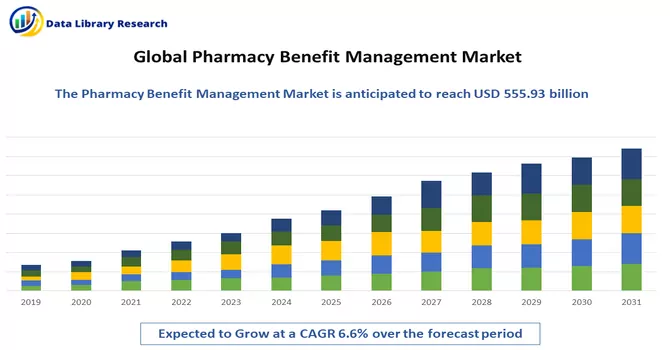

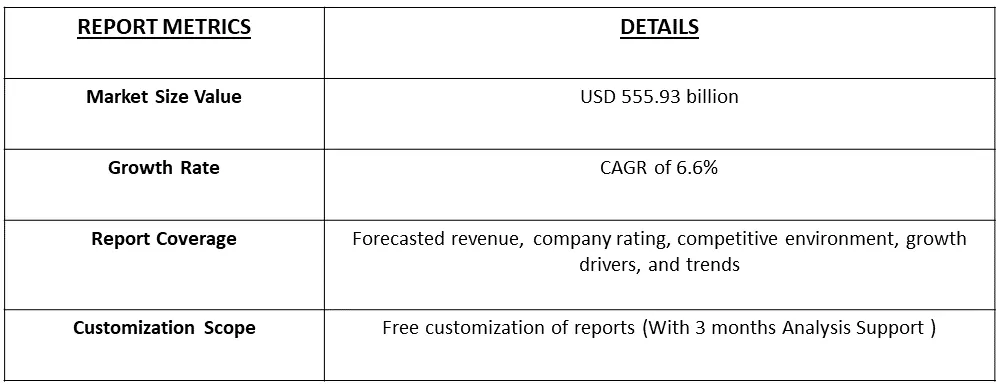

The Pharmacy Benefit Management Market size is expected to grow from USD 555.93 billion in 2022 and is expected to register a CAGR of 6.6% during the forecast period (2023-2030).

Get Complete Analysis Of The Report - Download Free Sample PDF

Pharmacy Benefit Management (PBM) refers to a third-party administrator or organization that manages prescription drug benefit programs on behalf of health insurers, employers, or government health programs. PBMs play a crucial role in the healthcare system by facilitating the distribution of prescription drugs, controlling costs, and improving the overall efficiency of the prescription drug benefit process.

The increasing preference for pharmacy benefits management is expected to boost market growth over the forecast period, enhancing the precision, safety, and efficiency of pharmacy stores while also contributing to improved patient health outcomes.

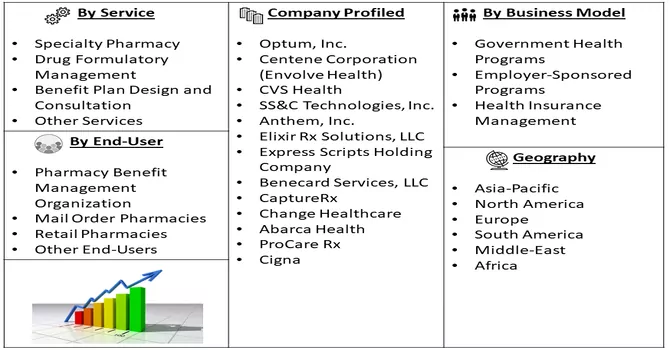

Market Segmentation: The Pharmacy Benefit Management Market is Segmented by Service (Specialty Pharmacy, Drug Formulatory Management, Benefit Plan Design and Consultation, and Other Services), Business Model (Government Health Programs, Employer-Sponsored Programs, and Health Insurance Management), End-User (Pharmacy Benefit Management Organization, Mail Order Pharmacies, Retail Pharmacies, and Other End-Users), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The PBM industry has been witnessing a trend of consolidation, with larger PBMs acquiring smaller ones or merging to enhance their market share and capabilities. Some PBMs have engaged in vertical integration by merging with or acquiring health insurers or retail pharmacy chains, aiming for a more integrated healthcare delivery model. Moreover, the increased focus on adopting technology to streamline processes, improve efficiency, and enhance customer experience. Integration of digital tools, data analytics, and artificial intelligence to manage and analyze prescription data, identify cost-saving opportunities, and optimize medication adherence.

