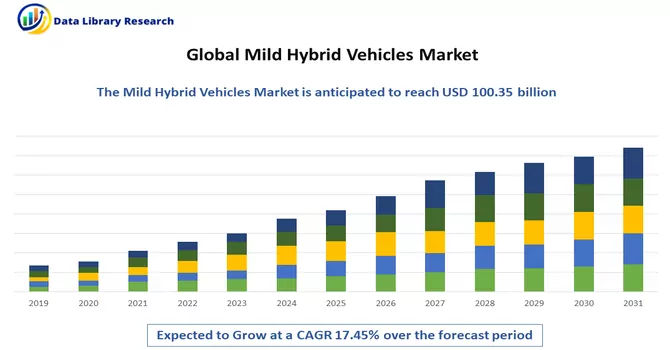

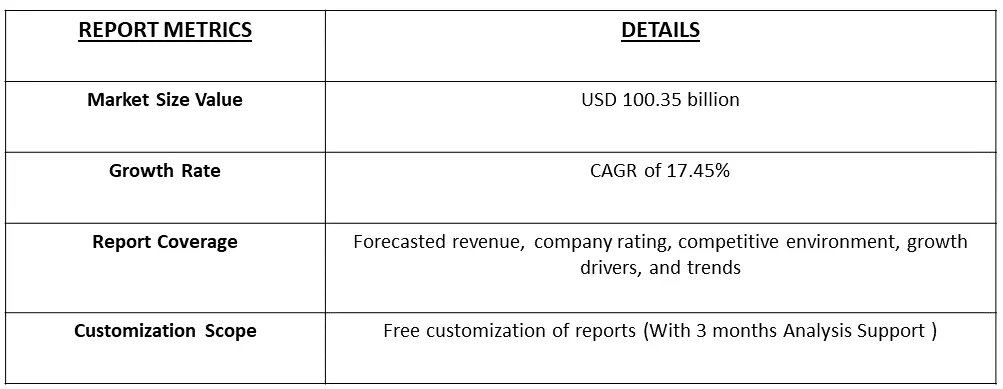

The current valuation of the Mild Hybrid Vehicles Market is estimated to be around USD 100.35 billion, and projections indicate a substantial growth trajectory. Over the next five years, the market is anticipated to reach USD 224.27 billion, reflecting a notable Compound Annual Growth Rate (CAGR) of 17.45% during the forecast period, 2023-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Mild hybrid vehicles constitute a distinct category within the automotive landscape, characterized by the integration of a small electric motor and a battery alongside an internal combustion engine. These systems collaborate to enhance fuel efficiency and curtail emissions, distinguishing mild hybrids from their counterparts like full hybrids or plug-in hybrids due to their provision of limited electric-only propulsion.

The impetus for the increasing prevalence of mild hybrid vehicles is grounded in the global enforcement of stringent emissions regulations. Automakers are compelled to innovate and produce vehicles with lower emissions, aligning with evolving environmental standards. Mild hybrids, through their enhancement of fuel economy and emission reduction capabilities, prove instrumental in meeting these regulatory requirements.

Consumer preferences are also shaping the landscape, with a growing environmental consciousness driving demand for vehicles that are both fuel-efficient and eco-friendly. Mild hybrid vehicles strike a balance between efficiency and affordability, making them particularly appealing to environmentally-conscious buyers who seek sustainable transportation solutions without compromising affordability. The shift toward hybrid vehicles, including mild hybrids, is further driven by factors such as stringent emission standards, the pursuit of fuel efficiency, and government incentives. However, it is noteworthy that the market dynamics are evolving, and the growth of mild hybrid vehicles faces competition from the surging demand for battery-electric vehicles. This growing preference for fully electric options poses a potential challenge to the continued expansion of the mild hybrid vehicle market. The delicate balance between these factors will likely influence the trajectory of the automotive industry in the coming years.

Mild hybrids incorporate start-stop technology, shutting down the internal combustion engine when the vehicle is stationary and restarting it swiftly when needed, reducing idling time and fuel consumption. They use regenerative braking systems to capture kinetic energy during deceleration, converting it into electricity to recharge the battery. This technology improves efficiency by harnessing energy that would otherwise be lost as heat.Mild hybrids employ an electric motor to assist the engine during acceleration or when additional power is required. This motor works alongside the combustion engine, reducing the workload on the engine and enhancing overall efficiency.

