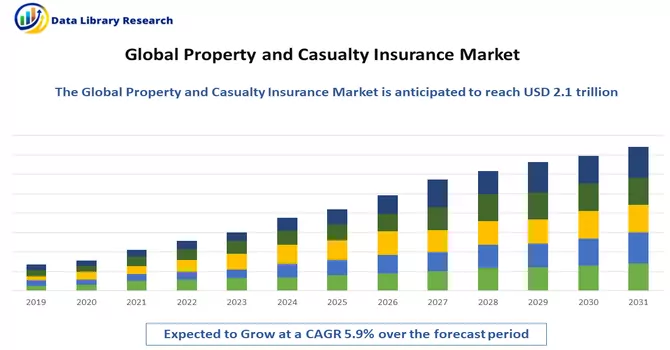

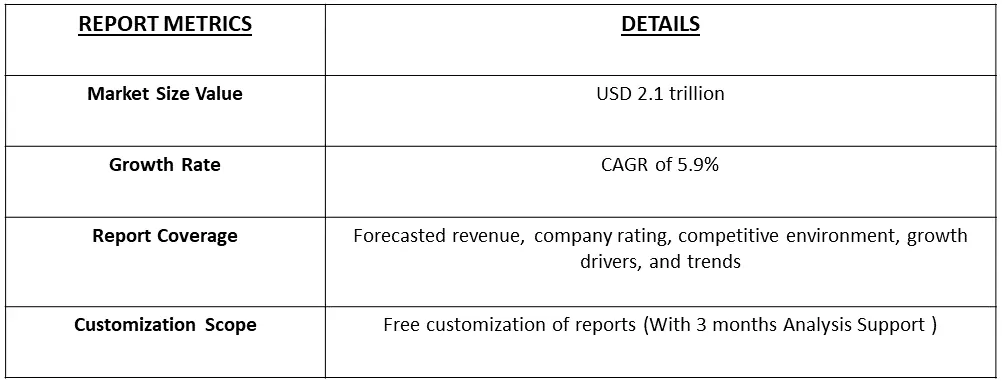

Property & Casualty Insurance Market size was valued at USD 2.1 trillion in 2023 and is estimated to register a CAGR of over 5.9% between 2024 and 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Property and Casualty (P&C) insurance is a comprehensive category of non-life or general insurance that safeguards individuals and businesses against financial losses due to property damage, liability claims, and various risks. Property insurance covers physical assets like homes and commercial buildings against perils such as fire, theft, and natural disasters. Meanwhile, casualty insurance focuses on liability, providing coverage for legal responsibilities arising from injury to others or damage to their property. With policies like homeowners, renters, commercial property, general liability, and auto liability insurance, P&C insurance offers a diverse range of protection tailored to meet the specific needs of policyholders, ensuring financial support in the face of unforeseen events and accidents.

The growth of the Property and Casualty (P&C) Insurance Market is propelled by several factors, including the broader economic expansion fostering increased demand for coverage against property damage and liability risks. Technological advancements, such as artificial intelligence and data analytics, enhance risk assessment and streamline processes, while regulatory changes promoting fair competition and consumer protection create opportunities for insurers. Rising awareness of diverse risks, globalization, and international trade complexities boost the demand for specialized P&C insurance products. The changing climate patterns and the increased frequency of natural disasters drive the need for insurance coverage against property damage. Furthermore, the digitalization of distribution channels and collaboration with insurtech startups enable insurers to reach a wider audience, offer personalized products, and enhance customer experiences, contributing to market growth. This dynamic landscape provides insurers with opportunities to innovate, adapt to evolving market dynamics, and meet the diverse needs of policyholders.

The Property and Casualty (P&C) Insurance Market is undergoing significant transformations driven by various trends. The integration of insurtech is reshaping the industry, with artificial intelligence, machine learning, and blockchain enhancing efficiency in underwriting, claims processing, and risk assessment. Data analytics plays a pivotal role, enabling insurers to employ predictive modeling for accurate risk evaluation and personalized offerings. The increasing prevalence of cyber threats has spurred the growth of cyber insurance, while the impact of climate change is influencing product development and risk modeling. Insurers are prioritizing customer-centric approaches, leveraging digital platforms and personalized solutions to enhance customer experiences. The evolving regulatory landscape emphasizes transparency, consumer protection, and fair competition, prompting insurers to adapt. Resilience planning gains prominence, particularly in the face of extreme events, and telematics is transforming auto insurance with a focus on individualized risk assessment. Collaborations between insurers and insurtech startups, as well as strategic partnerships, are fostering innovation and adaptability. Overall, these trends underscore the dynamic nature of the P&C insurance market, requiring proactive strategies to navigate the changing landscape successfully.

