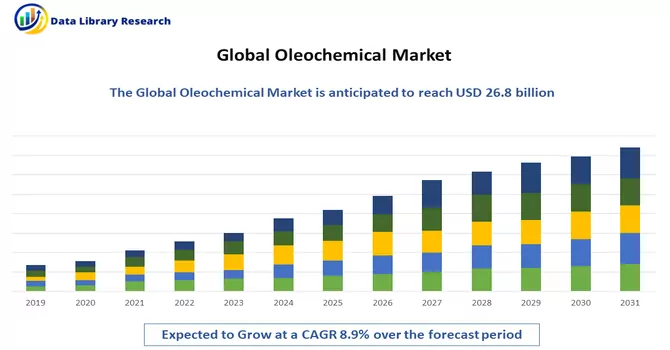

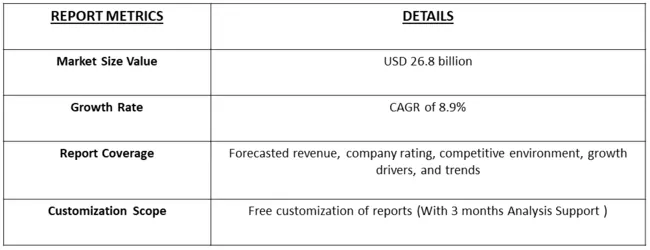

The global oleochemicals market size was valued at USD 26.8 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Oleochemicals refer to a diverse group of chemicals derived from natural fats and oils, primarily sourced from plants and animals. These renewable raw materials undergo chemical processes like hydrolysis and transesterification to produce a wide range of oleochemical products. Common oleochemicals include fatty acids, glycerol, fatty alcohols, and esters, which find applications in various industries such as cosmetics, detergents, pharmaceuticals, and agriculture. Recognized for their biodegradability and sustainable sourcing, oleochemicals are increasingly favoured over traditional petrochemicals, aligning with the global shift towards environmentally friendly and socially responsible business practices. The versatility and eco-friendly nature of oleochemicals contribute to their growing importance in the business landscape as companies seek greener alternatives in their manufacturing processes and product formulations.

The increasing demand for oleochemicals stems from their widespread utilization across diverse industries, including industrial, personal care & cosmetics, textiles, pharmaceuticals, and food processing. This surge in demand can be attributed to the shift towards sustainable and eco-friendly raw materials. Oleochemicals, derived from natural fats and oils, have gained prominence as alternatives to traditional petrochemicals due to their biodegradability and renewable sourcing. In the industrial sector, oleochemicals find applications in lubricants, metalworking fluids, and other formulations. The personal care & cosmetics industry values oleochemicals for their role in producing emollients, surfactants, and other cosmetic ingredients. The textile, pharmaceutical, and food processing sectors also benefit from the versatility of oleochemicals in various formulations. As industries globally prioritize environmentally conscious practices, the demand for oleochemicals is expected to continue its upward trajectory, reflecting a broader commitment to sustainable sourcing and manufacturing across multiple sectors.

Market Segmentation: The Oleochemicals Market Size, Share & Trends Analysis Report By Product (Specialty Esters, and Fatty Amines), Application (Personal Care & Cosmetics, Consumer Goods, and Healthcare & Pharmaceuticals), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The market size and forecast are provided in terms of value (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market trends in the oleochemicals industry are marked by a growing emphasis on sustainability and eco-friendly practices. Oleochemicals, derived from renewable sources such as plant and animal fats, are witnessing increased demand across various sectors including personal care, food processing, and industrial applications. The industry is experiencing a notable shift towards green chemistry, with a focus on biodegradability, reduced environmental impact, and circular economy principles. The rising consumer awareness regarding the ecological footprint of products is driving manufacturers to explore and adopt innovative oleochemical solutions. Additionally, the oleochemicals market is witnessing a surge in research and development activities, leading to the introduction of novel formulations and multifunctional products. As industries globally strive to meet stringent environmental regulations and cater to the demand for sustainable alternatives, the oleochemicals market is poised for continuous growth, with a trajectory shaped by a commitment to environmental responsibility and a shift towards greener and more socially responsible business practices.

Market Drivers:

Increasing demand for sustainable and eco-friendly products and the growing awareness of the environmental impact of traditional petrochemicals

The marketplace is witnessing a notable surge in the demand for sustainable and eco-friendly products, propelled by an increasing awareness of the environmental impact associated with traditional petrochemicals. Consumers and industries alike are prioritizing environmentally responsible choices, leading to a paradigm shift towards greener alternatives. The escalating concern for climate change and ecological sustainability has catalyzed this demand, driving industries to seek eco-conscious solutions across various sectors. As a result, the market is experiencing a profound transformation with a growing emphasis on products derived from renewable sources, such as oleochemicals, which offer a more sustainable and biodegradable option compared to conventional petrochemicals. This shift reflects a broader commitment to mitigating environmental harm and fostering a more sustainable future, influencing purchasing behaviours and driving innovation in industries keen on reducing their ecological footprint.

The rising consumer preference for products with natural and sustainable ingredients further propels the demand for oleochemicals in various applications, including personal care, pharmaceuticals, and industrial process.