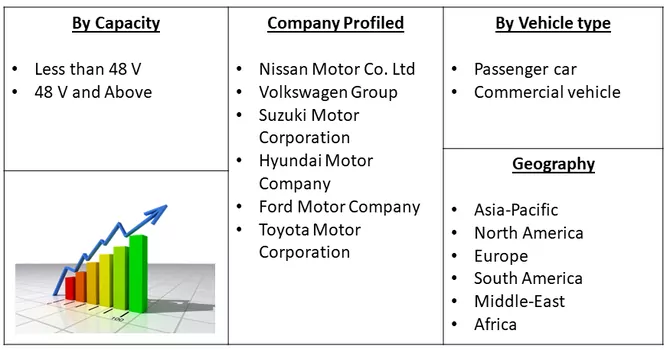

Market Segmentation: The Mild Hybrid Vehicles Market is segmented by capacity (less than 48 V and 48 V and Above), vehicle type (passenger car and commercial vehicle), and geography (North America, Europe, Asia-Pacific, and the rest of the world). The report offers market size and forecasts for all the above segments in value (in USD).

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Regulatory Standards and Emission Reduction Goals:

The global push for increasingly stringent emission standards is a pivotal driver behind the widespread adoption of mild hybrid technology in the automotive industry. Governments worldwide are imposing stringent regulations aimed at curbing vehicle emissions, compelling automakers to innovate and incorporate mild hybrid systems into their vehicles to align with these standards. The motivation behind these regulations lies in the collective effort to address environmental concerns and mitigate the impact of transportation-related emissions on air quality and climate change.

In response to these regulations, automakers are facing heightened scrutiny and potential penalties for exceeding prescribed emissions limits. The financial implications of such penalties serve as a significant incentive for manufacturers to explore and implement technologies that contribute to emission reduction. Mild hybrid technology emerges as a strategic solution in this context, as it enables a substantial reduction in carbon dioxide emissions.

By integrating mild hybrid systems, automakers not only demonstrate their commitment to environmental sustainability but also position themselves to comply with regulatory standards. The avoidance of fines becomes a tangible benefit, encouraging the widespread adoption of mild hybrid technology as a practical and effective means of achieving emission reduction targets. This symbiotic relationship between regulatory pressures and technological advancements underscores the role of mild hybrid systems in shaping the future of the automotive industry toward greater environmental responsibility.

Consumer Demand for Fuel Efficiency and Eco-Friendly Vehicles:

Rising environmental consciousness among consumers drives the demand for greener transportation options. Mild hybrid vehicles, offering improved fuel efficiency and reduced emissions compared to conventional vehicles, align with consumers' preferences for eco-friendly alternatives. Consumers seek vehicles that provide fuel savings without a significant price premium. Mild hybrids offer improved fuel economy, attracting buyers looking for cost-effective options that also contribute to reduced environmental impact.

Market Restraints:

Mild hybrid vehicles often come with a higher price compared to conventional internal combustion engine vehicles due to the integration of hybrid technology. This price differential might deter cost-conscious consumers from opting for these vehicles. Some consumers may question the value proposition of mild hybrid technology, especially if the cost savings in fuel efficiency do not outweigh the initial higher purchase price of the vehicle. Thus, such factors are expected to slow down the growth of the studied market.

Automotive manufacturing facilities encountered temporary shutdowns or scaled-down operations as a response to adherence to health and safety regulations. These measures were implemented to ensure the well-being of the workforce during the challenging times posed by the global health crisis. Unfortunately, these necessary precautions significantly disrupted the established production schedules for mild hybrid vehicles. Compounding the challenges, disruptions in the global supply chain further exacerbated the situation.

The availability of critical components and parts essential for the integration of mild hybrid systems into vehicles was severely impacted. This, in turn, resulted in substantial delays in the production and assembly processes for mild hybrid vehicles. The intricate interdependence of the automotive industry's supply chain was particularly evident as manufacturers grappled with the complex task of sourcing and procuring the required components amid the ongoing disruptions. In the current, with ease in lockdown restrictions and technological developments the market is expected to witness significant growth over the forecast period.

Segmentation Analysis:

Passenger Car and Commercial Vehicle Segment is Expected to Witness Significant Growth Over the Forecast Period.

