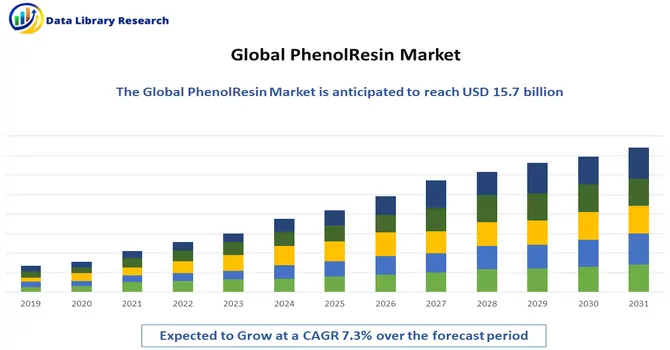

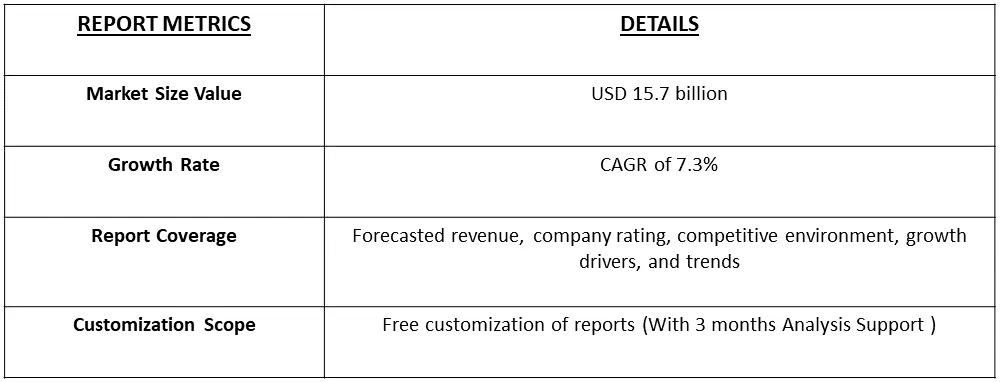

The global phenolic resin market size was valued at USD 15.7 billion in 2023 and is projected to reach a CAGR of 7.3% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Phenolic resin refers to a synthetic polymer derived from the reaction of phenol (an aromatic organic compound) with formaldehyde. This thermosetting resin has a wide range of applications due to its excellent thermal stability, chemical resistance, and mechanical strength. The process of polymerization involves the cross-linking of phenol and formaldehyde molecules, resulting in a three-dimensional network structure. Phenolic resins can be produced in various forms, including liquid, powder, or solid, and they exhibit properties such as high heat resistance, flame retardancy, and resistance to chemicals. These characteristics make phenolic resins commonly used in the manufacturing of molded products, adhesives, coatings, laminates, and composite materials. The versatility and durable nature of phenolic resins make them valuable in industries such as automotive, construction, electronics, and aerospace.

The phenolic resin market is experiencing robust growth driven by various factors across industries. The construction sector's expansion, especially in emerging economies, is a major catalyst, with phenolic resins being widely utilized in construction materials due to their durability and fire resistance. In the automotive industry, the increasing demand for high-performance materials has led to a surge in the use of phenolic resins in components like brake parts and interior components, owing to their heat resistance and mechanical strength. The electronics sector benefits from the excellent electrical insulation properties of phenolic resins, finding applications in electronic components and printed circuit boards. Additionally, the wood industry relies on phenolic resins for adhesives, contributing to the production of plywood and laminated veneer lumber. Moreover, the focus on sustainable and environmentally friendly products is shaping the market, with the development of bio-based phenolic resins aligning with the growing trend towards eco-friendly materials. Overall, the phenolic resin market's expansion is a result of its diverse applications and its ability to meet the evolving performance requirements in key industries.

