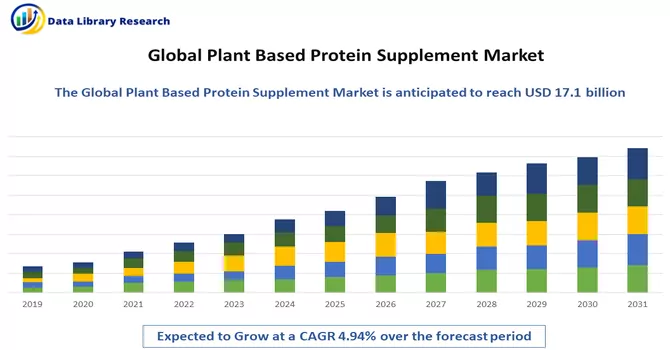

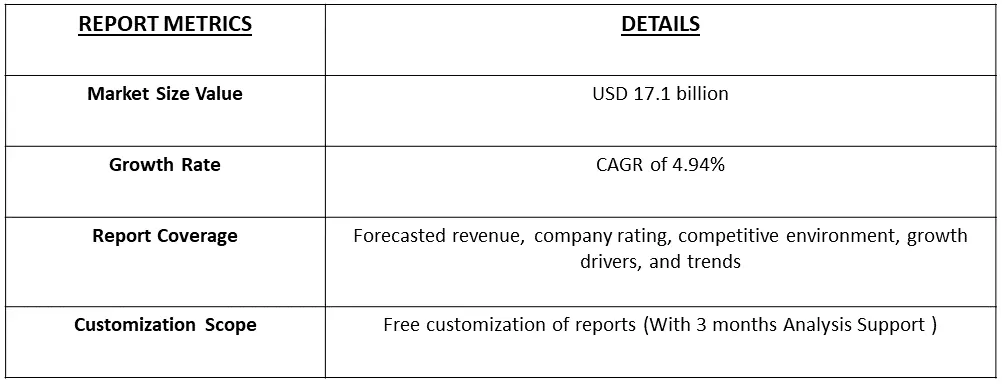

The Plant Protein Market size is estimated at USD 17.1 billion in 2023, and is expected to register a CAGR of 4.94% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Plant-based protein refers to protein derived from plant sources, such as legumes (beans, lentils), grains (quinoa, oats), nuts and seeds (almonds, chia seeds), soy products (tofu, tempeh), and vegetables (spinach, broccoli). This type of protein is an alternative to animal-based sources and is commonly chosen by those following vegetarian or vegan diets or seeking to reduce their consumption of animal products. Plant-based proteins offer a range of essential amino acids, fiber, vitamins, and minerals, contributing to a well-rounded and nutritious diet. It's essential for individuals on a plant-based diet to diversify their protein sources to ensure they obtain all the necessary amino acids for optimal health.

The plant-based protein market is experiencing significant growth, driven by several key factors. Firstly, the rising awareness of health and environmental concerns is prompting consumers to adopt plant-based diets, seeking alternatives to traditional animal-based proteins. Additionally, the increasing prevalence of lifestyle-related health issues and a growing emphasis on fitness and wellness are fueling the demand for plant-based protein products. The expanding vegan and vegetarian population, along with a surge in flexitarianism, where individuals reduce their meat consumption, is contributing to market growth. Moreover, advancements in food technology have led to improved taste and texture of plant-based protein products, making them more appealing to a broader consumer base. The global focus on sustainability and ethical consumption is also boosting the plant-based protein market, as consumers seek environmentally friendly and cruelty-free protein sources. Furthermore, strategic investments and product innovations by food companies are driving the availability and accessibility of a wide range of plant-based protein products in the market, further accelerating its growth.

