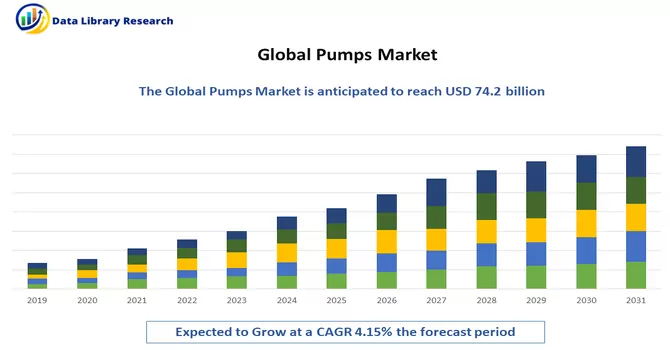

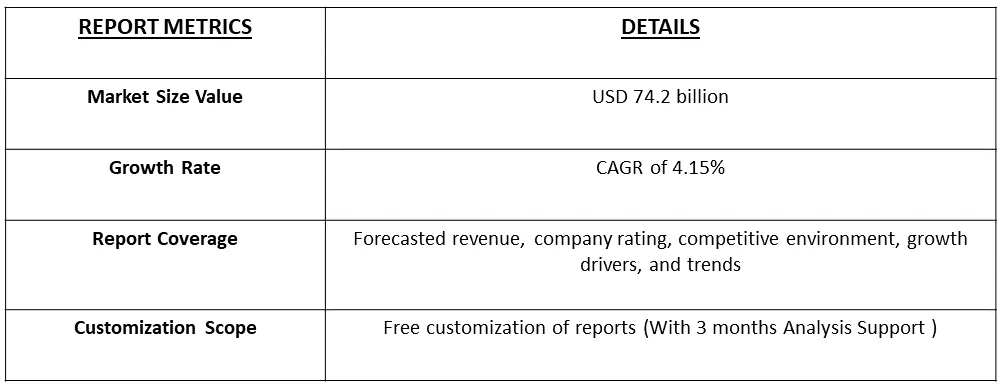

The global pumps market was valued at USD 74.2 billion in 2023 and is expected to register a CAGR of 4.15% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A pumping system is a mechanical arrangement designed to transport fluids, such as liquids or gases, from one location to another. The primary component of a pumping system is a pump, which imparts energy to the fluid and facilitates its movement through pipelines or conduits. Pumps come in various types, including centrifugal pumps, positive displacement pumps, and reciprocating pumps, each suited for specific applications and fluid characteristics. The pumping system typically includes auxiliary components such as valves, pipes, motors, and controls to regulate and manage the flow of the transported fluid. Pumping systems find extensive use in diverse industries, including water supply, wastewater treatment, oil and gas, manufacturing, and agriculture, playing a crucial role in processes ranging from water circulation to chemical processing and beyond. Efficient pumping systems are essential for maintaining fluid flow, ensuring proper distribution, and meeting the operational requirements of various industrial and commercial applications.

The global pump market is propelled by a confluence of dynamic factors that collectively shape its growth trajectory. A primary driver lies in the ongoing wave of industrialization and extensive infrastructure development projects worldwide, fostering a substantial demand for pumps across diverse sectors. The increasing emphasis on efficient water and wastewater management, driven by population growth, urbanization, and environmental concerns, is another pivotal factor steering the market. Within the energy sector, encompassing oil and gas, power generation, and renewable energy, pumps play a critical role in various processes, influencing market dynamics based on sector-specific demands. Technological advancements, including smart pump systems and automation integration, contribute significantly to market growth by enhancing performance and operational efficiency. Additionally, the growing demand for energy-efficient solutions aligns with broader sustainability goals, prompting the adoption of pumps designed to conserve energy and reduce carbon footprints.

