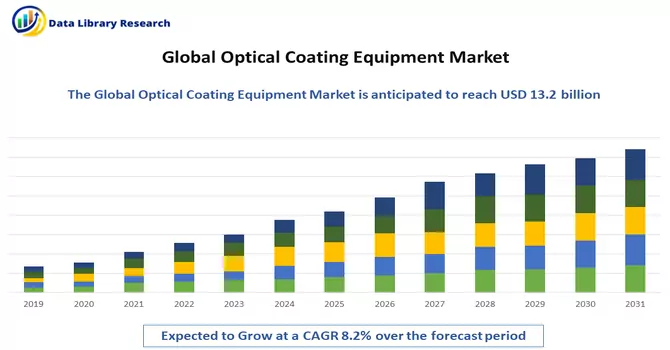

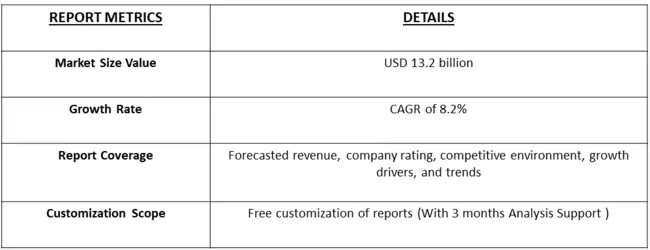

The optical coatings market is projected to grow from USD 13.2 billion in 2023 and is expected to register a CAGR of 8.2% during the forecast period, 2024-2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Optical coatings are thin layers of materials applied to the surfaces of optical components, such as lenses, mirrors, filters, and prisms, to modify their optical properties, including reflectance, transmittance, and spectral characteristics. Employing techniques like physical vapour deposition or chemical vapour deposition, these coatings can be composed of dielectric materials (like oxides and fluorides) or metallic films (such as aluminium or silver). By carefully controlling the thickness and composition of these coatings, engineers and manufacturers can tailor the optical properties of components to meet specific application requirements, whether it be reducing reflections, enhancing light transmission, improving durability, or achieving particular optical effects. Optical coatings are integral in industries like optics, telecommunications, aerospace, photography, and laser technology, where they play a pivotal role in optimizing the performance of optical devices by managing the interaction of light with component surfaces.

The optical coatings market is experiencing robust growth driven by various factors. The surge in consumer electronics, including smartphones, cameras, and displays, demands optical coatings to enhance performance. Automotive applications, such as advanced lighting systems and smart mirrors, contribute significantly to market expansion. The ongoing global expansion of telecommunications networks, coupled with the rise in fiber optic communication systems, fuels the demand for coatings that optimize signal transmission. Additionally, the solar industry's quest for high-efficiency solar panels propels the need for coatings to reduce reflection losses. Medical devices, particularly in diagnostics and imaging, utilize optical coatings for improved optical performance. Aerospace and defence applications, such as sensors and imaging systems, are driving the market with a demand for lightweight, high-performance coatings. The emergence of augmented and virtual reality technologies is influencing the market, necessitating advanced coatings for enhanced image quality. The focus on energy-efficient lighting, especially in the LED sector, propels the adoption of coatings to improve light output and longevity. Ongoing technological advancements, research and development efforts, and a growing awareness of the benefits of optical coatings collectively contribute to the dynamic growth of the market.

Market Segmentation: The Optical Coatings Market is Segmented by Product Type (Optical Filter Coatings, Anti-Reflective Coatings, Transparent Conductive Coatings, Mirror Coatings (High Reflective), Beam Splitter Coatings, and Other Product Types), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Size and Forecasts for The Optical Coatings Market are provided in terms of Revenue (USD Billion) for all the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

The current trend in the optical coatings sector emphasizes a strategic shift towards customization and tailoring to cater to specific application needs across various industries. This approach involves the meticulous design and formulation of optical coatings with characteristics precisely tailored to optimize performance in specialized sectors such as aerospace, defense, and telecommunications. In the aerospace industry, customized optical coatings play a critical role in addressing unique challenges, such as enhancing the durability of components, minimizing weight, and improving overall optical properties. Tailored coatings can contribute to achieving stringent performance standards required in aerospace applications. Similarly, in the defense sector, where optical systems are integral to surveillance, targeting, and communication, customized coatings are designed to enhance functionalities such as stealth, clarity, and resilience to harsh environmental conditions. In the telecommunications industry, the trend towards customization involves creating coatings that optimize signal transmission efficiency, reduce signal loss, and meet the specific demands of evolving communication technologies. This deliberate tailoring of optical coatings reflects the industry's commitment to providing solutions that not only meet but exceed the stringent and diverse requirements of different sectors, ultimately driving advancements in optical technology and contributing to the overall progress of these industries.

