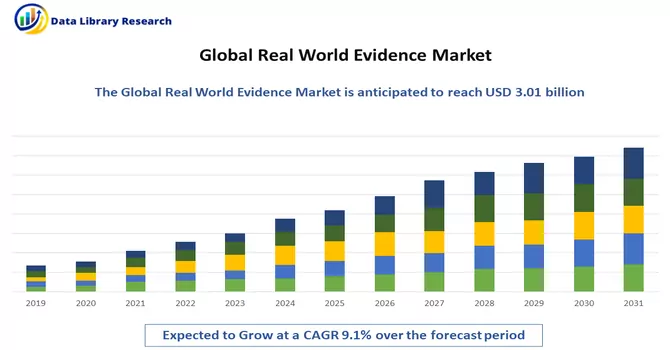

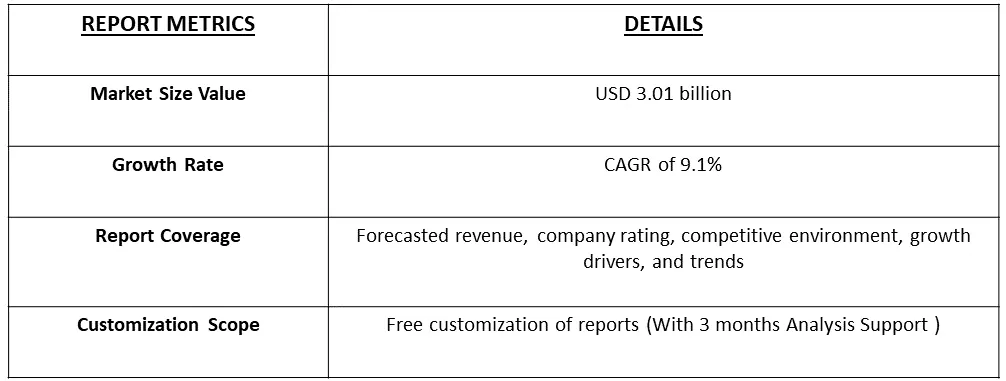

The global real world evidence solutions market size was estimated at USD 3.01 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Real-world evidence (RWE) solutions refer to methodologies and tools that utilize data derived from real-world settings, such as clinical practice, patient experiences, and health outcomes, to generate insights and make informed decisions. In the context of healthcare and pharmaceuticals, real-world evidence solutions leverage data from electronic health records, claims databases, patient registries, wearable devices, and other sources outside the controlled environment of clinical trials. These solutions aim to provide a comprehensive understanding of how medical products, treatments, or interventions perform in everyday clinical practice. RWE is increasingly valuable for healthcare decision-makers, regulators, and stakeholders, offering insights into the effectiveness, safety, and economic impact of healthcare interventions in diverse patient populations. Real-world evidence solutions play a crucial role in complementing traditional clinical trial data, offering a broader perspective on the real-world impact and value of healthcare interventions across various patient demographics and care settings.

The expansion of the market is propelled by a growing need for improved capabilities in Real-World Evidence (RWE) within the life science sector, indicative of a broader market transition from volume-centric to value-based healthcare models. Progressions in data analytics and the utilization of real-world evidence play a pivotal role in bolstering efforts related to regulatory compliance, research initiatives, and the development of solutions within medical device and life sciences enterprises. This shift underscores a strategic alignment with evolving trends in the industry, where the emphasis on value-driven care is becoming increasingly prominent. The integration of advanced data analytics and the leveraging of real-world evidence not only facilitate adherence to regulatory requirements but also contribute significantly to the innovation and enhancement of solutions within the dynamic landscape of medical devices and life sciences.

