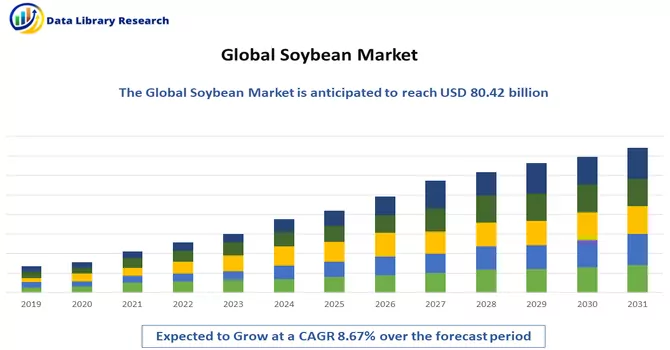

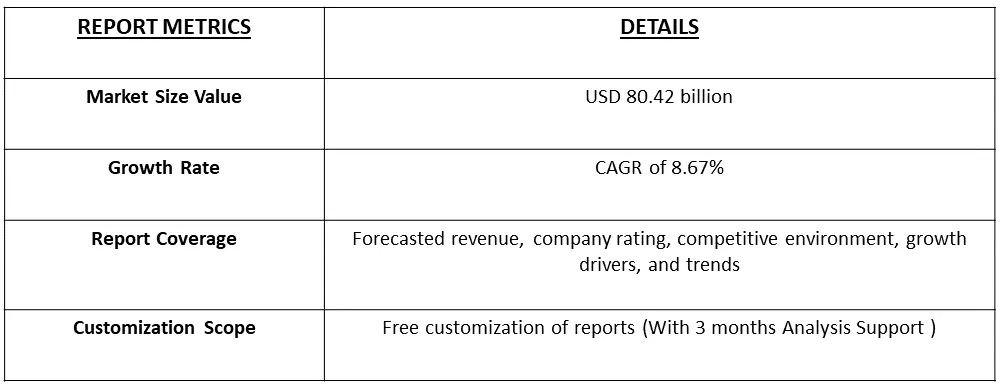

The soybean processing market was valued at USD 80.42 billion in 2023 and registered a CAGR of 8.67% during the forecast period of 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Soybeans are a versatile and nutritious legume that is highly valued for its protein and oil content. Originally cultivated in East Asia, soybeans are now grown extensively around the world due to their importance as a food and industrial crop. One of the key features of soybeans is their high protein content, making them an essential source of plant-based protein for human consumption. Soybeans are a staple ingredient in many vegetarian and vegan diets, providing a valuable source of essential amino acids. Soybeans are also rich in oil, which is extracted and used for cooking and in a wide range of industrial applications. Soybean oil is a popular choice due to its neutral flavor, high smoke point, and nutritional benefits. It is commonly used in food products, such as salad dressings, margarine, and mayonnaise, as well as in industrial applications like biodiesel production and as a lubricant. In addition to their culinary uses, soybeans are also used as animal feed, particularly in the livestock industry. The high protein content of soybeans makes them an ideal feed ingredient for livestock, helping to support healthy growth and development. Thus soybeans play a crucial role in global agriculture and food production, providing a valuable source of protein, oil, and other nutrients for both human and animal consumption.

The soybean market is witnessing several key trends driving its growth. There is a rising demand for plant-based protein, leading to increased consumption of soybeans and soy products. Additionally, the expansion of the livestock industry is fueling demand for soybean meal as animal feed. Soybeans are also increasingly used in food products such as tofu, soy milk, and meat substitutes, especially in regions like Asia Pacific and North America. The popularity of soybean oil is also on the rise due to its use in cooking and food processing. Technological advancements in farming practices, including precision farming and GM soybean varieties, are boosting soybean yields and production efficiency. Moreover, the growing awareness of the health benefits of soybeans, such as their high protein content and potential cholesterol-lowering effects, is driving consumer demand for soy-based products. Overall, these trends indicate a positive outlook for the soybean market, with increasing demand from various industries and regions expected to drive growth in the foreseeable future.