The plant protein market is witnessing notable trends reflecting evolving consumer preferences and broader industry shifts. There is a growing inclination towards plant-based diets, driven by health and sustainability concerns, leading to increased demand for plant protein products. Novel plant protein sources and formulations, such as pea protein and hemp protein, are gaining popularity, offering alternatives with improved taste and nutritional profiles. The market is also marked by the expansion of plant-based protein product portfolios, including ready-to-eat meals, snacks, and beverages, catering to diverse consumer needs. Collaborations and partnerships between food companies and plant-based protein manufacturers are fostering innovation and product development. Additionally, labeling transparency and clean-label initiatives are becoming pivotal as consumers seek natural and minimally processed plant protein options. The plant protein market is expected to continue its upward trajectory, driven by a confluence of health, environmental, and ethical considerations shaping consumer choices.

Market Segmentation: The Plant Protein Market is segmented by Protein Type (Hemp Protein, Pea Protein, Potato Protein, Rice Protein, Soy Protein, and Wheat Protein), by End User (Animal Feed, Food and Beverages, Personal Care and Cosmetics, and Supplements) and by Region (Africa, Asia-Pacific, Europe, Middle East, North America, and South America). Market value in USD and market volume in tonnes are presented. Key data points observed include the market volume of end-user segments, per capita consumption, and raw material production.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasingly choosing plant-based proteins to reduce their carbon footprint and address climate change concerns associated with traditional animal agriculture

The surge in consumer preference for plant-based proteins is intricately linked to a growing awareness of environmental sustainability and the desire to mitigate the impact of traditional animal agriculture on climate change. As individuals become more conscious of their carbon footprint, there is a discernible shift towards plant-based diets as a means of reducing the environmental strain associated with meat production. Traditional animal agriculture is a significant contributor to greenhouse gas emissions, deforestation, and water pollution. By choosing plant-based proteins, consumers aim to align their dietary choices with eco-friendly practices, as plant cultivation generally has a lower environmental footprint compared to raising livestock. The adoption of plant-based proteins is perceived as a sustainable lifestyle choice that addresses climate change concerns. Plants typically require fewer resources such as water, land, and feed, and they produce fewer greenhouse gas emissions compared to livestock. This conscious shift reflects a broader commitment to sustainable living, with consumers recognizing the potential positive impact of reducing reliance on animal agriculture. As the discourse around climate change intensifies, the plant-based protein market stands at the forefront of this eco-conscious movement, offering consumers a viable and impactful way to contribute to environmental conservation through their dietary choices.

Surge in investments and research and development efforts by major food companies are fostering innovation in plant-based protein formulations.

The plant-based protein market is currently experiencing a notable surge in investments and dedicated research and development efforts from major food companies. This influx of financial support and strategic focus underscores the industry's recognition of the growing consumer demand for plant-based alternatives. With an eye on capturing a substantial share of this burgeoning market, food companies are actively engaging in innovative practices to enhance plant-based protein formulations. These investments are facilitating advancements in technology and production processes, enabling the creation of plant-based products with improved taste, texture, and nutritional profiles. Companies are exploring novel ingredients and refining extraction methods to enhance the overall quality and versatility of plant-based proteins. This commitment to innovation is not only meeting the expectations of consumers seeking sustainable and healthier food choices but is also expanding the appeal of plant-based products to a wider audience. Moreover, the emphasis on research and development is yielding a diverse array of plant-based protein options, catering to different culinary applications and dietary preferences. This dynamic landscape of continuous improvement and innovation is reshaping the plant-based protein market, positioning it as a robust and evolving sector within the broader food industry. As these efforts persist, consumers can anticipate a growing array of high-quality, palatable, and nutritionally rich plant-based protein options, further solidifying the role of plant proteins in mainstream diets.

Market Restraints:

Regulatory Challenges

The plant-based protein market faces hindrances in the form of regulatory complexities and issues related to product labelling. The absence of standardized definitions and regulations for plant-based products, coupled with potential discrepancies in labeling practices, poses challenges. It is crucial to establish clear and uniform guidelines to ensure accurate and transparent labeling, fostering consumer trust and preventing the spread of misinformation. Addressing these regulatory challenges is imperative for creating a more stable and reliable foundation for the plant-based protein market, allowing consumers to make informed choices with confidence.

