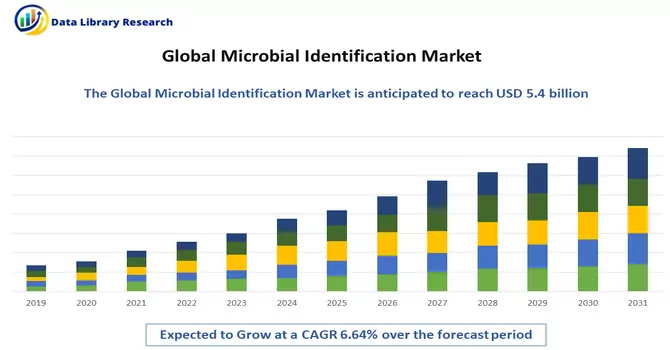

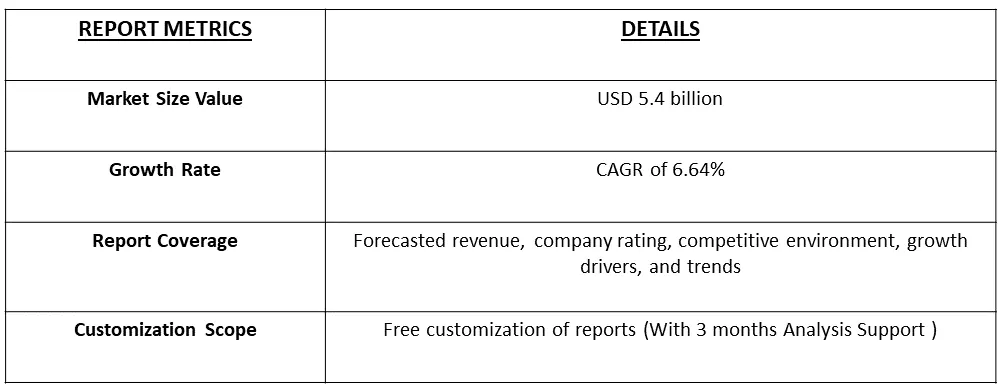

The microbial identification methods market size is expected to grow from USD 5.4 billion in 2023 and is expected to register a CAGR of 6.64% from 2022 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Microbial identification refers to the process of determining and categorizing microorganisms, such as bacteria, viruses, fungi, and other microscopic entities, to understand their specific characteristics and identity. This scientific discipline employs various methods and technologies to analyze the genetic, biochemical, or morphological features of microorganisms, allowing for their classification and differentiation. Accurate microbial identification is crucial in numerous fields, including healthcare, pharmaceuticals, food safety, environmental monitoring, and research. The identification of microorganisms helps in assessing their potential impact on human health, understanding their role in various ecosystems, ensuring product quality and safety, and developing targeted treatments or interventions when necessary. Advanced techniques, such as DNA sequencing, mass spectrometry, and other molecular biology approaches, have significantly improved the precision and speed of microbial identification processes in recent years.

The microbial identification market is propelled by several growth-driving factors, including the increasing prevalence of infectious diseases, continuous technological advancements in DNA sequencing and mass spectrometry, and the expanding pharmaceutical and biotechnological industries' emphasis on quality control. Additionally, the rising awareness of food safety, the need for environmental monitoring, and the globalization of trade and travel contribute to the demand for accurate microbial identification. Research and development initiatives, the trend toward point-of-care testing, stringent regulatory requirements, and a growing awareness of the importance of microbial identification in disease prevention collectively fuel the market's expansion. These factors highlight the dynamic nature of the microbial identification landscape, with advancements in technology and increased applications across various industries driving ongoing growth.

