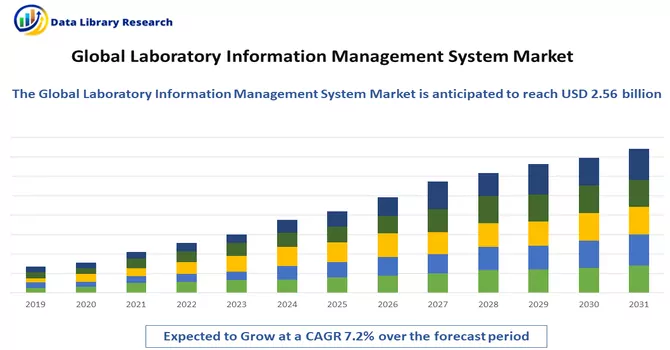

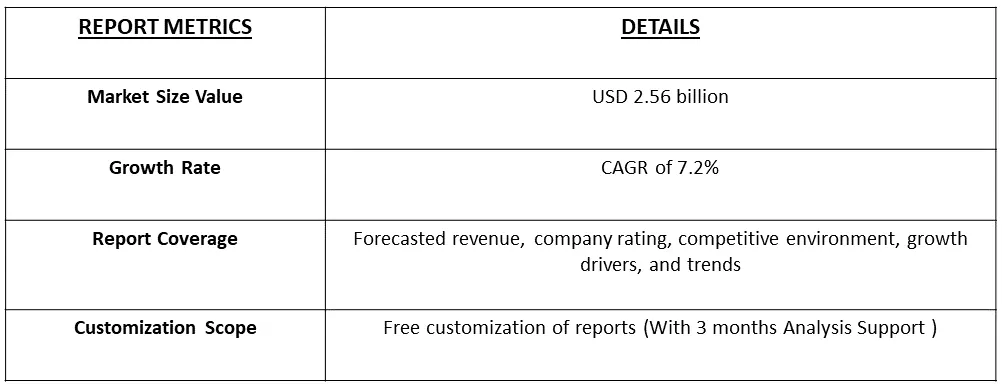

The global laboratory information management system market size was estimated at USD 2.56 billion in 2023 and is expected to hit a compound annual growth rate (CAGR) of 7.2% during the forecast period 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global Laboratory Information Management Systems (LIMS) market is witnessing robust growth driven by the increasing demand for efficient data management and workflow automation in laboratories across various industries. LIMS play a pivotal role in organizing, tracking, and managing laboratory data, contributing to streamlined processes and enhanced productivity. Industries such as pharmaceuticals, biotechnology, healthcare, and environmental science are adopting LIMS to meet regulatory compliance, improve data accuracy, and accelerate research and development activities.

The market is characterized by technological advancements, including the integration of cloud-based solutions and data analytics, offering scalable and cost-effective options for laboratories of all sizes. As laboratories continue to prioritize data integrity and operational efficiency, the global LIMS market is poised for sustained growth in the foreseeable future. The growth of the global Laboratory Information Management Systems (LIMS) market is primarily driven by the increasing need for enhanced data accuracy, efficiency, and compliance in laboratory operations across diverse industries. As laboratories grapple with growing volumes of data, stringent regulatory requirements, and the need for streamlined workflows, the adoption of LIMS becomes imperative. The continuous advancements in technology, such as the integration of cloud-based solutions, artificial intelligence, and data analytics, contribute to the scalability and flexibility of LIMS. Additionally, the rising focus on research and development activities in sectors like pharmaceuticals, biotechnology, and healthcare further propels the demand for sophisticated LIMS solutions, fostering the market's steady growth trajectory.

