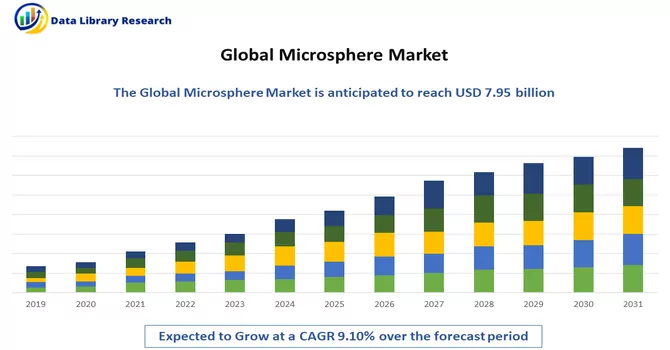

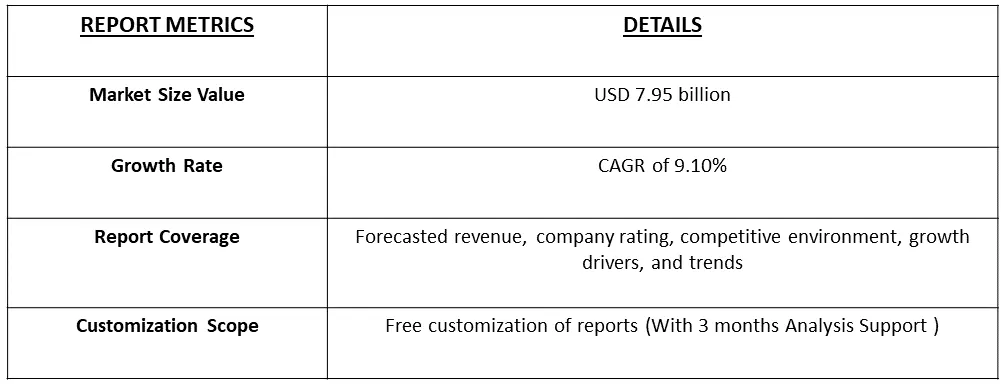

The microsphere market size is estimated at USD 7.95 billion in 2024 and is expected to register a CAGR of 9.10% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Microspheres play a pivotal role in diverse industries, driving innovation and expanding applications in the global market. These tiny spherical particles, typically ranging from 1 to 1000 micrometers in size, find extensive use in areas such as pharmaceuticals, cosmetics, healthcare, construction, and automotive sectors. The market for microspheres is witnessing robust growth due to their unique properties, including lightweight, high surface area, and controlled porosity, contributing to improved product performance and enhanced functionalities. As demand for advanced materials and technologies continues to rise, microspheres offer solutions for varied challenges, fostering their integration into a broad spectrum of products and processes.

The market's trajectory is further propelled by ongoing research and development activities, emphasizing sustainability, biodegradability, and eco-friendly alternatives, positioning microspheres as integral components in the evolving landscape of modern industries. The exponential growth of the microsphere market is primarily driven by the escalating demand for lightweight materials across multiple industries, including aerospace, automotive, and construction. Microspheres, with their inherent properties of reduced density and enhanced strength, are increasingly employed as fillers, additives, or components in composite materials, contributing to the development of high-performance and fuel-efficient products. The relentless pursuit of efficiency, coupled with the ongoing emphasis on sustainability, positions microspheres as a crucial solution for industries seeking to achieve optimal performance while minimizing environmental impact. This quest for lightweight, durable, and eco-friendly materials propels the expansion of the microsphere market as a key enabler of innovation in diverse sectors.

Market segmentation: The Global Microspheres Market is segmented by Raw Material (Glass, Polymer, Ceramic, Fly Ash, Metallic, and Other Raw Materials), Application (Automotive, Aerospace, Cosmetics, Oil and Gas, Paints and Coatings, Medical Technology, Composites, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers market size and forecast in revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The microsphere market is currently witnessing notable trends that reflect the evolving landscape of various industries. One prominent trend is the increasing adoption of bio-based and biodegradable microspheres, aligning with the global push towards sustainable practices. As environmental concerns gain prominence, manufacturers are exploring eco-friendly alternatives, driving innovation in microsphere production. Moreover, the healthcare sector is experiencing a surge in demand for microspheres in drug delivery applications, enhancing therapeutic efficacy and minimizing side effects. Additionally, the expanding utilization of microspheres in 3D printing technologies and the development of smart materials further underscore the market's dynamic nature. The continuous integration of advanced technologies, coupled with a focus on green solutions and cutting-edge applications, shapes the ongoing trends in the microsphere market, paving the way for diverse and impactful developments in the near future.