Market Segmentation: The Global Soybean Processing Market, By Product (Whole Soybean, Meal, Oil, Others), Application (Animal Feed, Aqua Feed, Biofuel, Food and Beverages, Personal Care, Dietary Supplements, Pharmaceuticals, Lubricants, Coatings, Paints, Industrial Solvents, Adhesives and Sealants, Hydraulic Fluids, Building Materials, Others) and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Growing demand of soybean by-product

The demand for soybean by-products, including soybean meal and oil cakes, has increased significantly in recent years. This growth can be attributed to the high nutritional value of these products, which has boosted their popularity among consumers. Additionally, the rising disposable income of consumers in urbanized nations has contributed to the increased demand for soybean by-products. Countries with enhanced soybean productivity, particularly in urbanized regions, have witnessed a surge in demand for soybean by-products. For example, in the United States, soybean oil production reached 11.3 million tons in 2020, up from 9.9 million tons in 2016. This increase in production is driven by the growing demand for soybean oil in various industries, including food manufacturing. The demand for soybean oil in the U.S. has led to the development of various commodities, further driving the growth of the soybean processing market. This trend is expected to continue during the forecast period, with increasing demand for soybean by-products driving growth in the soybean processing industry.

Increasing usage of soybeans in the food sector

Soybeans are a versatile and nutritious ingredient used in various food products due to their numerous health benefits and functional properties. In the food sector, soybeans are commonly used as condiments in salads and for cooking purposes, adding flavor and texture to dishes. One of the key advantages of soybeans is their role as a healthy substitute for foods high in fat and cholesterol. Soybeans are rich in protein and contain unsaturated fats, which are beneficial for heart health. They are also a good source of fiber, vitamins, and minerals, making them a nutritious addition to a balanced diet. Soybeans are particularly popular as a dairy substitute for individuals who are lactose intolerant or following a vegan diet. Soy milk, made from soybeans, is a common alternative to cow's milk and is used in various dairy-free products such as non-dairy creamers, whipped toppings, and mayonnaise. In addition to their nutritional benefits, soybeans are valued for their functional properties in food processing. Soybean oil, extracted from soybeans, is widely used in the food industry for its neutral flavor and high smoke point, making it suitable for frying and baking. Soybean protein is also used as a texturizing agent in meat analogs and other vegetarian products. Thus, the high usage of soybeans in the food sector is driven by their nutritional benefits, versatility, and functional properties, making them a valuable ingredient in a wide range of food products.

Market Restraints:

Issues associated with the soybean processing market

Regulations regarding genetically modified soybeans and concerns related to lecithin allergy from soy derivatives are expected to hinder the growth of the soybean processing market. Genetically modified soybeans are a common source of soy derivatives, and regulations surrounding their use can impact the market. Additionally, issues related to lecithin allergy, which can arise from consuming soy derivatives, are a concern for some consumers and may limit market growth. Furthermore, there are increasing concerns about the environmental impact of soybean cultivation, particularly in the Amazon region, where soybean cultivation has been linked to deforestation. These concerns are likely to pose challenges to the soybean processing market, as consumers and regulatory bodies increasingly prioritize sustainable and environmentally friendly practices. Despite these challenges, the soybean processing market offers various opportunities for growth. The report mentioned provides detailed insights into recent developments, trade regulations, import-export analysis, production analysis, and value chain optimization. It also covers market share, the impact of domestic and localized market players, and analyzes opportunities in terms of emerging revenue pockets. Additionally, the report discusses changes in market regulations, strategic market growth analysis, market size, category market growths, application niches, and dominance. It also includes information on product approvals, product launches, geographic expansions, and technological innovations in the market.

The COVID-19 pandemic has had a significant impact on the soybean market, both in terms of production and demand. The pandemic led to disruptions in the global supply chain, affecting the planting, harvesting, and transportation of soybeans. Lockdowns and restrictions imposed to curb the spread of the virus resulted in labor shortages and logistical challenges, impacting the production and distribution of soybeans. On the demand side, the pandemic led to changes in consumer behavior and preferences. With many people staying at home and cooking more meals, there was an increased demand for soy products used in home cooking. However, the closure of restaurants and food service establishments led to a decline in demand for soy products used in the food service industry. The pandemic also affected the soybean market indirectly through its impact on the livestock industry. As the pandemic led to disruptions in meat processing facilities and changes in consumer demand for meat products, there were fluctuations in the demand for soybean meal, which is used as animal feed. Thus, while the soybean market experienced some disruptions and challenges due to the COVID-19 pandemic, it also saw some opportunities, particularly in the consumer food sector. As the world continues to recover from the pandemic, the soybean market is expected to gradually stabilize and resume its growth trajectory.