The global phenolic resin market is undergoing significant shifts marked by key trends that are reshaping its landscape. A prominent trend is the escalating demand for eco-friendly phenolic resins, driven by a growing emphasis on sustainability and environmental responsibility. Manufacturers are actively developing bio-based formulations to align with the increasing preference for greener materials without compromising performance. In the electronics sector, phenolic resins are experiencing heightened demand, particularly in the production of printed circuit boards, owing to their exceptional electrical insulation properties and resistance to heat. The automotive industry is increasingly incorporating phenolic resins in lightweighting initiatives, leveraging their notable strength-to-weight ratio to enhance fuel efficiency and meet stringent environmental regulations.

Market Segmentation: The Global Phenolic Resin Market is Segmented by Product Type (Novolac and Resol), Application (Molding, Adhesive, Insulation, and Other Applications), End-user Industry (Automotive and Transportation, Consumer Electronics, Building and Construction, Oil and Gas, Furniture, and Other End-user Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers market size and forecasts for Phenolic Resin in value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

The Increasing Demand for Construction and Transportation Industry

The surging demand within the construction and transportation industries is significantly shaping the utilization of phenolic resin. With the global demand for infrastructure projects on the rise, particularly in emerging markets, there is a heightened need for construction materials that offer both durability and high performance. Phenolic resins, renowned for their versatility and exceptional properties, are emerging as pivotal components in various construction applications. Their application in the production of laminates, coatings, and adhesives contributes to the creation of robust and fire-resistant materials, aligning seamlessly with the stringent safety standards prevalent in the construction sector.

Increase Demand for Flame Retardant Material

The increasing demand for flame-retardant materials has propelled the use of phenolic resin across various industries. As safety considerations become paramount in construction, transportation, electronics, and other sectors, the need for materials that can effectively withstand and mitigate fire risks is on the rise. Phenolic resins, with their intrinsic flame-retardant properties, have emerged as pivotal components in meeting these stringent safety requirements. The increase in the demand for flame-retardant materials underscores the critical role played by phenolic resins in addressing fire safety concerns across diverse industries. Their versatility, coupled with the ability to withstand high temperatures and inhibit the spread of flames, positions phenolic resins as key contributors to the development of materials that prioritize safety and reliability in the face of fire hazards.

Restraints:

High Initial Cost

The high initial cost of phenolic resin is a notable factor influencing decision-making processes in various industries. While phenolic resin offers a range of advantageous properties, including high heat resistance, excellent flame retardancy, and durability, its upfront expenses can present a challenge for potential users. Thus, while the high initial cost of phenolic resin may pose a challenge, its unique properties and performance benefits make it a preferred choice in applications where durability and fire resistance are critical. Investment in phenolic resin is often seen as a strategic decision for industries that prioritize long-term reliability and safety.

The COVID-19 pandemic significantly influenced the phenolic resin market, creating both immediate challenges and long-term trends. Disruptions in the global supply chain, stemming from factory closures and logistical issues during lockdowns, impacted the production and distribution of phenolic resins. Industries vital to phenolic resin applications, such as automotive and construction, experienced slowdowns and temporary closures, leading to reduced demand for products like adhesives and coatings. The construction sector, a major consumer of phenolic resins, faced delays in projects due to lockdowns and labor shortages. However, certain sectors, including electronics, witnessed recovery as remote work increased the demand for electronic devices, subsequently influencing the demand for phenolic resins in electronic applications. The market showcased resilience as manufacturers adapted to the new normal, implementing safety measures and reevaluating supply chain strategies. Looking ahead, the phenolic resin market is expected to undergo shifts in demand patterns, with a potential emphasis on applications related to sustainability, healthcare, and emerging technologies in the post-pandemic landscape.

