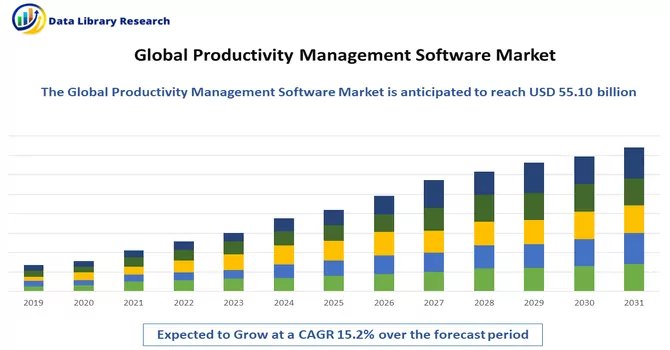

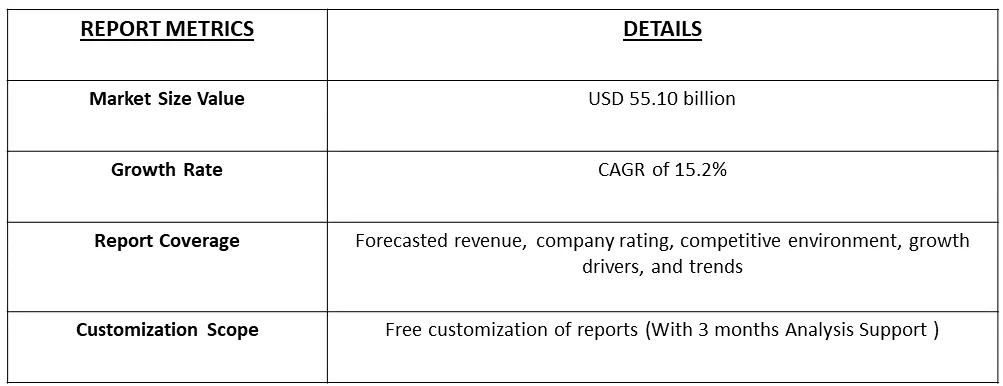

The global productivity management software market size was valued at USD 55.10 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 15.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Productivity management software refers to a category of digital tools and applications designed to enhance and optimize the efficiency, organization, and overall productivity of individuals, teams, or organizations. These software solutions typically offer a range of features that assist in planning, tracking, and managing tasks, projects, and workflows. Common functionalities include task assignments, progress tracking, collaboration tools, document sharing, time tracking, and performance analytics. By providing a centralized platform for coordinating and monitoring work activities, productivity management software aims to streamline processes, improve communication, and ensure that projects are completed in a timely and effective manner. This type of software is widely used in various industries and business settings to boost productivity, facilitate teamwork, and achieve organizational goals.

The increasing need for efficient task and workflow management within businesses, coupled with rapid advancements in Machine Learning (ML) and Artificial Intelligence (AI), constitutes the primary drivers for the market. Additionally, the rising embrace of cloud computing in various business operations and the expanding adoption of enterprise mobility, smartphones, and the Bring Your Own Device (BYOD) trend, leading to the proliferation of the mobile workforce, are significant factors fueling the demand for productivity management software. These trends collectively contribute to the market's growth, as organizations seek innovative solutions to enhance operational efficiency, streamline workflows, and adapt to the evolving landscape of digital work environments.

