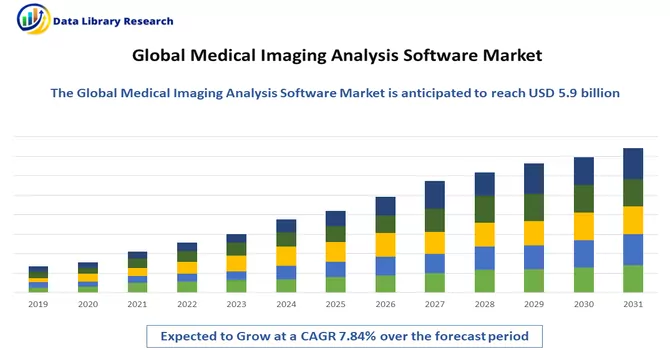

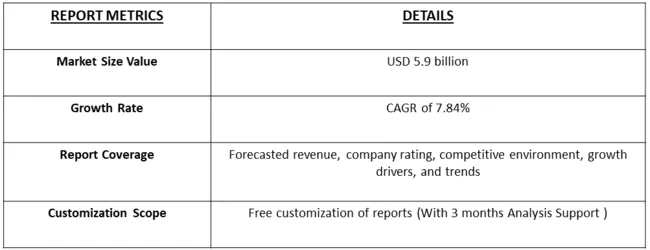

The global medical image analysis software market in terms of revenue was estimated to be worth USD 5.9 billion in 2023 and is expected to reach a CAGR of 7.84% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The medical imaging analysis software market stands at the forefront of transformative healthcare technologies, offering advanced solutions for interpreting and extracting valuable insights from medical images. This software plays a pivotal role in enhancing diagnostic accuracy, treatment planning, and research endeavours across various medical disciplines. Leveraging artificial intelligence (AI) and machine learning algorithms, medical imaging analysis software efficiently processes and interprets complex images generated by modalities such as X-ray, CT scans, MRI, and ultrasound. The market has witnessed a paradigm shift towards precision medicine, with these software solutions enabling personalized and targeted treatment plans based on detailed image analytics.

The demand for seamless integration with electronic health records (EHRs), interoperability, and enhanced visualization tools further propels the growth of this market. However, challenges such as the need for regulatory compliance, data security, and addressing interoperability issues remain crucial considerations for stakeholders navigating this dynamic landscape. As the healthcare industry continues to embrace digital transformation, medical imaging analysis software emerges as a cornerstone technology, revolutionizing the way medical professionals interpret and utilize diagnostic imaging data. A primary growth-driving factor for the medical imaging analysis software market lies in the transformative impact of artificial intelligence (AI) and machine learning (ML) technologies within the healthcare landscape. The integration of advanced algorithms into medical imaging analysis software enhances diagnostic capabilities, streamlines image interpretation, and augments the overall efficiency of healthcare workflows. AI-powered software can rapidly analyze vast datasets from diverse imaging modalities, enabling quicker and more accurate identification of abnormalities and potential diseases. This not only expedites the diagnostic process but also contributes to the burgeoning field of precision medicine by tailoring treatment plans based on intricate image analytics. The continuous evolution of these technologies, coupled with increasing demands for personalized healthcare, positions medical imaging analysis software as a pivotal tool in improving patient outcomes, fostering early detection, and revolutionizing the diagnostic capabilities of healthcare providers worldwide.

Market segmentation: The Medical Imaging Analysis Software Market is Segmented by Image Type (2D Image, 3D Image, and 4D Image), Modality (Tomography, Ultrasound Imaging, Radiographic Imaging, X-ray Imaging, Magnetic Resonance Imaging (MRI), and Other Modalities), Software Type (Integrated Software and Standalone Software), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market trends in the medical imaging analysis software sector reflect a dynamic landscape shaped by technological advancements and evolving healthcare needs. One prevailing trend is the widespread adoption of artificial intelligence (AI) and machine learning (ML) algorithms within these software solutions, significantly enhancing diagnostic capabilities. The integration of AI not only expedites image analysis but also facilitates the development of predictive analytics and personalized treatment plans. Another notable trend is the increasing focus on interoperability, with a growing demand for software that seamlessly integrates with various imaging modalities and electronic health records (EHRs). Telemedicine has accelerated the need for remote imaging analysis, leading to a surge in cloud-based solutions, allowing healthcare professionals to access and analyze medical images from any location. Furthermore, the shift towards 3D imaging and advanced visualization tools is gaining prominence, providing clinicians with more comprehensive insights for complex medical cases. While these trends drive innovation and efficiency in medical imaging analysis, challenges such as data security and regulatory compliance remain critical considerations for sustained market growth. The continuous evolution of these trends positions the medical imaging analysis software market at the forefront of transformative technologies, shaping the future of diagnostic imaging in healthcare.

