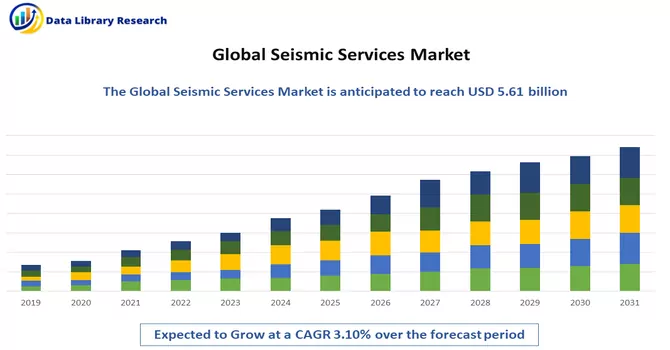

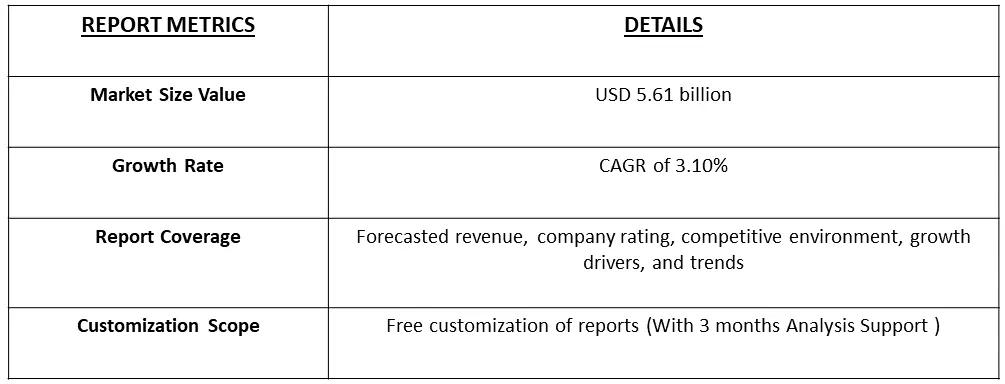

The Seismic Services Market size is estimated at USD 5.61 billion in 2024 and is expected to reach USD 6.54 billion by 2029, growing at a CAGR of 3.10% during the forecast period (2024-2031).

Get Complete Analysis Of The Report - Download Free Sample PDF

Seismic services encompass a range of geophysical techniques used to study and analyze the Earth's subsurface structure. These services involve the generation of controlled seismic waves, typically through the use of vibrators or explosives, and the measurement of their reflections to create detailed images of the subsurface. Primarily employed in the oil and gas industry for exploration and reservoir characterization, seismic services aid in identifying potential hydrocarbon reserves by mapping geological formations and structures beneath the Earth's surface. The data acquired through seismic surveys are crucial for making informed decisions in energy exploration, reservoir management, and geological research, providing valuable insights into the composition and properties of subsurface layers. Additionally, seismic services find applications in civil engineering, environmental studies, and natural resource exploration, contributing to a comprehensive understanding of subsurface conditions.

The Seismic Services Market is propelled by a confluence of factors, including the persistent rise in global energy demand and population growth, necessitating increased exploration for oil and gas reserves. Technological advancements in seismic imaging techniques play a pivotal role, providing accurate subsurface mapping and enhancing reservoir characterization. The growing focus on unconventional resources, stringent regulatory requirements, and environmental concerns further drive the demand for precise seismic services. Investments in infrastructure development, emerging offshore exploration opportunities, and the liberalization of oil and gas markets contribute to the market's expansion. Additionally, the integration of big data analytics and artificial intelligence in seismic data interpretation enhances the efficiency and accuracy of analysis, fostering the adoption of advanced seismic services. Companies in the market leverage these factors to mitigate exploration risks, optimize asset development, and stay competitive in the dynamic landscape of oil and gas exploration.

