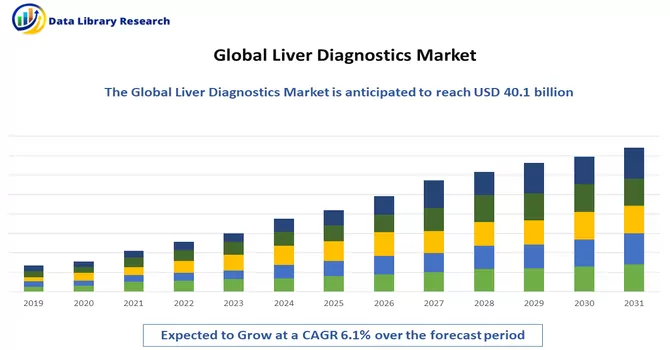

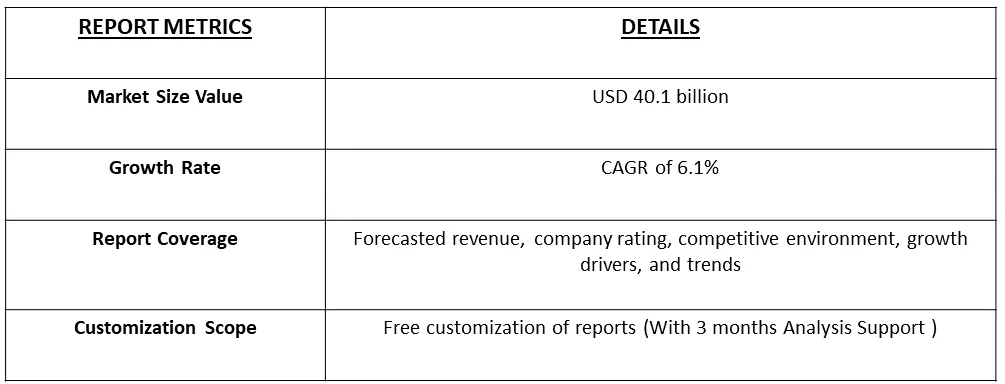

The liver disease diagnostics market is currently valued at USD 40.1 billion in 2022 and is expected to register a CAGR of 6.1% in 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Liver disease diagnostics involve a range of methods to identify and assess disorders affecting the liver. Common approaches include blood tests, such as Liver Function Tests measuring enzyme levels indicative of liver function, imaging studies like ultrasound, CT scans, and MRIs to visualize liver structure, and liver biopsy for microscopic examination. Non-invasive techniques like FibroScan measure liver stiffness to assess fibrosis. Serological tests and viral hepatitis tests target specific antibodies or antigens, while functional tests, including prothrombin time, evaluate clotting ability. Endoscopy and upper endoscopy may be employed, and clinical assessment through patient history and physical examination remains crucial. A combination of these diagnostic tools offers a comprehensive understanding of liver health, aiding in early detection and effective management of liver diseases. It's imperative that these procedures are conducted by healthcare professionals based on individual patient needs and considerations.

The liver disease diagnostics market is expected to experience significant growth due to the escalating incidence of both acute and chronic liver illnesses. Key contributors to this expansion include the concerted efforts of major industry players to develop highly sensitive and rapid diagnostic tests specifically tailored for at-risk populations such as pregnant women and HIV-positive patients. Additionally, the surge in research and development activities focused on creating precise diagnostic systems plays a pivotal role in facilitating timely detection and improved outcomes for patients with liver diseases. The introduction of innovative diagnostic approaches further contributes to market growth. Notably, shifting societal behaviors, such as increased alcohol consumption and unhealthy diets, are also anticipated to positively influence the demand for liver disease diagnostics. This multifaceted landscape underscores the need for advanced diagnostic solutions, positioning the market to meet the evolving challenges associated with liver health assessment.

