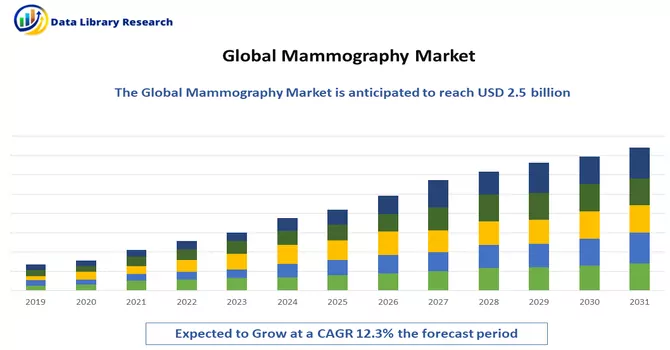

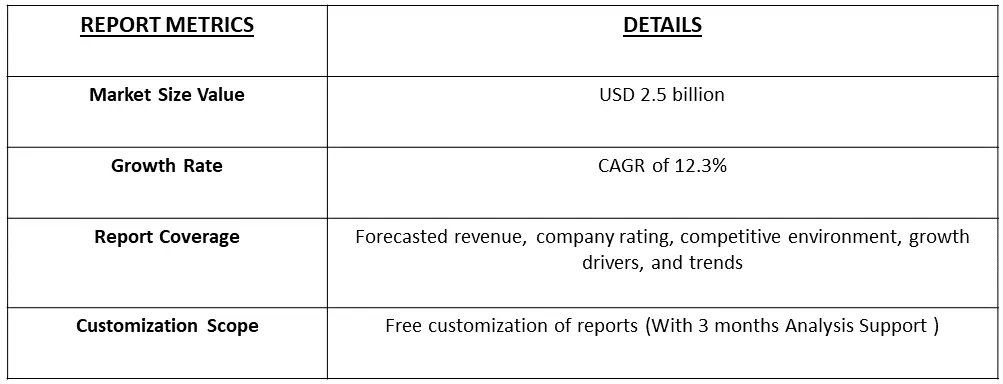

The global mammography market size was valued at USD 2.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Mammography is a medical imaging technique specifically designed for the examination of the breast tissue. It involves using low-dose X-rays to capture detailed images of the internal structures of the breast, including the presence of any abnormalities or potential signs of breast cancer, such as tumors or microcalcifications. Mammography plays a crucial role in breast cancer screening, early detection, and diagnosis. The images produced, known as mammograms, are carefully interpreted by radiologists to identify any suspicious findings that may warrant further investigation or medical intervention. Regular mammographic screening is a key component of breast cancer prevention and early detection strategies, particularly in women over the age of 40 or those with an increased risk of developing breast cancer.

The anticipated surge in breast cancer prevalence and the growing need for early-stage diagnosis among patients are expected to be key drivers of demand for breast cancer diagnostic devices, with mammography leading the way. The increasing availability of breast cancer screening systems, coupled with expanding government initiatives to support clinical interpretation, is slated to propel the growth of the mammography market. Notably, initiatives like the Health Resources and Services Administration's healthcare program, geared towards boosting screening procedures in medically underserved areas, underscore the commitment to broader accessibility of breast cancer diagnostics. Additionally, collaborative efforts such as BreastScreen Australia, led by governmental entities, aim to curtail breast cancer-related illness and mortality by emphasizing early disease detection. These initiatives collectively contribute to fostering a conducive environment for the expansion of the mammography market in the forecast period.

The mammography market is witnessing transformative trends that underscore its crucial role in breast cancer diagnosis. Technological advancements, including 3D mammography and digital breast tomosynthesis, are enhancing precision, while the shift to digital systems and the integration of artificial intelligence contribute to improved diagnostics. With a global rise in breast cancer incidence, mammography's prominence as a primary diagnostic tool is growing, supported by government-led awareness programs and screening initiatives such as BreastScreen. The trend towards personalized medicine influences tailored mammography strategies, and the emergence of portable devices facilitates accessibility. Telemedicine integration and regulatory support further contribute to the market's evolution, emphasizing innovation, improved diagnostic capabilities, and expanded accessibility to breast cancer screening services.

