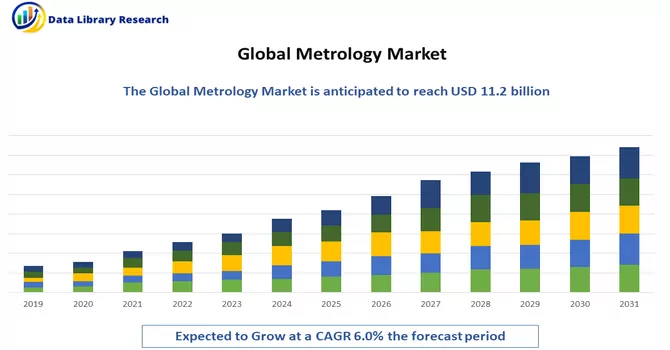

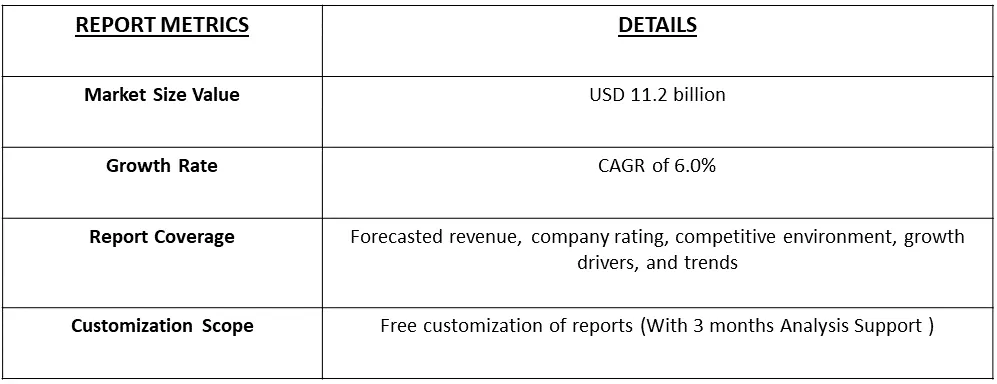

The industrial metrology market is currently valued at USD 11.2 billion in the year 2023 and is expected to register a CAGR of 6.0% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Metrology is the scientific discipline dedicated to the study of measurement, encompassing both theoretical principles and practical applications. It involves the establishment and maintenance of precise measurement standards, calibration of instruments to ensure accuracy, and the development of advanced tools and technologies for measurement purposes. A fundamental aspect of metrology is traceability, which provides a clear chain of comparisons linking measurements to internationally recognized standards. Uncertainty analysis is employed to quantify the range within which the true value of a measured quantity is likely to lie. Metrology plays a crucial role in various fields, including science, industry, and commerce, by contributing to quality assurance, legal compliance, and international collaboration for standardized measurement practices. It is integral to scientific research, industrial processes, and the advancement of technology, providing the foundation for accurate and reliable measurements that underpin numerous aspects of modern life.

The industrial metrology market is experiencing significant growth, propelled by a heightened emphasis on quality control across diverse industries. This surge is particularly driven by the increasing demand for automobiles in developing nations and the expanding market for Big Data analytics. Industries are placing a growing importance on precise measurements and accurate data to ensure the quality of their products. This trend is notably pronounced in the automotive sector, where robust quality control processes are essential. Concurrently, the burgeoning Big Data analytics market is fueling the need for precise and standardized measurements, as accurate data forms the foundation for effective analytics. The intersection of these factors underscores the pivotal role that industrial metrology plays in meeting the evolving requirements of modern industries, contributing to enhanced product quality, operational efficiency, and data-driven decision-making.