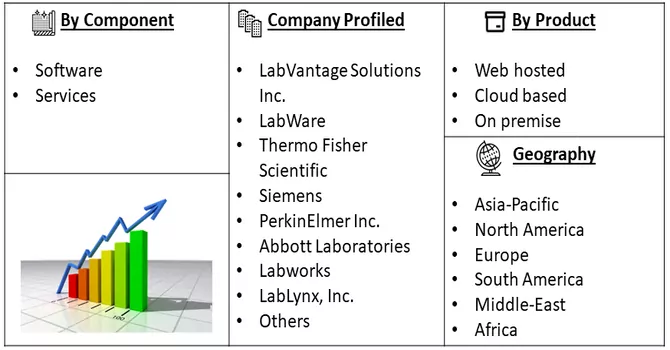

Market Segmentation: The Laboratory Information Management System Market By Product (Web hosted, Cloud based, and On premise) Component (Software and Services) and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America). The market provides the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global Laboratory Information Management Systems (LIMS) market is witnessing several notable trends that are shaping its dynamics. One key trend is the increasing adoption of cloud-based LIMS solutions, providing organizations with flexibility, scalability, and ease of access to data. Integration of advanced technologies such as artificial intelligence and machine learning within LIMS is another trend, enabling laboratories to derive valuable insights from large datasets. Moreover, there is a growing emphasis on interoperability and integration with other laboratory instruments and systems, facilitating a seamless flow of information. The demand for mobile LIMS applications is also on the rise, allowing users to access and manage data on the go, enhancing overall efficiency and collaboration in laboratory settings.

Market Drivers:

Increasing Demand for Efficient Data Management:

The global Laboratory Information Management Systems (LIMS) market is being driven by the rising demand for efficient data management in laboratories. As laboratories generate and handle vast amounts of data, the need for robust systems to organize, track, and manage this data has become paramount. LIMS provides a centralized platform for data storage, retrieval, and analysis, contributing to streamlined laboratory workflows and improved overall efficiency.

Growing Regulatory Compliance Requirements:

The stringent regulatory landscape governing laboratories, especially in industries such as healthcare and pharmaceuticals, is a significant driver for the adoption of LIMS. Laboratories must adhere to strict compliance standards and data integrity requirements. LIMS offers features like audit trails, electronic signatures, and secure data storage, ensuring that laboratories can meet regulatory standards and maintain the highest levels of data accuracy and traceability. This compliance-driven demand is propelling the growth of the global LIMS market.

Market Restraints:

The global LIMS market faces certain challenges that may impede its growth trajectory. One notable restraint is the high initial implementation costs associated with adopting LIMS. The installation, customization, and integration of LIMS into existing laboratory infrastructures often require a substantial upfront investment, making it a barrier for smaller laboratories or organizations with budget constraints. Additionally, the complexity of LIMS implementation can lead to longer deployment timelines, causing potential disruptions to ongoing laboratory operations. Another restraint lies in the resistance to change among traditional laboratory setups, where manual processes may still be deeply ingrained. Overcoming these barriers and ensuring a seamless transition to LIMS adoption will be crucial for market players to address in order to unlock the full potential of this technology in diverse laboratory environments.

The COVID-19 pandemic has exerted both positive and negative influences on the LIMS market. On one hand, the increased focus on healthcare and life sciences research during the pandemic has underscored the importance of efficient laboratory management and data handling, driving a surge in demand for LIMS solutions. Laboratories involved in COVID-19 testing, vaccine development, and other essential research areas have accelerated their adoption of LIMS to streamline workflows and enhance data accuracy.On the other hand, the widespread economic challenges and disruptions in laboratory operations caused by lockdowns and restrictions have led to delays or deferrals in LIMS implementation for some organizations. Budgetary constraints and uncertainties have prompted a cautious approach, impacting the overall growth momentum. However, as the world adapts to the new normal, the increased awareness of the benefits offered by LIMS in terms of data integrity, collaboration, and remote accessibility is expected to fuel the market recovery post-pandemic.

Segmental Analysis:

Cloud based Segment is Expected to Witness Significant Growth Over the Forecast Period

The cloud-based segment of Laboratory Information Management Systems (LIMS) is experiencing rapid growth, driven by the increasing adoption of cloud computing in the healthcare and life sciences industries. Cloud-based LIMS offer numerous benefits, including scalability, flexibility, and cost-effectiveness, making them an attractive option for laboratories of all sizes. These systems allow laboratories to store and manage data securely in the cloud, enabling remote access and collaboration. Additionally, cloud-based LIMS often come with advanced features such as data analytics, integration with other laboratory instruments and systems, and compliance with regulatory requirements. As the demand for digitalization and automation in laboratories continues to grow, the cloud-based segment of LIMS is expected to expand further, providing laboratories with efficient and modern solutions for managing their operations.