The Seismic Services Market is witnessing dynamic trends, exemplified by strategic collaborations and technological advancements. Notably, in August 2022, Schlumberger and Microsoft forged a multi-year agreement to develop cloud-native data products for the energy sector, focusing on creating the first-of-its-kind DELFI Seismic Processing solution using the OSDU Data Platform. This move reflects a broader industry shift towards open and extensible cloud-native solutions. Furthermore, the collaborative pre-funding effort by TGS, PGS, and Schlumberger for a large-scale 3D seismic survey off Malaysia signifies a growing emphasis on multi-client initiatives. The market is also influenced by significant discoveries, such as ADNOC's announcement in February 2022 of a substantial gas find in Abu Dhabi's offshore area. Overall, the Seismic Services Market is characterized by a convergence of technological innovation, strategic partnerships, and a heightened focus on efficient exploration methods, signalling a trajectory marked by collaboration, data-driven solutions, and global exploration endeavours.

Market Segmentation: The Seismic Services Market is Segmented by Service (Data Acquisition and Data Processing and Interpretation), Location of Deployment (Onshore and Offshore), and Geography (North America, Europe, Asia-Pacific, South America, and Middle-East and Africa). The report offers the market size and forecasts for non-stick coatings in revenue (USD) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Exploration in Offshore Areas

The seismic services market is experiencing a notable surge in demand due to increasing exploration activities in offshore areas. As global energy demand continues to rise, exploration efforts have expanded to offshore regions, which often present significant untapped reserves. Offshore exploration poses unique challenges, including deeper waters and complex geological structures, necessitating advanced seismic technologies for accurate subsurface mapping. This has led to a growing reliance on seismic services to mitigate exploration risks and optimize resource extraction. Technological advancements in seismic imaging and data processing have enhanced the industry's capability to address the complexities of offshore exploration. The development of high-resolution, cloud-native seismic solutions allows for precise characterization of subsurface structures, enabling efficient decision-making in the identification of potential oil and gas reserves. Major players in the seismic services market are strategically positioned to capitalize on the increasing demand for offshore exploration, offering comprehensive solutions that encompass data acquisition, processing, and interpretation. Moreover, the shift towards environmentally sustainable practices in the oil and gas sector further underscores the importance of accurate seismic data in minimizing ecological impact. As offshore exploration gains prominence, the seismic services market is poised for continued growth, driven by the imperative to unlock and optimize hydrocarbon resources beneath the ocean floor to meet the world's escalating energy needs.

The Strengthening of Crude Oil Prices, Making the Upstream Activities Economically Feasible

The recent strengthening of crude oil prices has significantly impacted the economic feasibility of upstream activities, consequently influencing the seismic services market. As crude oil prices rise, exploration and production activities become more economically viable for oil and gas companies. This, in turn, propels the demand for seismic services, as companies seek advanced technologies to conduct thorough subsurface assessments, enhance reservoir characterization, and optimize drilling strategies. The correlation between crude oil prices and the financial viability of upstream operations amplifies the importance of seismic services in mitigating exploration risks and maximizing the recovery of hydrocarbon resources. The seismic services market is poised to benefit from this trend, with increased investments in cutting-edge technologies and comprehensive solutions to meet the growing needs of the oil and gas industry in a market environment characterized by heightened exploration and production activities.

Market Restraints:

Shifting to Renewable Energy Sources

The transition towards renewable energy sources has the potential to exert a moderating influence on the growth of the seismic services market. As the world increasingly embraces cleaner and sustainable energy alternatives, there is a gradual shift away from traditional fossil fuels towards renewable sources such as solar, wind, and hydropower. This transition can impact the demand for seismic services, particularly in the oil and gas sector, as exploration and extraction activities may witness a slowdown. Renewable energy projects typically do not require the same level of subsurface mapping and exploration as traditional oil and gas endeavors, where seismic services play a crucial role in identifying and characterizing reservoirs. Consequently, reduced reliance on fossil fuels may lead to a decrease in exploration budgets and a shift in investment priorities away from traditional hydrocarbon exploration techniques. However, it's essential to note that the seismic services market has shown adaptability and resilience in the face of changing industry dynamics. The industry has the potential to pivot towards supporting geothermal projects, carbon capture and storage initiatives, and other environmentally friendly applications. The extent of the impact on the seismic services market will depend on the pace and scale of the global transition to renewable energy sources, as well as the industry's ability to diversify its services to align with emerging market demands.