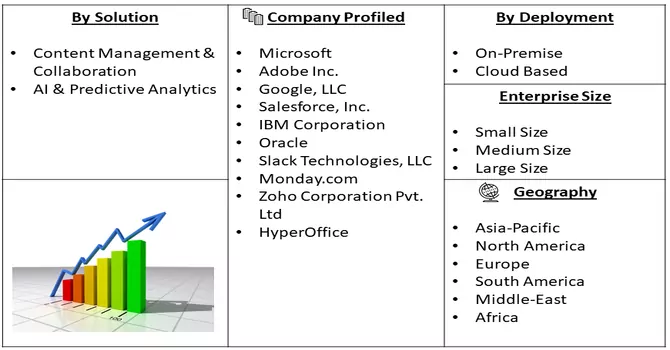

Market Segmentation: The Productivity Management Software Market is Segmented By Solution (Content Management & Collaboration, and AI & Predictive Analytics), Deployment (On-Premise and Cloud Based), Enterprise Size (Small Size, Medium Size and Large Size) and geography (North America, Europe, Asia-Pacific, South America, and Africa). The report offers the market size and forecasts in terms of volume in metric tons and value in USD thousand for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Productivity Management Software market is experiencing dynamic trends shaped by the evolving needs of businesses and advancements in technology. There is a notable integration of Artificial Intelligence (AI) and Machine Learning (ML), enhancing automation and providing intelligent insights. Collaboration features are gaining prominence, emphasizing real-time communication and file sharing to facilitate seamless teamwork, while the rise of remote work is driving demand for mobile accessibility and robust support for remote collaboration. Customization and personalization options are becoming crucial, allowing businesses to tailor software solutions to their unique workflows. Analytics and reporting functionalities are increasingly important for data-driven decision-making, and security features are prioritized to address growing data protection concerns. User-friendly interfaces, automation of repetitive tasks, and integration with other business applications contribute to improved user experiences. The market also sees a shift towards subscription-based and cloud solutions, providing scalability and flexibility for businesses to adapt to changing needs. These trends collectively reflect the industry's commitment to enhancing efficiency, collaboration, and adaptability in the modern digital work landscape.

Market Drivers:

Increasing Complexity of Work Environments

In the contemporary landscape, businesses encounter intricate work environments characterized by a multitude of tasks, diverse projects, and dynamic team structures. This complexity necessitates a heightened demand for comprehensive productivity management tools that can adeptly navigate and address these diverse challenges. Such solutions serve as centralized platforms, offering a unified space for the efficient orchestration and oversight of various work elements. By providing a consolidated hub for task management, project coordination, and team collaboration, these tools streamline workflows and enhance overall operational efficiency. This becomes particularly crucial as businesses strive to manage the intricacies of their operations in a seamless and organized manner, ensuring that tasks, projects, and teams are effectively synchronized to achieve optimal productivity. Furthermore, the developments in the studied market segment are expected to drive the growth of the studied market over the forecast period. For instance, in July 2019, IBM announced the successful completion of its landmark acquisition of Red Hat. The deal involved IBM acquiring all of Red Hat's issued and outstanding common shares at a cash payment of USD 190.00 per share, resulting in a total company valuation of USD 34 billion. Importantly, the strategic decision to maintain Red Hat's independence underscores IBM's aim to establish a formidable presence in the mixed cloud services landscape, positioning itself as a leading player.

Growing Awareness of Workforce Productivity

An escalating number of organizations are acknowledging the intrinsic connection between workforce productivity and overall business success. Within this paradigm, productivity management software assumes a pivotal role, providing businesses with the tools to systematically gauge, analyze, and elevate workforce productivity. By leveraging data-driven insights and performance analytics, these software solutions empower organizations to delve into the intricacies of employee output. They enable a comprehensive evaluation of individual and collective performance, facilitating informed decision-making to optimize productivity levels. As businesses increasingly prioritize efficiency, the implementation of productivity management software becomes integral to fostering a culture of continuous improvement and achieving sustained success in the competitive landscape.

