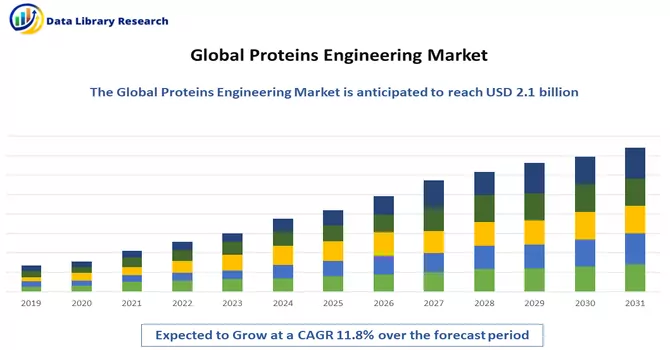

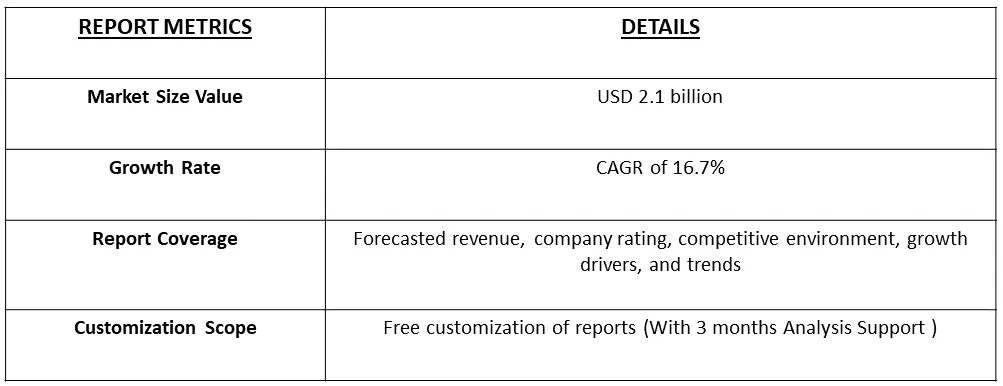

As of 2022, the global protein engineering market has been estimated to generate revenue amounting to USD 2.1 billion, with a projected Compound Annual Growth Rate (CAGR) of 16.7% anticipated for the forecast period spanning from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

Protein engineering involves the application of molecular biology and genetic engineering techniques to modify and craft proteins for specific purposes. Within this field, amino acid sequences in proteins are manipulated to enhance or create desired functionalities. The overarching goal is to produce proteins with improved properties, such as heightened stability, modified binding affinities, enhanced enzymatic activities, or the introduction of novel functions. Particularly significant in the biotechnology and pharmaceutical industries, protein engineering plays a pivotal role in crafting therapeutic proteins, enzymes, and other biologics. This encompasses a range of techniques, including site-directed mutagenesis, rational design, directed evolution, and computational modelling, all aimed at achieving targeted protein modifications. The increasing demand for innovative and more effective biopharmaceuticals, including monoclonal antibodies and therapeutic enzymes, serves as a driving force for protein engineering. Engineered proteins demonstrate improved therapeutic properties, reduced immunogenicity, and enhanced pharmacokinetics. The field of protein engineering significantly contributes to the design of proteins for targeted drug delivery systems, elevating the specificity and efficacy of pharmaceutical interventions. Ongoing advancements in protein engineering facilitate the exploration of new therapeutic targets, thereby fostering the discovery and development of innovative drugs.

The persistent progress in gene editing technologies, such as CRISPR-Cas9 and other precision editing tools, is propelling advancements in protein engineering. These cutting-edge technologies provide more efficient and precisely targeted methods for modifying protein structures. A notable trend emerging from these developments is the creation of next-generation therapeutic antibodies and biologics characterized by improved efficacy, diminished immunogenicity, and enhanced pharmacokinetics. This involves the engineering of various protein formats, including antibody fragments, bispecific antibodies, and innovative protein scaffolds.

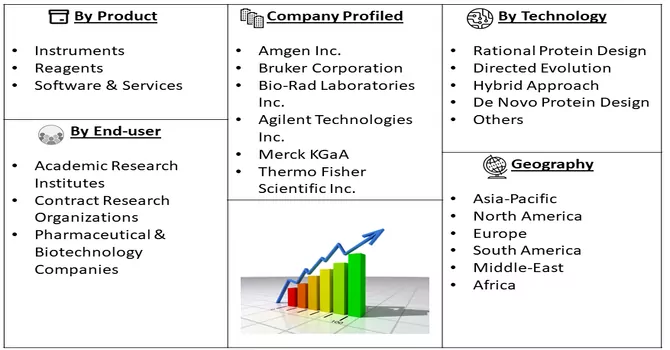

Market Segmentation: The Global Protein Engineering Market Segmented by Product Type (Insulin, Monoclonal Antibodies, Coagulation Factors (Blood Factors + Tissue Plasminogen), Vaccines, Growth Factors (Hormones + Cytokine), and Other Product Types), Technology (Irrational Protein Design and Rational Protein Design), End User (Pharmaceutical and Biotechnology Companies, Academic Institutions, and Contract Research Organizations (CROs)), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The value is provided in terms of (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Biopharmaceutical Development