The liver disease diagnostics market is undergoing transformative trends, including rapid technological advancements that enhance diagnostic precision and early detection. Personalized medicine is gaining prominence, tailoring diagnostic approaches based on individual factors. The rising prevalence of non-alcoholic fatty liver disease (NAFLD) is driving demand for condition-specific diagnostics. Point-of-care testing and the integration of telemedicine are becoming increasingly important, offering convenient and real-time solutions. Emphasis on early detection is growing, with proactive screening efforts and check-ups. Collaborations between industry players, regulatory initiatives, and a focus on liver fibrosis assessment are shaping the market landscape. Additionally, global health challenges, such as the burden of viral hepatitis, are driving investments and initiatives to address liver diseases on a broader scale. These dynamic trends underscore the market's evolution towards more precise, accessible, and proactive liver disease diagnostics.

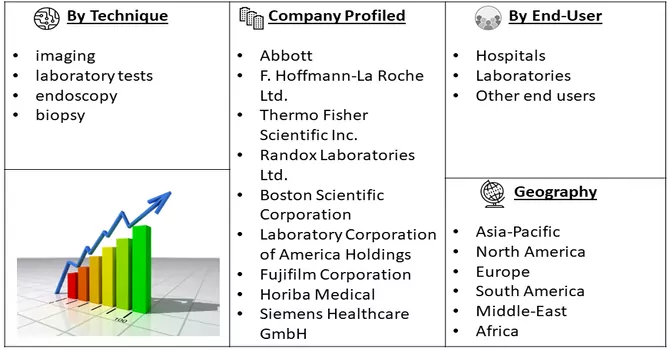

Market Segmentation: The Liver Disease Diagnostics Market is Segmented by Technique (imaging, laboratory tests, and endoscopy, biopsy), End Use (hospitals, laboratories, and other end users) and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & and Africa). The market size and forecasts for all the above segments are provided in terms of value (USD Billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Disease Prevalence

The increasing prevalence of both acute and chronic liver diseases on a global scale serves as a significant catalyst propelling the growth of the liver disease diagnostics market. This heightened prevalence can be attributed to various factors, including shifts in lifestyle patterns, a surge in viral infections, and the escalating incidence of non-alcoholic fatty liver disease. Lifestyle changes characterized by sedentary habits and unhealthy dietary choices contribute to the rising burden of liver conditions. Additionally, the proliferation of viral infections, such as hepatitis, further amplifies the need for advanced diagnostic tools. Notably, the expanding prevalence of non-alcoholic fatty liver disease, associated with factors like obesity and metabolic syndrome, underscores the imperative for effective and timely diagnostic solutions to address this multifaceted global health challenge.

In September 2023, American Liver Foundation reported that the prevalence of liver disease in the United States is a significant driver propelling the growth of the liver disease diagnostics market. The source reported that with over 100 million individuals estimated to have some form of liver disease, and only 1.8% of U.S. adults diagnosed, there exists a substantial undiagnosed population, particularly in the case of fatty liver disease affecting an estimated 80-100 million adults. The underdiagnosis underscores a pressing need for comprehensive and widespread liver disease diagnostics. The potential consequences of untreated liver disease, such as liver failure and cancer, emphasize the critical importance of early detection and intervention. In 2020 alone, 51,642 adults succumbed to liver disease in the U.S., making it the 12th leading cause of death. These alarming statistics underscore the urgent demand for advanced diagnostic tools to facilitate timely identification, management, and treatment of liver conditions, thereby driving the growth of the liver disease diagnostics market as healthcare providers strive to address the significant public health challenge posed by liver diseases.

Technological Advancements

The ongoing progress in diagnostic technologies, encompassing advancements in imaging modalities, biomarker identification, and molecular diagnostics, plays a pivotal role in propelling the liver disease diagnostics market forward. The continuous evolution of these technologies not only enhances the accuracy and sensitivity of diagnostic tools but also fosters the development of innovative non-invasive methods. This technological momentum contributes significantly to the adoption of advanced diagnostic tools within the market, offering healthcare professionals more effective and precise means of detecting and assessing liver diseases. The improved capabilities in accuracy and reduced invasiveness are particularly valuable in enhancing patient experiences and facilitating early diagnosis and intervention, ultimately elevating the standard of care in liver disease diagnostics.