The Seismic Services Market experienced significant disruptions due to the COVID-19 pandemic, with the global economic downturn impacting exploration and production activities in the oil and gas industry. The widespread travel restrictions, lockdowns, and reduced workforce availability led to project delays and cancellations, affecting seismic survey operations. Uncertainties surrounding energy demand and volatile oil prices further intensified the challenges faced by the industry. Despite these setbacks, the pandemic also accelerated digital transformation efforts within the sector, with increased emphasis on remote sensing technologies and data analytics to enhance operational efficiency. The market has shown resilience as the industry adapts to the new normal, emphasizing a more agile and technology-driven approach to seismic services.

Segmental Analysis:

Data Processing and Interpretation Segment is Expected to Witness Significant Growth Over the Forecast Period

Data processing and interpretation play pivotal roles in the seismic services market, serving as critical components in transforming raw seismic data into valuable insights for the oil and gas industry. The seismic data collected during exploration efforts undergoes intricate processing to enhance its quality, reduce noise, and create accurate representations of subsurface structures. Advanced data processing techniques, often involving high-performance computing and sophisticated algorithms, contribute to the production of detailed seismic images that aid in identifying potential hydrocarbon reservoirs. Interpretation of processed seismic data is a key phase where geoscientists and engineers analyze the subsurface characteristics to make informed decisions about reservoir size, composition, and overall viability for extraction. This process is crucial for optimizing well placement, estimating reserves, and mitigating exploration risks. With the evolution of technology, artificial intelligence and machine learning algorithms are increasingly integrated into data interpretation workflows, enhancing efficiency and accuracy. The seismic services market is witnessing a transformation driven by advancements in data processing and interpretation technologies. Cloud-native solutions, coupled with real-time processing capabilities, enable faster decision-making, reducing exploration timelines and costs. Additionally, the integration of geophysical data with reservoir engineering data enhances the comprehensive understanding of subsurface conditions. As the industry faces challenges such as the transition to renewable energy sources, the seismic services market adapts by expanding its role beyond traditional oil and gas applications. Diversification into environmental monitoring, carbon capture and storage projects, and geothermal exploration highlights the versatility of data processing and interpretation services in addressing evolving market needs. The seismic services market's future growth is intricately tied to its ability to leverage cutting-edge technologies for more accurate and efficient processing and interpretation of seismic data across various applications.

OnShore Segment is Expected to Witness Significant Growth Over the Forecast Period

Onshore seismic services play a pivotal role in the exploration and production activities within the seismic services market. Unlike offshore exploration, onshore projects involve subsurface mapping in areas located on land. The demand for onshore seismic services is influenced by several factors, including the continuous need to discover and extract hydrocarbon resources, geological complexity, and technological advancements. One key advantage of onshore seismic exploration is the relatively lower cost compared to offshore operations. The accessibility of onshore locations facilitates cost-effective data acquisition, making it an attractive option for companies, especially in regions with known petroleum reserves. Additionally, onshore seismic services are often used in unconventional resource plays, such as shale gas and tight oil, where accurate subsurface mapping is crucial for optimizing extraction techniques. The seismic services market for onshore projects encompasses a range of services, including data acquisition, processing, and interpretation. Advanced technologies, such as 3D seismic imaging and real-time processing, enhance the accuracy and efficiency of onshore exploration, providing valuable insights into subsurface structures and reservoir characteristics. As the energy landscape evolves with a growing emphasis on environmental sustainability, onshore seismic services are adapting to support not only traditional oil and gas exploration but also emerging sectors like geothermal energy and carbon capture and storage. The versatility of onshore seismic services positions the market to play a crucial role in the broader energy transition, showcasing the adaptability of these services in addressing evolving industry needs beyond conventional hydrocarbon exploration.