Market Drivers:

Rising Inclination Towards Pharmacy Benefit Management System (PBMS) and Increasing Health Expenditure

The growing inclination towards adopting Pharmacy Benefit Management Systems (PBMS) is closely linked to the increasing health expenditure, playing a pivotal role in shaping the Pharmacy Benefit Management (PBM) market landscape. As healthcare spending continues to rise, there is a heightened emphasis on leveraging PBMS to streamline processes, enhance cost-effectiveness, and optimize patient outcomes. This inclination towards PBMS is anticipated to drive substantial growth in the Pharmacy Benefit Management market in the foreseeable future. For example, according to the Annual Report for the year 2021, Optum Inc. recorded a revenue of USD 91,314 million from its Optum RX division, a comprehensive prescription drug benefit provider with an extensive network encompassing retail chains and independent pharmacies. This figure reflected a 4% growth compared to the USD 87,498 million reported in 2020. Consequently, the observed advantages of Pharmacy Benefit Management (PBM) solutions during the pandemic may contribute to a sustained increase in their adoption over the coming years.

Pharmacy Benefit Management Market Growing Demand for Prescription Products

The surge in individuals relying on insurance to manage escalating medical expenses, including costs associated with treatment, hospital stays, health check-ups, and hospitalization fees, has become increasingly prevalent. Additionally, Pharmacy Benefit Management (PBM) integrates both medical and pharmaceutical components, providing end-to-end healthcare solutions that furnish insurers with comprehensive patient information. This capability empowers insurers to offer patients more effective programs, thereby contributing to the growing demand for pharmacy benefit management systems and driving market expansion. Moreover, the global uptick in health expenditures is projected to prompt greater adoption of technologically advanced software and solutions for monitoring drug inventory and supply, as well as ensuring affordable medications for patients. This anticipated trend is poised to further boost market growth over the forecast period. As an illustrative example, data from 2021 released by the Centers for Medicare and Medicaid Services reveals that National Health Service spending increased by 2.7% to reach USD 4.3 trillion (USD 12,914 per person), constituting 18.3% of the GDP. Similarly, private health insurance spending witnessed a 5.8% rise to USD 1,211.4 billion, and prescription drug spending surged by 7.8% to USD 378 billion in 2021, according to the same source.

Market Restraints :

Reluctance To Adopt Pharmacy Automation Systems and Stringent Regulatory Procedures on Confidentiality

The growth of Pharmacy Benefit Management (PBM) is being hindered by a reluctance to adopt pharmacy automation systems and the imposition of stringent regulatory procedures related to confidentiality. The hesitancy in embracing automation within pharmacies, coupled with regulatory measures that prioritize the protection of confidential information, has contributed to a slowdown in the expansion of PBM.

Organizations may be cautious in adopting pharmacy automation systems due to concerns about their integration, potential disruptions to existing workflows, and uncertainties about the return on investment. Moreover, stringent regulatory procedures related to confidentiality may impose additional compliance burdens, impacting the smooth implementation and operation of PBM systems. These challenges underscore the importance of addressing issues related to technology adoption and regulatory compliance to facilitate the continued growth of Pharmacy Benefit Management. Finding ways to alleviate concerns, ensuring seamless integration of automation systems, and fostering a regulatory environment that balances confidentiality with the efficient operation of PBMs are critical factors in overcoming these obstacles.

The growth trajectory of the pharmacy benefit management market witnessed an impact from the COVID-19 pandemic. As highlighted in an article published in Research in Social and Administrative Pharmacy in January 2021, the heightened demand for various pharmaceuticals, notably prescription drugs like metformin and omeprazole, posed challenges for hospitals. These challenges manifested in difficulties related to personnel shortages, disruptions in drug supply chains, and the provision of pharmaceutical care. In response to the surge in demand for pharmaceuticals, companies offering a diverse range of pharmacy care services reported a noteworthy increase in their revenue. This uptick reflected the critical role played by pharmacy benefit management in navigating the complexities brought about by the pandemic. The strains on healthcare systems, coupled with the surge in pharmaceutical needs, underscored the importance of effective pharmacy benefit management during unprecedented times, highlighting both challenges and opportunities within the industry.

Segmental Analysis:

Benefit Plan Design and Consultation Segment is Expected to Witness Significant growth over the Forecast Period

Consultation services in benefit planning involve expert guidance provided by PBMs to employers, insurers, and other stakeholders. These consultations often focus on optimizing benefit plan designs, ensuring compliance with regulatory requirements, and addressing the unique healthcare needs of the covered population. PBM consultants may offer insights into industry best practices, emerging trends, and innovative solutions for achieving cost-effectiveness while enhancing the overall quality of care. The synergy between benefit plan design and consultation services is integral to the growth and adaptation of the Pharmacy Benefit Management market. As employers seek to tailor healthcare benefits to attract and retain talent, PBMs become essential partners in creating and implementing customized pharmacy benefit plans. The collaborative efforts in benefit planning contribute to the expansion of the PBM market as these services become increasingly intertwined with overall healthcare benefit strategies. Thus, such factors are expected to contribute to the growth of the studied market.

