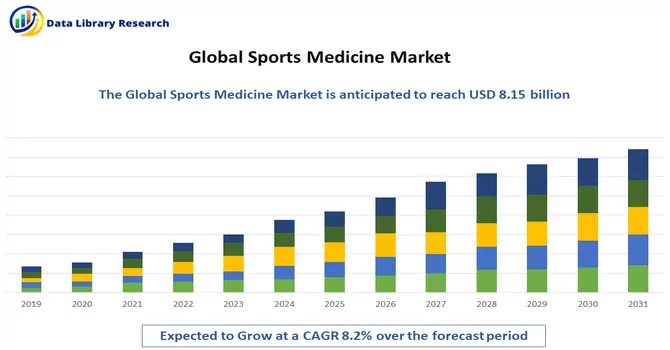

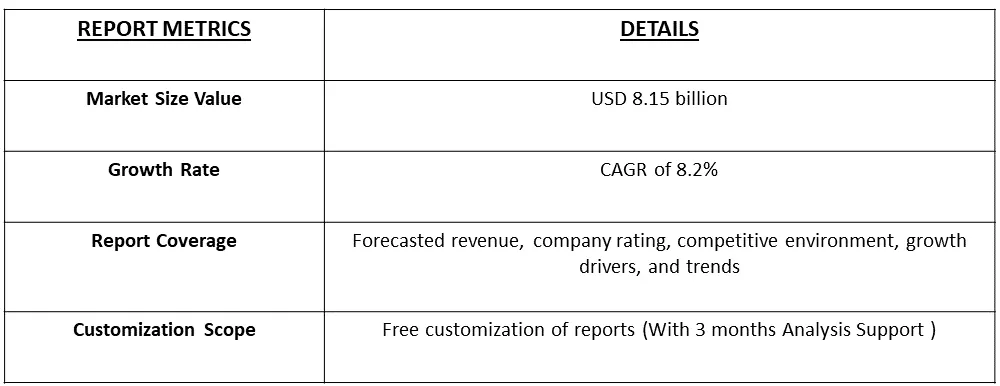

The global sports medicine market in terms of revenue was estimated to be worth USD 8.15 billion in 2023 and is poised to register a CAGR of 8.2% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

The field of sports medicine involves the delivery of medical care, goods, and technologies focused on diagnosing, treating, and preventing injuries associated with physical activity, sports, and exercise. It includes various disciplines such as orthopedics, rehabilitation, athletic training, and sports science. As more individuals participate in sports and physical activities for various reasons such as improving health, enjoying leisure time, or competing, there is a greater demand for sports medicine services. This field encompasses a range of medical specialties and technologies aimed at diagnosing, treating, and preventing injuries related to physical activity. Recent technological advancements have significantly improved the effectiveness of sports medicine treatments. For example, modern diagnostic tools and imaging technologies allow for more accurate and detailed assessments of injuries, helping medical professionals develop more targeted treatment plans. Surgical techniques have also advanced, leading to less invasive procedures with faster recovery times. Furthermore, rehabilitation modalities have evolved, providing athletes with more personalized and effective recovery programs. These advancements have not only improved the outcomes for athletes but have also expanded the range of conditions that can be effectively managed through sports medicine.

The field of sports medicine is undergoing a transformative phase, thanks to the relentless progress in medical technology. This progress is reshaping the diagnosis and treatment of sports-related injuries, offering athletes unprecedented levels of care and attention. Central to this transformation are several key innovations that are revolutionizing how injuries are managed. Advanced medical devices are at the forefront of this revolution. These devices are becoming increasingly sophisticated, allowing for more accurate and detailed assessments of injuries. For example, wearable sensors can track an athlete's movements and provide real-time feedback on their performance, helping to prevent injuries before they occur. Additionally, these devices can monitor vital signs and other health metrics, providing valuable insights into an athlete's overall health and well-being. Precise imaging tools are also playing a crucial role in improving the management of sports injuries. Techniques such as MRI and CT scans can now provide incredibly detailed images of the body, allowing healthcare providers to identify injuries with greater precision. This not only helps in diagnosing injuries more accurately but also enables healthcare providers to develop more targeted treatment plans. Minimally invasive surgeries are another area where significant progress has been made. These procedures, which involve smaller incisions and less trauma to the body, are becoming increasingly common in sports medicine. They offer several advantages over traditional open surgeries, including faster recovery times, less scarring, and reduced risk of complications. This means that athletes can return to their sport more quickly and with a lower risk of long-term damage. One of the most exciting developments in sports medicine is the rise of personalized treatment plans. These plans are tailored to meet the specific needs of individual athletes, taking into account factors such as genetics, biomechanics, and past injury history. By considering these factors, healthcare providers can develop more effective treatment strategies that are more likely to lead to successful outcomes. Overall, these innovations are transforming the field of sports medicine, offering athletes a level of care and attention that was once unimaginable. As these technologies continue to advance, we can expect to see further improvements in the diagnosis, treatment, and prevention of sports-related injuries, ultimately leading to better outcomes and a higher quality of life for athletes everywhere.

