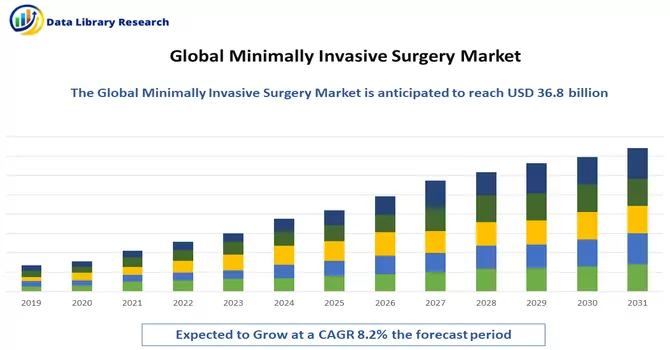

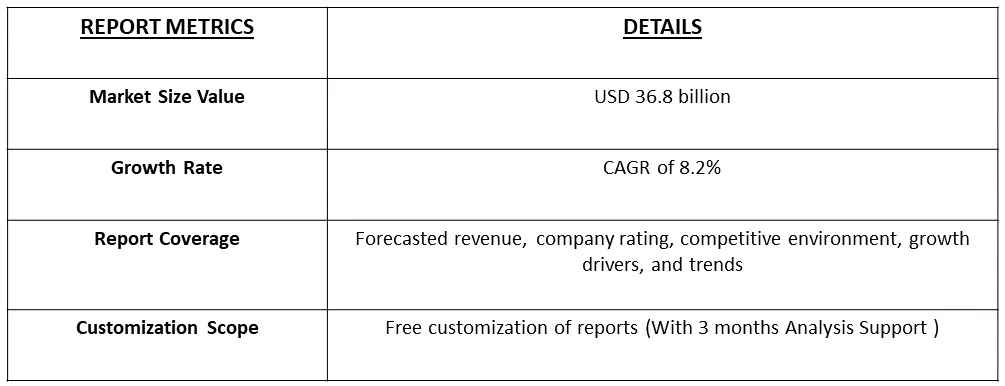

The Minimally Invasive Surgery Devices Market size is estimated at USD 36.8 billion in 2024 and is expected to register a CAGR of 8.2% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Minimally-Invasive Surgery (MIS) Devices refer to a category of medical instruments and equipment designed to perform surgical procedures with minimal disruption to the body's tissues. These devices are employed in minimally invasive surgical techniques, which involve making small incisions, typically using specialized tools such as laparoscopes and endoscopes. MIS procedures aim to reduce trauma, scarring, and recovery time compared to traditional open surgeries. Common examples of MIS devices include laparoscopic instruments, robotic-assisted surgical systems, endoscopic cameras, trocars, and electrosurgical instruments. These devices enable surgeons to visualize, access, and operate inside the body through small incisions, often guided by real-time imaging technologies. Minimally invasive surgery is widely used across various medical specialities, including gastroenterology, gynaecology, urology, and orthopaedics, offering patients less invasive treatment options with potentially faster recovery and improved outcomes.

The robust growth of the minimally invasive surgical devices market can be attributed to several key factors. One significant driver is the escalating prevalence of lifestyle-related and chronic disorders. As the global burden of diseases such as cardiovascular conditions, cancer, and neurological disorders continues to rise, there is a growing demand for advanced and less invasive treatment options. Minimally invasive surgical devices, with their ability to minimize trauma, reduce recovery times, and enhance patient outcomes, have become instrumental in addressing these health challenges. Additionally, there is a noticeable shift in medical preferences towards minimally invasive procedures. Patients and healthcare professionals alike are increasingly recognizing the benefits of less invasive interventions compared to traditional surgical approaches. Minimally invasive surgeries offer advantages such as smaller incisions, reduced postoperative pain, shorter hospital stays, and quicker recovery periods. This shift in preference aligns with the broader healthcare trend emphasizing patient-centric care and improved quality of life. These factors collectively contribute to the sustained growth of the minimally invasive surgical devices market, positioning it as a pivotal component in the evolving landscape of medical interventions.

