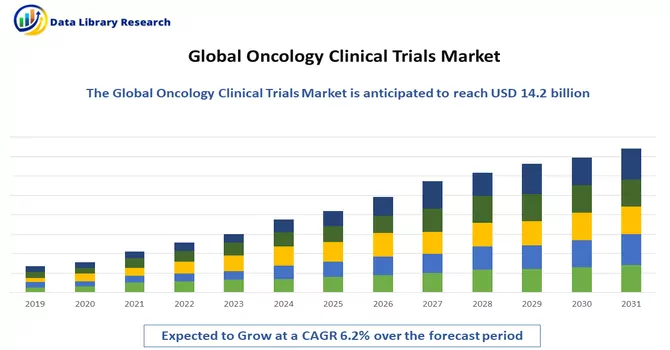

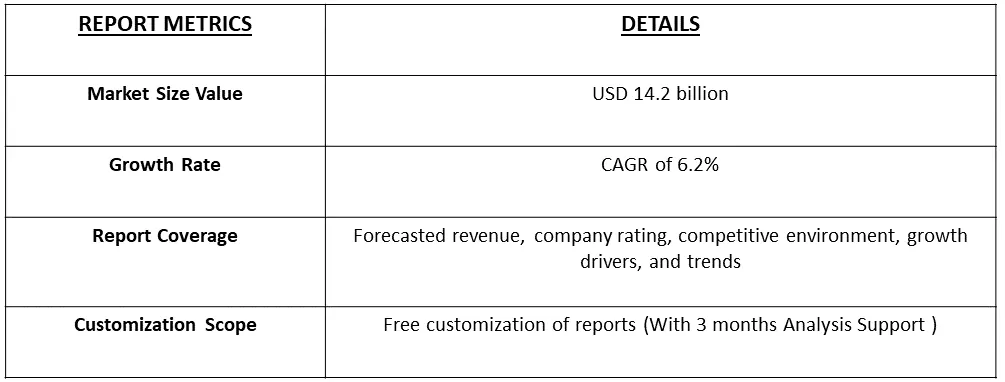

The global oncology clinical trials market size was estimated at USD 14.2 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Oncology clinical trials refer to research studies conducted to evaluate and investigate new treatments, interventions, or therapeutic approaches specifically focused on cancer. These trials aim to advance medical knowledge and improve the understanding of cancer biology, diagnosis, prevention, and treatment. Oncology clinical trials may involve testing novel cancer drugs, exploring innovative therapeutic combinations, assessing new surgical or radiation techniques, and investigating diagnostic or screening methods. These trials are essential for determining the safety and efficacy of potential cancer treatments before they can be approved for widespread clinical use. Patient participation in oncology clinical trials is crucial for advancing cancer care and contributing to the development of breakthrough therapies that may offer improved outcomes for individuals affected by cancer.

The oncology clinical trials market is propelled by several key factors, including advancements in technology, a surge in cancer incidences, and notable progress in personalized medicine, as well as the emergence of innovative approaches such as cell and gene therapies for cancer-related diseases. The continuous evolution of new treatments is driving the market forward. Additionally, a significant uptick in funding from pharmaceutical and biotech companies, non-profit organizations, and Contract Research Organizations (CROs) dedicated to oncology clinical trials is providing substantial support. This financial backing is instrumental in fostering the development of advanced products and therapies, contributing to the market's growth and facilitating the quest for effective solutions in the realm of cancer research and treatment.

Market Segmentation: The Oncology Clinical Trials Market is Segmented By Phase Type (Phase I, Phase II, Phase III, Phase IV), Study Design (Interventional Study, Observational Study, and Expanded Access Study), and geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The oncology clinical trials market is undergoing transformative trends that underscore the dynamic nature of cancer research and treatment. Immunotherapy is a dominant force, with a focus on developing novel agents like checkpoint inhibitors and CAR-T cell therapies. Precision medicine's integration, tailoring treatments based on genetic and molecular profiles, is standard practice for improved efficacy. Combination therapies are on the rise, exploring synergistic effects to overcome resistance. Real-world evidence is gaining traction alongside traditional trial data, offering insights into long-term treatment effectiveness. Digital technologies, including telemedicine and wearables, streamline data collection and enhance patient engagement. Patient-centric trials prioritize participant convenience and experience. Global collaborations and outsourcing to Contract Research Organizations (CROs) facilitate diverse patient access and optimize trial resources. These trends collectively shape a forward-looking landscape, emphasizing innovation, patient-centred approaches, and the pursuit of cutting-edge oncology therapies.

Market Drivers:

Growing Burden of Cancer Worldwide

The growing prevalence of cancer underscores the urgent need for enhanced research, innovative treatment modalities, and proactive public health measures. It has spurred increased investment in oncology research and the development of targeted therapies and personalized medicine to address the unique characteristics of individual tumours. Additionally, public health campaigns focus on preventive measures, early detection, and lifestyle interventions to mitigate the risk factors associated with cancer. The collaborative efforts of the medical community, researchers, policymakers, and advocacy groups are crucial in addressing the multifaceted challenges posed by the growing prevalence of cancer and working towards effective prevention, early diagnosis, and improved treatment outcomes.