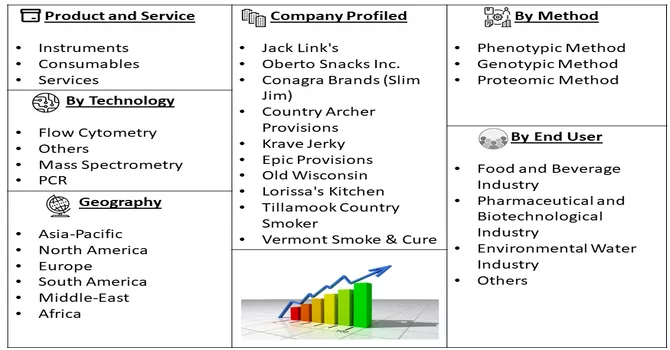

Market Segmentation: The Microbial Identification Market is segmented by Products and Services (Instruments, Consumables, and Services), Method (Phenotypic Methods, Genotypic Methods, and Proteomics-based Methods), Application (Diagnostics, Food, and Beverage Testing, Pharmaceuticals, Cosmetics, and Personal Care Products Testing, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The microbial identification market has witnessed significant trends that have shaped its landscape. Continuous technological advancements, particularly in mass spectrometry, polymerase chain reaction (PCR), and DNA sequencing, contribute to more accurate and rapid identification. The pharmaceutical and biotechnological industries are increasingly relying on microbial identification for quality control and research purposes. The food and beverage sector's growing focus on safety testing has fueled demand for solutions detecting foodborne pathogens. Automation, high-throughput screening, and the integration of artificial intelligence (AI) and machine learning (ML) are enhancing efficiency and accuracy. Point-of-care testing (POCT) and portable devices are gaining traction, especially in healthcare settings. Global health concerns, exacerbated by the COVID-19 pandemic, underscore the need for rapid microbial identification. Collaborations between solution providers, research institutions, and industry players aim to advance technologies and expand market reach. Environmental monitoring and industrial applications, alongside regulatory compliance and standardization, are also driving market developments. Overall, the microbial identification market is dynamic, responding to technological innovation, industry needs, and global health priorities.

Market Drivers:

Rising Burden of Infectious Diseases

The escalating burden of infectious diseases worldwide has underscored the critical importance of microbial testing in contemporary healthcare. With infectious diseases posing significant threats to global public health, the need for accurate and timely identification of microbial pathogens has become paramount. Microbial testing plays a pivotal role in disease diagnosis, treatment planning, and public health management. The rising incidence of infectious diseases, coupled with the emergence of new and re-emerging pathogens, has heightened the demand for advanced microbial testing methodologies. Microbial testing encompasses a spectrum of techniques, including PCR, DNA sequencing, mass spectrometry, and traditional culture-based methods. These approaches facilitate the rapid detection and characterization of pathogens, aiding healthcare professionals in making informed decisions regarding patient care and public health interventions. Moreover, microbial testing is instrumental in surveillance efforts, outbreak investigations, and the monitoring of antimicrobial resistance, contributing to effective disease control strategies. The ongoing global health challenges, such as the COVID-19 pandemic, have further emphasized the need for robust microbial testing infrastructure. The ability to swiftly and accurately identify infectious agents is crucial for timely containment measures, treatment initiation, and the prevention of disease spread. As healthcare systems adapt to the evolving landscape of infectious diseases, microbial testing remains at the forefront, enabling a proactive and targeted approach to managing infectious threats. Thus, the rising burden of infectious diseases underscores the pivotal role of microbial testing in contemporary healthcare. The continuous development and integration of advanced testing technologies are essential for enhancing diagnostic capabilities, improving treatment outcomes, and mitigating the impact of infectious diseases on global health.

Technological Advancements in Microbial Identification

Technological advancements in microbial identification have propelled the field to new heights, offering unprecedented precision and efficiency. Next-Generation Sequencing (NGS) allows for comprehensive genomic analysis, while mass spectrometry, particularly Matrix-Assisted Laser Desorption/Ionization Time-of-Flight (MALDI-TOF), ensures rapid and accurate microbial differentiation based on protein profiles. Polymerase Chain Reaction (PCR) techniques, including real-time and quantitative variants, continue to advance in sensitivity and speed. High-throughput screening systems, microarray technology, and the integration of bioinformatics, artificial intelligence (AI), and machine learning (ML) enhance the efficiency of microbial identification processes. Nanotechnology introduces innovative nanoscale sensors, and CRISPR-based technologies revolutionize the specificity of microbial DNA detection. These advancements collectively empower diverse applications in healthcare, food safety, environmental monitoring, and beyond, promising a future of increasingly sophisticated and accessible tools for microbial identification.

