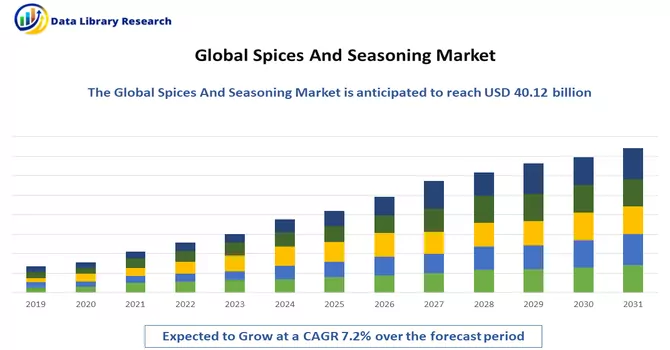

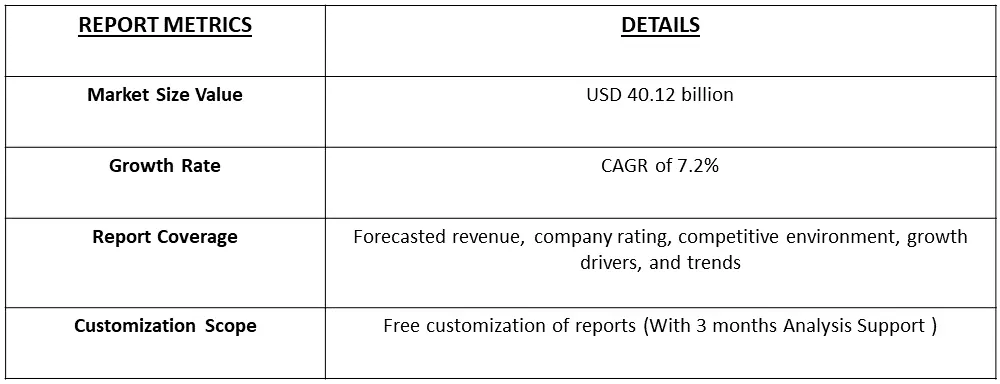

The global seasoning & spices market size was valued at USD 40.12 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The spices and seasonings market encompasses the global industry involved in producing, processing, distributing, and retailing a variety of spice and seasoning products. Spices, derived from natural plants, are utilized to enhance food with flavor, color, and aroma, while seasonings consist of blends incorporating spices, herbs, salt, and other flavor enhancers. This market includes a diverse array of offerings such as whole spices, ground spices, spice blends, herbs, and various seasoning mixes. Spices and seasonings play a crucial role in culinary practices worldwide, shaping the taste and allure of a multitude of cuisines. The rising popularity of diverse and global culinary traditions has spurred demand for a broad spectrum of spices and seasonings. As consumers explore and embrace different food cultures, the market adapts by providing an extensive range of products to cater to varied flavour preferences. Increased consumer awareness of the health benefits associated with certain spices and herbs has become a driving force. Many spices are recognized for their antioxidant properties, anti-inflammatory effects, and potential health advantages. This heightened awareness has resulted in a surge in demand for natural and healthier flavouring options, propelling the spices and seasonings market.

The spices and seasonings market is currently characterized by dynamic trends reflecting evolving consumer preferences and global culinary influences. With an increasing demand for diverse and global cuisines, the market has witnessed a surge in the variety of spice and seasoning products offered, including whole spices, ground spices, spice blends, herbs, and seasoning mixes. Notably, the industry has experienced notable expansions and product launches from major players, such as The Kraft Heinz Company introducing Just Spices to the U.S. market following its majority stake acquisition. Another significant trend is the emphasis on health-conscious choices, as consumers become more aware of the health benefits associated with certain spices and herbs, driving the demand for natural and healthier flavouring options. Additionally, strategic partnerships and collaborations, as seen with The McCormick brand and Tabitha Brown, are contributing to the introduction of innovative and unique seasoning products, catering to diverse taste preferences, including salt-free and vegan options. Overall, the spices and seasonings market is marked by a blend of innovation, diversity, and a growing focus on health-conscious choices.