The COVID-19 pandemic has had a multifaceted impact on the plant protein market, presenting both challenges and opportunities. Initially, the disruptions in supply chains, logistical constraints, and changes in consumer behavior created challenges for the plant protein industry. Lockdowns, restrictions on movement, and the closure of foodservice establishments led to a temporary decline in demand for certain plant-based products, particularly those targeted at the hospitality sector. However, the pandemic also acted as a catalyst for certain aspects of the plant protein market. Increased awareness of health and well-being during the pandemic prompted many consumers to reevaluate their dietary choices, leading to a surge in interest in plant-based diets. The growing focus on personal health and immune system support encouraged individuals to incorporate more plant-based proteins into their diets. Furthermore, as consumers became more conscious of the link between zoonotic diseases and industrial animal agriculture, there was a heightened interest in sustainable and ethical food choices, driving demand for plant-based protein alternatives. The pandemic accelerated the existing trend toward plant-based diets, reflecting a broader shift in consumer attitudes toward healthier, more sustainable eating habits. Thus, the plant protein market is expected to continue its growth trajectory, influenced by the enduring impacts of the pandemic on consumer behavior, increased emphasis on health and wellness, and the rising awareness of environmental sustainability. As the world adapts to the "new normal," the plant protein market is likely to see sustained demand and further innovation in response to evolving consumer preferences.

Segmental Analysis:

Rice Protein Segment is Expected to Witness Significant Growth Over the Forecast Period

Rice protein is a popular and versatile plant-based protein derived from brown or white rice. It has gained prominence in the plant protein market due to its hypoallergenic nature, making it suitable for individuals with allergies to common allergens like soy and dairy. This protein source is extracted through a process that involves isolating the protein from rice grains, resulting in a protein concentrate or isolate. One notable characteristic of rice protein is its balanced amino acid profile, though it may be lower in certain essential amino acids compared to animal-based proteins. However, this deficiency can be mitigated by combining rice protein with complementary plant protein sources to ensure a complete amino acid intake. Rice protein is commonly used in a variety of plant-based products, including protein powders, bars, and meat alternatives. Its neutral flavor and smooth texture make it a versatile ingredient in the food industry, allowing for the development of products that cater to various dietary preferences. In the broader context of plant protein, the market has witnessed a surge in demand driven by factors such as health consciousness, environmental sustainability, and ethical considerations. Plant proteins, including rice protein, serve as alternatives to traditional animal-based proteins, offering consumers a diverse range of options for meeting their protein needs. The plant protein market encompasses various sources such as soy, pea, hemp, and rice, each contributing to the market's rich and dynamic landscape. Ongoing research and development efforts are focused on enhancing the taste, texture, and nutritional profiles of plant-based protein products, ensuring their appeal to a broad and growing consumer base seeking sustainable and nutritious dietary choices.

Food and Beverages Segment is Expected to Witness Significant Growth Over the Forecast Period