Market Drivers:

The burgeoning demand for lightweight materials in industries

The industrial landscape is witnessing a substantial surge in the demand for lightweight materials across diverse sectors, driven by a collective pursuit of enhanced efficiency, reduced energy consumption, and improved performance. Industries such as aerospace, automotive, and construction are increasingly prioritizing lightweight materials like advanced composites, alloys, and microspheres to achieve weight reduction without compromising structural integrity. This demand is fueled by the need for fuel-efficient transportation, lower emissions, and cost-effective construction solutions. Lightweight materials not only contribute to the development of more sustainable products but also address regulatory requirements and consumer preferences for eco-friendly and high-performance solutions. As a result, the relentless quest for enhanced efficiency and environmental sustainability is propelling the adoption of lightweight materials, reshaping the dynamics of various industries and driving innovation in material science and engineering.

The growing emphasis on drug delivery advancements in the pharmaceutical sector

The pharmaceutical sector is experiencing a notable paradigm shift with a growing emphasis on drug delivery advancements, marked by a surge in research and development efforts to enhance therapeutic outcomes. The demand for more precise and effective drug delivery systems has led to the prominence of innovative technologies, and microspheres are playing a pivotal role in this evolution. These microscopic spherical particles offer a versatile platform for controlled and targeted drug release, improving bioavailability, reducing side effects, and enhancing patient compliance. The pharmaceutical industry's commitment to personalized medicine and the need for optimized treatment regimens are driving the exploration and integration of microsphere-based drug delivery systems, fostering a new era in pharmaceutical formulations that prioritize efficacy, safety, and patient-centric approaches.

Market Restraints:

The microsphere market faces certain constraints that impact its growth trajectory. One significant restraint is the cost associated with the production of high-quality microspheres, stemming from the need for advanced manufacturing techniques and raw materials. The intricate processes involved in achieving precise size, shape, and surface characteristics contribute to elevated production expenses, potentially limiting widespread adoption, particularly in cost-sensitive industries. Another constraint lies in the regulatory challenges associated with certain applications, especially in the healthcare sector, where rigorous approval processes are essential for ensuring the safety and efficacy of microsphere-based products. Additionally, concerns related to environmental impact and the potential health effects of microplastics pose challenges, leading to increased scrutiny and the demand for sustainable alternatives. Overcoming these economic, regulatory, and environmental obstacles is essential for unlocking the full potential of the microsphere market and fostering broader market penetration across industries.

The COVID-19 pandemic has exerted a discernible impact on the microsphere market, introducing a complex set of challenges and opportunities. Disruptions in global supply chains, restrictions on manufacturing activities, and fluctuations in demand across industries have collectively influenced the market dynamics. While certain sectors, such as healthcare, experienced increased demand for microspheres in applications like drug delivery systems, other industries like automotive and construction faced temporary setbacks due to halted projects and economic uncertainties. The heightened focus on healthcare and the need for advanced materials in pandemic response efforts have driven innovation in microsphere applications. Moreover, the pandemic has underscored the importance of resilient supply chains, pushing for increased localization and diversification. As the world navigates the ongoing impact of the pandemic, the microsphere market is adapting to evolving demands and recalibrating strategies to align with the shifting landscape of global industries.

Segmental Analysis:

Ceramic Segment is Expected to Witness Significant Growth Over the Forecast Period

The ceramic segment in the microsphere market has been experiencing significant growth, driven by the expanding applications in various industries such as construction, oil & gas, and healthcare. Ceramic microspheres are lightweight, inert, and have excellent thermal and chemical resistance, making them ideal for a wide range of applications. In the construction industry, ceramic microspheres are used as lightweight fillers in construction materials such as concrete, grouts, and coatings. They help improve the properties of these materials, including strength, durability, and thermal insulation. Additionally, ceramic microspheres are used as additives in paint and coatings to enhance their performance and reduce weight. In the oil & gas industry, ceramic microspheres are used as proppants in hydraulic fracturing operations. They help prop open the fractures created in the rock formation, allowing for the extraction of oil and gas. Ceramic microspheres are preferred in this application due to their high crush strength and thermal stability. Moreover, the healthcare industry, ceramic microspheres are used in medical devices and implants. They are biocompatible and can be used in applications such as drug delivery, tissue engineering, and medical diagnostics. The ceramic segment in the microsphere market is characterized by a high level of competition, with several key players competing based on product quality, price, and innovation. As the demand for lightweight, high-performance materials continues to grow, the ceramic microsphere market is expected to expand further, driven by advancements in technology and increasing applications across various industries.