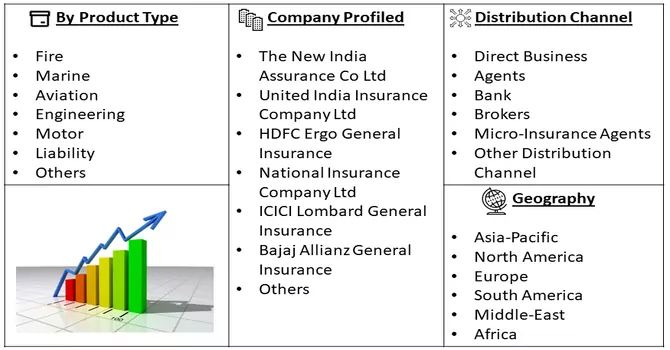

Market Segmentation: The Global P&C (Property and Casualty) Insurance Market segmented by Product Type (Fire, Marine, Aviation, Engineering, Motor, Liability, and Others) and Distribution Channel (Direct Business, Agents, Bank, Brokers, Micro-Insurance Agents, and Other Distribution Channel) and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The market size and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Technological Advancements and Insurtech Integration

The continuous progression of technology and the seamless integration of innovative insurtech solutions stand out as pivotal catalysts propelling the Property and Casualty (P&C) Insurance Market forward. Key technological advancements, including artificial intelligence, data analytics, and blockchain, play instrumental roles in elevating risk evaluation methodologies, optimizing underwriting procedures, and bolstering operational efficiencies across the industry. Through the application of these cutting-edge technologies, insurers are empowered to streamline processes, enhance accuracy in risk assessment, and expedite claims handling, consequently fostering a more agile and responsive insurance ecosystem. Moreover, the infusion of insurtech innovations fosters heightened levels of automation, facilitates the delivery of personalized insurance products, and elevates the overall customer experience. By embracing these transformative technologies, insurers are strategically positioned to adapt to the ever-evolving needs of the market while cultivating a competitive edge in the digital terrain, ensuring their relevance and sustainability amidst rapid technological advancements.

Increasing Awareness and Demand for Cyber Insurance

The increasing frequency and complexity of cyber threats have become a driving force behind the growing demand for cyber insurance within the Property and Casualty (P&C) market. As businesses and individuals become increasingly cognizant of the potential financial consequences associated with cyberattacks, data breaches, and privacy concerns, there is a noticeable uptick in awareness regarding the necessity for specialized coverage in these areas. This heightened awareness is spurring the development of customized cyber insurance products that specifically target the unique risks inherent in the realm of cybersecurity. Insurers are strategically positioning themselves to capitalize on the expanding demand within this segment by tailoring comprehensive solutions that address the evolving nature of cyber threats. As a result, the P&C insurance market is witnessing a notable surge in interest and adoption of cyber insurance products, reflecting the industry's proactive response to the evolving landscape of digital risks.

Market Restraints:

Regulatory Challenges and Compliance Complexity

The Property and Casualty (P&C) insurance market encounters challenges stemming from intricate and dynamic regulatory frameworks. The necessity to conform to a multitude of national and international regulations places substantial demands on resources and efforts within the industry, thereby affecting the operational flexibility of insurers. The evolving nature of compliance requirements necessitates ongoing adaptations, adding complexity to the regulatory landscape. Ensuring strict adherence to these intricate legal standards presents a significant hurdle for insurers, potentially impeding their ability to swiftly respond to changing market dynamics. The continuous effort and investment required to stay abreast of regulatory changes divert resources that could otherwise be allocated to innovation and address emerging risks, highlighting the profound impact of regulatory complexities on the agility and adaptability of P&C insurers.

The COVID-19 pandemic has profoundly impacted the Property and Casualty (P&C) insurance market, reshaping risk landscapes and prompting a surge in claims. Business interruption claims have surged as closures and disruptions became widespread, leading to disputes over policy interpretations. Event cancellations and liability concerns related to the virus have also increased claims, requiring insurers to reassess coverage and underwriting strategies. The economic downturn has influenced premium affordability and purchasing decisions, challenging insurers to balance risk management with policyholders' financial constraints. Remote work adoption has altered the risk profile for commercial property insurance, and insurers are navigating this shift alongside an accelerated digital transformation. Insurers are increasingly turning to insurtech solutions to enhance risk assessment, claims management, and customer service. The pandemic's regulatory impact, including guidance and amendments, adds another layer of complexity for insurers navigating an evolving landscape. Overall, the pandemic has catalyzed changes in risk evaluation, claims processing, and digital integration, reshaping the P&C insurance market's dynamics.

Segmental Analysis:

Liability Insurance Segment is Expected to Witness Significant Growth Over the Forecast Period

Liability insurance is of paramount importance as it serves as a fundamental pillar of risk management, offering indispensable financial protection against legal liabilities. For individuals and businesses, this coverage is a safeguard against the potential financial devastation of legal claims arising from bodily injury, property damage, or personal injury. Not only does liability insurance ensure compliance with legal requirements, but it also plays a crucial role in risk mitigation, preserving business continuity, and protecting personal assets. Beyond its financial implications, liability insurance enhances professional credibility, fosters trust in contractual agreements, and provides individuals and businesses with the peace of mind that they are equipped to handle unforeseen legal challenges. In essence, liability insurance is a vital tool for navigating the complex landscape of legal liabilities, offering a robust defense against the financial consequences of unexpected events.