Segmental Analysis:

Resol Segment is Expected to Witness Significant Growth Over the Forecast Period

Resol, short for resole, refers to a type of phenolic resin that is commonly used in various industrial applications. Phenolic resins are synthetic polymers derived from the reaction between phenol (an aromatic organic compound) and formaldehyde. Resol resins are part of the thermosetting resin family, meaning they undergo a chemical reaction during curing that irreversibly hardens them. This curing process involves the formation of a three-dimensional network structure, resulting in a highly durable and heat-resistant material. Resol resins find extensive use in the manufacturing of composite materials, adhesives, coatings, and molded products. One of the key characteristics of resol resins is their ability to withstand high temperatures, making them suitable for applications where heat resistance is critical. They are widely utilized in the production of flame-resistant and heat-resistant products, including components for the aerospace and automotive industries. These resins are particularly valued for their excellent adhesion properties and resistance to water and chemicals. The versatility of resol resins extends to their application in the production of molded parts, such as electrical components, where their robust and durable nature is advantageous. Thus, resol refers to a type of phenolic resin known for its thermosetting characteristics, high heat resistance, and suitability for various industrial applications, particularly in the manufacturing of durable and heat-resistant composite materials.

Insulation Segment is Expected to Witness Significant Growth Over the Forecast Period

Phenol resin is widely employed in insulation applications due to its outstanding thermal and electrical insulating properties. One prevalent use is in the production of phenolic foam insulation, known for its exceptional thermal insulation capabilities and resistance to fire. This type of insulation is commonly utilized in buildings to conserve energy and regulate temperature effectively. In the electrical industry, phenol resin finds application in electrical insulation materials, contributing to the manufacturing of components like insulators and switchgear. Phenolic laminates, composed of layers of paper or fabric impregnated with phenolic resin, serve as vital elements in electrical insulation applications. Additionally, phenolic foam is employed for insulating pipes, providing an effective solution to prevent heat loss or gain in industrial settings. In construction, phenolic resin-based insulation panels offer thermal insulation, fire resistance, and structural stability when used in walls, roofs, and floors. The lightweight and fire-resistant nature of phenolic insulation boards contribute to their popularity in construction projects.

Furthermore, phenolic foam insulation is utilized in refrigeration applications, ensuring energy efficiency and temperature maintenance within refrigeration units. Lastly, in the aerospace industry, phenol resin plays a crucial role in insulating various components due to its lightweight properties and exceptional thermal resistance. The versatility of phenol resin in different insulation scenarios stems from its moldability, excellent thermal characteristics, and resistance to fire and chemicals, making it a preferred choice where effective insulation is paramount for energy efficiency, safety, and performance. Thus, such factors are expected to drive the segmental growth.

Automotive and Transportation Segment is Expected to Witness Significant Growth Over the Forecast Period

Phenol resin serves as a vital component in the automotive and transportation industry, playing a multifaceted role in various applications that capitalize on its distinctive properties. Its contribution to lightweighting is noteworthy, as phenolic composites, reinforced with materials like fiberglass or carbon fiber, are extensively used in manufacturing lightweight components for vehicles. This not only enhances fuel efficiency but also aligns with the industry's focus on sustainability. Phenolic resins are integral in the production of brake and clutch components, ensuring durability and high performance under elevated temperatures.

The excellent electrical insulating properties of phenolic resins make them valuable for applications within vehicles, particularly in the manufacturing of insulators and connectors for electrical systems. Additionally, phenolic resins contribute to the production of interior components and laminates, providing a balance of aesthetics, durability, and fire resistance for various interior trim elements. Under-the-hood applications benefit from the heat resistance of phenolic resins, making them suitable for engine components and other parts in the powertrain. In transportation equipment such as buses and trains, phenolic foam insulation is employed to provide effective thermal insulation, contributing to energy efficiency in HVAC systems. Moreover, phenolic resins serve as crucial adhesives and sealants in the assembly of automotive components, ensuring strong bonds and structural integrity. The versatile nature of phenol resin, encompassing heat resistance, mechanical strength, and electrical insulation capabilities, positions it as a key material in advancing automotive technologies and meeting the evolving demands of the transportation sector.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is poised to experience remarkable growth in the phenolic resin market, primarily driven by substantial consumption in diverse sectors such as consumer electronics, transportation, furniture, building and construction, and the oil and gas industry, with China and India leading the demand. Among these sectors, the transportation and automotive industry holds the largest share in the phenolic resin market, with the burgeoning transportation business in Asia-Pacific propelling the rubber industry, consequently fostering demand for phenolic resins. Legislative initiatives in various Asia-Pacific countries promoting the construction of energy-efficient buildings have further fueled the overall demand for phenolic resins, contributing to the rapid advancement of the market.