The escalating consumer preference for products featuring natural and sustainable ingredients is a pivotal driver propelling the demand for oleochemicals across diverse applications. This shift in consumer behavior reflects an increasing awareness of the environmental impact and health considerations associated with traditional chemical formulations. In sectors such as personal care, pharmaceuticals, and industrial processes, there is a growing inclination towards incorporating oleochemicals due to their biodegradable nature and renewable sourcing from plant and animal fats. The versatility of oleochemicals in formulations for cosmetics, skincare, pharmaceutical products, and industrial applications aligns with the discerning preferences of environmentally conscious consumers. This trend not only underscores a preference for sustainable alternatives but also drives innovation within these industries, emphasizing the market's response to the evolving demand for natural, eco-friendly solutions that cater to both consumer expectations and environmental sustainability goals.

Market Restraints:

Market restraints for the oleochemical industry include challenges associated with fluctuating raw material prices, as the production of oleochemicals relies heavily on natural fats and oils, which are susceptible to price volatility influenced by factors such as climate conditions and geopolitical events. Additionally, the initial capital investment required for establishing oleochemical production facilities and the complexity of the manufacturing processes pose barriers for new market entrants. Stringent regulatory standards and compliance requirements can also be constraining factors, particularly as environmental regulations evolve. Furthermore, the limited availability of feedstock in certain regions and the competition with conventional petrochemicals in terms of cost-effectiveness present challenges for widespread adoption. These constraints collectively influence the growth and market penetration of oleochemicals, requiring industry stakeholders to navigate these challenges through strategic planning and innovation.

Segmental Analysis:

Fatty Amines Segment is Expected to Witness Significant Growth Over the Forecast Period

Fatty amines, a subgroup of oleochemicals, play a significant role in various industries and applications due to their versatile chemical properties. Derived from natural fats and oils, these amines are characterized by long hydrocarbon chains, making them suitable for a wide range of formulations. Fatty amines find extensive use in the production of surfactants, emulsifiers, and corrosion inhibitors, particularly in the personal care, agriculture, and oil and gas industries. Their ability to act as conditioning agents in hair and skin care products, as well as their role in enhancing the effectiveness of agrochemicals, highlights their importance in the oleochemical market. The renewable and sustainable nature of fatty amines aligns with the global shift towards green chemistry, driving their adoption as eco-friendly alternatives to traditional petrochemical-derived compounds. As industries continue to prioritize sustainability, fatty amines remain integral components within the broader spectrum of oleochemicals, contributing to the development of environmentally responsible and effective solutions across diverse sectors.

Healthcare & Pharmaceuticals Segment is Expected to Witness Significant Growth Over the Forecast Period

In the healthcare and pharmaceutical sectors, oleochemicals serve as crucial components for various applications, playing a vital role in the formulation of pharmaceutical products, medical devices, and healthcare solutions. Oleochemical derivatives, such as fatty acids and glycerol, find utility in the production of pharmaceutical excipients, emollients for skincare formulations, and as base materials for medical lubricants. The versatile nature of oleochemicals allows them to contribute to drug delivery systems, providing sustainable and biocompatible options. Moreover, oleochemicals are increasingly preferred in the pharmaceutical industry for their renewable sourcing, lower environmental impact, and compatibility with stringent regulatory standards. As the healthcare and pharmaceutical sectors strive for sustainable practices and innovative formulations, oleochemicals stand as essential ingredients, showcasing their significance in contributing to advancements in medical and pharmaceutical applications.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, oleochemicals have emerged as key components in various industries, contributing to the region's sustainable and environmentally conscious practices. Derived from renewable sources such as plant and animal fats, oleochemicals find diverse applications in sectors ranging from personal care and cosmetics to pharmaceuticals and industrial processes. With a growing emphasis on green chemistry and eco-friendly alternatives, North America has witnessed increased adoption of oleochemicals due to their biodegradability and reduced carbon footprint. The versatility of oleochemicals aligns with the region's commitment to sustainability, prompting industries to incorporate these compounds into formulations that meet both regulatory standards and consumer demands for environmentally responsible products. As North America continues to prioritize sustainability across diverse sectors, oleochemicals play a pivotal role in shaping the region's transition towards greener and more socially responsible business practices.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Key Oleochemicals Companies:

Recent Development:

1) In April 2023, KLK Oleo successfully finalized the acquisition of Temix Oleo, a move strategically designed to broaden its product offerings and bolster market presence on a global scale. This acquisition aligns seamlessly with KLK Oleo's overarching strategy, emphasizing the diversification of its product portfolio and the expansion of market share across various regions. The incorporation of Temix Oleo into KLK Oleo's business framework is anticipated to fortify the company's standing in the industry, fostering innovation and providing a more comprehensive range of solutions to meet evolving market demands.

2) In April 2023, Emery Oleochemicals, a prominent producer of natural speciality chemicals, introduced a groundbreaking product, INFIGREEN 420R. This innovative offering is derived from post-industrial waste, highlighting Emery Oleochemicals' commitment to sustainable practices. By utilizing materials from post-industrial sources, INFIGREEN 420R not only introduces a new dimension to Emery Oleochemicals' product line but also underscores the company's dedication to environmental responsibility and circular economy principles. This product launch signifies Emery Oleochemicals' continuous efforts to provide eco-friendly alternatives and contribute to the industry's sustainable development goals.

Q1. What was the Oleochemical Market size in 2023?

As per Data Library Research the global oleochemicals market size was valued at USD 26.8 billion in 2023.

Q2. At what CAGR is the Oleochemical market projected to grow within the forecast period?

Oleochemical Market is anticipated to grow at a compound annual growth rate (CAGR) of 8.9% over the forecast period.

Q3. Which region has the largest share of the Oleochemical market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. Who are the key players in Oleochemical Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model