Government health programs Consultation Segment is Expected to Witness Significant growth over the Forecast Period

Government health programs play a significant role in influencing and shaping the Pharmacy Benefit Management (PBM) market. These programs, often administered by government agencies, are designed to provide healthcare coverage and access to prescription medications for specific populations. The relationship between government health programs and the PBM market is complex, with various factors influencing their dynamic interplay.

Medicaid, a joint federal and state program, provides healthcare coverage for low-income individuals, while Medicare serves the elderly and certain qualifying populations. PBMs often work with these programs to manage pharmacy benefits, ensuring efficient prescription drug coverage for beneficiaries. Government health programs may partner with PBMs to implement public health initiatives, such as vaccination programs, medication adherence campaigns, and population health management. PBMs contribute to the success of these initiatives by efficiently managing the distribution and accessibility of medications. Thus, such factors are expected to contribute to the growth of the studied market.

Pharmacy Benefit Management Organization Segment is Expected to Witness Significant growth over the Forecast Period

PBMOs are responsible for the administration of pharmacy benefits within health plans. This includes managing prescription drug claims, coordinating with pharmacies, and ensuring that plan participants have access to necessary medications. They often employ advanced technology and data analytics to streamline administrative processes. PBMOs are actively involved in formulary management, which involves creating a list of preferred medications covered by a specific health plan. They negotiate with pharmaceutical manufacturers to secure favorable pricing for these medications, balancing cost considerations with the need to provide effective and clinically appropriate treatment options. Thus, such factors are expected to contribute to the growth of the studied market.

North America Region is Expected to Witness Significant growth over the Forecast Period

The pharmacy benefit management market in North America is poised for substantial growth in the foreseeable future, driven by various factors, including the escalating number of medication errors, increased adoption of pharmacy benefit management (PBM), and a rise in healthcare expenditure.

According to a July 2022 article published by Oxford University Press, a notable surge in overall prescription drug spending is anticipated in the United States, projected to increase from 4% in the previous year to 6% in 2022. This surge signifies a heightened demand for prescription drugs in the region, creating a compelling need for advanced pharmacy management systems, thereby stimulating market expansion.

The region's inclination towards embracing PBM systems stands out as a primary catalyst propelling market growth. Notably, in May 2022, U.S. Senators Maria Cantwell (D-Wash.) and Chuck Grassley (D-Iowa) introduced the Pharmacy Benefit Manager Transparency Act of 2022. This legislation aims to curtail prescription costs by granting authority to the Federal Trade Commission and state attorneys general to address unfair and deceptive practices by PBMs. Furthermore, in October 2021, a non-profit coalition of nearly 40 companies, including major U.S. retailers Walmart and Costco, launched a new firm dedicated to providing pharmacy benefit management (PBM) services for employers.

Likewise, the collaborative efforts of Mark Cuban Cost Plus Drug Company PBC and the Purchaser Business Group on Health, a nonprofit coalition of around 40 large public and private employers, resulted in the establishment of a new pharmacy-benefit management company in October 2021. PBMs, acting on behalf of businesses, labor organizations, and governments, play a pivotal role in determining patient access to medications, negotiating cost discounts, and managing payments to pharmacies. Consequently, due to the increasing adoption of pharmacy benefit management systems and heightened industry activities, the market is anticipated to experience sustained growth throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The pharmacy benefit management market exhibits competitiveness, featuring numerous global and international players. Key industry participants are strategically implementing various growth initiatives to strengthen their market footprint. These strategies include forging partnerships, entering into agreements and collaborations, launching new products, expanding into different geographical regions, and engaging in mergers and acquisitions. To elaborate, companies are actively seeking partnerships and collaborations to leverage complementary strengths and enhance their overall market standing. Simultaneously, there is a focus on continuous innovation, with frequent new product launches aimed at catering to evolving market needs and staying ahead of the competition. Geographical expansions involve entering new markets or increasing the footprint in existing ones to tap into emerging opportunities.

Some of the key market players working in this market segment are:

Recent Developments:

1) In October 2022, Omnicell, Inc., a company specializing in medication management and adherence tools for health systems and pharmacies, introduced Specialty Pharmacy Services. This comprehensive offering is specifically crafted to assist health systems in establishing and/or enhancing fully managed, hospital-owned specialty pharmacies.

2) In March 2022, ProdigyRx, a pharmacy benefits manager, initiated its business operations, providing Pharmacy Benefit Management (PBM) services and clinical solutions tailored for workers' compensation insurers, third-party administrators, and self-insured/administered employers

Q1. How big is the Pharmacy Benefit Management Market ?

The Pharmacy Benefit Management Market size is expected to grow from USD 555.93 billion in 2022.

Q2. At what CAGR is the Pharmacy Benefit Management Market projected to grow within the forecast period?

Pharmacy Benefit Management Market is expected to register a CAGR of 6.6% during the forecast period.

Q3. What segments are covered in the Pharmacy Benefit Management Market Report?

By Service, By Business Model. End-User and Geography are some of the segments covered in the Pharmacy Benefit Management Market Report.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model