Market Drivers:

The growing need for accurate and efficient diagnostic solutions is propelling the demand for sophisticated medical imaging analysis software

The escalating demand for accurate and efficient diagnostic solutions is a driving force propelling the market for sophisticated medical imaging analysis software. As healthcare systems worldwide face the challenges of an ageing population and the increasing prevalence of complex medical conditions, the need for precise and timely diagnostic tools becomes paramount. Medical imaging analysis software addresses this need by offering advanced capabilities to interpret intricate imaging data from modalities such as X-rays, CT scans, and MRIs. The emphasis on early detection and precise diagnosis, coupled with the rising adoption of personalized medicine, intensifies the demand for software solutions that can swiftly and accurately analyze medical images. These sophisticated tools not only enhance diagnostic accuracy but also contribute to improved treatment planning and patient outcomes. As the healthcare industry continues to prioritize precision and efficiency in diagnostics, the demand for cutting-edge medical imaging analysis software is expected to rise, transforming the landscape of diagnostic imaging practices globally.

The integration of AI and machine learning algorithms into medical imaging analysis software is a significant driver

The integration of artificial intelligence (AI) and machine learning (ML) algorithms into medical imaging analysis software stands as a pivotal driver in revolutionizing diagnostic capabilities within the healthcare sector. This integration brings forth a transformative approach, allowing the software to autonomously learn and adapt from vast datasets of medical images. AI-powered medical imaging analysis software enhances the efficiency of diagnostics by rapidly and accurately interpreting complex imaging data from various modalities, including X-rays, MRIs, and CT scans. The algorithms contribute to expedited and precise identification of anomalies, facilitating early detection of diseases. Moreover, the incorporation of AI enables these software solutions to evolve over time, adapting to the nuances of medical imaging, and paving the way for personalized and data-driven healthcare. The continuous advancements in AI-driven medical imaging analysis position the technology as a significant driver, shaping a future where diagnostic processes are not only more efficient but also increasingly tailored to individual patient needs.

Market Restraints:

The market for medical imaging analysis software faces several challenges and restraints that impact its growth and widespread adoption. One significant constraint is the complexity and high costs associated with implementing these sophisticated software solutions. The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) demands substantial initial investments in infrastructure, training, and ongoing maintenance. Additionally, concerns related to data security and patient privacy act as a notable restraint. The sensitive nature of medical imaging data requires stringent measures to ensure compliance with regulations and protect against unauthorized access or breaches. Interoperability issues present another challenge, as different imaging modalities and healthcare systems may not seamlessly integrate with the software, hindering its widespread use. Furthermore, the resistance to change within traditional healthcare practices and the need for extensive validation of these advanced technologies by regulatory authorities contribute to a slower pace of adoption. Addressing these restraints requires concerted efforts to streamline implementation costs, enhance interoperability, and establish robust security measures to foster trust among healthcare providers, ultimately advancing the growth and integration of medical imaging analysis software within the healthcare ecosystem.

The COVID-19 pandemic has exerted a multifaceted impact on the market for medical imaging analysis software. On one hand, the increased demand for diagnostic solutions, particularly for chest imaging to assess respiratory health, has accelerated the adoption of advanced medical imaging analysis software. These tools, often equipped with artificial intelligence algorithms, have played a crucial role in the rapid interpretation of medical images, aiding in the diagnosis and monitoring of COVID-19 cases. However, the pandemic has also posed challenges, with disruptions in routine healthcare services affecting the overall market dynamics. Delayed or deferred non-urgent imaging procedures during lockdowns have led to a temporary reduction in demand. Additionally, concerns about infection control and the need for remote diagnostics have prompted a renewed focus on telemedicine, influencing the market towards more accessible and cloud-based imaging solutions. The post-pandemic landscape is likely to witness a continued emphasis on the integration of medical imaging analysis software in healthcare systems, with lessons learned from the pandemic contributing to a more resilient and technologically advanced diagnostic ecosystem.

Segmental Analysis:

3D Image Segment is Expected to Witness Significant Growth Over the Forecast Period

The 3D imaging and medical imaging software analysis market is experiencing significant growth, driven by advancements in technology, increasing demand for minimally invasive surgeries, and rising prevalence of chronic diseases. 3D imaging technology allows for the creation of detailed 3D models of anatomical structures, providing healthcare professionals with enhanced visualization and improved diagnostic capabilities. Medical imaging software analysis plays a crucial role in interpreting these 3D images, enabling healthcare providers to accurately diagnose and treat patients. These software solutions offer a range of tools for image processing, segmentation, and quantitative analysis, allowing for the precise measurement of anatomical structures and the detection of abnormalities. The market for 3D imaging and medical imaging software analysis is also benefiting from the growing adoption of telemedicine and remote healthcare services, which require advanced imaging technologies for accurate diagnosis and treatment planning. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms into medical imaging software is further driving market growth, as these technologies can help automate image analysis and improve diagnostic accuracy. North America is expected to dominate the 3D imaging and medical imaging software analysis market, owing to the presence of well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and strong government support for research and development in the healthcare sector. However, emerging economies in Asia-Pacific and Latin America are also witnessing significant growth in this market, driven by increasing healthcare expenditure and a growing demand for advanced medical imaging solutions.