Notably, the Singapore government's introduction of the Singapore Green Building Masterplan in March 2021, aiming to achieve 80% green buildings by 2030, exemplifies the region's commitment to sustainability, with 49% of Singapore's buildings being greened by the end of 2021. Globally, the demand for phenol reached approximately 12 million metric tons in 2022, showcasing a steady average annual increase of 2.5% over the past five years. Additionally, the escalating use of phenolic resins in adhesives and insulation is anticipated to drive demand within the building and construction sector. With heightened construction activities in China, India, and Southeast Asia, the Asia-Pacific region is expected to witness increased market concentration in the years to come. Thus, such factors are expected to drive the market’s growth on the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The phenolic resin market is characterized by fragmentation, reflecting a diverse landscape with the presence of numerous players operating across regional and global scales. This fragmentation is attributed to the versatility of phenolic resins, which find applications in various industries, including construction, automotive, electronics, and consumer goods. Multiple manufacturers, ranging from large multinational corporations to smaller regional players, contribute to the overall production and distribution of phenolic resins. Some of the key market players working in this domain are:

Recent Development:

1) In January 2023, BASF SE made a strategic investment to enhance the production capacity of polymer dispersions at its facility in Merak, Indonesia. This expansion aligns with the increasing demand for high-quality packaging materials observed in the ASEAN region. Notably, ASEAN serves as a hub for major paper and board manufacturers. The investment underscores BASF's commitment to meeting the rising needs of this market by bolstering its capabilities in polymer dispersions, which play a crucial role in the production of advanced packaging materials. This move is indicative of BASF's proactive stance in catering to the evolving trends and demands within the packaging industry in the ASEAN region, positioning the company to better serve key manufacturers in the paper and board sector.

2) In November 2022, the ASK Chemicals Group successfully finalized the acquisition of the industrial resins business from the US-based SI Group. This strategic purchase encompasses resin manufacturing facilities located in Rio Claro (Brazil), Ranjangaon (India), and Johannesburg (South Africa). Additionally, the acquisition includes licensed technology and the execution of numerous tolling agreements on a global scale. Through this transaction, ASK Chemicals has not only strengthened its foothold in the foundry market but has also taken a significant initial stride in establishing a robust presence in the phenolic industrial resin sector. The integration of SI Group's industrial resins business not only reinforces ASK Chemicals' influence in the foundry market but also marks a strategic entry into the phenolic industrial resin domain. This diversification is likely to enhance ASK Chemicals' competitiveness, enabling it to cater to a wider spectrum of industrial applications and customer needs. As a result, the acquisition is expected to contribute positively to the overall growth and market presence of ASK Chemicals in the coming years.

Q1. What was the PhenolResin Market size in 2023?

As per Data Library Research the global phenolic resin market size was valued at USD 15.7 billion in 2023.

Q2. At what CAGR is the PhenolResin market projected to grow within the forecast period?

PhenolResin market is projected to reach a CAGR of 7.3% over the forecast period.

Q3. What are the factors on which the PhenolResin market research is based on?

By Product Type, End-User and Geography are the factors on which the PhenolResin market research is based.

Q4. What are the factors driving the PhenolResin Market?

Key factors that are driving the growth include the The Increasing Demand for Construction and Transportation Industry and Increase Demand for Flame Retardant Material.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model