Some key players operating in the market include

Q4. Which region has the largest share of the Lab Software Automation market? What are the largest region's market size and growth rate?

Asia-Pacific has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model