In January 2024, During CES® 2024, Lenovo unveiled a diverse array of over 40 AI-powered devices and solutions, aligning with their commitment to democratize AI accessibility. The comprehensive lineup spans Yoga™, ThinkBook™, ThinkPad™, ThinkCentre™, and Legion™ sub-brands, showcasing groundbreaking AI PC innovations for personalized computing experiences. Among the announcements are two pioneering proof-of-concept products, a versatile tablet, a software app, Motorola AI features, and an array of cutting-edge accessories. Lenovo's focus on consumers introduces AI-optimized Yoga laptops for heightened creativity, an interactive tablet for play and learning, and IdeaPad™ laptops catering to everyday users. Notably, their latest Microsoft Windows 11 Yoga laptops feature the exclusive Lenovo Yoga Creator Zone—a creative software offering a simple and secure space for generative AI. This platform empowers users to effortlessly translate text-based descriptions or sketches into visually captivating representations, revolutionizing the landscape of creative expression and productivity. Thus, such developments are expected to drive the studied market’s growth over the forecast period.

Market Restraints:

Data Security Concerns and Integration Complexity

As productivity management software involves handling sensitive employee data, organizations are often cautious about potential security vulnerabilities. Ensuring robust data security measures becomes crucial to address these concerns. Moreover, implementing productivity management software often requires integration with existing systems and workflows, which can be complex and time-consuming. Compatibility issues may arise, hindering seamless integration and adoption. Thus, these factors are expected to slow down the growth of the studied market.

The COVID-19 pandemic has profoundly influenced the adoption and functionality of productivity management software. With the abrupt shift to remote work, organizations sought tools that facilitate collaboration, monitor workloads, and maintain employee well-being. This led to an increased emphasis on features promoting real-time communication and collaborative project management within productivity tools. The integration of virtual communication tools became crucial for remote teams, and cloud-based solutions gained prominence for their accessibility and scalability. Organizations also turned to productivity software for strategic planning and adaptability in the face of uncertainty. The pandemic heightened awareness of productivity metrics, leading to a reevaluation of how organizations measure and optimize remote work performance. While the challenges of training and onboarding persisted, the enduring impact of COVID-19 on productivity management software is evident in the continued emphasis on flexibility, collaboration, and employee well-being in the evolving work landscape.

Segmental Analysis:

Content Management & Collaboration Segment is Expected to Witness Significant Growth Over the Forecast Period

Content Management and Collaboration are integral aspects of productivity management software, playing crucial roles in optimizing workflows and fostering efficient teamwork within organizations. Productivity management software often includes features for content creation, storage, and sharing, providing a centralized platform for teams to collaborate on documents, projects, and tasks. This integration ensures that employees can seamlessly access, edit, and collaborate on content in real-time, irrespective of their geographical locations. Version control and document tracking functionalities enhance collaboration by minimizing errors and ensuring that teams work on the latest versions of files. Additionally, content management tools within productivity software contribute to efficient knowledge sharing and retrieval, enabling teams to organize, search, and access information quickly. This synergy between content management and collaboration features facilitates a cohesive work environment, promoting transparency and effective communication among team members. As organizations increasingly adopt remote and flexible work models, the role of content management and collaboration within productivity management software becomes paramount in ensuring streamlined and productive work processes.

Cloud Based Segment is Expected to Witness Significant Growth Over the Forecast Period

Cloud-based Product Management Software represents a transformative approach to managing and optimizing product-related processes. By leveraging cloud technology, this software offers businesses the flexibility of accessing and managing product data, development, and lifecycles from any location with internet connectivity. The cloud-based model eliminates the need for on-premises infrastructure, reducing costs and enhancing scalability. Product managers can collaborate seamlessly with cross-functional teams, sharing real-time updates and insights. Cloud-based solutions facilitate efficient data storage, enabling businesses to handle large volumes of product information, including specifications, features, and documentation. Additionally, the cloud provides a secure environment for data storage and access, ensuring that critical product information remains protected. This approach enhances agility, allowing businesses to adapt quickly to market changes, streamline product development, and improve overall productivity. The cloud-based paradigm for product management software thus aligns with modern business demands, offering a dynamic and accessible solution for organizations of varying sizes and industries.