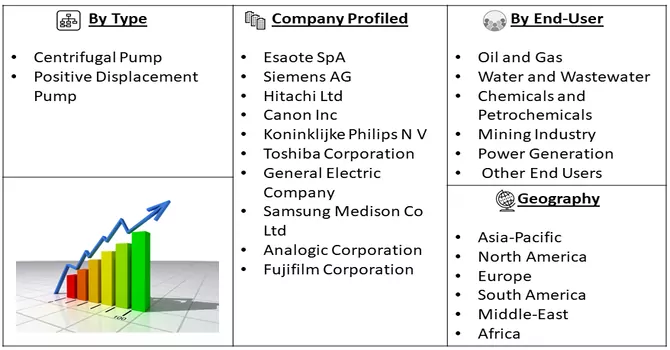

Market Segmentation: The Pumping System Market is Segmented by Type (Centrifugal Pump and Positive Displacement Pump), End User (Oil and Gas, Water and Wastewater, Chemicals and Petrochemicals, Mining Industry, Power Generation, and Other End Users), and Geography (North America, Asia-Pacific, Europe, South America, Middle East, and Africa). The market size and demand forecasts for the pump market in revenue (USD billion) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The global pumping system market is currently characterized by several notable trends that underscore the industry's evolution. A prominent trend is the increasing integration of smart technologies into pumping systems, incorporating sensors, the Internet of Things (IoT), and automation. This shift allows for remote monitoring, predictive maintenance, and real-time data analytics, enhancing operational efficiency. Energy efficiency is a focal point, with manufacturers developing pumps equipped with advanced motor technologies, variable speed drives, and optimized controls to minimize energy consumption and reduce operational costs. Positive displacement pumps are witnessing widespread adoption, particularly in industries requiring precision and versatility in fluid handling, such as chemicals, pharmaceuticals, and food processing. Additionally, regulatory compliance and adherence to environmental standards are influencing product development, as manufacturers strive to provide sustainable and compliant pumping solutions. Together, these trends characterize the dynamic landscape of the pumping system market, reflecting advancements in technology, industry demands, and a broader shift toward sustainable practices.

Market Drivers:

Increasing Emphasis on Energy Efficiency and Sustainability

The escalating focus on energy efficiency and sustainability is driving a surge in the demand for pump solutions that prioritize optimal energy usage. Manufacturers are actively engaged in the development of pumps incorporating cutting-edge motor technologies, variable speed drives, and intelligent control systems. These advancements are specifically designed to curtail energy consumption and operational costs significantly. By integrating sophisticated features, these pumps aim to enhance overall efficiency, offering a more sustainable and economically viable solution for various industries. The emphasis on energy-efficient pump technologies reflects a broader commitment to environmental stewardship and cost-effectiveness in the evolving landscape of fluid handling systems. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Increasing Global Shift Toward Renewable Energy Sources, Such as Solar and Wind Power

The worldwide transition to renewable energy sources, exemplified by the adoption of solar and wind power, has spurred an elevated demand for pumps integral to renewable energy systems. Pumps assume a pivotal role in facilitating fluid circulation and optimizing heat transfer processes within these renewable energy applications. As solar and wind power technologies continue to gain prominence, the demand for pumps that effectively manage and enhance the efficiency of fluid and thermal dynamics within these systems has become more pronounced. This underscores the critical interplay between advanced pump technologies and the broader shift towards sustainable and eco-friendly energy solutions, positioning pumps as fundamental components in the renewable energy landscape. Thus, such factors are expected to drive the growth of the studied market over the forecast period.

Market Restraints:

High Upfront Investment Required for Acquiring and Installing Advanced Pump Systems

The acquisition and installation of advanced pump systems, particularly those integrating state-of-the-art technologies to enhance energy efficiency, entail a substantial upfront investment. The significant initial costs associated with these cutting-edge systems have the potential to serve as a formidable barrier for certain end-users, particularly those operating in industries where capital expenditure is a crucial factor influencing decision-making. The financial commitment required at the outset can be a considerable challenge, deterring some entities from adopting these advanced pump technologies. This obstacle is particularly pronounced in sectors where stringent budget constraints and a focus on minimizing initial capital outlay significantly influence investment decisions. Overcoming this barrier may require innovative financing models, incentives, or clear demonstrations of the long-term cost savings and operational benefits associated with these advanced pump systems.

The global pump market experienced significant disruption during the COVID-19 pandemic, with supply chain challenges, reduced industrial activities, and a downturn in the oil and gas sector. Lockdowns led to delays in project execution and a shift in end-user priorities, impacting capital expenditures on new pumping systems. Essential service industries, like water and wastewater treatment, remained relatively stable, while the healthcare sector saw increased demand for medical pumps. Supply and demand volatility presented challenges, prompting a heightened focus on digital adoption and remote engagement in the pump industry. Companies are resilient to uncertainties and adapted by optimizing digital capabilities, highlighting the enduring impact of the pandemic on industry dynamics. As economies recover, the pump market is expected to rebound gradually, with a reshaped landscape reflecting lasting changes in market conditions.

Segmental Analysis:

Positive Displacement Pump Segment is Expected to Witness Significant Growth Over the Forecast Period

A Positive Displacement (PD) pump is a type of pump that operates by trapping a fixed amount of fluid in a chamber and then forcibly displacing that fluid to increase pressure. Unlike dynamic pumps, such as centrifugal pumps, which impart kinetic energy to the fluid, positive displacement pumps deliver a constant volume of fluid per cycle, regardless of changes in pressure. This design makes PD pumps highly versatile for handling a wide range of fluids, including viscous and abrasive substances. Common types of positive displacement pumps include rotary pumps (such as gear, lobe, and screw pumps) and reciprocating pumps (such as piston and diaphragm pumps).