The integration of plant-based proteins into the food and beverage industry represents a significant and transformative trend, reflecting the evolving preferences of consumers towards healthier and more sustainable dietary choices. Plant-based proteins, derived from sources like soy, pea, rice, and others, have become integral components of a diverse range of food and beverage products. In the beverage sector, plant-based proteins are frequently incorporated into smoothies, shakes, and dairy alternatives, providing a nutritious and plant-powered alternative to traditional protein sources. Plant-based milk, made from soy, almond, oat, or pea protein, has gained substantial popularity as a dairy substitute. This segment of the market continues to expand with innovations in flavors and formulations to cater to various consumer preferences. In the food industry, plant-based proteins are key ingredients in the development of meat alternatives, burgers, sausages, and nuggets. The aim is to mimic the taste, texture, and nutritional profile of traditional animal-based products, appealing to both vegetarians and flexitarians seeking sustainable protein options. Plant-based protein is also integrated into snacks, energy bars, and protein-rich baked goods, providing convenient and nutritious options for on-the-go consumers. The use of plant-based proteins extends beyond product formulations to labeling and marketing strategies. Many food and beverage companies emphasize the plant-based nature of their products to align with the growing demand for ethical and sustainable choices. Moreover, partnerships and collaborations between food manufacturers and plant-based protein suppliers contribute to the expansion of this market, fostering innovation and introducing new and diverse plant protein sources. As the plant-based protein market continues to grow, it reshapes the landscape of the food and beverage industry, encouraging a shift towards more sustainable and plant-centric diets. The incorporation of plant-based proteins is not merely a trend but a fundamental response to the increasing consumer awareness of health, environmental impact, and ethical considerations in their food choices.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American region is experiencing a significant surge in the plant protein market, driven by a growing consumer preference for sustainable and plant-based diets. In the United States and Canada, there is a notable shift towards plant-based protein sources, with soy, pea, and rice proteins gaining prominence in various products, ranging from meat alternatives to snacks and beverages. Major food and beverage companies are investing in research and development to innovate and expand their plant protein offerings, responding to the increasing demand fueled by heightened health consciousness, environmental awareness, and ethical considerations. The retail landscape is evolving to accommodate this trend, with dedicated sections for plant-based products in grocery stores and an increasing presence of speciality stores. Fast-food chains and restaurants are also adapting by incorporating plant-based options into their menus. Government initiatives and dietary guidelines further contribute to the thriving plant protein market in North America, positioning the region at the forefront of the global shift towards plant-centric diets.

Get Complete Analysis Of The Report - Download Free Sample PDF

The plant protein market exhibits a fragmented structure characterized by a diverse array of players and a variety of product offerings. Rather than being dominated by a few major companies, the market comprises numerous manufacturers, suppliers, and startups contributing to its diversity. This fragmentation is evident across different plant protein sources, such as soy, pea, rice, and others, each having its set of producers and market participants. The fragmented nature of the plant protein market is driven by the dynamic and evolving landscape of plant-based diets and consumer preferences. Various companies specialize in specific plant protein sources or focus on particular product categories, leading to a decentralized market structure. This diversity fosters competition and innovation as companies strive to differentiate themselves by offering unique formulations, flavors, and nutritional profiles. Additionally, the fragmented market allows for niche players to emerge, catering to specific consumer segments or preferences. The presence of numerous small to mid-sized enterprises and startups contributes to a rich tapestry of product innovation and novel approaches within the plant protein market. While this fragmentation can present challenges in terms of standardization and market consolidation, it also reflects the adaptability and responsiveness of the industry to evolving consumer demands and preferences for plant-based protein alternatives.

Recent Development:

1) In June 2022, Roquette, a prominent plant-based protein manufacturer, unveiled a significant addition to their product portfolio with the launch of two innovative rice proteins. The newly introduced Nutralys rice protein line comprises a rice protein isolate and a rice protein concentrate, strategically developed to meet the escalating market demand for meat substitute applications.

2) In May 2022, BENEO, a subsidiary of Südzucker, solidified its commitment to diversify its product range by entering into a purchase agreement to acquire Meatless BV, a reputable producer of functional ingredients. This strategic move aims to bolster BENEO's existing offerings, particularly in the realm of texturizing solutions for meat and fish alternatives. The acquisition positions BENEO to provide an even more extensive range of high-quality options in response to the growing consumer interest in plant-based alternatives. These industry developments underscore the dynamic and expanding landscape of the plant-based protein market, with companies strategically positioning themselves to cater to evolving consumer preferences and market trends.

Q1. What was the Plant Based Protein Supplement Market size in 2023?

As per Data Library Research the Plant Protein Market size is estimated at USD 17.1 billion in 2023.

Q2. At what CAGR is the Plant Based Protein Supplement Market projected to grow within the forecast period?

Plant Based Protein Supplement Market is expected to register a CAGR of 4.94% during the forecast period.

Q3. What Impact did COVID-19 have on the Plant Based Protein Supplement Market?

The COVID-19 pandemic has had a multifaceted impact on the plant protein market, presenting both challenges and opportunities. For detailed insights request a sample here.

Q4. Which region has the largest share of the Plant Based Protein Supplement Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model