Market Restraints:

Complexity in Disease Diagnosis

The complexity inherent in diagnosing liver diseases poses a potential impediment to the growth of the liver disease diagnostics market. Liver conditions, characterized by diverse etiologies, manifestations, and stages of progression, present challenges in achieving accurate and timely diagnoses. The intricate nature of diseases such as non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis (NASH) requires comprehensive diagnostic approaches that can discern between various liver pathologies. This complexity extends to distinguishing between different stages of fibrosis, a crucial factor in determining disease severity. Additionally, the need for nuanced diagnostic tools that can effectively differentiate between liver conditions complicates the development and adoption of standardized diagnostic methodologies. Addressing the complexity in disease diagnosis is essential for the liver disease diagnostics market to overcome challenges and provide healthcare professionals with more accessible and reliable diagnostic solutions for improved patient outcomes. Advanced technologies and ongoing research efforts are pivotal in navigating these complexities and advancing the field of liver disease diagnostics.

The COVID-19 pandemic has exerted both direct and indirect impacts on the liver disease diagnostics market. Directly, the pandemic has led to disruptions in healthcare services, including routine diagnostic procedures, as healthcare resources were diverted to manage COVID-19 cases. Non-urgent medical appointments and screenings, including liver disease diagnostics, were postponed or canceled, potentially delaying the identification and management of liver conditions. Additionally, the economic strain caused by the pandemic may have limited access to healthcare for certain populations, affecting their ability to undergo diagnostic tests. Indirectly, the pandemic has influenced liver health through lifestyle changes. Lockdowns, reduced physical activity, and altered dietary habits during periods of quarantine may contribute to conditions such as non-alcoholic fatty liver disease (NAFLD). Furthermore, the increased incidence of severe COVID-19 cases in individuals with pre-existing liver conditions has highlighted the importance of liver health in the context of viral infections. On the positive side, the pandemic has accelerated the adoption of telemedicine and remote monitoring solutions, offering opportunities for virtual consultations and the continuation of care for individuals with liver diseases. Innovations in telehealth may contribute to improved accessibility for liver disease diagnostics. Thus, the COVID-19 pandemic has presented challenges to the liver disease diagnostics market by disrupting routine healthcare services and influencing lifestyle factors that impact liver health. However, it has also spurred innovations in remote healthcare delivery, potentially shaping the future landscape of liver disease diagnostics. Continued research and adaptation to changing healthcare dynamics will be crucial for addressing the evolving needs of patients with liver conditions in the post-pandemic era.

Segmental Analysis:

Endoscopy Segment is Expected to Witness Significant Growth Over the Forecast Period

Endoscopy involves the use of a flexible, lighted tube called an endoscope to visually examine the interior of the digestive tract, including the liver and bile ducts. In liver disease diagnostics, endoscopy is often employed to assess conditions such as cirrhosis, portal hypertension, and varices. For instance, esophagogastroduodenoscopy (EGD) can reveal varices in the esophagus, providing valuable information about the severity of liver disease and the risk of complications. Endoscopic retrograde cholangiopancreatography (ERCP) is another technique that allows visualization of the bile ducts, aiding in the diagnosis of conditions affecting these structures.

In October 2023, Olympus Corporation, a leading global medical technology company dedicated to enhancing people's well-being, safety, and overall fulfillment, has unveiled its latest innovation, the EVIS X1™ endoscopy system. This cutting-edge system is set to be showcased and demonstrated at the upcoming American College of Gastroenterology (ACG) annual meeting in Vancouver, Canada, from October 22-24. The introduction of the next-generation EVIS X1™ endoscopy system signifies a significant advancement in medical technology, potentially contributing to the liver disease diagnostic market. This state-of-the-art system is poised to enhance the capabilities of endoscopic procedures, offering healthcare professionals advanced tools for visualizing and diagnosing liver conditions. As technological innovations continue to drive improvements in diagnostic precision and efficiency, the EVIS X1™ system could play a pivotal role in elevating the standards of liver disease diagnostics, ultimately benefiting patient care and outcomes. Thus, such developments are expected to drive the studied segment’s growth over the forecast period.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, liver disease diagnostics constitute a critical aspect of healthcare management due to the region's diverse population and varying lifestyle factors that impact liver health. The prevalence of liver diseases, including non-alcoholic fatty liver disease (NAFLD), hepatitis, and cirrhosis, underscores the significance of robust diagnostic strategies. The region has witnessed a growing awareness of liver health, prompting increased screening and diagnostic efforts. Advanced diagnostic technologies play a pivotal role in North America's liver disease diagnostics landscape. The availability of state-of-the-art imaging modalities, molecular diagnostics, and non-invasive techniques has contributed to early detection and improved understanding of liver conditions. As a result, healthcare professionals can employ these tools to identify liver diseases at earlier stages, allowing for timely intervention and management.The integration of innovative solutions, such as telemedicine and remote monitoring, has further enhanced accessibility to liver disease diagnostics. These technologies facilitate virtual consultations and continuous monitoring, ensuring that individuals, particularly those in remote or underserved areas, can receive timely assessments for liver conditions.North America is also characterized by a proactive approach to research and development, with ongoing efforts to enhance diagnostic accuracy and introduce novel technologies. The collaboration between healthcare institutions, industry stakeholders, and research organizations has led to the development of diagnostic methodologies that align with evolving standards of care.Challenges persist, including the economic burden associated with liver diseases and the need for widespread education on risk factors and preventive measures. However, the collective efforts of healthcare professionals, technology innovators, and public health initiatives contribute to shaping an evolving landscape for liver disease diagnostics in North America. As the region continues to prioritize liver health, advancements in diagnostic capabilities are anticipated to play a vital role in mitigating the impact of liver diseases and improving overall patient outcomes.