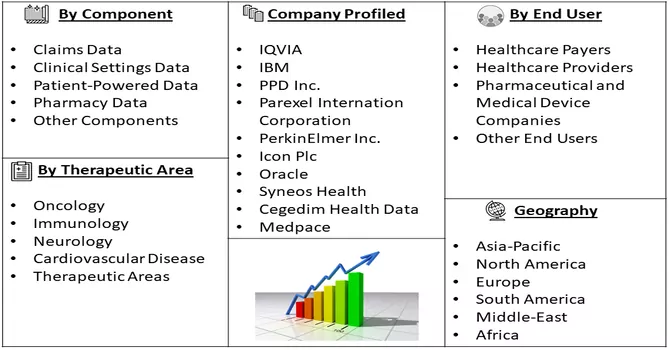

Market Segmentation: The Real-world Evidence Solutions Market is segmented by Component (Claims Data, Clinical Settings Data, Patient-Powered Data, Pharmacy Data, and Other Components), Therapeutic Area (Oncology, Immunology, Neurology, Cardiovascular Disease, Other Therapeutic Areas), End User (Healthcare Payers, Healthcare Providers, Pharmaceutical and Medical Device Companies, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Real-World Evidence (RWE) solution market is experiencing several notable trends that are shaping its trajectory and influencing decision-making in the healthcare and life sciences industries. Firstly, there is a growing emphasis on the integration of diverse data sources to generate comprehensive and holistic insights. The incorporation of electronic health records, claims data, patient registries, and wearable device data allows for a more nuanced understanding of treatment outcomes and patient experiences. Secondly, the market is witnessing increased collaboration between stakeholders, including pharmaceutical companies, healthcare providers, payers, and technology vendors. Collaborative efforts aim to establish data-sharing initiatives, creating a more interconnected healthcare ecosystem and fostering research collaborations that leverage real-world evidence for improved decision-making. Thirdly, advancements in data analytics, artificial intelligence, and machine learning are enhancing the capabilities of RWE solutions. These technologies enable more sophisticated analysis of large datasets, uncovering patterns and trends that can inform clinical research, regulatory decisions, and healthcare policies. Moreover, the demand for RWE solutions is being driven by a shift towards value-based care. Healthcare systems globally are increasingly recognizing the importance of understanding the real-world effectiveness and cost-effectiveness of treatments, aligning with a value-driven approach to patient care. Additionally, regulatory bodies are becoming more receptive to the use of real-world evidence in decision-making processes. The evolving acceptance of RWE by regulatory authorities is encouraging industry players to invest in developing robust methodologies and ensuring data quality and reliability. Thus the market trends in Real-World Evidence solutions underscore a movement towards a more collaborative, data-driven, and value-focused healthcare landscape, driven by advancements in technology, changing regulatory perspectives, and the growing recognition of the significance of real-world evidence in healthcare decision-making.

Market Drivers:

Shift From Volume- to Value-based Care

The shift from volume- to value-based care represents a transformative approach in the healthcare industry, emphasizing the quality and outcomes of patient care over the quantity of services provided. Historically, healthcare reimbursement models were predominantly fee-for-service, rewarding healthcare providers based on the number of services and procedures delivered. However, this approach often led to fragmented care, unnecessary procedures, and escalating healthcare costs. In contrast, value-based care focuses on improving patient outcomes, enhancing patient experience, and controlling costs. Under this model, healthcare providers are incentivized to deliver high-quality, efficient care that leads to better health outcomes for patients. Value-based care often involves coordinated and patient-centered care delivery, preventive measures, and the use of healthcare data and technology to drive informed decision-making. Key components of the shift to value-based care include alternative payment models (APMs) such as accountable care organizations (ACOs), bundled payments, and pay-for-performance initiatives. ACOs, for example, encourage collaboration among healthcare providers to deliver coordinated care for a defined patient population, with financial incentives tied to achieving cost savings and quality improvement goals.

