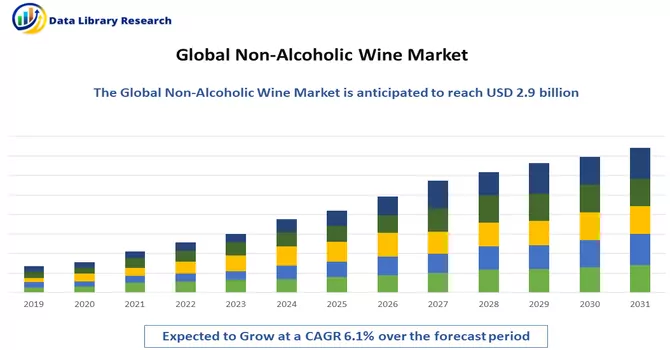

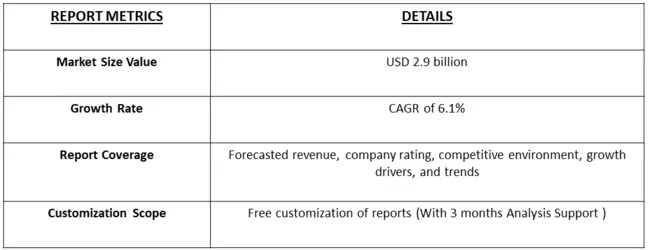

Non-Alcoholic Wine Market is currently valued at USD 2.9 billion in the year 2023, and is expected to register a CAGR of 6.1% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

In the global market overview, the non-alcoholic wine market stands out as a segment experiencing significant growth and transformation. With a rising trend toward healthier lifestyles and the increasing popularity of non-alcoholic beverages, the non-alcoholic wine market has witnessed a surge in demand. Consumers are seeking sophisticated and flavorful alternatives to traditional alcoholic beverages, contributing to the expansion of the non-alcoholic wine sector.

The market is characterized by a diverse range of products, including red, white, and sparkling non-alcoholic wines, catering to varying consumer preferences. Key factors driving this market include a growing health-conscious population, changing drinking habits, and a rising awareness of the adverse effects of alcohol consumption. Additionally, advancements in production techniques and the development of high-quality non-alcoholic wine varieties further contribute to the market's positive trajectory, making it an intriguing segment within the broader beverage industry. The growth of the global non-alcoholic wine market is propelled by the increasing consumer trend towards healthier lifestyle choices and a rising demand for non-alcoholic beverage options. As more individuals embrace wellness and seek alternatives to traditional alcoholic drinks, non-alcoholic wine presents itself as an attractive option. Factors such as a growing awareness of the health risks associated with excessive alcohol consumption, coupled with changing social preferences, contribute to the surge in demand for non-alcoholic wine. Moreover, the market benefits from advancements in production techniques, allowing manufacturers to create non-alcoholic wines with improved taste profiles, resembling the complexity and richness of their alcoholic counterparts. The expanding market is also driven by the strategic efforts of industry players to innovate and introduce a diverse range of high-quality non-alcoholic wine products, catering to different consumer preferences and occasions. Overall, the global non-alcoholic wine market is on the ascent, fueled by a health-conscious consumer base seeking sophisticated, alcohol-free alternatives.