Middle East and Africa Segment is Expected to Witness Significant Growth Over the Forecast Period

The offshore seismic survey stands out as a cost-effective method for mapping oil and gas deposits, employing multiple seismic sources to collect data on subsurface structures, refraction, and reflection. The Middle East and Africa region are witnessing a surge in offshore exploration, particularly in offshore West Africa, offering substantial untapped resources and creating opportunities for oil and gas exploration companies. The heightened exploration activities in this region are anticipated to be a significant driver for the seismic services market. A notable instance is Shell PLC's substantial oil and gas discovery in the Graff-1 well offshore Namibia in January 2022. The drilling results indicate a considerable hydrocarbon reservoir, estimated to contain 250 to 300 million barrels of oil and gas equivalent. The expected production commencement by 2026, following comprehensive development, including seismic surveys, is poised to stimulate market growth. Moreover, Australian geoscience company Searcher initiated a seismic survey off the West Coast of South Africa in January 2022. Covering multiple petroleum license blocks in an expansive permit area, the survey program, including two-dimensional and three-dimensional speculative seismic surveys, is likely to contribute to the market's expansion in the region. The confluence of new oil and gas discoveries, alongside approvals for seismic testing, is expected to propel the seismic services market in the Middle East and Africa region throughout the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The seismic services market is characterized by a high level of concentration, primarily attributed to significant entry barriers, substantial capital requirements, and the need for specialized technological expertise. Established players with a global presence, extensive infrastructure, and a history of research and development investments dominate the industry. Long-term contracts, compliance with complex regulatory environments, and a track record of effectively managing inherent exploration risks further contribute to the market concentration. These key factors collectively establish a competitive landscape where a few major companies hold significant market share, emphasizing their technological prowess, experience, and ability to offer integrated solutions as key drivers of industry dominance. Some of the key market players working in this market are:

Recent Development:

1) In August 2022, Schlumberger and Microsoft inked a multi-year pact, combining their expertise to develop open and extensible cloud-native data products tailored for the energy industry. The upcoming phase focuses on utilizing the OSDU Data Platform's openness and agility to create the first-ever cloud-native seismic processing solution called DELFI Seismic Processing. Through leveraging the OSDU Data Platform, the partnership aims to establish a cost-effective foundation for innovative applications and workflows addressing current seismic requirements. The collaborative effort extends to third-party developers who will have the opportunity to build and enhance seismic processing solutions, either for internal utilization or for market offerings.

2) In May 2023, TGS, in collaboration with PGS and Schlumberger, secured pre-funding for an extensive 6,885 square kilometer multi-client 3D seismic survey off the coast of Malaysia in the North Luconia Province of the Sarawak Basin.

3) In February 2022, Abu Dhabi's state-owned oil and gas company ADNOC announced a significant discovery of 1.5 to 2 trillion standard cubic feet of gas in an offshore area situated in the Emirate's Northwest.

Q1. How big is the Seismic Services Market?

The Seismic Services Market size is estimated at USD 5.61 billion in 2024 and is expected to reach USD 6.54 billion by 2029.

Q2. At what CAGR is the Seismic Services market projected to grow within the forecast period?

Seismic Services market is growing at a CAGR of 3.10% during the forecast period.

Q3. What segments are covered in the Seismic Services market Report?

By Service, By Location and Deployment and Geography these segments are covered in the Seismic Services market Report.

Q4. What are the factors driving the Seismic Services market?

Key factors that are driving the growth include the Increasing Exploration in Offshore Areas and The Strengthening of Crude Oil Prices, Making the Upstream Activities Economically Feasible.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model