Market Drivers:

Growing Demand from the Solar Industry

The optical coating industry is experiencing a surge in demand propelled by the growing needs of the solar industry. This trend is particularly evident in the quest for high-efficiency solar panels and advanced solar technologies. Optical coatings play a pivotal role in enhancing the performance of solar panels by improving light absorption, minimizing reflection losses, and optimizing energy conversion efficiency. Coatings applied to the surfaces of solar cells help manage the interaction of sunlight, ensuring that a maximum amount of light is absorbed and converted into electricity. In the solar industry, antireflection coatings are commonly used to reduce reflections on the surface of solar panels, allowing more sunlight to reach the solar cells. This, in turn, enhances the overall efficiency of the solar energy conversion process. Additionally, coatings with specific spectral properties can be tailored to match the absorption characteristics of solar cells, further optimizing their performance. As the demand for clean and renewable energy sources continues to rise, the solar industry's reliance on optical coatings is poised to grow. The development of coatings that are durable, cost-effective, and tailored to the specific requirements of solar applications is crucial for advancing solar technologies and making solar energy more accessible and efficient. This intersection of optical coating technology and solar innovation underscores the critical role that coatings play in the ongoing global transition toward sustainable and renewable energy solutions.

Technological Advancements in the Optical Coatings Process

Technological advancements in the optical coatings process are revolutionizing the industry, enhancing efficiency, precision, and versatility. Innovations in deposition techniques, such as ion beam sputtering and plasma-assisted methods, offer precise control over coating thickness and composition, yielding coatings with superior optical properties. Automation and robotics have streamlined operations, ensuring reproducibility and high-quality coatings, particularly beneficial for large-scale production. Nanotechnology has introduced nanocomposite coatings with improved hardness, scratch resistance, and durability, allowing for tailored optical functionalities. Novel coating materials, including advanced dielectric materials and metamaterials, expand possibilities for customization. Real-time monitoring and control, facilitated by sensing and measurement technologies, ensure continuous assessment of coating thickness and optical properties. Machine learning and artificial intelligence optimize coating design and manufacturing, enabling the development of coatings with tailored properties for specific applications. Collectively, these advancements propel the optical coatings industry forward, meeting the evolving demands across diverse sectors, including optics, electronics, aerospace, and renewable energy.

Market Restraints:

High Costs and Some Limiting Properties of Optical Coatings

High costs and certain limiting properties pose challenges in the field of optical coatings. The intricate process of designing and applying optical coatings often involves sophisticated technologies and materials, contributing to elevated production costs. The deposition of specialized coatings, such as multilayer interference coatings, requires precision and high-quality control, adding to the overall expenses. The use of advanced materials and technologies, while beneficial, can contribute to the cost challenges associated with optical coatings.

The COVID-19 pandemic has profoundly impacted the optical coating market, with disruptions reverberating throughout the supply chain and manufacturing processes. The industry faced challenges due to supply chain interruptions, leading to delays in the delivery of raw materials and components, hindering production capacities. Operational restrictions, lockdowns, and shifts in consumer priorities resulted in reduced manufacturing activities and altered demand dynamics across sectors. Certain industries, such as aerospace and automotive, experienced diminished demand for optical coatings, while others, like medical equipment and telecommunications, saw increased needs. The pandemic prompted the postponement of projects and capital investments, influencing the market's recovery trajectory. Notably, the rise of remote work and accelerated digital transformation during the pandemic impacted the demand for optical coatings in communication technologies. As economies recover, the optical coating market is witnessing a gradual rebound, accompanied by initiatives to enhance supply chain resilience and adapt to the evolving post-pandemic landscape.