Positive displacement pumps are known for their accuracy in delivering a consistent flow, making them suitable for applications where precise dosing or high-pressure requirements are essential. These pumps find widespread use in industries such as oil and gas, chemical processing, pharmaceuticals, and food and beverage, showcasing their adaptability to various fluid-handling challenges. Despite their efficiency and reliability, it's crucial to consider factors like proper maintenance and choosing the right type of positive displacement pump for specific applications to ensure optimal performance and longevity. Thus, these factors are expected to drive the growth of the studied market over the forecast period.

Power Generation Segment is Expected to Witness Significant Growth Over the Forecast Period

The synergy between power generation and the pump market is indispensable, with pumps playing a pivotal role in the efficiency and functionality of various aspects within the power generation process. In thermal power plants, pumps are instrumental in circulating cooling fluids, supplying boiler feedwater, and managing condensate extraction, ensuring optimal heat exchange and the continuous generation of electricity. Hydroelectric power plants utilize pumps for pump storage, allowing for the efficient storage and release of energy.

Nuclear power plants heavily rely on pumps for tasks such as cooling reactor cores and handling radioactive fluids. Moreover, pumps are integral to renewable energy systems, participating in processes like circulating heat transfer fluids in solar power plants. The pump market in power generation faces challenges related to energy efficiency and environmental compliance, prompting a shift toward smart technologies for enhanced monitoring and control. The global outlook of the pump market in power generation is influenced by regional energy demands, infrastructure development, and investments in new projects. As the energy landscape evolves with a heightened focus on sustainability, the pump market is poised to witness ongoing advancements to meet the dynamic needs of the power generation sector. Thus, these factors are expected to drive the growth of the studied market over the forecast period.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

In North America, the pump market serves as a cornerstone for diverse industries, playing a vital role in the region's economic landscape. The oil and gas sector, particularly prominent in the United States and Canada, relies heavily on pumps for processes like crude oil extraction and hydraulic fracturing. Additionally, North America places a strong emphasis on efficient water management and wastewater treatment, driving the demand for pumps in water distribution networks and industrial treatment facilities. The manufacturing sector, spanning chemical production to food and beverage manufacturing, benefits significantly from pumps that ensure fluid handling and industrial processes run seamlessly.

The power generation industry, with its varied energy sources, utilizes pumps extensively in applications ranging from cooling systems to renewable energy projects. Infrastructure development projects, including construction and urbanization initiatives, further contribute to the demand for pumps in tasks such as dewatering and material handling. The market trends in North America align with global patterns, focusing on energy efficiency, smart pump technologies, and sustainability. While the region's pump market is competitive with established global players, it reflects a continuous drive for innovation to meet the evolving needs of diverse industries. As North America progresses in its industrial and infrastructure developments, the pump market remains integral to supporting and enhancing various economic sectors across the region. Thus, these factors are expected to witness the growth of the market in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global pump market exhibits a moderate level of fragmentation due to the presence of numerous companies, each vying to enhance its market share through diverse strategic initiatives. Key market players are actively engaged in implementing a range of marketing strategies, including the introduction of new products, substantial investments, strategic partnerships, and mergers and acquisitions. Companies are also allocating resources to robust product development efforts while emphasizing competitive pricing strategies to strengthen their competitive positions. The pursuit of various developmental strategies, such as business expansion initiatives and joint ventures, not only fuels market growth but also presents lucrative opportunities for market players. This competitive landscape underscores the dynamic nature of the pump market, with companies strategically positioning themselves to navigate the evolving industry dynamics and capitalize on emerging market trends. Some of the prominent players in the global pumps market include:

Recent Development:

1) In July 2023, Grundfos Holding A/S successfully completed the acquisition of Metasphere, a prominent provider of smart sewer solutions. This strategic acquisition is poised to significantly enhance Grundfos's product portfolio, particularly within the pumps and hydraulic segment. By incorporating Metasphere's expertise in smart sewer solutions, Grundfos aims to further strengthen its offerings and technological capabilities.

2) In May 2023, KSB SE & Co. KGaA expanded its MegaCPK pumps series by introducing nineteen new sizes. With clients now having the option to choose from a total of 55 sizes and over 78 hydraulic systems, this product extension is expected to be a substantial enhancement to KSB's product mix, particularly catering to the chemical market. The move underscores KSB's commitment to diversifying and optimizing its product range to meet the evolving needs of its clientele.

Q1. What was the Pumps Market size in 2023?

The global pumps market was valued at USD 74.2 billion in 2023.

Q2. At what CAGR is the Pumps Market projected to grow within the forecast period?

Pumps Market is expected to register a CAGR of 4.15% over the forecast period.

Q3. Which region has the largest share of the Pumps Market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Q4. Who are the key players in Pumps Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model