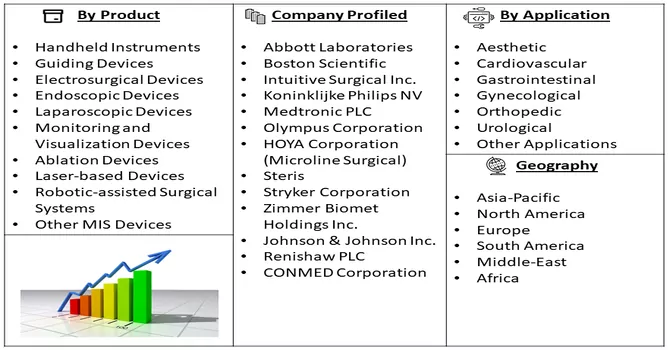

Market Segmentation: The Global Minimally-Invasive Surgery (MIS) Devices Market is Segmented by Product (Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Laparoscopic Devices, Monitoring and Visualization Devices, Ablation Devices, Laser-based Devices, Robotic-assisted Surgical Systems, and Other MIS Devices), Application (Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The market values are provided in terms of (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global market for Minimally Invasive Surgery (MIS) Devices is marked by several key trends shaping its trajectory. Continuous technological advancements, especially in imaging systems and robotic-assisted surgery, contribute to improved surgical precision and patient outcomes. Robotic-assisted surgical systems are gaining prominence across various specialities, expanding the scope of minimally invasive techniques. The applications of MIS devices are diversifying into orthopaedics, cardiovascular, and gastrointestinal surgeries. There is a noticeable trend towards performing minimally invasive surgeries in ambulatory surgery centers, driven by cost-effectiveness and reduced hospital stays. The increasing adoption of single-incision surgery and a focus on training surgeons in MIS techniques contribute to the market's evolution. A patient-centric approach, emphasizing quicker recovery and improved cosmetic outcomes, aligns with the goals of MIS devices. Thus, such market trends are expected to witness significant growth over the forecast period.

Market Drivers:

Higher Acceptance Rate of Minimally Invasive Surgeries Over Traditional Surgeries

The higher acceptance rate of minimally invasive surgeries over traditional surgeries has become a notable trend in the field of medical interventions. Patients and healthcare providers increasingly prefer minimally invasive procedures due to several advantages they offer. These surgeries typically involve smaller incisions, leading to reduced trauma to the body, quicker recovery times, and less postoperative pain. Moreover, the risk of complications, such as infections, is lower compared to traditional open surgeries. The advancements in technology, including the availability of sophisticated equipment and imaging tools, have enhanced the precision and safety of minimally invasive surgeries. Patients are often drawn to the idea of shorter hospital stays and a faster return to normal activities associated with these procedures. The trend toward higher acceptance of minimally invasive surgeries is expected to continue, driven by ongoing innovations in surgical techniques and the growing awareness of the benefits they bring to both patients and healthcare systems.

Growing Technological Advancements

The minimally invasive surgical devices market is witnessing substantial growth driven by continuous technological advancements. Innovations in surgical techniques and the development of cutting-edge devices have revolutionized the landscape of minimally invasive surgery (MIS). Key technological advancements include the integration of robotics, advanced imaging technologies, and real-time data analytics into MIS devices. Robotic-assisted surgical systems, such as the da Vinci Surgical System, have gained prominence for their precision and enhanced maneuverability, enabling surgeons to perform complex procedures with minimal invasiveness. Moreover, advancements in imaging technologies, such as high-definition cameras and three-dimensional visualization systems, provide surgeons with improved clarity and depth perception during procedures.

In August 2023, The CK Birla Group has collaborated with 'Intuitive India' to introduce the newest da Vinci Surgical Robot. As per the hospital's press release, the launch ceremony took place in the presence of Vipul Jain, Chief Business Officer at the CK Birla Hospital, along with Henry Charlton, Senior Vice President and Chief Commercial and Marketing Officer, and Mandeep Singh Kumar, VP and Country GM, Intuitive India, among various other notable figures. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Market Restraints:

Shortage of Experienced Professionals and Uncertain Regulatory Framework

The Minimally Invasive Surgery (MIS) market faces challenges stemming from a shortage of experienced professionals and an uncertain regulatory framework, which are anticipated to impede its growth. The demand for skilled and experienced healthcare professionals proficient in performing minimally invasive procedures is outpacing the available workforce, leading to a shortage that could potentially affect the adoption of MIS techniques. Additionally, the regulatory landscape surrounding minimally invasive surgeries is subject to uncertainties, which can create obstacles for market players in terms of compliance and product approvals. These challenges highlight the importance of addressing workforce shortages and establishing clear and consistent regulatory guidelines to ensure the continued growth and success of the Minimally Invasive Surgery market.

The COVID-19 pandemic had a substantial impact on the minimally invasive surgery (MIS) devices market. The initial phase of the pandemic saw a significant decline in the demand for MIS devices due to restricted hospital visits and postponed surgeries. However, as lockdowns and restrictions were gradually lifted, surgical procedures resumed under specialized regulations in 2021. Notably, minimal access approaches were deemed safe during the pandemic with proper patient selection and additional precautions, as highlighted in a July 2022 article in the Global Journal of Medical Pharmaceutical and Biomedical Update. The implementation of proper guidelines aimed at minimizing disease transmission, coupled with the inherent benefits of MIS in reducing hospital stays, contributed to the resurgence of demand for MIS devices. While the pandemic initially disrupted the market, the subsequent recovery and increased adoption of MIS procedures are anticipated to bring the market back to pre-pandemic levels during the forecast period.

Segmental Analysis:

Laparoscopic Devices Segment is Expected to Witness Significant Growth over the Forecast Period

Laparoscopic devices play a pivotal role in advancing minimally invasive surgical procedures, offering a range of specialized instruments designed for procedures conducted through small incisions or natural body openings. Laparoscopy, a type of minimally invasive surgery, involves the use of these devices to perform surgeries with reduced trauma to the body, resulting in quicker recovery times and minimized scarring. These devices typically include trocars, graspers, scissors, and video systems that enable surgeons to visualize the surgical site in real time. The adoption of laparoscopic devices has significantly contributed to the popularity of minimally invasive surgeries across various medical specialities, such as gynaecology, urology, and general surgery. As these devices continue to evolve with technological advancements, they enhance precision, improve surgical outcomes, and promote patient well-being, driving the growth of the minimally invasive surgery market.