SMEs Segment is Expected to Witness Significant Growth Over the Forecast Period

Product Management Software is particularly beneficial for Small and Medium-sized Enterprises (SMEs), offering tailored solutions to address the unique challenges and requirements of businesses in this category. SMEs often face resource constraints and the need for streamlined operations, making effective product management crucial for success. Product management software designed for SMEs typically provides user-friendly interfaces, ensuring ease of adoption for teams with varying technical expertise. These solutions empower SMEs to efficiently handle product development, lifecycle management, and collaboration among dispersed teams. Features such as task tracking, document management, and collaborative workflows enhance communication and coordination within smaller teams. Additionally, many product management software options for SMEs offer scalability, allowing businesses to expand their usage as they grow. The centralized nature of these tools helps SMEs organize product-related data, streamline decision-making processes, and adapt quickly to market changes. Overall, product management software tailored for SMEs serves as a strategic asset, supporting their growth, competitiveness, and ability to navigate dynamic market conditions.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

In the North American region, Product Management Software plays a pivotal role in enhancing the efficiency and competitiveness of businesses across various industries. The dynamic and technologically advanced business landscape in North America necessitates robust solutions to manage and optimize product-related processes. Product management software provides organizations with tools to streamline tasks such as product development, collaboration, and lifecycle management. With a focus on innovation and market responsiveness, North American businesses leverage these tools to bring products to market faster, adapt to changing customer demands, and gain a competitive edge. The region's emphasis on technology adoption aligns well with the features offered by modern product management software, including real-time collaboration, analytics, and scalability. As businesses in North America continue to evolve and seek ways to stay agile in a fast-paced market, product management software remains a key enabler for driving efficiency, innovation, and overall success.

Get Complete Analysis Of The Report - Download Free Sample PDF

Major market players actively pursue strategies such as expanding their production capabilities, engaging in mergers and acquisitions, and conducting research and development initiatives to maintain a competitive edge in the industry. This involves increasing their capacity for manufacturing, acquiring other companies or merging with them to strengthen their market position, and investing in innovative research and development efforts. These strategic moves are crucial for staying ahead of competitors, enhancing market share, and ensuring sustained growth in the dynamic business environment. The commitment to these initiatives underscores the players' proactive approach in adapting to market trends, meeting evolving customer demands, and securing a prominent position in the competitive landscape. Key Productivity Management Software Companies:

Recent Developments:

1) In January 2024, Appogee HR presents a range of fully customizable HR and people management software solutions, designed for user-friendly functionality and seamless scalability to accommodate the growth of businesses. The company offers an extensive suite of cloud-based HR solutions, encompassing software for absence management, core HR management, advanced HR management, and time tracking. This overview delves into the details of Appogee HR's offerings and highlights the distinctive features that set the company apart in the HR software landscape.

2) In Feb 2023, ClickUp, the comprehensive productivity platform consolidating work processes, has unveiled ClickUp 3.0, marking the latest evolution of its platform aimed at shaping the future of productivity. This version introduces a myriad of innovations, including a sleek and intuitive design, the incorporation of ClickUp AI for effortless writing, summarization, and idea generation with a single click, and a revolutionary Search feature. Notably, ClickUp 3.0 is underpinned by a completely reimagined infrastructure, emphasizing exceptional speed, reliability, and limitless scalability. This update is poised to elevate team productivity by enabling faster workflows, improved collaboration, and substantial time savings for users.

Q1. What was the Productivity Management Software Market size in 2023?

As per Data Library Research the global productivity management software market size was valued at USD 55.10 billion in 2023.

Q2. At what CAGR is the Productivity Management Software market projected to grow within the forecast period?

Productivity Management Software Market is expected to grow at a compound annual growth rate (CAGR) of 15.2% over the forecast period.

Q3. What are the factors on which the Productivity Management Software market research is based on?

By Solution, By deployment, By Enterprise Size and Geography are the factors on which the Productivity Management Software market research is based.

Q4. What are the factors driving the Productivity Management Software market ?

Key factors that are driving the growth include the Increasing Complexity of Work Environments and Growing Awareness of Workforce Productivity.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model