Market Segmentation: The Global Mammography Market is Segmented by Product Type (Digital Systems, Analog Systems, Breast Tomosynthesis, and Other Product Types), End Users (Hospitals, Specialty Clinics, and Diagnostic Centers), and Geography (North America, Europe, Asia Pacific, Middle-East and Africa, and South America). The market values are provided in terms of (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing Burden of Breast Cancer

The growing burden of breast cancer worldwide has intensified the imperative for effective screening and diagnostic tools, with mammography emerging as a pivotal player in the battle against this prevalent disease. As breast cancer continues to affect a rising number of individuals, especially women, mammography plays a critical role in early detection, enabling timely intervention and improved treatment outcomes. Mammography, a specialized X-ray imaging technique for breast examination, aids in identifying abnormalities, such as tumors or microcalcifications, even before symptoms manifest. Routine mammographic screening is instrumental in detecting breast cancer at its earliest stages, facilitating less invasive treatments and higher survival rates. The utilization of mammography aligns with global efforts to mitigate the impact of breast cancer by fostering regular screening, emphasizing the significance of early diagnosis, and ultimately contributing to improved public health outcomes in the face of the escalating burden posed by breast cancer.

Technological Advancements in the Field of Breast Imaging

Technological advancements in the field of breast imaging have significantly transformed diagnostic capabilities, enhancing precision, early detection, and patient outcomes. One notable innovation is the advent of digital breast tomosynthesis (DBT) or 3D mammography, offering a three-dimensional view of breast tissue, reducing overlapping structures, and improving the detection of abnormalities. Artificial intelligence (AI) has emerged as a game-changer, with AI algorithms aiding radiologists in analyzing mammograms, identifying subtle patterns, and providing more accurate and efficient interpretations. Contrast-enhanced mammography, incorporating contrast agents for improved visibility of lesions, represents another breakthrough. Additionally, molecular breast imaging and positron emission mammography (PEM) provide functional insights into breast tissue, aiding in the assessment of tumor characteristics. Innovations like automated whole-breast ultrasound (ABUS) and breast magnetic resonance imaging (MRI) further contribute to comprehensive breast imaging approaches. These advancements collectively empower healthcare professionals with advanced tools for early and precise breast cancer detection, underscoring the ongoing commitment to improving breast health outcomes.

Market Restraints:

Risk of Adverse Effects from Radiation Exposure

The risk of adverse effects from radiation exposure poses a potential challenge that could impede the growth of the mammography market. Mammography, while pivotal for breast cancer screening and detection, involves the use of ionizing radiation, raising concerns about cumulative exposure and its potential impact on long-term health. As awareness of radiation-related risks grows, some individuals may express reluctance to undergo regular mammographic screenings, impacting the overall adoption of this diagnostic modality. Efforts to minimize radiation dose, such as the transition to digital mammography and the exploration of alternative technologies like tomosynthesis, aim to address these concerns. However, continued education, transparent communication about the benefits and risks, and ongoing advancements in technology are crucial to mitigating apprehensions surrounding radiation exposure and sustaining the effectiveness of mammography in breast cancer prevention and early detection.

The ongoing COVID-19 pandemic continues to reshape the trajectories of various markets, with diverse immediate impacts. Initially, the mammography market experienced a pronounced downturn as numerous hospitals and screening centers closed due to lockdown measures, leading to a temporary decrease in demand for mammography procedures. The short-term outlook was affected by disruptions in healthcare services. For instance, an article titled 'Screening Mammography Recovery after COVID-19 Pandemic Facility Closures: Associations of Facility Access and Racial and Ethnic Screening Disparities,' published in June 2022, highlighted a decrease in mammography volumes in 2019 followed by a substantial 61% increase in 2021. This fluctuation is anticipated to significantly influence mammography device manufacturers, as the demand for their products has undergone a notable surge in the post-pandemic period. The dynamic nature of healthcare services during the pandemic underscores the need for adaptability and strategic responses within the mammography market.

Segmental Analysis:

Digital Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

Digital systems have emerged as a transformative force in the mammography market, revolutionizing the landscape of breast imaging. The adoption of digital mammography systems represents a paradigm shift from traditional film-based methods, offering advantages such as improved image quality, enhanced diagnostic accuracy, and streamlined data management. Digital mammography enables rapid acquisition, efficient storage, and easy retrieval of patient images, facilitating seamless integration with electronic health records (EHR) and picture archiving and communication systems (PACS). This transition to digital systems not only expedites the diagnostic process but also allows for advanced features such as computer-aided detection (CAD) and image enhancements, contributing to more precise breast cancer detection. The digitalization of mammography has significantly impacted screening programs, making them more accessible, efficient, and conducive to early diagnosis. As the mammography market continues to evolve, the prominence of digital systems underscores their pivotal role in advancing breast imaging technologies and improving patient outcomes.