In July 2023, Genesis MedTech, a prominent medical device company, reported the successful approval of its groundbreaking ArtiSential series of articulating laparoscopic instruments by China's National Medical Products Administration (NMPA). This regulatory approval signifies a significant milestone for Genesis MedTech, allowing the market release of ArtiSential in China. The articulating laparoscopic instruments in the ArtiSential series are designed to offer enhanced flexibility and precision during minimally invasive surgical procedures. This achievement reinforces Genesis MedTech's commitment to advancing medical technology and expanding its innovative solutions to contribute to the field of laparoscopic surgery. Thus, such factors are expected to contribute to the growth of the studied market.

Cardiovascular Segment is Expected to Witness Significant Growth over the Forecast Period

The cardiovascular field has witnessed a notable impact from the integration of minimally invasive surgical devices. These devices have transformed the landscape of cardiovascular interventions by offering less invasive alternatives to traditional open-heart surgeries. Procedures like angioplasty, stent placement, and minimally invasive heart valve surgeries have become more commonplace. Minimally invasive techniques involve smaller incisions, reduced trauma, and quicker recovery times for patients. The adoption of devices such as catheters, guidewires, and advanced imaging technologies in cardiovascular surgeries has led to improved patient outcomes and a shift toward more outpatient procedures. As technological advancements continue to enhance the precision and effectiveness of minimally invasive cardiovascular interventions, the market for these devices is expected to experience sustained growth. This trend aligns with the broader healthcare industry's goal of providing more patient-friendly and efficient treatment options. Thus, owing to such advantages, the segment is expected to witness significant growth over the forecast period.

North America Region is Expected to Witness Significant Growth over the Forecast Period

North America has historically dominated the minimally invasive surgery devices market, and this trend is expected to continue in the forecast period. The region's strong market presence is primarily attributed to a high disease burden requiring minimally invasive procedures and an increasing awareness of such surgical techniques. Within North America, the United States is anticipated to hold a significant market share, driven by the prevalent cases of chronic diseases like cardiovascular diseases, cancer, and neurological disorders

For example, recent CDC data updated in October 2022 revealed that a person in the United States suffers from cardiovascular disease every 34 seconds, indicating a substantial disease burden and the ensuing demand for surgeries. This scenario presents opportunities for the growth of minimally invasive surgical procedures in the country.

In November 2023, Medtronic plc, a global healthcare technology leader, announced FDA approval for its Symplicity Spyral renal denervation (RDN) system, known as the Symplicity blood pressure procedure, for hypertension treatment. The approval addresses the pressing issue of hypertension, a leading cause of heart attacks, strokes, and mortality, particularly affecting underserved U.S. populations. Despite available medications and lifestyle interventions, low control rates highlight the need for adjunctive treatment options to better manage blood pressure, further emphasizing the significance of Medtronic's Symplicity Spyral system. Thus, owing to such factors the market is expected to witness significant growth over the forecast period in the North America region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The market for minimally invasive surgery devices is characterized by competitiveness and fragmentation, with the participation of numerous key players. A diverse range of companies is actively investing substantial resources in innovative product development, introducing novel devices to address patient needs, and providing high-quality, life-sustaining treatments. This competitive landscape fosters a dynamic environment where companies strive to differentiate themselves through technological advancements and the introduction of cutting-edge solutions. The commitment to new product innovation underscores the industry's dedication to advancing minimally invasive surgical techniques and improving patient outcomes. The continuous efforts by market players to enhance their product portfolios contribute to the overall evolution and growth of the minimally invasive surgery devices market. Some of the key market players working in this market segment are:

Recent Development:

1) In January 2023, PENTAX Medical successfully secured CE marks for its PENTAX Medical INSPIRA, a state-of-the-art video processor, and the i20c video endoscope series. This new premium video processor maintains compatibility with PENTAX Medical's recent endoscope models while setting new standards with the introduction of the i20c video endoscope generation.

2) In June 2022, Boston Scientific entered into an agreement with South Korea's Synergy Innovation to acquire a majority stake in M.I.Tech, a renowned manufacturer and distributor of non-vascular metal stents utilized in endoscopic and urologic procedures. Boston Scientific's acquisition involved offering nearly KRW 14,500 (approximately USD 11) per M.I.Tech share, resulting in a total transaction value of around KRW 291.2 or USD 230 million.

Q1. What is the current Minimally Invasive Surgery Market size?

As per Data Library Research the Minimally Invasive Surgery Devices Market size is estimated at USD 36.8 billion.

Q2. At what CAGR is the Minimally Invasive Surgery market projected to grow within the forecast period?

Minimally Invasive Surgery Market is expected to register a CAGR of 8.2% during the forecast period.

Q3. What are the factors on which the Minimally Invasive Surgery market research is based on?

By Product, By Appliction, End-User and Geography are the factors on which the Minimally Invasive Surgery market research is based.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model