Market Restraints:

High Cost of Automated Microbial Identification Systems

The high cost associated with automated microbial identification systems stands as a potential impediment to the growth of the microbial testing market. While these advanced technologies offer unparalleled accuracy and efficiency, their substantial upfront and operational expenses can pose challenges for widespread adoption. The capital investment required for the acquisition and maintenance of automated systems, coupled with ongoing expenses for consumables and software updates, may deter some laboratories, particularly in resource-limited settings, from embracing these cutting-edge solutions. This cost barrier could potentially limit the accessibility of advanced microbial identification technologies, slowing down their integration into routine testing practices. As the industry navigates these challenges, there is a need for continued efforts to develop more cost-effective solutions and explore avenues for making these technologies more accessible to a broader spectrum of healthcare providers and laboratories. Overcoming the hurdle of high costs will be crucial for ensuring the widespread implementation of automated microbial identification systems, ultimately contributing to the advancement of microbial testing capabilities.

The COVID-19 pandemic has significantly impacted the microbial identification market, reshaping its dynamics and priorities. The urgent need for identifying the SARS-CoV-2 virus has driven a surge in demand for microbial identification tools, accelerating the adoption of advanced technologies such as PCR and next-generation sequencing. Emphasis on point-of-care testing has heightened, and the rise of telemedicine has influenced remote diagnostics. Supply chain disruptions have presented challenges, prompting increased research and development efforts to address the crisis. Collaborations and partnerships between industry stakeholders have intensified, fostering a collective approach to enhancing microbial identification capabilities. Regulatory priorities have shifted to accommodate the urgent demand for diagnostics, reflecting the broader recognition of microbial identification's pivotal role in managing infectious diseases. Overall, the pandemic has propelled the microbial identification market to adapt, innovate, and underscore its critical significance in global health crises.

Segmental Analysis:

Instruments Segment is Expected to Witness Significant Growth over the Forecast Period

Instruments for microbial identification testing constitute a diverse array of advanced technologies crucial for accurate and efficient analysis of microorganisms across industries. Mass spectrometers, such as MALDI-TOF, enable rapid identification through unique protein profiles, while PCR machines amplify and analyze microbial DNA. Next-generation sequencing platforms offer high-throughput sequencing for comprehensive identification, and automated systems streamline testing processes. Microarrays simultaneously analyze multiple microbial sequences, and flow cytometers assess cellular properties for identification. Digital microscopes enhance visualization, while biochemical analyzers and nanotechnology-based sensors contribute to rapid and sensitive detection. Bioinformatics tools play a vital role in data analysis. The continuous evolution of these instruments is essential for staying at the forefront of microbial identification, and advancing capabilities across healthcare, pharmaceuticals, food safety, and environmental monitoring. However, the high cost of some advanced instruments remains a potential hurdle for widespread adoption.

Phenotypic Methods Segment is Expected to Witness Significant Growth over the Forecast Period

Phenotypic methods in microbial testing constitute a traditional yet essential approach for the identification and characterization of microorganisms. These methods rely on observing the physical and biochemical characteristics of microbial cells, including colony morphology, growth patterns, and metabolic activities. Common phenotypic techniques include biochemical assays, culture-based methods, and antibiotic susceptibility testing. Despite the advent of molecular technologies, phenotypic methods remain valuable in clinical microbiology and research, offering cost-effective and readily applicable means for microbial identification. These techniques play a crucial role in complementing advanced molecular approaches, contributing to a comprehensive understanding of microbial diversity and aiding in the effective management of infectious diseases, particularly in resource-limited settings where sophisticated molecular instrumentation may be less accessible.