The escalating demand for innovative and more potent biopharmaceuticals stands as a significant catalyst in propelling the protein engineering market forward. With the continuous expansion of the biopharmaceutical sector, there is an increasing requirement for engineered proteins, including monoclonal antibodies and therapeutic enzymes, characterized by enhanced therapeutic properties. Protein engineering plays a crucial role in modifying proteins to augment their efficacy, mitigate immunogenicity, and enhance pharmacokinetics, thereby contributing to the advancement of more sophisticated and targeted therapeutic approaches. A notable example of this progress is the development of a bioluminescent diagnostic kit in July 2021 by researchers at the Eindhoven University of Technology in Germany. This kit can be employed to ascertain whether an individual's immune system is generating antibodies in response to the coronavirus. Thus, the above-mentioned factors are expected to drive the growth of the studied market over the forecast period.

Gene Editing Technologies:

Advanced gene editing technologies, notably CRISPR-Cas9 and other precision editing tools, are at the forefront of propelling advancements in protein engineering. These cutting-edge technologies empower precise and targeted modifications of protein structures, allowing researchers to craft proteins with specific functionalities. The versatility and efficiency of gene editing tools expedite the protein engineering process, facilitating the creation of next-generation biologics, vaccines, and various other protein-based products. The continuous evolution of gene editing techniques enhances the capabilities of protein engineers, enabling them to manipulate protein sequences for diverse applications across industries. In a noteworthy development, Generate Biomedicines and Amgen formalized a research partnership contract in January 2022 to advance protein therapies for five clinical targets. The demand for protein engineering is further fueled by the increasing prevalence of chronic and lifestyle disorders, including diabetes and cardiovascular conditions. Additionally, factors such as the growing incidence of protein deficiency disorders, notably Protein-Energy Malnutrition (PEM), predominantly in low-income countries, contribute to the market's revenue growth. With the upsurge in both private and public investments in synthetic biology and ongoing advancements in engineering personalized therapies, the industry anticipates substantial growth in the foreseeable future.

Market Restraints :

High Development Costs:

An evident limitation in the protein engineering market is the substantial costs associated with the development and commercialization of engineered proteins. The intricate process of designing, testing, and optimizing these proteins requires extensive research, cutting-edge technologies, and specialized expertise. The need for state-of-the-art equipment, skilled personnel, and sophisticated computational tools amplifies the overall development expenses. Additionally, stringent regulatory requirements aimed at ensuring the safety and efficacy of engineered proteins contribute to the financial burden borne by companies. The heightened development costs can pose a significant barrier, especially for smaller biotech firms, limiting their capacity to invest in protein engineering projects. Ethical considerations and regulatory challenges present significant constraints in the protein engineering market. The ethical implications of manipulating genetic material, particularly in humans, can be a source of public concern and debate. Addressing ethical issues related to gene editing and the use of engineered proteins is crucial for gaining public acceptance and regulatory approval. Moreover, the regulatory landscape for novel biotechnological interventions, including engineered proteins, is continuously evolving. Adhering to regulatory guidelines and obtaining approvals for new protein-based products can be a time-consuming and complex process. Uncertainties in regulatory frameworks may lead to delays in market entry and limit the scope of certain protein engineering applications.

The COVID-19 pandemic disrupted laboratory activities, impeding the progress of ongoing research and development projects related to protein engineering. Restrictions on physical access to laboratories, reduced workforce availability, and logistical challenges hindered the pace of experiments and data collection. The pandemic prompted a shift in research priorities, with a significant focus on COVID-19-related research and therapeutic development. Funding that might have been designated for non-COVID-19 projects, including certain protein engineering initiatives, was redirected to address immediate public health needs. Disruptions in global supply chains also affected the availability of laboratory reagents, consumables, and equipment essential for protein engineering research. Delays in obtaining necessary materials had an impact on the timelines for experiments and data collection in this field.

Segmentation Analysis:

Insulin, Monoclonal Antibodies Segment is Expected to Witness Significant Growth Over the Forecast Period

Insulin is a hormone produced by the pancreas that plays a crucial role in regulating blood sugar levels. Recombinant DNA technology and protein engineering have been instrumental in the production of insulin for therapeutic use. Insulin used for treating diabetes is often produced through genetically engineered bacteria or yeast cells. These cells are modified to express human insulin, allowing for large-scale production of the hormone. The production of insulin through protein engineering has revolutionized diabetes treatment, ensuring a more reliable and sustainable supply of this essential hormone. Advances in insulin engineering have also led to the development of insulin analogues with modified properties, such as faster onset or longer duration of action, providing more personalized and effective treatment options for individuals with diabetes. Monoclonal antibodies are laboratory-produced molecules designed to mimic the immune system's ability to fight off harmful pathogens, such as bacteria or viruses. Protein engineering techniques are employed to create monoclonal antibodies that specifically target certain cells or proteins. This involves modifying the antibody structure for enhanced binding affinity and therapeutic efficacy. Monoclonal antibodies have become a cornerstone in the treatment of various diseases, including cancer, autoimmune disorders, and infectious diseases. The development of therapeutic monoclonal antibodies involves intricate protein engineering to optimize their specificity and reduce potential side effects. The success of mAbs in treating conditions like cancer has led to a growing market for these biopharmaceuticals.