Micro-Insurance Agents Segment is Expected to Witness Significant Growth Over the Forecast Period

Micro-insurance offers crucial advantages by addressing the specific needs of low-income individuals and small businesses, fostering financial inclusion and risk mitigation. Designed to be affordable, these tailored insurance products provide a safety net against unforeseen events, such as health issues or natural disasters, contributing to economic stability in underserved communities. By offering simplified processes and customized coverage, micro-insurance enhances financial literacy, promotes entrepreneurial endeavors, and supports community development. Leveraging innovative distribution channels and often involving collaborations between governments, NGOs, and the private sector, micro-insurance not only protects against financial shocks but also fosters social cohesion, resilience, and poverty reduction, making it a powerful tool for sustainable development.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America's Property and Casualty (P&C) insurance market is a dynamic and robust sector, shaped by various factors that influence both the demand for coverage and the strategies of insurance providers. The region encompasses the United States and Canada, where P&C insurers play a crucial role in addressing diverse risks faced by individuals, businesses, and industries. In the United States, the P&C insurance market is extensive and highly competitive. It covers a wide range of insurance products, including auto insurance, homeowners insurance, commercial property insurance, liability insurance, and specialty lines. The market's landscape is influenced by factors such as regulatory frameworks, economic conditions, and technological advancements. The regulatory environment, overseen by state insurance departments, shapes insurance practices and ensures consumer protection. Auto insurance is a significant segment within the P&C market, with varying state regulations influencing coverage requirements. Liability coverage, including general liability and professional liability, is vital for businesses to protect against legal claims. Additionally, homeowners insurance provides coverage for property damage, liability, and natural disasters, addressing the unique risks associated with home ownership. Canada's P&C insurance market exhibits similarities to the U.S. market but is also influenced by distinct regional characteristics. The market covers various lines, including auto, property, liability, and specialty coverages. Provinces regulate insurance, leading to variations in coverage requirements and regulatory frameworks. Technological advancements and insurtech innovations play a growing role in the North American P&C insurance market. Insurers are adopting digital technologies for underwriting, claims processing, and customer engagement, enhancing operational efficiency and customer experiences. Telematics in auto insurance, data analytics, and artificial intelligence contribute to more accurate risk assessment and personalized pricing. Catastrophic events, such as hurricanes, wildfires, and floods, impact the P&C market, leading to a focus on risk modeling, underwriting practices, and catastrophe management. Climate change considerations have heightened the industry's awareness of evolving risks and prompted insurers to adapt their coverage offerings. Collaborations and partnerships, both within the insurance industry and with technology providers, are shaping the market's evolution. Insurers are exploring innovative distribution channels and strategic alliances to expand their reach and improve customer accessibility. Overall, the North American P&C insurance market reflects a blend of tradition and innovation, responding to the region's diverse risk landscape. As technological advancements continue to reshape the industry, insurers in North America navigate regulatory landscapes, address evolving risks, and strive to meet the changing needs of policyholders in this dynamic and competitive market.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players in the studied market are:

Recent Development:

1) In June 2021, HDFC ERGO General Insurance, a leading private sector general insurance company in India, unveiled a strategic collaboration with Visa, a global leader in digital payments. This partnership aims to deliver specially tailored insurance offerings for Visa's business cardholders. Under this alliance, two distinct insurance products were introduced - Business Suraksha Classik and my: Credit Personal Accident Insurance group policy. These offerings are designed to provide comprehensive coverage and benefits to Visa's business cardholders, enhancing their financial protection in various scenarios.

2) In July 2021, Bajaj Allianz General Insurance and Bank of India, one of the largest Public Sector Banks in India, forged a corporate agency agreement to facilitate the distribution of Bajaj Allianz General Insurance's products through the extensive network of Bank of India. This network encompasses 5084 branches, 80 Retail Business Centers, and 60 SME City Centers across the country. Through this collaboration, Bajaj Allianz aims to leverage the expansive reach of Bank of India, making its insurance products more accessible to a wider audience. The strategic alliance signifies a concerted effort to tap into the vast customer base of Bank of India and provide tailored insurance solutions through an extended distribution channel, thereby fostering growth and enhancing customer convenience in the insurance market.

Q1. What was the Property and Casualty Insurance Market size in 2023?

As per Data Library Research the Property & Casualty Insurance Market size was valued at USD 2.1 trillion in 2023.

Q2. What is the Growth Rate of the Property and Casualty Insurance Market ?

Property and Casualty Insurance Market is estimated to register a CAGR of 5.9% over the forecast period.

Q3. What are the factors driving the Property and Casualty Insurance Market?

Key factors that are driving the growth include the Increasing Awareness and Demand for Cyber Insuranceand Technological Advancements and Insurtech Integration.

Q4. What segments are covered in the Property and Casualty Insurance Market Report?

By Product Type, By Distribution Channel and Geogrpahy are the segments covered in the Property and Casualty Insurance Market Report.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model