Market Segmentation: The Global Spice Market is segmented by Product Type (Salt and Salt Substitutes, Herbs and Seasonings, and Spices); by Application (Bakery and Confectionery, Soup, Noodles and Pasta, Meat, and Seafood, Sauces, Salads, and Dressing, Savory Snack, and Other Applications); by Geography (North America, Europe, Asia Pacific, South America, and Middle East & Africa). The report offers market size and values in (USD Million) during the forecasted years for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Consumer Exploration of Global Cuisines

Consumer exploration of global cuisines has become a significant driving force behind the growth and evolution of the spices and seasonings market. As individuals increasingly embrace diverse culinary traditions from around the world, there has been a surge in demand for a wide variety of spices and seasonings to recreate and experiment with authentic flavors. This trend is evident in the market's response, with an expansion of product offerings that includes whole spices, ground spices, spice blends, herbs, and various seasoning mixes. Consumers are seeking to elevate their cooking experiences by incorporating flavors from different cultures, leading to a more extensive and diverse range of products available in the market.The popularity of global cuisines has prompted major players in the industry to innovate and introduce unique spice and seasoning combinations to cater to varying taste preferences. For instance, the entry of The Kraft Heinz Company into the U.S. market with Just Spices reflects the company's recognition of the growing consumer interest in diverse and authentic flavor profiles. This expansion aligns with the broader trend of consumers becoming more adventurous in their culinary pursuits, exploring tastes beyond their traditional comfort zones. Furthermore, the influence of social media, food blogs, and cooking shows has played a pivotal role in inspiring consumers to experiment with different global flavours in their kitchens. The accessibility of information about international cuisines has fueled curiosity and openness to trying new ingredients and spice blends. As a result, the spices and seasonings market is adapting to meet this demand by providing an extensive array of products that enable consumers to recreate the authentic tastes of various world cuisines. Thus, consumer exploration of global cuisines is a driving factor reshaping the spices and seasonings market. The demand for diverse and authentic flavours, coupled with an increased awareness of the health benefits associated with certain spices, has led to a market landscape characterized by innovation, diversity, and a focus on providing consumers with the tools to create rich and culturally inspired culinary experiences in their own kitchens.

Demand for Authentic Flavor

The surge in the demand for authentic flavor experiences has significantly influenced the utilization of spices and seasonings across various culinary practices. Consumers, increasingly drawn to diverse global cuisines, seek genuine and culturally rich tastes, propelling the market for an extensive array of spices and seasoning products. These flavor enhancers, ranging from whole spices to intricate spice blends, play a pivotal role in recreating authentic dishes and elevating the overall culinary experience. The desire for authenticity extends beyond traditional fare, with consumers exploring international flavours and experimenting with spice combinations to infuse a sense of uniqueness into their cooking. This trend has spurred innovation in the industry, with companies strategically responding to the demand for genuine flavours by introducing new products and emphasizing the quality and origin of their spice offerings. As a result, the market is witnessing a shift towards a more diverse and culturally nuanced array of spices and seasonings, reflecting the growing consumer preference for authenticity in their culinary endeavours.

Market Restraints:

Supply Chain Disruptions and Seasonal Variability

The spices and seasonings sector is susceptible to supply chain disruptions stemming from diverse factors, including weather conditions, geopolitical tensions, and natural disasters. Fluctuations in crop yields due to seasonal variations pose a significant risk, influencing both the availability and pricing of specific spices. Unfavorable weather conditions, such as droughts or excessive rainfall, can adversely affect cultivation, leading to potential shortages and market fluctuations. Additionally, geopolitical issues and global events can disrupt the transportation and distribution of spices, impacting the industry's overall stability. Natural disasters, such as hurricanes or earthquakes, may also disrupt the production and transportation processes, further emphasizing the vulnerability of the spices and seasonings market to external factors. Navigating these challenges requires industry players to adopt resilient supply chain strategies and contingency plans to ensure a consistent and reliable flow of products to meet consumer demands.