For Detailed Market Segmentation - Download Free Sample PDF

Major players in the industry are actively employing diverse strategies to pioneer the development of innovative technologies aimed at advancing patient care. This includes initiatives focused on research and development, technological advancements, and the introduction of cutting-edge solutions to enhance the overall quality of patient care. These strategies encompass a broad spectrum, ranging from the exploration of novel diagnostic methodologies to the integration of advanced treatment modalities. The overarching goal is to drive progress in healthcare by introducing groundbreaking technologies that can significantly improve patient outcomes, contribute to more accurate diagnostics, and ultimately elevate the standard of care in the medical landscape. Key Liver Disease Diagnostics Companies:

Recent Development:

1) In July 2023, the U.S. Food and Drug Administration (FDA) granted Breakthrough Device Designation to Siemens Healthineers' Enhanced Liver Fibrosis (ELF™) Test, marking a significant advancement for physicians managing patients with non-alcoholic fatty liver disease (NAFLD). This designation represents a pivotal development for healthcare professionals who currently rely on liver biopsies to identify advanced fibrosis in NAFLD patients. Notably, there are currently no blood tests approved for diagnostic use in NAFLD patients in the United States. The reliance on biopsies as the standard diagnostic method often deters patients from seeking early medical attention. However, earlier intervention is crucial in preventing the progression of non-alcoholic steatohepatitis (NASH), a severe form of NAFLD characterized by advancing fibrosis that can lead to cirrhosis and liver cancer. The Breakthrough Device Designation for the ELF Test underscores its potential to fulfill an unmet medical need in diagnosing NAFLD, offering a non-invasive alternative that could significantly improve patient care and outcomes.

2) In June 2022, Echosens and Novo Nordisk collaborated to advance non-invasive diagnostic methodologies for non-alcoholic steatohepatitis (NASH) while concurrently promoting awareness of the condition and emphasizing the significance of early detection and treatment. The joint initiative aims to significantly increase the number of diagnoses for individuals afflicted with moderate to severe NASH, with the ambitious goal of quadrupling the diagnostic rate by the year 2025. The collaboration underscores a shared commitment to addressing the challenges posed by NASH through innovative diagnostic solutions, fostering early intervention, and ultimately enhancing the overall management and outcomes for individuals affected by this liver condition.

Q1. What is the current Liver Diagnostics Market size?

The liver disease diagnostics market is currently valued at USD 40.1 billion.

Q2. What is the Growth Rate of the Liver Diagnostics Market?

Liver Diagnostics Market is expected to register a CAGR of 6.1% over the forecast period.

Q3. What segments are covered in the Liver Diagnostics Market Report?

By Technology, End User & Geography these segments are covered in the Liver Diagnostics Market Report.

Q4. What Impact did COVID-19 have on the Liver Diagnostics Market?

The COVID-19 pandemic has exerted both direct and indirect impacts on the liver disease diagnostics market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model