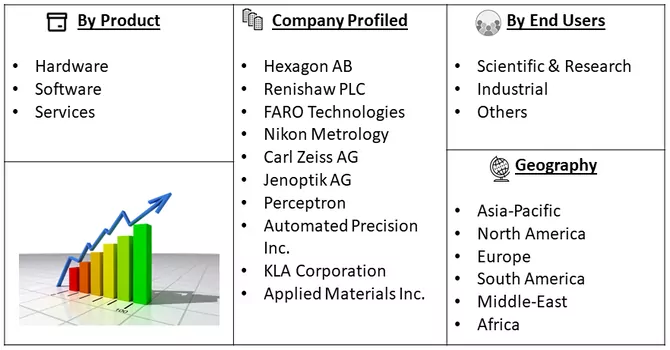

Market Segmentation: The Metrology Market is Segmented by Equipment (Coordinate Measuring Machine, Optical Digitizer and Scanner, Measuring Instrument, X-Ray and Computed Tomography, Automated Optical Inspection, 2D Equipment), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The metrology market is witnessing several notable trends that are shaping its trajectory and influencing its dynamics. One prominent trend is the growing adoption of advanced technologies such as 3D metrology, laser scanning, and optical metrology across various industries. These technologies offer high precision and efficiency, contributing to improved measurement accuracy and streamlined processes. Additionally, there is a rising demand for portable and handheld metrology solutions, driven by the need for on-site measurements and flexibility in diverse applications. Industry 4.0 and the integration of smart technologies are transforming metrology into a critical component of smart manufacturing, enabling real-time monitoring and data analytics for enhanced quality control.

Market Drivers:

Rise in Big Data Analytics

The rise in Big Data analytics is significantly influencing the field of metrology, introducing new dimensions to precision measurement and quality control. Big Data analytics in metrology involves the collection, analysis, and interpretation of vast amounts of measurement data to extract meaningful insights. This paradigm shift is driven by the increasing complexity of manufacturing processes and the need for real-time, data-driven decision-making. In metrology, the integration of Big Data analytics enables the identification of patterns, trends, and anomalies in measurement data, contributing to a deeper understanding of manufacturing processes. This, in turn, facilitates proactive quality control measures and predictive maintenance, reducing errors and enhancing overall operational efficiency. The combination of metrology and Big Data analytics is particularly crucial in industries such as aerospace, automotive, and healthcare, where precision and quality standards are paramount. The utilization of advanced analytics tools allows organizations to harness the full potential of the voluminous data generated by metrology systems, transforming it into actionable insights for continuous improvement and optimization. As industries increasingly recognize the value of data-driven decision-making, the synergy between Big Data analytics and metrology is poised to play a pivotal role in shaping the future of quality assurance and manufacturing excellence. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Adoption of Cloud Services to Integrate the Metrological Data

Cloud services facilitate seamless integration with metrology equipment and systems, allowing for automated data transfer and updates. This not only enhances operational efficiency but also ensures that all stakeholders have access to the most current and accurate measurement information. Moreover, the scalability of cloud services accommodates the growing volume of metrological data generated in today's complex manufacturing environments. This shift to the cloud enhances data security, as reputable cloud service providers implement robust security measures and compliance standards. The adoption of cloud services in metrology aligns with broader Industry 4.0 trends, empowering organizations to leverage advanced analytics, artificial intelligence, and machine learning for predictive maintenance, quality improvement, and overall process optimization. As industries increasingly recognize the benefits of cloud-based metrology, it is expected to become an integral component of modern manufacturing ecosystems, offering agility, accessibility, and enhanced collaboration in the management of critical measurement data. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Market Restraints:

High Cost of Setting Up Metrology Facility

The high cost associated with setting up a metrology facility stands as a potential impediment that could slow the growth of the metrology market. Establishing a comprehensive metrology infrastructure involves significant investments in advanced measuring equipment, precision instruments, and sophisticated software solutions. These costs are particularly pronounced for industries requiring cutting-edge metrology capabilities, such as aerospace, automotive, and semiconductor manufacturing. The financial burden extends beyond initial equipment procurement to include ongoing expenses for calibration, maintenance, and skilled personnel. Small and medium-sized enterprises (SMEs), in particular, may find these upfront costs challenging, potentially limiting their ability to adopt state-of-the-art metrology solutions. Thus, such factors may slow the growth of the studied market over the forecast period.

The COVID-19 pandemic has significantly impacted the metrology market, initially causing disruptions with supply chain challenges and a temporary slowdown in the adoption of metrology solutions due to economic uncertainties. Industries faced delays in manufacturing and delivery of metrology equipment. However, the pandemic accelerated digital transformation in manufacturing, leading to a heightened focus on remote and automated metrology solutions for virtual inspections and quality control. Essential industries like healthcare and aerospace continued to prioritize metrology for maintaining stringent quality standards. Despite challenges, the metrology market showcased resilience as companies leveraged precision measurement technologies to enhance operational efficiency and ensure product quality. As economies recover, the market is expected to rebound, with industries recognizing the long-term importance of metrology in maintaining high standards and navigating uncertainties.