According to the 2023 report from the World Cancer Research Foundation, the global landscape in 2020 witnessed an estimated 18.1 million cases of cancer, with 9.3 million occurrences in men and 8.8 million in women. Breast and lung cancers emerged as the predominant forms, constituting 12.5% and 12.2%, respectively, of the total new cancer cases diagnosed that year. Colorectal cancer secured the third position in terms of prevalence, accounting for 1.9 million new cases in 2020 and contributing to 10.7% of the overall newly diagnosed cancer cases. These statistics underscore the global impact of cancer and emphasize the need for continued efforts in research, prevention, and treatment to address the significant burden of this disease worldwide. Thus, such instances prove that there is a growing need for oncology-related clinical trials, which is expected to drive the growth of the studied market.

Increasing Role of Precision and Personalized Medicine for Cancer Treatment

The market is experiencing growth propelled by several key factors, including the increasing incidence of cancer cases, a demand for personalized medicines, and substantial research and development (R&D) investments by the pharmaceutical industry in the field of oncology. Notably, the expansion is underscored by specific initiatives, such as the launch of two cancer research centers by Griffith University in August 2022. Supported by a substantial USD 4.6 million in funding from the Australian Cancer Research Foundation (ACRF), these centers exemplify the industry's commitment to advancing cancer research. This strategic investment reflects a broader trend where institutions and organizations are actively channeling resources to address the pressing challenges posed by cancer, contributing to advancements in treatment modalities and personalized healthcare solutions. Thus, such instances are fueling the growth of the studied market over the forecast period.

Market Restraints:

Stringent Regulations for Patient Enrollment

The growth trajectory of the oncology clinical trials market may face impediments due to the imposition of stringent regulations governing patient enrollment. Stringent regulatory frameworks, designed to ensure patient safety and data integrity, can inadvertently contribute to delays in the enrollment process for clinical trials in the field of oncology. These regulations often require comprehensive screening, stringent eligibility criteria, and ethical considerations, lengthening the time needed to identify and recruit suitable participants. While these regulations are crucial for maintaining the ethical standards and scientific rigor of clinical trials, the prolonged patient enrollment timelines can potentially slow down the pace of research and development in the oncology sector. Striking a balance between rigorous regulatory oversight and streamlining the enrollment process is imperative to ensure that innovative oncology therapies can progress efficiently from the clinical trial phase to eventual patient access, addressing the urgent medical needs in the field.

The COVID-19 pandemic exerted substantial economic repercussions across various sectors, including pharmaceuticals and biotechnology. This global crisis notably influenced the oncology clinical trials market as a precautionary measure to curb the virus spread resulted in a decrease in the number of cancer clinical trials. In 2021, the Cancer Research Institute reported the halting of 1,130 clinical trials due to pandemic-related concerns. Furthermore, an article published in 2022 titled 'The Impact of COVID-19 on Cancer Care and oncology clinical research: An Experts' perspective' highlighted the exposure of the pandemic to the underrepresentation of minority groups in clinical trials. To address this, a proposed method aimed at enhancing the generalizability of efficacy and outcome data in oncology clinical trials. Consequently, a problem-focused collaborative framework emerged between decision-makers and stakeholders in oncology trials to leverage and expedite novel clinical research strategies developed during the COVID-19 epidemic. Thus, the impact of COVID-19 on the oncology clinical trial market has been significant, prompting adaptive measures and collaborative initiatives in response to the challenges posed by the pandemic.

Segmental Analysis:

Phase III Segment is Expected to Witness Significant Growth Over the Forecast Period

Phase III occupies a pivotal position as the final stage before a new treatment is considered for approval by regulatory authorities. This phase involves a larger patient population and aims to confirm the efficacy, safety, and overall benefits of the investigational treatment compared to standard or existing therapies. Phase III trials in oncology play a crucial role in providing comprehensive data on the therapeutic intervention's performance, helping to establish its place in the standard of care. These trials often involve randomized and controlled designs to ensure robust and reliable results. Successful completion of Phase III trials is a key milestone, as positive outcomes pave the way for regulatory submissions and potential approval, ultimately bringing promising oncology treatments to patients in need.

Phase III trials not only serve the purpose of seeking regulatory approval but also extend their focus to long-term safety assessments, addressing post-marketing commitments. A notable example is Novartis AG's initiation of a phase III clinical trial in July 2020, evaluating the combination of alpelisib with pertuzumab and trastuzumab. This trial specifically aims to investigate the safety and effectiveness of the combination as adjuvant therapy for patients dealing with HER2-positive advanced breast cancer. By incorporating long-term safety studies into phase III trials, pharmaceutical companies contribute to a comprehensive understanding of the treatment's overall profile, ensuring ongoing commitment to patient well-being beyond initial regulatory approval.

Interventional Study Segment is Expected to Witness Significant Growth Over the Forecast Period

The motivation behind adopting interventional study designs in oncology clinical trials is largely influenced by the distinctive challenges posed by these conditions. With restricted patient populations, the design of studies must be intricately crafted to optimize the likelihood of identifying significant treatment effects.