Hormones + Cytokine Segment is Expected to Witness Significant Growth Over the Forecast Period

Hormones are signalling molecules produced by glands in the endocrine system, and they play essential roles in regulating various physiological processes. Protein engineering techniques are employed to produce recombinant hormones for therapeutic use. For example, growth hormone, insulin, and thyroid hormones can be manufactured using genetically modified organisms, such as bacteria or yeast, to express the human hormone. Protein engineering has transformed the production of hormones, making it possible to generate these molecules in large quantities with high purity. Engineered hormones are used in the treatment of endocrine disorders, growth disorders, and diabetes. The ability to modify hormone structures has also led to the development of longer-acting or faster-acting analogues for improved therapeutic outcomes. Cytokines are a diverse group of proteins that play a crucial role in cell signalling, particularly in the immune system. Protein engineering is employed to design recombinant cytokines with enhanced specificity, stability, and therapeutic efficacy. Engineered cytokines can be used to modulate immune responses, making them valuable in the treatment of various diseases, including cancer and autoimmune disorders. The application of protein engineering in cytokine research has led to the development of cytokine-based therapies with improved safety and efficacy profiles. Modified cytokines can target specific cell types or signalling pathways, minimizing adverse effects. The use of engineered cytokines in immunotherapy has gained traction, contributing to advancements in cancer treatment and other immune-related conditions.

Irrational Protein Design Segment is Expected to Witness Significant Growth Over the Forecast Period

Irrational protein design involves exploring diverse modifications and alterations to proteins without necessarily adhering to established structural or functional guidelines. This exploratory nature allows researchers to investigate unconventional protein structures and functions. Computational methods, such as de novo protein design algorithms, are often employed in irrational protein design. These algorithms may generate entirely new protein sequences that do not have direct counterparts in nature, and the resulting proteins may possess unique properties or functions.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America, notably the United States, stands as a global leader in the biopharmaceutical industry. The region is home to a multitude of biotech and pharmaceutical companies, research institutions, and academic centres dedicated to advancing protein engineering technologies. Distinguished research institutions and universities in North America actively participate in protein engineering research, contributing significantly to the evolution of innovative technologies and methodologies that shape the biopharmaceutical market. An illustrative example is the September 2021 protein engineering partnership between Selecta Biosciences, Inc., and Cyrus Biotechnology, Inc., which brought together Selecta's ImmTOR platform and Cyrus' expertise in fundamentally redesigning protein treatments. The primary objective of the collaboration was to develop an exclusive interleukin-2 (IL-2) agonist designed to selectively enhance regulatory T cell (Treg) growth for treating individuals with autoimmune disorders.

Get Complete Analysis Of The Report - Download Free Sample PDF

In the protein engineering market, players are placing significant emphasis on strategic initiatives, including mergers and acquisitions, the introduction of new products, and expanding their geographical presence to fortify their market positions. A prevailing trend among pharmaceutical and biotechnology companies involves a shift toward engaging with Contract Research Organizations (CROs). Some of the market players include

Recent Developments:

1) In January 2022, Amgen and Generate Biomedicines joined forces in a research collaboration aimed at discovering and developing protein therapeutics for five clinical targets spanning various therapeutic areas and employing multiple modalities. Under the terms of this collaboration, Amgen will provide an upfront payment of USD 50 million for the initial five programs, with the potential transaction value reaching USD 1.9 billion, inclusive of future royalties.

2) In July 2021, Eli Lilly and Company completed the acquisition of Protomer Technologies for a sum exceeding USD 1 billion. This strategic acquisition is poised to bolster Eli Lilly's diabetes portfolio and pipeline, incorporating Protomer's cutting-edge technology program centered on glucose-sensing insulin. This program leverages Protomer's proprietary Molecular Engineering of Protein Sensors (MEPS) platform to innovate in the field of diabetes therapeutics.

Q1. What was the Proteins Engineering Market size in 2022?

As per Data Library Research the global proteins engineering market has been estimated to generate revenue amounting to USD 2.1 billion.

Q2. At what CAGR is the Proteins Engineering market projected to grow within the forecast period?

Proteins Engineering market is expected to grow at a Compound Annual Growth Rate (CAGR) of 16.7% over the forecast period.

Q3. What are the factors on which the Proteins Engineering market research is based on?

By Product Type, By Technology, End-User and Geography are the factors on which the Proteins Engineering market research is based.

Q4. Who are the key players in Proteins Engineering market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model