Specialty Clinics Segment is Expected to Witness Significant Growth Over the Forecast Period

Specialty clinics play a crucial role in the realm of mammography, contributing to the comprehensive and specialized healthcare services focused on breast health. These clinics are dedicated to providing tailored and efficient mammographic services, often with a specific emphasis on breast cancer screening, diagnosis, and follow-up care. Mammography services offered by speciality clinics are characterized by a patient-centric approach, where healthcare professionals specialize in breast imaging and work closely with patients to ensure a comfortable and informed experience. The focused expertise of speciality clinics allows for the incorporation of advanced technologies, such as digital mammography and 3D tomosynthesis, ensuring cutting-edge diagnostic capabilities. Additionally, these clinics often engage in preventive measures, including patient education, awareness campaigns, and regular screenings, contributing to early detection and improved outcomes. The collaboration between speciality clinics and mammography services underscores a commitment to specialized care and underscores their pivotal role in the broader landscape of breast health and breast cancer prevention.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America maintains a significant share in the mammography market, and this trend is anticipated to persist consistently throughout the forecast period, marked by steady growth. The region's robust healthcare infrastructure and the escalating prevalence of breast cancer contribute to the sustained expansion of the market. Despite a temporary setback due to the COVID-19 outbreak, characterized by delays in diagnosis and drug shortages, the market is poised for recovery as pandemic-related restrictions ease. The gradual relaxation of lockdowns has led to an upswing in demand for mammography services, with women resuming postponed appointments. Organizations like the Breast Cancer Research Foundation in the United States assure the public of the preparedness and safety of healthcare facilities, encouraging women to prioritize their scheduled scans to avoid diagnostic delays. According to the American Cancer Society, the diagnosed cases of breast cancer in 2020 were significant, and the numbers are expected to rise in the future.

Various companies are launching initiatives to support breast cancer testing, exemplified by Hologic Inc.'s Back to Screen campaign launched in August 2020, aimed at motivating women to schedule delayed mammograms due to the pandemic. The market's growth is further propelled by the introduction and increasing adoption of advanced mammography devices incorporating innovative technologies. A case in point is FUJIFILM Canada Inc.'s ASPIRE Cristalle digital mammography solution, which received Health Canada medical device approval in October 2021, and its expanded availability across every province in Canada through a partnership with Christie Innomed. Consequently, with the rising prevalence of breast cancer and ongoing product launches, the mammography market is expected to witness sustained growth in the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The mammography market exhibits consolidation, primarily characterized by the dominance of a select few major players. These key market participants are strategically directing their efforts towards technological advancements and mitigating the potential side effects associated with mammography procedures. By prioritizing innovation, these major players aim to enhance the precision, efficiency, and safety of mammography, contributing to improved diagnostic capabilities. This focus on technological advancements underscores the competitive landscape of the market, where key stakeholders strive to lead in terms of cutting-edge solutions and patient-centric approaches. The concerted efforts of these major players play a crucial role in shaping the trajectory of the mammography market, ensuring that advancements benefit both healthcare providers and patients. Some of the key market players:

Recent Developments:

1) In May 2022, Volpara Health unveiled enhanced products as part of its integrated platform, catering to personalized breast care, at the SBI/ACR Breast Imaging Symposium 2022. The newly introduced AI-driven breast software tools from Volpara encompass advanced capabilities, including mammography quality and reporting, volumetric breast density measurements, and a comprehensive cancer risk assessment feature. These tools signify a commitment to advancing breast care through cutting-edge technology.

2) In January 2022, ScreenPoint Medical expanded its global presence, including in the United States and 30 other countries, with the introduction of Transpara, an AI Breast Care system. This system introduces innovative solutions for breast care, leveraging artificial intelligence to enhance diagnostic capabilities and streamline breast cancer detection processes, contributing to the evolution of breast imaging technologies on a global scale.

Q1. What was the Mammography Market size in 2023?

The global mammography market size was valued at USD 2.5 billion in 2023.

Q2. At what CAGR is the Mammography market projected to grow within the forecast period?

Mammography Market is expected to grow at a compound annual growth rate (CAGR) of 12.3% during the forecast period.

Q3. What are the factors driving the Mammography Market?

Key factors that are driving the growth include the Growing Burden of Breast Cancer and Technological Advancements in the Field of Breast Imaging.

Q4. Which factor is Limiting the growth of Mammography Market?

Risk of Adverse Effects from Radiation Exposure this factor is Limiting the growth of Mammography Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model