Furthermore, the recent development are expected to contribute to the studied market’s growth. For instance, in September 2023, Walgreens and Pearl Health have unveiled a strategic partnership aimed at expediting the growth of value-based care through collaboration with community-based primary care physicians. Leveraging Pearl Health's technology and insight solutions, clinical teams can deliver comprehensive, personalized treatments essential for value-based and quality-focused care. In conjunction with these capabilities, Walgreens will contribute complementary services encompassing prescription fulfillment, medication adherence programs, immunizations, care gap closure, and diagnostic testing. Additionally, Walgreens will collaborate with healthcare providers to facilitate the smooth transition of patients from hospital discharge to home care. This partnership reflects a concerted effort to enhance the delivery of value-based care by integrating technology, personalized treatments, and a range of support services to benefit patients and community-based primary care physicians alike. Thus, such developments are expected to fuel the growth of the studied market over the forecast period.

Advancements in Data Analytics and Real-World Evidence (RWE)

Advancements in data analytics and real-world evidence (RWE) are revolutionizing the landscape of healthcare and life sciences, ushering in an era of informed decision-making and evidence-based practices. Data analytics, powered by sophisticated algorithms and machine learning, has enabled the processing and analysis of vast datasets at unprecedented speeds, uncovering meaningful patterns and insights. This transformative capability has significant implications for healthcare, as it allows for a deeper understanding of patient populations, disease trends, and treatment outcomes. In parallel, the integration of real-world evidence has become increasingly integral to healthcare decision-making. RWE encompasses data derived from diverse sources such as electronic health records, claims databases, patient registries, and wearable devices, providing a comprehensive view of patient experiences and treatment outcomes in real-world settings. This contrasts with traditional clinical trial data, offering insights into how treatments perform in everyday clinical practice.

Furthermore in August 2023, Target RWE, a leader in real-world evidence (RWE), has unveiled its innovative suite of advanced analytical solutions, as announced today. These cutting-edge solutions, crafted to identify unmet needs and address pivotal strategic inquiries throughout the pharmaceutical product life cycle, employ groundbreaking epidemiological methods and robust statistical principles for data visualization and analysis. In response to the growing demand for enhanced RWE capabilities, Target RWE has introduced its proprietary analytical platform to drive its Syndicated Science Insights (SSI) solutions. These solutions, designed to tackle research hypotheses, are indifferent to the data source type, allowing the utilization of claims, electronic health records data, and other interconnected data sources. Each solution encompasses substantial scientific content and interactive data visualizations, facilitating on-the-fly stratification analyses such as tracking disease progression in specific patient cohorts. Furthermore, all content is adaptable, permitting updates, edits, and revisions to accommodate evolving study questions, additional data, and changing healthcare guidance over time. Thus, such developments are fuelling the studied market’s growth.

Market Restraints:

Unwillingness to Rely on Real-world Studies

The reluctance to depend on real-world studies could pose a hindrance to the accelerated growth of the real-world evidence (RWE) solution market. Despite the increasing recognition of the value that real-world evidence brings to healthcare decision-making, there exists a cautious approach among some stakeholders who may still prioritize traditional clinical trial data. This unwillingness to fully embrace real-world studies may be rooted in concerns about data quality, standardization, and regulatory acceptance. Additionally, the historical reliance on controlled clinical trials as the gold standard for evidence may contribute to a hesitancy to fully leverage the potential of real-world evidence solutions. Overcoming this reluctance requires concerted efforts to address concerns related to data integrity, privacy, and the development of standardized methodologies for real-world evidence generation. As the industry navigates towards a more evidence-driven and patient-centric healthcare paradigm, fostering trust and confidence in the reliability of real-world evidence will be crucial for unlocking the full potential of the RWE solution market.