Market Segmentation: The Global Sports Medicine Devices Market is Segmented by Product (Implants, Arthroscopy Devices, Prosthetics, Orthobiologics, Braces, Bandages and Tapes, and Other Products), Application (Knee Injuries, Shoulder Injuries, Ankle and Foot Injuries, Back and Spine Injuries, Elbow and Wrist Injuries, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, and South America). The market report also covers the estimated market sizes and trends for 17 different countries across major regions globally. The market size and forecasts are provided in terms of value (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Advancements in Medical Technology

In recent years, the field of sports medicine has witnessed remarkable advancements in technology, leading to significant improvements in the care provided to athletes and active individuals. One area that has seen notable progress is orthopedic implants, with products like in January 2023, the DynaClip Quattro and DynaClip Delta bone staples from Enovis (DJO, LLC) revolutionizing surgical procedures for foot and ankle injuries. These innovative implants have been specifically designed to enhance the ease of use and procedural efficiency for foot and ankle surgeons. They offer a level of precision and reliability that was previously unavailable, allowing surgeons to perform procedures with greater confidence and accuracy. This not only leads to better outcomes for patients but also reduces the risk of complications during surgery. Furthermore, these advancements in orthopedic implants are just one example of how technology is shaping the future of sports medicine. From minimally invasive surgical techniques to diagnostic imaging and rehabilitation equipment, the tools available to healthcare providers are constantly evolving. This evolution is driving improvements in patient care, enabling quicker recovery times and better long-term outcomes for athletes and active individuals alike. Thus, the continuous development of technology in sports medicine is transforming the way injuries are treated and managed. As these innovations continue to advance, we can expect to see even greater improvements in the quality of care provided to athletes, ultimately helping them to stay healthy and perform at their best.

Emphasis on Injury Prevention and Rehabilitation

The acquisition of CrossRoads Extremity Systems by DePuy Synthes in February 2022 represents a significant development in the sports medicine market, particularly in the area of foot and ankle care. This acquisition is expected to drive advancements in podiatric, orthopedic, and medical technology through both internal innovation within DePuy Synthes and external collaborations with CrossRoads Extremity Systems. One of the key ways this acquisition will contribute to the sports medicine market is by expanding the range of specialized solutions available for foot and ankle injuries. CrossRoads Extremity Systems is known for its innovative approaches to addressing complex foot and ankle conditions, and by integrating these solutions into its portfolio, DePuy Synthes can offer a more comprehensive suite of products for sports medicine professionals. Moreover, the acquisition will likely lead to advancements in minimally invasive surgical techniques and implant technologies, which are crucial in sports medicine for reducing recovery times and improving outcomes. By leveraging CrossRoads Extremity Systems' expertise in these areas, DePuy Synthes can further enhance its offerings in the sports medicine market, meeting the growing demand for advanced treatment options among athletes and active individuals. Thus, the acquisition of CrossRoads Extremity Systems by DePuy Synthes is expected to drive innovation and improve patient care in the sports medicine market, particularly in the field of foot and ankle care. As sports medicine continues to prioritize preventive measures and comprehensive care, this acquisition underscores the importance of specialized solutions that can meet the unique needs of athletes and active individuals.

Market Restraints:

High Cost of Sports Medicine

The cost of sports medicine procedures, treatments, and equipment can be a significant obstacle for many patients, particularly those who are uninsured or underinsured. This financial barrier can limit the accessibility and affordability of sports medicine services, affecting the overall market penetration. Furthermore, the stringent regulatory requirements imposed on medical devices, pharmaceuticals, and therapeutic interventions in sports medicine can pose challenges for companies seeking to introduce new products to the market. These regulations are in place to ensure the safety and efficacy of medical products, but they can also lead to delays in product approvals, increase development costs, and restrict market entry for innovative technologies and treatments. Thus, addressing these challenges is crucial for improving access to sports medicine services and fostering innovation in the field. This may involve finding ways to reduce costs, improving insurance coverage, and streamlining regulatory processes to facilitate the introduction of new and effective treatments.