Ultrasound Imaging Segment is Expected to Witness Significant Growth Over the Forecast Period

The ultrasound imaging and medical imaging software market is experiencing rapid growth globally, driven by technological advancements, increasing prevalence of chronic diseases, and rising demand for non-invasive diagnostic procedures. Ultrasound imaging, also known as sonography, uses high-frequency sound waves to produce images of internal body structures, such as organs, tissues, and blood vessels. It is widely used in obstetrics, cardiology, and oncology, among other medical specialities, due to its safety, versatility, and real-time imaging capabilities. Medical imaging software plays a critical role in enhancing the diagnostic capabilities of ultrasound imaging by providing advanced image processing, analysis, and visualization tools. These software solutions enable healthcare professionals to interpret ultrasound images more accurately, leading to improved patient outcomes. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms into medical imaging software is further driving market growth by enabling automated image analysis and diagnosis. Overall, the ultrasound imaging and medical imaging software market is poised for continued growth, driven by technological advancements, increasing healthcare investments, and growing demand for accurate and efficient diagnostic imaging solutions.

Integrated Software Segment is Expected to Witness Significant Growth Over the Forecast Period

Integrated software in the medical imaging software market refers to comprehensive software solutions that combine various functionalities such as image processing, analysis, visualization, and storage into a single platform. These integrated software solutions are designed to streamline workflow, improve efficiency, and enhance diagnostic capabilities in medical imaging. One of the key drivers for the growth of integrated software in the medical imaging software market is the increasing demand for more efficient and cost-effective healthcare solutions. Integrated software allows healthcare providers to access and analyze medical images more quickly and accurately, leading to improved patient care and outcomes. Additionally, integrated software can help reduce the need for multiple software applications, saving time and resources for healthcare providers. Another factor driving the growth of integrated software in the medical imaging software market is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies. These technologies can be integrated into medical imaging software to provide advanced image analysis and diagnostic capabilities, further enhancing the value of integrated software solutions. North America is expected to dominate the integrated software segment of the medical imaging software market, owing to the region's advanced healthcare infrastructure, high adoption rates of medical imaging technologies, and strong regulatory framework. However, emerging economies in Asia-Pacific and Latin America are also expected to witness significant growth in the integrated software segment, driven by increasing healthcare investments and a growing demand for more efficient healthcare solutions. Overall, integrated software solutions are playing an increasingly important role in the medical imaging software market, offering healthcare providers a comprehensive and efficient way to manage and analyze medical images.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America is a key region driving the growth of the medical imaging software market, primarily due to its advanced healthcare infrastructure, high adoption rates of medical imaging technologies, and strong emphasis on research and development in the healthcare sector. The region is home to several leading medical imaging software companies, contributing to its dominance in the market. One of the key factors driving the growth of the medical imaging software market in North America is the increasing demand for advanced imaging technologies for diagnostic purposes. Medical imaging software plays a crucial role in enhancing the diagnostic capabilities of imaging modalities such as MRI, CT, and ultrasound, leading to improved patient outcomes. Additionally, the rising prevalence of chronic diseases such as cancer and cardiovascular disorders in North America is driving the demand for medical imaging software. These software solutions help healthcare providers accurately diagnose and treat these conditions, leading to better patient care. Furthermore, the adoption of telemedicine and remote healthcare services in North America is also fueling the growth of the medical imaging software market. These services require advanced imaging technologies and software solutions to enable accurate diagnosis and treatment planning from remote locations. Overall, North America is expected to continue dominating the medical imaging software market, driven by factors such as technological advancements, increasing healthcare expenditure, and growing demand for efficient diagnostic solutions.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company's presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the key market players are:

Recent Development:

1) In July 2022, Siemens Healthineers, a leading medical technology company, formally incorporated Subtle Medical's advanced SubtleMR image-enhancement software into its latest reconstruction pipeline known as Open Recon. SubtleMR leverages deep learning (DL) post-processing techniques to effectively reduce noise and enhance sharpness in accelerated MRI sequences. This integration marks a significant advancement, promising improved image quality, streamlined workflow, and an enhanced overall patient experience.

3) In March 2022, Canon Medical Systems took a strategic step to bolster its global X-ray business by entering into an agreement to acquire Nordisk Rontgen Teknik, a prominent Danish medical equipment manufacturer. This acquisition underscores Canon Medical Systems' commitment to expanding its portfolio and strengthening its position in the medical imaging market. The collaboration is poised to bring forth innovative solutions in X-ray technology, contributing to advancements in diagnostic capabilities and healthcare delivery.

Q1. What was the Medical Imaging Analysis Software Market size in 2023?

As per Data Library Research the global medical image analysis software market was estimated to be worth USD 5.9 billion in 2023.

Q2. What is the Growth Rate of the Medical Imaging Analysis Software Market?

Medical Imaging Analysis Software Market is expected to reach a CAGR of 7.84% over the forecast period.

Q3. Who are the key players in Medical Imaging Analysis Software market?

Some key players operating in the market include

Q4. Which region has the largest share of the Medical Imaging Analysis Software market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model