Software Segment is Expected to Witness Significant Growth Over the Forecast Period

Software plays a crucial role in Laboratory Information Management Systems (LIMS), serving as the backbone for managing and organizing laboratory data and operations. LIMS software is designed to streamline workflows, improve efficiency, and ensure compliance with regulatory standards in various industries, including healthcare, pharmaceuticals, and research. LIMS software offers a range of features, including sample tracking, data management, instrument integration, and workflow automation. These features help laboratories manage samples more effectively, track the status and location of samples in real-time, and streamline processes such as sample preparation, testing, and analysis. Moreover, LIMS software enables laboratories to store and manage vast amounts of data securely, ensuring data integrity and confidentiality. It also facilitates data analysis and reporting, allowing laboratories to derive valuable insights from their data. In recent years, there has been a shift towards cloud-based LIMS software, which offers benefits such as scalability, flexibility, and cost-effectiveness. Cloud-based LIMS allow laboratories to access their data and software from anywhere, at any time, making collaboration easier and more efficient. Thus, software is an essential component of LIMS, playing a crucial role in helping laboratories manage their operations, improve efficiency, and ensure compliance with regulatory requirements. As technology continues to advance, the role of software in LIMS is expected to become even more critical, driving further innovation and improvement in laboratory management systems.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

Laboratory Information Management Systems (LIMS) in North America play a pivotal role in enhancing laboratory operations, data management, and regulatory compliance across various industries such as healthcare, pharmaceuticals, biotechnology, and research. LIMS in North America offer a wide range of functionalities, including sample tracking, data management, instrument integration, workflow automation, and reporting. One of the key drivers of LIMS adoption in North America is the increasing demand for digitalization and automation in laboratories. LIMS enable laboratories to streamline their workflows, reduce manual errors, and improve efficiency, ultimately leading to better outcomes and cost savings. Additionally, the stringent regulatory environment in North America, especially in industries such as healthcare and pharmaceuticals, has led to the widespread adoption of LIMS. These systems help laboratories ensure compliance with regulatory standards and maintain data integrity, which is crucial for product quality and patient safety. Furthermore, the increasing volume and complexity of data generated in laboratories have made LIMS indispensable for managing and analyzing data effectively. LIMS provide laboratories with the tools to store, retrieve, and analyze large datasets, helping them derive valuable insights and make informed decisions. Thus, LIMS in North America continue to evolve, driven by technological advancements and the growing needs of laboratories. As laboratories seek to improve efficiency, comply with regulations, and manage data effectively, LIMS are expected to play an increasingly important role in transforming laboratory operations in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Laboratory Information Management System Market Players:

Recent Development:

1) In 2022, Thermo Fisher Scientific, Inc unveiled the 21.1 iteration of its SampleManager LIMS software, featuring new functionalities such as Analytical Quality Control (AQC) HL7 support. Additionally, this version includes advanced capabilities like data packager, kit deployment, voice control, and robust data support for analytics, monitoring, and charts.

2) In 2022, LabVantage Solutions, Inc also introduced Version 8.8 of its core LIMS platform in 2022, implementing numerous enhancements across all components.

Q1. What was the Laboratory Information Management System Market size in 2023?

As per Data Library Research he global laboratory information management system market size was estimated at USD 2.56 billion in 2023.

Q2. At what CAGR is the Laboratory Information Management System market projected to grow within the forecast period?

Laboratory Information Management System Market is expected to hit a compound annual growth rate (CAGR) of 7.2% during the forecast period.

Q3. What segments are covered in the Laboratory Information Management System Market Report?

By Product, By Component and Geography these are covered in the Laboratory Information Management System Market Report.

Q4. Who are the key players in Laboratory Information Management System Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model