Numerous automakers have integrated mild hybrid systems across a diverse range of passenger vehicles, spanning sedans, hatchbacks, and SUVs. These vehicles capitalize on advanced features like start-stop technology, regenerative braking, and electric motor assistance, collectively contributing to heightened fuel efficiency and decreased emissions, particularly in urban driving scenarios and stop-and-go traffic conditions. Beyond the realm of passenger cars, mild hybrid technology has extended its footprint to encompass light commercial vehicles such as vans and pickups.

These vehicles, often instrumental in deliveries and smaller cargo transportation, experience notable advantages in terms of enhanced fuel efficiency and reduced emissions, particularly in the context of urban driving and frequent stops. The application of mild hybrid systems in light commercial vehicles aligns with the broader industry shift towards more sustainable and eco-friendly mobility solutions, acknowledging the unique demands and challenges of urban logistics. Thus, such factors are expected to contribute towards the growth of the studied segment.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period.

Numerous automakers have integrated mild hybrid systems into a diverse range of passenger vehicles, spanning sedans, hatchbacks, and SUVs. These vehicles leverage advanced technologies such as start-stop functionality, regenerative braking, and electric motor assistance to enhance fuel efficiency and reduce emissions, particularly in urban driving conditions and stop-and-go traffic. This strategic incorporation of mild hybrid technology underscores a commitment to more sustainable and eco-friendly mobility solutions.

A notable trend among major automakers, including industry leaders like Mercedes-Benz, Audi, and BMW, is the substantial investment in 48 V mild hybrid technology. A growing number of their latest models now incorporate this advanced technology, providing tangible benefits. For instance, the 2022 Mercedes-Benz S-Class boasts a 48 V mild hybrid system, delivering an additional 22 horsepower and up to 184 lb-ft of torque. Simultaneously, it achieves a noteworthy improvement in fuel efficiency, showcasing the potential of this innovative hybrid approach.

Beyond the high-profile automakers, the global automotive landscape is witnessing the introduction of vehicles equipped with mild hybrid systems with less than 48 V capacity. This trend is amplifying the demand for the sub-48 V segment, demonstrating the broad industry shift towards integrating hybrid technologies across various power capacities. Prominent vehicle manufacturers such as Suzuki Corporation, Mahindra, Hyundai, and others have previously launched vehicles featuring a 12 V mild hybrid system. However, in response to the escalating demand from consumers, manufacturers are increasingly directing their efforts toward developing vehicles equipped with the more potent 48 V mild hybrid system. This strategic shift is poised to be a significant factor influencing the trajectory of market growth in the foreseeable future, as automakers strive to meet the evolving preferences of environmentally-conscious consumers.

Get Complete Analysis Of The Report - Download Free Sample PDF

The surge in demand for mild hybrid cars is being significantly propelled by the introduction of new products from various automobile manufacturers. These launches represent a strategic response to the evolving market preferences and a concerted effort to meet the growing demand for more environmentally friendly and fuel-efficient vehicles. The incorporation of mild hybrid technology in these newly launched cars stands out as a key feature. Mild hybrids typically integrate an electric motor with a conventional internal combustion engine, offering benefits such as improved fuel efficiency and reduced emissions. The emphasis on sustainability and eco-friendly driving experiences aligns with the changing consumer sentiments and global efforts towards a greener automotive landscape.

Some of the major players in the market include:

Recent Developments:

1) In May 2023, Toyota South Africa revealed plans to introduce mild-hybrid powertrains for the Fortuner and Hilux models. These SUVs are anticipated to utilize Toyota's TNGA platform and may potentially extend their global reach with a debut in the Indian market scheduled for 2024.

2) Also in May 2023, Chinese manufacturer GAC launched the Trumpchi E9 hybrid MPV, offering three distinct trims. The entry-level Pro trim is priced at CNY 329,800 (USD 45,170), while the mid-spec Max trim is available at CNY 369,800 (USD 50,648).

Q1. What is the current Mild Hybrid Vehicles Market size?

The current valuation of the Mild Hybrid Vehicles Market is estimated to be around USD 100.35 billion.

Q2. At what CAGR is the Mild Hybrid Vehicles market projected to grow within the forecast period?

Mild Hybrid Vehicles Market is expected grow at a Compound Annual Growth Rate (CAGR) of 17.45% during the forecast period.

Q3. What segments are covered in the Mild Hybrid Vehicles Market Report?

By Capacity, By Vehicle Type and Geography are the segments covered in the Mild Hybrid Vehicles Market Report.

Q4. Which Region is expected to hold the highest Market share?

Asia-pacific region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model