Segmental Analysis:

Transparent Conductive Coatings Segment is Expected to Witness Significant Growth Over the Forecast Period

Transparent conductive coatings (TCCs) are thin films that seamlessly blend optical transparency with electrical conductivity, playing a pivotal role in diverse applications. Indium tin oxide (ITO), renowned for its optimal balance between transparency and conductivity, is a common material used in TCCs. In the realm of electronic devices, TCCs are crucial for displays like LCDs, OLEDs, and touchscreens, offering transparency for visibility and conductivity for efficient signal transmission. They are also instrumental in the development of flexible and bendable electronic devices. In solar panels, TCCs enhance light transmission while facilitating the collection and transport of electrical current, thereby improving solar cell efficiency. The evolution of optoelectronic devices, including smart windows and flexible displays, hinges on advancements in TCCs, with ongoing research exploring alternative materials like silver nanowires and graphene. Despite their significance, challenges such as cost-effective manufacturing and the quest for alternative materials persist. As technology advances, innovations in transparent conductive coatings continue to drive progress in electronic and photonic applications, shaping the landscape of modern devices and sustainable energy solutions.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The optical coatings market is poised for dominance in the Asia-Pacific region throughout the forecast period, driven by increasing demand from key sectors such as electronics, semiconductors, aerospace, and defense in countries including China, India, Japan, and South Korea. The Civil Aviation Administration of China (CAAC) anticipates the recovery of domestic aviation traffic to reach approximately 85% of pre-pandemic levels, with Chinese airline companies planning substantial aircraft purchases, valued at around USD 1.2 trillion, over the next two decades, further boosting the demand for optical coatings. In India, a significant player in the renewable energy sector, the solar market has experienced robust growth. India ranks fourth globally in renewable energy and wind power capacity and fifth in solar power capacity. The country added a remarkable 10 GW of solar power in 2021, with solar power accounting for 62% of newly added power capacity, marking the largest share to date. Large-scale solar PV projects dominated installations, constituting 83% and reflecting a substantial 230% annual increase. Meanwhile, in Japan, the electronics and IT industry has shown resilience and growth. According to the Japan Electronics and Information Technology Industries Association (JEITA), global production by the Japanese electronics and IT industry, estimated at JPY 37.32 trillion (~USD 340.54 billion) in 2021, exhibited an 8% annual growth. The industrial production forecast for 2022 is JPY 38.02 trillion (~USD 346.89 billion), with an expected 2% annual growth. These factors collectively contribute to the anticipated steady growth of the optical coatings market in the Asia-Pacific region during the forecast period. The region's economic activities, coupled with significant developments in aviation, renewable energy, and electronics, underscore its pivotal role in driving the demand for optical coatings in diverse industries.

Get Complete Analysis Of The Report - Download Free Sample PDF

The optical coatings market is characterized by a high degree of fragmentation, reflecting a diverse landscape with numerous players operating in the industry. This fragmentation is evident in the presence of a multitude of suppliers, manufacturers, and service providers, each contributing to the market in various capacities. The industry's segmentation is driven by the specialization of companies in specific types of coatings, applications, or technologies. This diverse ecosystem encompasses both large established companies and smaller, niche players, each vying for market share. The competitive dynamics are further influenced by ongoing technological advancements, innovations in coating materials, and the emergence of new market entrants. This fragmentation not only promotes healthy competition but also signifies the market's adaptability to a wide range of applications and end-users. As a result, customers often have a plethora of options to choose from, fostering innovation, differentiation, and a continuous quest for excellence among the various participants in the optical coatings market. Some of the market players working in this domain are:

Recent Development:

1) In April 2022, Imatest unveiled a strategic collaboration with Edmund Optics Inc., streamlining the purchasing process for Imatest software and charts directly through the Edmund Optics website. This partnership not only ensures a seamless experience for Imatest customers but also provides an efficient avenue for Edmund Optics' imaging clientele to effortlessly acquire the necessary tools for evaluating their imaging performance.

2) In April 2022, Edmund Optics Inc. inaugurated a new facility in New Jersey, USA, strategically located within a short distance from the company's headquarters. This state-of-the-art office is poised to enhance both internal and external collaboration and communication. The facility is well-equipped, featuring specialized technical support labs, cutting-edge video studios, and convenient accessibility for visitors, marking a significant advancement in the company's operational capabilities.

Q1. What was the Optical Coating Equipment Market size in 2023?

As per Data Library Research the Optical Coatings Equipment market is projected to grow from USD 13.2 billion in 2023.

Q2. At what CAGR is the Optical Coatings Equipment market projected to grow within the forecast period?

Optical Coatings Equipment Market is expected to register a CAGR of 8.2% during the forecast period.

Q3. What are the factors driving the Optical Coatings Equipment market?

Key factors that are driving the growth include the Growing Demand from the Solar Industry and Technological Advancements in the Optical Coatings Process.

Q4. Which Region is expected to hold the highest Market share?

Asia-Pacific region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model