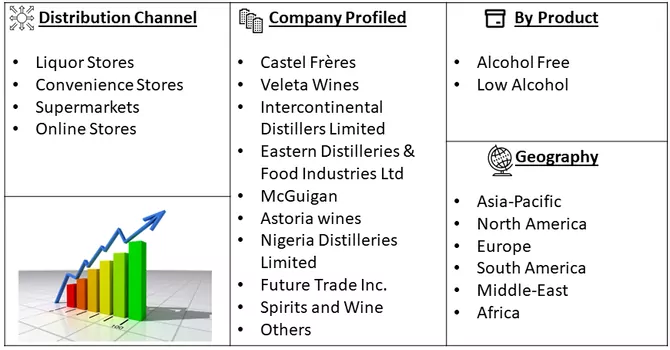

Market Segmentation: The global non-alcoholic wine market is Segmented by Distribution Channel (Liquor Stores, Convenience Stores, Supermarkets, and Online Stores), Product Types (Alcohol Free and Low Alcohol) and Geography (North America, Europe, Asia Pacific, Middle East and Africa, and South America). The market provides the value (in USD million) for the above-mentioned segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global non-alcoholic wine market is witnessing several notable trends that shape its dynamics. One prominent trend is the increasing popularity of sophisticated and diverse non-alcoholic wine offerings. Consumers are seeking non-alcoholic alternatives that mirror the taste, aroma, and complexity of traditional wines, leading to the development of premium, alcohol-free wine varieties. Another trend is the surge in product innovation and creative branding strategies. Manufacturers are investing in research and development to create unique non-alcoholic wine blends, incorporating exotic flavors and ingredients. Additionally, there is a growing emphasis on sustainable and eco-friendly practices within the industry, with consumers showing a preference for non-alcoholic wines produced through environmentally conscious methods. The market is also witnessing a rise in e-commerce channels for non-alcoholic wine distribution, providing consumers with convenient access to a diverse range of products. Overall, these trends indicate a dynamic and evolving landscape for non-alcoholic wines, driven by consumer preferences for premium, innovative, and sustainable choices.

Market Drivers:

Changing Consumer Preferences:

The increasing awareness of health and wellness, coupled with a growing trend toward mindful drinking, has led to a shift in consumer preferences. Many individuals are opting for non-alcoholic beverages, including non-alcoholic wine, as a healthier and lifestyle-conscious choice. This change in consumer behavior is driving the demand for high-quality, non-alcoholic wine alternatives.

Product Innovation and Quality Improvement:

The non-alcoholic wine market is experiencing a surge in product innovation and improvements in quality. To meet consumer expectations and compete with traditional wines, manufacturers are investing in developing sophisticated and flavorful non-alcoholic wine varieties. Advancements in production techniques and the use of premium ingredients contribute to creating non-alcoholic wines that closely mimic the taste and aroma of traditional wines. This focus on innovation and quality is attracting a broader consumer base, including those who may have previously been deterred by the limitations of non-alcoholic beverage options.

Market Restraints:

One significant market restraint for the global non-alcoholic wine market is the challenge of achieving an authentic taste and mouthfeel comparable to traditional alcoholic wines. Non-alcoholic wines often face difficulties in replicating the complex flavors and aromas associated with their alcoholic counterparts. The removal of alcohol can alter the overall sensory experience, affecting the perceived quality and enjoyment for consumers. Despite advancements in technology and production techniques, achieving a truly satisfying non-alcoholic wine that meets consumer expectations remains a hurdle. Additionally, the limited variety and availability of high-quality non-alcoholic wine options in comparison to the wide range of traditional wines can impede market growth, as consumers may opt for other non-alcoholic alternatives or choose to abstain from alcohol altogether. Overcoming these taste and variety challenges will be crucial for the non-alcoholic wine market to gain broader acceptance and compete effectively with alcoholic beverages.

The global non-alcoholic wine market has felt the impact of the COVID-19 pandemic in various ways. The restrictions imposed on social gatherings, closure of bars and restaurants, and economic uncertainties during lockdowns have influenced consumer behavior. While there has been an increased focus on health and wellness during the pandemic, leading to a surge in demand for non-alcoholic beverages, the overall beverage industry has experienced disruptions in the supply chain and distribution channels.The closure of on-premise consumption venues and the decline in social events affected the sales of non-alcoholic wine. Additionally, economic uncertainties led to changes in consumer spending patterns, with some individuals opting for more economical choices. However, the health-conscious trend and the growing preference for non-alcoholic alternatives may have mitigated the overall impact to some extent. As the global economy gradually recovers and restrictions ease, the non-alcoholic wine market is expected to adapt to the changing landscape, leveraging consumer preferences for healthier choices and convenience.

Segmental Analysis:

Liquor Stores Segment is Expected to Witness Significant Growth Over the Forecast Period

The sales of low-alcohol wine are on the rise in liquor stores across the globe, reflecting changing consumer preferences and a growing interest in healthier lifestyles. Low-alcohol wines, typically containing less than 12% alcohol by volume (ABV), offer a lighter alternative to traditional wines, appealing to consumers looking for a more moderate alcohol content. Several factors contribute to the increasing popularity of low-alcohol wine. Health-conscious consumers are seeking beverages with lower alcohol content, driven by concerns about the negative health effects of excessive alcohol consumption. Additionally, low-alcohol wine aligns with the trend towards mindful drinking, where consumers are opting for quality over quantity and savoring their drinking experiences. Moreover, the improved quality and variety of low-alcohol wines available in the market have contributed to their growing sales. Winemakers are using innovative techniques to produce wines with lower alcohol content without compromising on taste or quality. This has led to a wider selection of low-alcohol wines, catering to different preferences and tastes. Liquor stores are responding to this trend by expanding their offerings of low-alcohol wines, dedicating more shelf space to these products and highlighting them in promotions and marketing campaigns. Some stores are also organizing tasting events and educational sessions to introduce customers to the variety and quality of low-alcohol wines available. Thus, the growing sales of low-alcohol wine in liquor stores reflect a broader shift in consumer preferences towards more moderate and mindful drinking habits, driving the demand for lighter and healthier beverage options.