The COVID-19 pandemic has significantly impacted the real-world evidence (RWE) solution market, amplifying the importance of leveraging real-world data for timely insights and decision-making. The urgency of the health crisis prompted a shift in research focus towards COVID-19-related studies, where RWE played a crucial role in assessing treatment effectiveness and vaccine outcomes. The pandemic accelerated the digital transformation in healthcare, driving the adoption of innovative data collection methods compatible with remote and decentralized clinical trials. However, challenges emerged in traditional data collection due to lockdowns and changes in patient behavior. Despite these challenges, increased regulatory recognition of RWE's value led to more flexible approval processes. The lessons learned during the pandemic are anticipated to have a lasting impact on healthcare practices, fostering a continued reliance on RWE solutions for population health insights and treatment outcomes in the post-pandemic era.

Segmental Analysis:

Claims Data Segment is Expected to Witness Significant Growth Over the Forecast Period

Claims data plays a pivotal role in the realm of real-world evidence (RWE) solutions, serving as a valuable source of information for understanding healthcare patterns, treatment outcomes, and patient experiences in real-world settings. Real-world evidence derived from claims data offers a comprehensive view of patient journeys, encompassing data on diagnoses, treatments, procedures, and healthcare utilization. This data, sourced from insurance claims, electronic health records, and other administrative databases, enables researchers and healthcare stakeholders to analyze large, diverse patient populations and draw insights into the effectiveness, safety, and economic impact of medical interventions. Claims data in the context of RWE solutions provides a longitudinal perspective, tracking patient outcomes over time and allowing for the assessment of long-term effects and real-world treatment patterns. This information is particularly valuable for evaluating the effectiveness of therapies in routine clinical practice beyond the controlled environment of clinical trials. Moreover, the integration of claims data into RWE solutions facilitates the exploration of healthcare disparities, comparative effectiveness research, and the identification of unmet medical needs. Researchers can leverage claims data to analyze variations in treatment outcomes across different demographic groups, geographical regions, and healthcare settings.

Oncology Segment is Expected to Witness Significant Growth Over the Forecast Period

Oncology stands at the forefront of the evolving landscape of real-world evidence (RWE) solutions, where the integration of real-world data (RWD) plays a crucial role in understanding, treating, and improving outcomes for cancer patients. Real-world evidence in oncology draws from a diverse array of sources, including electronic health records, claims data, patient registries, and molecular profiling data. One of the key strengths of RWE in oncology lies in its ability to capture the complexity and heterogeneity of cancer care in real-world settings, beyond the controlled environments of clinical trials. In the oncology field, RWE is instrumental in assessing the effectiveness and safety of cancer treatments in diverse patient populations, including those underrepresented in clinical trials. It provides insights into treatment patterns, disease progression, and patient outcomes over extended periods, offering a more comprehensive understanding of the real-world impact of oncological interventions. Moreover, RWE is increasingly being utilized to inform regulatory decisions and health policy in oncology. Regulatory bodies recognize the importance of supplementing traditional clinical trial data with real-world evidence to make more informed decisions about cancer therapies. This shift reflects a growing appreciation for the practical insights that real-world evidence provides, contributing to a more holistic and patient-centric approach to oncology research and treatment.

Pharmaceutical & Medical Device Companies Segment is Expected to Witness Significant Growth Over the Forecast Period

Pharmaceutical and medical device companies are embracing the transformative power of real-world evidence (RWE) solutions to enhance their research, development, and decision-making processes. Recognizing the limitations of traditional clinical trial data, these industries are leveraging RWE to gain a more comprehensive understanding of the real-world performance, safety, and effectiveness of drugs and medical devices. In drug development, RWE is optimizing trial designs and informing strategies by uncovering insights into patient characteristics, treatment patterns, and adherence in diverse real-world settings. Similarly, medical device companies are utilizing RWE to demonstrate the practical impact and value of their products, evaluating safety, effectiveness, and comparative outcomes. Collaborations between these industries and RWE solution providers are on the rise, aiming to extract meaningful insights from extensive real-world data. While RWE contributes to a more patient-centric and evidence-driven approach, addressing challenges related to data quality, standardization, and regulatory acceptance remains essential for unlocking the full potential of real-world evidence solutions in the pharmaceutical and medical device sectors.