Pharmaceuticals Methods Segment is Expected to Witness Significant Growth over the Forecast Period

Microbial testing is a critical component in the pharmaceutical industry, ensuring the safety, quality, and efficacy of pharmaceutical products. Pharmaceutical companies conduct microbial testing at various stages of the manufacturing process, from raw materials to the final product, to mitigate the risk of microbial contamination. Common microbial tests include total aerobic microbial count, total yeast and mold count, and tests for specific pathogens. These tests are essential to comply with regulatory standards and good manufacturing practices (GMP). Microbial contamination in pharmaceuticals can compromise product stability, efficacy, and, most importantly, pose health risks to consumers. As pharmaceutical products are often administered to patients, rigorous microbial testing is imperative to prevent the introduction of harmful microorganisms. Advanced technologies, including rapid microbial detection methods and automated systems, enhance the efficiency and accuracy of microbial testing in the pharmaceutical industry, ensuring the production of safe and high-quality drugs.

North America Region Expected to Witness Significant Growth over the Forecast Period

North America is poised for growth in the microbial identification market in the foreseeable future, attributed to factors such as the increasing prevalence of infectious diseases, periodic outbreaks, heightened concerns regarding food safety, and the prominent presence of key industry players launching new products. A November 2022 update from the CDC highlighted 20 reported cases of illness and 5 hospitalizations due to an E. coli outbreak associated with frozen falafel, emphasizing the pivotal role of microbial identification in investigating and mitigating infectious diseases linked to foodborne pathogens. The region's technological advancements and the introduction of innovative products by key players further contribute to the anticipated market expansion. For instance, BD's FDA clearance for the BD Kiestra IdentifA system in January 2022 automates the preparation of microbiology bacterial identification testing, while Bruker Corporation's launch of the MBT Sepsityper Kit US IVD in January 2021 allows rapid microbial identification from positive blood cultures. Additionally, North America's emphasis on food safety, with government and local agencies utilizing microbial identification for microbe detection in food, is expected to drive market growth. Effective collaboration between various organizations at federal, state, and municipal levels is deemed crucial for ensuring comprehensive food safety, with local health departments playing a significant role in prevention operations, inspections, and education, while federal agencies regulate food policies.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the market players working in this segment are:

Recent Development:

1) In April 2022, Bruker Corporation made notable strides in the realm of infectious disease diagnostics by advancing its multiplex PCR assays, leveraging its proprietary LiquidArray technology. Additionally, the company expanded its mycobacteria portfolio with the introduction of the FluoroType Mycobacteria PCR assay. This innovative assay, conducted on the high-precision FluoroCycler XT thermocycler, utilizes the robust LiquidArray technology to distinguish among 31 clinically relevant non-tuberculous mycobacteria and the M. tuberculosis complex in a single comprehensive test.

2) In March 2022, Accelerate Diagnostics, Inc. unveiled the Accelerate Arc system, a revolutionary solution comprising the Arc Module and BC Kit. This automated system presents a streamlined pathway for swift and accurate microbial identification in positive blood cultures. What sets the Accelerate Arc system apart is its capability to eliminate the need for overnight culture incubation, thereby significantly reducing the turnaround time for results. Moreover, the system addresses concerns related to cross-reactivity and potential false-positive outcomes, commonly associated with rapid multi-targeted molecular tests. These advancements reflect the ongoing commitment of both Bruker Corporation and Accelerate Diagnostics, Inc. to enhance the efficiency and accuracy of microbial identification processes, offering valuable solutions in the field of infectious disease diagnostics.

Q1. What was the Microbial Identification Market size in 2023?

As per Data Library Research the microbial identification methods market size was astimated USD 5.4 billion in 2023.

Q2. At what CAGR is the market projected to grow within the forecast period?

Microbial Identification market is expected to register a CAGR of 6.64% durimg the forecaste period.

Q3. Which region has the largest share of the Microbial Identification market? What are the largest region's market size and growth rate?

North America has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. What are the factors driving the Microbial Identification Market?

Key factors that are driving the growth include the Rising Burden of Infectious Diseases and Technological Advancements in Microbial Identification.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model