Get Complete Analysis Of The Report - Download Free Sample PDF

The spices and seasonings market felt the significant impact of the COVID-19 pandemic, experiencing disruptions in supply chains, shifts in consumer behaviour, and changes in demand patterns. Lockdowns and restrictions led to logistical challenges, affecting the transportation of raw materials and finished products. Home cooking gained prominence, altering the types of spices in demand, with a focus on versatile blends and health-oriented options. The closure of food service establishments prompted companies to adapt, emphasizing retail and e-commerce channels. Economic uncertainties influenced consumer purchasing behaviour, emphasizing affordability. However, the crisis also highlighted the importance of online platforms, contributing to the growth of e-commerce in the market. As the industry navigates post-pandemic challenges, resilience and adaptability remain crucial for sustained success.

Segmental Analysis:

Salt and Salt Substitutes Segment is Expected to Witness Significant Growth Over the Forecast Period

Salt serves as an indispensable seasoning, playing a pivotal role in elevating the inherent flavours of diverse culinary creations. This versatile ingredient finds application across a broad spectrum of dishes, ranging from savoury to sweet, imparting a crucial element of taste equilibrium. Beyond its flavour-enhancing capabilities, salt possesses preservative properties that effectively extend the shelf life of specific food items. Its utilization extends to various preservation techniques, including pickling and curing, where it contributes to safeguarding and enhancing the longevity of diverse food products. In essence, salt stands as a multifaceted culinary tool, not only enhancing taste but also serving as a valuable agent in food preservation methods that have been employed throughout culinary traditions.

Herbs and Seasoning Segment is Expected to Witness Significant Growth Over the Forecast Period

Herbs, whether in their fresh or dried form, stand as natural flavour enhancers, imparting depth and intricacy to a variety of dishes. These botanical wonders contribute unique and aromatic flavours that seamlessly complement an array of spices and ingredients. The inclusion of herbs in culinary creations elevates the overall sensory experience, infusing dishes with distinctive fragrance and palatability. Renowned herbs such as basil, cilantro, parsley, rosemary, thyme, and mint each bring their own singular aroma, adding a layer of complexity to the culinary palette. In the realm of seasonings, which can encompass a blend of herbs, spices, and other flavor enhancers, a diverse range of complex flavor profiles emerges to cater to specific culinary preferences. Examples include the savory allure of Italian seasoning, the exotic notes of curry blends, and the nuanced richness of herb-infused salts. The convenience of pre-made seasonings proves invaluable to consumers, providing a quick and effortless means to infuse a variety of flavors into their dishes without the intricacies of individual herb and spice measurements. This convenience is particularly advantageous for busy home cooks seeking an efficient way to enhance the taste of their meals.

Bakery and Confectionery Segment is Expected to Witness Significant Growth Over the Forecast Period

Bakery, desserts are transformed into delectable masterpieces through the artful use of sweet spices, imparting a rich and nuanced character to an array of treats. Classics like cinnamon, nutmeg, and ginger take center stage, infusing cookies, cakes, and other sweet delights with warmth and depth. However, the world of artisanal and specialty baking ventures into uncharted territory, embracing unique herbs and spices to craft distinctive flavor signatures. Lavender-infused desserts, thyme-kissed shortbread, and cardamom-spiced cakes exemplify the creativity that unfolds in this culinary domain.

Confectionery, with its indulgent offerings like chocolates and truffles, takes the sensory journey a step further by incorporating an eclectic mix of spices to create sophisticated and unparalleled flavor profiles. From the bold kick of chili to the comforting allure of cinnamon and the exotic notes of cardamom, these spices elevate confectionery creations to a realm of culinary artistry. The marriage of spices and sweets extends to nuts and candies, where an array of seasonings, herbs, and flavorings dance together to produce enticing combinations. Cinnamon-sugar almonds, chili-lime cashews, and ginger-spiced candies exemplify the harmonious blend of textures and tastes that captivates the palate. In essence, the convergence of spices and desserts in the bakery and confectionery worlds serves as a testament to the endless possibilities that arise when traditional and exotic flavor profiles intertwine. The exploration of these culinary dimensions continues to inspire innovation, allowing bakers and confectioners to weave a tapestry of tastes that captivate and delight the discerning palate.