Aerospace Segment is Expected to Witness Significant Growth Over the Forecast Period

The aerospace sector is a significant consumer of microspheres, particularly in advanced composite materials used in aircraft manufacturing. Microspheres are small, hollow particles that offer benefits such as reduced weight, improved strength-to-weight ratio, and enhanced acoustic properties. These characteristics make them valuable in aerospace applications where reducing weight while maintaining strength and performance is critical. In aerospace composites, microspheres are often used as fillers in resin systems to create lightweight materials with improved mechanical properties. They can help reduce the overall weight of aircraft structures, leading to fuel savings and lower emissions. Additionally, microspheres can improve the acoustical properties of composite materials, reducing noise in aircraft interiors. Microspheres are also used in aerospace coatings and paints. By incorporating microspheres into these coatings, manufacturers can create finishes that are more durable, scratch-resistant, and resistant to UV radiation. This helps extend the lifespan of aircraft exteriors and reduces maintenance costs. The aerospace sector's demand for microspheres is expected to grow as aircraft manufacturers seek to develop lighter, more fuel-efficient aircraft. Additionally, the increasing use of composite materials in aerospace manufacturing is driving the need for innovative materials like microspheres. As a result, the aerospace and microsphere markets are closely linked, with advancements in one sector often driving growth and innovation in the other.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is a key region in the global microsphere market, driven by the region's strong presence in industries such as healthcare, construction, and automotive, which are major consumers of microspheres. Microspheres, small spherical particles often made from various materials including glass, ceramic, and polymer, find extensive use in North America for their lightweight, insulating, and structural enhancement properties. In the healthcare sector, microspheres are used in drug delivery systems, diagnostics, and medical devices. They enable the controlled release of drugs, improve the effectiveness of treatments, and enhance imaging techniques. North America's advanced healthcare infrastructure and focus on research and development drive the demand for microspheres in this sector. The construction industry in North America utilizes microspheres in lightweight concrete, insulation materials, and speciality coatings.

Microspheres improve the strength-to-weight ratio of concrete, reduce the density of insulation materials, and enhance the performance of coatings, contributing to energy efficiency and sustainability goals. In the automotive sector, microspheres are used in lightweight composites for vehicle components. They help reduce vehicle weight, improve fuel efficiency, and enhance performance and safety. North America's emphasis on automotive innovation and environmental sustainability supports the growth of the microsphere market in this industry. The North American microsphere market is characterized by a strong presence of key players and a focus on technological advancements and product innovation. As industries continue to seek lightweight, high-performance materials, the demand for microspheres in North America is expected to grow, driving further innovation and market expansion.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players are:

Recent Development:

1) In June of 2022, Nouryon unveiled its latest product, the Expancel HP92 microspheres, designed to reduce weight and withstand high pressure in underbody coatings and sealants specifically tailored for the automotive industry. The manufacturing of these microspheres is currently based in Stockvik, Sweden, and plans are underway to commence production in Green Bay, Wisconsin, USA, by early 2023, showcasing Nouryon's commitment to global production and innovation.

2) In February 2022, 3M achieved a groundbreaking milestone as its high-strength, low-density hollow glass microspheres, known as glass bubbles, were utilized on an extensive industrial scale for the first time. These glass bubbles were employed as insulation for NASA's new liquid hydrogen storage tank. The insulation project at NASA's Kennedy Space Center began in 2021, with 3M providing substantial support by delivering two tankers filled with glass bubbles daily for 30 days. This significant collaboration highlights the versatility and impact of microspheres, particularly 3M's glass bubbles, in pushing the boundaries of innovation, especially within critical projects like those in the aerospace sector.

Q1. What is the current Microsphere Market size?

The microsphere market size is estimated at USD 7.95 billion in 2024.

Q2. At what CAGR is the Microsphere market projected to grow within the forecast period?

Microsphere Market is expected to register a CAGR of 9.10% during the forecast period.

Q3. What are the factors on which the Microsphere market research is based on?

By Raw Material, By Application and Geography are the factors on which the Microsphere market research is based.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model