North America Region is Expected to Witness Significant Growth over the Forecast Period

The North American region is experiencing substantial market growth driven by several factors. A favorable regulatory environment, a robust presence of real-world evidence (RWE) service providers, and the well-established pharmaceutical industry in the region, coupled with high research and development (R&D) expenditure, contribute to this growth. A notable collaboration between the US Food and Drug Administration and Aetion in May 2020 highlights the region's commitment to leveraging real-world data to understand and respond to health challenges like COVID-19. The increasing incidence of cancer cases in the United States, expected to rise significantly by 2040, presents opportunities for market players, prompting intensified research and development efforts to introduce innovative therapies. The utilization of real-world data from drug development to value-based care offers a substantial opportunity to enhance patient outcomes and inform critical healthcare decisions. Furthermore, the extensive healthcare data depository in Alberta positions the region as a global leader in real-world evidence generation, as evidenced by the establishment of the Alberta RWE Consortium in May 2021. These factors collectively underscore the North American region's potential for driving market growth in the foreseeable future.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global market for real-world evidence solutions exhibits a high level of competitiveness and fragmentation, as market players employ a variety of strategic initiatives to gain a competitive edge. These strategies include continuous product development and launches to stay at the forefront of innovation, expansion of distribution networks to enhance market reach, and the global footprint enhancement through the establishment of subsidiaries and strategic partnerships. The competitive landscape is marked by dynamic efforts from industry participants to strengthen their market presence and cater to the evolving demands of the healthcare and life sciences sectors. The fragmented nature of the market encourages players to actively engage in strategic moves, fostering a dynamic environment characterized by ongoing developments and collaborations to assert their positions in this rapidly evolving landscape. Key Real World Evidence Solutions Companies:

Recent Developments:

1) In January 2024, Caris Life Sciences® (Caris), a forefront AI TechBio company specializing in precision medicine, and Flatiron Health, a prominent healthtech company at the forefront of transforming evidence generation in healthcare, have announced a strategic partnership. This collaboration aims to establish a multimodal data offering that supports and expedites biopharmaceutical drug development and enhances patient care. By combining Caris' extensive genomic, transcriptomic, and imaging database with Flatiron's renowned longitudinal patient data and high-quality clinical outcomes, supported by profound scientific expertise, the partnership provides cancer researchers with a robust and comprehensive real-world data (RWD) offering at a significant scale. This collaboration is poised to empower the next phase of advancements in cancer therapeutics by offering an unparalleled depth of insights derived from diverse sources in the healthcare landscape.

2) In September 2023, Atropos Health, a trailblazer in evidence-based healthcare renowned for its Green Button Clinical Informatics Consult Service, has announced a collaboration with Janssen Research & Development, LLC (Janssen), a subsidiary of Johnson & Johnson. This partnership aims to expedite clinical development through the analysis of real-world data. Building on their existing collaboration, Atropos and Janssen data scientists will leverage Atropos's software platform to analyze Janssen's proprietary real-world data sets. The insights derived from this collaboration will be instrumental in shaping clinical development strategies, optimizing trial designs, understanding patient natural histories, and evaluating outcomes in real-world patient populations across a diverse range of therapeutic areas. This agreement signifies a concerted effort to harness the power of real-world data analysis to enhance clinical development processes and advance healthcare research.

Q1. What was the Real World Evidence Market size in 2023?

As per Data Library Research the global real world evidence solutions market size was estimated at USD 3.01 billion in 2023.

Q2. At what CAGR is the Real World Evidence market projected to grow within the forecast period?

Real World Evidence Market is expected to grow at a compound annual growth rate (CAGR) of 9.1% over the forecast period.

Q3. What are the factors driving the Real World Evidence market?

Key factors that are driving the growth include the Shift From Volume- to Value-based Care and Advancements in Data Analytics and Real-World Evidence (RWE)

Q4. Which Region is expected to hold the highest Market share?

North American region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model