North America Segment is Expected to Witness Significant Growth Over the Forecast Period

In North America, a robust tradition surrounds the appreciation of classic bakery items, encompassing staples like bread, pastries, muffins, and cookies. These delectable treats have ingrained themselves into the culinary fabric of the region, becoming staples that are readily accessible in a multitude of settings, including bakeries, cafes, and supermarkets. However, a notable shift is observed in recent years, marked by a growing trend towards artisanal and specialty bakeries that redefine the bakery experience. These establishments go beyond the conventional, offering a curated selection of handcrafted and unique baked goods. Artisanal and specialty bakeries have become hubs of creativity, where bakers experiment with an eclectic array of herbs, spices, and flavorings to craft distinctive and premium products. The emphasis on craftsmanship and quality ingredients sets these bakeries apart, appealing to a discerning consumer base seeking an elevated and personalized culinary experience. The trend towards artisanal and specialty bakeries is characterized by a dedication to innovation and the pursuit of new and exciting flavor combinations. Bakers often push the boundaries of traditional recipes, introducing unexpected elements that tantalize the taste buds. Whether it's infusing lavender into a baguette, incorporating exotic spices into muffins, or experimenting with unique flavor pairings in cookies, these establishments thrive on the artistry of baking. This shift reflects a broader cultural movement towards valuing authenticity, craftsmanship, and a connection to the origins of food. Consumers increasingly seek out these specialized bakeries not only for the exquisite taste of their products but also for the narrative woven into each handcrafted creation. The growing popularity of artisanal and specialty bakeries is a testament to the evolving palate of North American consumers and their desire for a diverse and personalized bakery experience that goes beyond the ordinary.

The market for seasonings and spices is defined by the existence of a handful of well-established entities alongside numerous small and medium-sized players. In this landscape, a select group of major companies holds a significant market share, contributing to the overall stability and influence within the industry. Alongside these industry giants, a multitude of smaller and medium-sized enterprises also actively participate, fostering a diverse and competitive marketplace. This dynamic composition, with both large and smaller players, results in a spectrum of product offerings, innovations, and market strategies. While established players often possess a substantial market presence and brand recognition, smaller and medium-sized players contribute to the market's vibrancy by introducing niche products, promoting innovation, and catering to specific consumer preferences. This mix of industry participants contributes to the overall dynamism and competitiveness of the seasoning and spices market. Some of the key players operating in the global seasoning & spices market include:

Recent Development:

1) In April 2023, The Kraft Heinz Company revealed the introduction of Just Spices into the U.S. market, a mere year following the company's successful acquisition of a majority stake in the business.

2) In April 2023, The McCormick brand disclosed an extension of its collaboration with Tabitha Brown, unveiling the arrival of five new salt-free, vegan seasoning products in U.S. grocery stores. Developed in partnership with Tabitha Brown, these products include McCormick Like Sweet Like Smoky All Purpose Seasoning, McCormick Burger Bliss Seasoning Mix, McCormick Very Good Garlic All Purpose Seasoning, McCormick Sauté Sensation Seasoning Mix, and McCormick Taco Tantalizer Seasoning Mix.

Q1. How big is the Spices and Seasoning Market ?

The global seasoning & spices market size was valued at USD 40.12 billion in 2023.

Q2. What is the Growth Rate of the Spices and Seasoning Market?

Spices and Seasoning Market is expected to grow at a compound annual growth rate (CAGR) of 7.2% over the forecast period.

Q3. What are the factors driving the Spices and Seasoning Market?

Key factors that are driving the growth include the Consumer Exploration of Global Cuisines and Demand for Authentic Flavor.

Q4. What are the factors on which the Spices and Seasoning market research is based on?

By Product Type, By Application and Geography are the factors on which the Spices and Seasoning market research is based.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model