In March 2023, MediMergent revealed the deployment of its digital clinical trials platform to gather and analyze real-world data (RWD) in a multicenter Engaging Immuno-Protection Intervention Study (EIMPRIS). The study's primary focus is on preventing symptomatic SARS-CoV-2 infection in cancer patients. Leveraging MediMergent's innovative methodology and artificial intelligence for capturing the voice of the patient (VOP), the study employs data collection instruments and compares them with other (proxy) sources, including pharmacy, claims data, and patient medical records. EIMPRIS aims to assess the impact of RWD on treatment and outcomes when integrated with data related to the quality of life, social determinants of health (SDoH), and other behavioural and attitudinal data.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In North America, the impact of COVID-19 on the oncology clinical trial market was significant, leading to the suspension or termination of cancer-related clinical trials due to the pandemic. Biopharmaceutical companies, including Merck & Co. Inc. and Eli Lilly and Company, announced delays in clinical trials in the United States. ClinicalTrials.gov data revealed that over 200 interventional oncology studies were halted in March and April 2020 due to the COVID-19 crisis. Within North America, the United States is anticipated to spearhead market growth, attributed to factors such as increased research and development (R&D) investments, robust government support, and a high incidence of cancer cases. Notably, the American Cancer Society reported a significant rise in newly affected individuals with cancer, from 608,570 in 2021 to an estimated 1,918,030 in 2022. For example, Pfizer Inc. (NYSE: PFE) and Genmab A/S (Nasdaq: GMAB) recently made an announcement revealing that the U.S. Food and Drug Administration (FDA) has accepted their supplemental Biologics License Application (sBLA). This application aims to transition the accelerated approval of TIVDAK® (tisotumab vedotin-tftv) to full approval for treating patients with recurrent or metastatic cervical cancer experiencing disease progression after first-line therapy. Notably, the FDA has granted Priority Review to the application, with a Prescription Drug User Fee Act (PDUFA) goal date set for May 9, 2024. This development underscores the companies' commitment to advancing therapeutic options and meeting critical medical needs in the oncology field.

Furthermore, as the incidence of cancer continues to rise, an upswing in the number of clinical trials is anticipated in the coming years. For instance, as of August 2022, the National Clinical Trials (NCT) Registry in the United States reported approximately 7,945 ongoing clinical trials related to cancer across various phases of development. Given these factors, North America is poised for robust growth throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The oncology clinical trials sector is characterized by intense competition, featuring numerous manufacturers vying for significant market shares. Key players employ diverse business strategies, including phase launches, regulatory approvals, strategic acquisitions, partnerships, and technological innovations, to sustain and expand their global presence. This competitive landscape underscores the industry's dynamic nature, with companies actively pursuing avenues for growth, collaboration, and advancements in clinical trial methodologies. This strategic diversity among market participants contributes to a vibrant and evolving landscape in oncology clinical trials. Key Oncology Clinical Trials Companies:

Key Developments:

1) In January 2024, Haystack Oncology, a subsidiary of Quest Diagnostics, joined forces with Alliance Foundation Trials, LLC (AFT) to leverage Haystack Oncology's personalized Minimal Residual Disease (MRD) technology, known as Haystack MRD™. This collaboration aims to analyze therapeutic response and provide molecular insights for AFT's interventional, randomized phase II clinical trial, AFT-57, focusing on patients with unresectable stage III non-small cell lung cancer (NSCLC). Supported by Genentech, the clinical study will investigate the efficacy and safety of anti-PD-L1 atezolizumab (Tecentriq®) with or without tiragolumab (anti-TIGIT) in combination with chemoradiotherapy.

2) In December 2023, The Jawaharlal Institute of Postgraduate Medical Education and Research (JIPMER) in Puducherry has established a multi-center clinical trial unit in oncology with the aim of enhancing treatment outcomes for cancer patients. This initiative is funded by the Biotechnology Research Assistance and Development Council (BIRAC) through its National Biopharma Mission Programme. The unit is designed to support Indian pharmaceutical companies in conducting clinical trials involving domestically developed medicines. BIRAC's broader initiative, launched in 2020, involves funding a network of oncology hospitals known as the Network of Oncology Clinical Trials India (NOCI). This network focuses on advancing new medicines, surgical techniques, and radiation techniques for cancer treatment, envisioning collaborative cancer trial groups across different regions of the country.

Q1. What was the Oncology Clinical Trials Market size in 2023?

As per Data Library Research the global oncology clinical trials market size was estimated at USD 14.2 billion in 2023.

Q2. At what CAGR is the Oncology Clinical Trials market projected to grow within the forecast period?

Oncology Clinical Trials Market is anticipated to grow at a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Q3. What are the Growth Drivers of the Oncology Clinical Trials Market?

Growing Burden of Cancer Worldwide and Increasing Role of Precision and Personalized Medicine for Cancer Treatment are the Growth Drivers of the Oncology Clinical Trials Market.

Q4. Who are the key players in Oncology Clinical Trials Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model