Segmental Analysis:

X-ray and computed tomography (CT) Segment is Expected to Witness Significant Growth

X-ray and computed tomography (CT) technologies play a crucial role in modern metrology, particularly in industries where non-destructive and high-resolution imaging is essential for quality control and precision measurement. X-ray metrology involves the use of X-rays to inspect and measure the internal features of objects, allowing for detailed analysis without physical contact. Computed tomography, an advanced form of X-ray imaging, utilizes computer algorithms to reconstruct cross-sectional images of an object, providing three-dimensional insights into its internal structure. In metrology applications, X-ray and CT technologies are employed for inspecting complex components in industries such as aerospace, automotive, electronics, and medical devices. These technologies enable the accurate measurement of internal geometries, material density variations, and potential defects, contributing to the assessment of product integrity and compliance with stringent quality standards. X-ray and CT metrology facilitate non-destructive testing, dimensional analysis, and the detection of hidden flaws, ensuring the precision and reliability of manufactured components. As advancements in X-ray and CT technologies continue, their integration into metrology processes enhances the capabilities of industries to achieve meticulous quality control and meet the demands of intricate manufacturing requirements.

Asia-Pacific Region is Expected to Witness Significant Growth

The Asia Pacific region is poised to dominate the industrial metrology market during the forecast period, driven primarily by the burgeoning automotive and manufacturing sectors in the region. The continuous technological advancements spearheaded by local companies further contribute to the market's robust growth. Substantial government funding for research and development initiatives, coupled with extensive industrial bases, serves as a cornerstone for the flourishing industrial metrology market in the Asia-Pacific. Notably, countries such as China, South Korea, and Japan play pivotal roles in propelling market expansion. In a strategic move, Hexagon partnered with India's Central Manufacturing Technology Institute (CMTI) to establish a Smart Manufacturing Development and Demonstration Cell in Bengaluru, India, enhancing Industry 4.0 capabilities. The metrology services market in Asia-Pacific is anticipated to be driven by applications in industrial and power generation sectors, encompassing various critical areas such as machine bearing, turbines, and alignment processes. The emphasis on improving product quality under the Make In India campaign, highlighted by Prime Minister Narendra Modi, underscores the government's commitment to elevating quality control standards in regional industries. The establishment of a national standardization and metrology system aligns with the broader goal of positioning the country as a regional and global hub for future industries.

Get Complete Analysis Of The Report - Download Free Sample PDF

The industrial metrology market exhibits a competitive landscape characterized by the presence of numerous players. The market, while moderately concentrated, sees major players employing strategic initiatives such as product innovations and mergers and acquisitions to enhance their competitive positions. Companies operating in this space are actively pursuing various growth and expansion strategies to gain a distinct advantage in the market. These strategies include continuous efforts towards introducing innovative products, forming strategic alliances through mergers and acquisitions, and engaging in initiatives that contribute to market expansion. The competitive dynamics within the industrial metrology market underscore the industry's commitment to staying at the forefront of technological advancements and fostering a robust environment of innovation and strategic collaboration. Some of the major market players working in this domain are:

Recent Development:

1) In November 2023, Camtek Ltd., a prominent manufacturer of metrology and inspection equipment, announced the completion of its acquisition of FRT Metrology business for USD 100 million in cash, subject to customary purchase price adjustments, from FormFactor (Nasdaq: FORM). The successful closure of this strategic transaction, which extends their reach into new markets and enables the provision of advanced solutions for additional process steps in semiconductor manufacturing. The portfolio from FRT aligns seamlessly with their strategic objective of providing comprehensive metrology solutions.

2) In September 2023, Camtek Ltd in collaboration with FormFactor, Inc. is excited to disclose their agreement for Camtek's acquisition of FormFactor, Inc.'s FRT Metrology business. The acquisition will be valued at USD 100 million in cash, with adjustments for customary purchase price considerations. This strategic move brings advanced metrology technologies into Camtek's portfolio, offering comprehensive measurement capabilities and heightened precision, particularly crucial as semiconductor designs become more intricate, including the rise of 3D structures.

Q1. What was the Metrology Market size in 2023?

As per Data Library Research The metrology market is currently valued at USD 11.2 billion in the year 2023.

Q2. At what CAGR is the Metrology market projected to grow within the forecast period?

Metrology Market is expected to register a CAGR of 6.0% during the forecast period.

Q3. What are the factors driving the Metrology Market?

Key factors that are driving the growth include the Rise in Big Data Analytics and Adoption of Cloud Services to Integrate the Metrological Data.

Q4. Which factor is Limiting the growth of Metrology Market?

High Cost of Setting Up Metrology Facility this factor is Limiting the growth of Metrology Market.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model