Alcohol Free Segment is Expected to Witness Significant Growth Over the Forecast Period

Alcohol-free wines are gaining popularity among consumers seeking a non-alcoholic alternative that still offers the flavors and experience of traditional wine. These beverages are created using a variety of methods to remove or reduce the alcohol content, while preserving the taste and aroma of the wine. One of the key drivers behind the growing popularity of alcohol-free wines is the rising trend of mindful drinking. Many consumers are looking for ways to enjoy wine without the effects of alcohol, whether for health, personal, or social reasons. Another factor contributing to the popularity of alcohol-free wines is the increasing quality and variety of options available. Winemakers are using innovative techniques to produce alcohol-free wines that closely mimic the taste and complexity of their alcoholic counterparts. Additionally, the growing acceptance and normalization of non-alcoholic beverages in social settings have made alcohol-free wines more accessible and appealing to a wider audience. Thus the growing demand for alcohol-free wines reflects a broader shift in consumer preferences towards healthier and more conscious drinking choices, driving the innovation and growth of this segment in the wine market.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America is experiencing a significant rise in the popularity of alcohol-free wines, reflecting a broader trend towards healthier and more mindful drinking habits. This region, encompassing the United States, Canada, and Mexico, has seen a surge in consumer interest in non-alcoholic beverages, including alcohol-free wines, driven by various factors. One of the key drivers of the growing demand for alcohol-free wines in North America is the increasing health consciousness among consumers. Many individuals are seeking alternatives to traditional alcoholic beverages to reduce their alcohol intake and lead a healthier lifestyle. Alcohol-free wines offer a way to enjoy the flavors and social aspects of wine without the negative effects of alcohol. Additionally, the availability of high-quality alcohol-free wines in North America has contributed to their popularity. Winemakers are increasingly producing alcohol-free wines using advanced techniques that preserve the taste and aroma of traditional wines. This has led to a wider variety of alcohol-free wines available to consumers, catering to different preferences and tastes. The changing social norms around drinking have also played a role in the rising popularity of alcohol-free wines in North America. The stigma once associated with non-alcoholic beverages has diminished, leading to greater acceptance and adoption of alcohol-free options in social settings. Furthermore, the increasing availability of alcohol-free wines in North America, both in retail stores and restaurants, has made them more accessible to consumers. This has been accompanied by marketing efforts that highlight the benefits of alcohol-free wines, further driving their popularity. Thus the North American market for alcohol-free wines is poised for continued growth, driven by consumer preferences for healthier options and the availability of high-quality products.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Some of the key market players are:

Recent Development:

1) In 2023, Free AF, a leading non-alcoholic beverage brand known for its popular range of non-alcoholic cocktails, has announced the successful launch of its inaugural product in the non-alcoholic wine category. The Free AF Sparkling Rosé is now available for purchase on Amazon, marking the brand's entry into this growing market segment. Free AF Sparkling Rosé is a premium, ready-to-drink non-alcoholic sparkling wine crafted to emulate the crisp and light characteristics of a traditional dry sparkling rosé, with delightful fragrant, fruity, and floral undertones. What sets Free AF's Sparkling Rosé apart from other non-alcoholic wines on the market is its unique crafting process, ensuring a superior taste experience for consumers seeking an alcohol-free alternative.

2) In December 2023, Mionetto, a prominent Italian prosecco brand, made its foray into the non-alcoholic beverage market with the launch of a new product. This zero-proof sparkling wine is carefully crafted to replicate the flavour profile of Mionetto's renowned Prestige Prosecco Brut. The product will be widely available across the United States starting in 2024, with a suggested retail price (SRP) of USD 15 per bottle.

Q1. What was the Non-Alcoholic Wine Market size in 2023?

Non-Alcoholic Wine Market is currently valued at USD 2.9 billion in the year 2023.

Q2. At what CAGR is the Non-Alcoholic Wine market projected to grow within the forecast period?

Non-Alcoholic Wine Market is expected to register a CAGR of 6.1% over the forecast period.

Q3. What are the factors driving the Non-Alcoholic Wine market?

Key factors that are driving the growth include the Changing Consumer Preferences and Product Innovation and Quality Improvement.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model