Segmental Analysis:

Whole Soybean Segment is Expected to Witness Significant Growth Over the Forecast Period

Whole soybeans are a highly versatile ingredient with a wide range of uses across industries. In the food sector, they are utilized in various forms, including cooked whole beans, soy flour, and fermented products like tempeh and natto. These beans are a rich source of protein and are often included in vegetarian and vegan diets as a meat substitute. In agriculture, whole soybeans are a valuable component of livestock feed, providing essential nutrients for poultry, swine, and cattle. Soybeans are also used in pet foods due to their high protein content. Soybean oil, extracted from whole soybeans, has numerous industrial applications. It is a key ingredient in biodiesel production, serving as a renewable and environmentally friendly alternative to traditional diesel fuel. Soybean oil is also used in the production of cosmetics, paints, inks, and lubricants due to its versatile nature and beneficial properties. Furthermore, soybean meal, a byproduct of soybean processing, is utilized as a soil amendment and fertilizer, contributing to soil health and plant growth. Overall, the diverse uses of whole soybeans underscore their importance in various industries, highlighting their value as a sustainable and multifunctional crop.

Aqua Feed Segment is Expected to Witness Significant Growth Over the Forecast Period

Aqua feed soybeans are a specialized type of soybean used in the production of feed for aquatic animals, particularly fish and shrimp. These soybeans are processed and formulated into aquafeed pellets, providing a balanced and nutritious diet for aquatic species in aquaculture operations. Aqua feed soybeans are valued for their high protein content, which is essential for the growth and development of fish and shrimp. They also contain essential amino acids, vitamins, and minerals necessary for the health and vitality of aquatic animals. The use of aqua feed soybeans in aquaculture helps to promote sustainable and environmentally friendly practices. By providing a high-quality diet, aqua feed soybeans support the efficient growth of aquatic animals, reducing the need for wild fish as feed and minimizing the environmental impact of aquaculture operations. Overall, aqua feed soybeans play a crucial role in the aquaculture industry, providing a nutritious and sustainable feed source for fish and shrimp production.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

North America plays a significant role in the production and consumption of soybeans. The United States and Canada are major producers of soybeans, with the United States being the world's largest producer and exporter of soybeans. In North America, soybeans are primarily used for animal feed, particularly in the livestock industry. Soybean meal, a byproduct of soybean processing, is a valuable source of protein for livestock feed, including poultry, swine, and cattle. Soybeans are also used in the food industry in North America, with soybean oil being a common ingredient in a variety of food products. Soybeans are processed into soy flour, which is used in baking, and soy protein isolate, which is used as a food additive and protein supplement. Additionally, soybeans are used in the production of biodiesel in North America, serving as a renewable and environmentally friendly alternative to traditional diesel fuel. Thus, soybeans play a crucial role in North America's agricultural sector, providing a valuable source of protein, oil, and other nutrients for both human and animal consumption.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In 2021, Bunge bolstered its soy protein manufacturing capacity by acquiring two soy processing plants from local crusher Imcopa for USD 12 million. This strategic move is aimed at enhancing Bunge's position in the soy protein market, allowing them to meet the growing demand for soy protein products.

2) In 2021, CHS undertook an expansion project at its Mankato plant to increase its soybean oil refining capacity by over 35%. This expansion is expected to significantly boost CHS's production capabilities, enabling them to cater to the rising demand for soybean oil in various industries. The expansion reflects CHS's commitment to meeting customer needs and strengthening its position in the soybean oil market.

Q1. What was the Soybean Market size in 2023?

As per Data Library Research the soybean processing market was valued at USD 80.42 billion in 2023.

Q2. At what CAGR is the Soybean market projected to grow within the forecast period?

Soybean Market registered a CAGR of 8.67% during the forecast period.

Q3. What Impact did COVID-19 have on the Soybean Market?

The COVID-19 pandemic has had a significant impact on the soybean market, both in terms of production and demand. For detailed insight request a sample here.

Q4. Which Region is expected to hold the highest Market share?

North America region is expected to hold the highest Market share.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model