The COVID-19 pandemic has had a profound impact on the sports medicine field, with the widespread postponement and cancellation of sporting events leading to a decrease in sports-related injuries requiring medical attention. This decline in injuries has directly affected the demand for sports medicine services, particularly in areas where strict lockdown measures and social distancing protocols were in place. Furthermore, many hospitals and healthcare facilities temporarily suspended elective procedures, including orthopedic surgeries and sports medicine interventions, to allocate resources for COVID-19 patients and reduce the risk of virus transmission. This decision resulted in decreased patient volumes and revenue loss for sports medicine providers and facilities, as these elective procedures are a significant source of income for many practices. Overall, the COVID-19 pandemic has presented significant challenges for the sports medicine field, including a decrease in demand for services and revenue loss due to the postponement of elective procedures. As the situation evolves, sports medicine providers and facilities will need to adapt to new norms and find innovative ways to meet the needs of athletes and active individuals while ensuring patient safety.

Segmentation Analysis:

Implants, Arthroscopy Devices Segment is Expected to Witness Significant Growth Over the Forecast Period

Implant devices are indispensable in sports medicine for the repair and stabilization of damaged tissues, particularly in athletes and active individuals prone to injuries in ligaments, tendons, and cartilage. These devices play a crucial role in restoring the function of the affected joint, facilitating the individual's return to physical activities. Arthroscopy is a pivotal technique in sports medicine for both diagnosing and treating joint conditions. This minimally invasive procedure offers several advantages over traditional open surgery, including smaller incisions, reduced risk of infection, less postoperative pain, and quicker recovery times. Arthroscopic procedures have significantly enhanced patient outcomes in sports medicine and have become a standard approach for addressing many joint-related injuries and conditions.

Knee Injuries, Shoulder Injuries Segment is Expected to Witness Significant Growth Over the Forecast Period

ACL tears are frequently seen in athletes who engage in sports requiring rapid changes in direction, like soccer or basketball. These injuries typically require surgery to reconstruct the torn ligament, often using grafts from the patient's own tissues or donor tissues, along with implant devices to stabilize the knee joint. Rehabilitation after surgery is essential to regain strength, mobility, and function in the knee. Rotator cuff tears are common in athletes who perform repetitive overhead motions, such as baseball pitchers or tennis players. These tears can also result from a traumatic injury. Initial treatment for rotator cuff tears often involves rest, physical therapy, and medication to reduce inflammation and pain. However, if conservative treatments fail to provide relief, surgery may be necessary. Arthroscopic surgery, which involves small incisions and the use of a camera and specialized instruments, is a minimally invasive option for repairing rotator cuff tears. Implant devices may be used to reinforce the repair and promote healing.

North America is home to vast populations actively engaged in sports, fitness activities, and recreational pursuits. This region's enthusiasm for sports like football, basketball, soccer, hockey, and skiing has created a substantial demand for sports medicine services focused on preventing, diagnosing, and treating injuries among athletes and active individuals. The U.S. stands out as a leader in the North American market, dominating in 2023. The increasing popularity of sports among young people is a major driver of growth in the U.S. sports medicine sector. Public health advocates and clinicians are actively promoting physical activity to maintain health and reduce the risk of obesity and other chronic diseases. This advocacy further fuels the demand for sports medicine services. However, as participation in sports and recreational activities continues to rise, injuries stemming from these pursuits have emerged as a significant public health concern. This trend has, in turn, contributed to the expansion of the sports medicine market. In September 2022, Zimmer Biomet achieved a milestone by obtaining clearance from the U.S. FDA for its Identity Shoulder System. This system is designed for use in reverse, anatomic, and revision shoulder replacement surgeries. This clearance underscores the ongoing advancements in medical technology aimed at improving patient outcomes in sports medicine and orthopedic care. Thus, the sports medicine sector in North America, particularly in the U.S., is witnessing robust growth driven by a combination of factors including increasing sports participation, advocacy for physical activity, and advancements in medical technology.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic maneuvers. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Key Sports Medicine Companies:

Recent Developments:

1) In August 2021, Zimmer Biomet received FDA approval for its ROSA® hip system, which assists in robotically guiding direct anterior total hip arthroplasty procedures. This innovative system enhances surgical precision and efficiency in hip replacement surgeries.

2) In June 2021, DJO acquired Mathys AG Bettlach, an orthopedic implants developer based in Switzerland. This acquisition strengthens DJO's capabilities in creating and providing advanced orthopedic technologies for future generations. The purchase of Mathys AG Bettlach allows DJO to expand its product portfolio and offer a wider range of innovative solutions for orthopedic patients.

Q1. What was the Sports Medicine Market size in 2023?

As per Data Library Research the global sports medicine market in terms of revenue was estimated to be worth USD 8.15 billion in 2023,

Q2. What is the Growth Rate of the Sports Medicine Market ?

Sports Medicine is expected to register a CAGR of 8.2% over the forecast period.

Q3. What are the factors driving the Sports Medicine market?

Key factors that are driving the growth include the Advancements in Medical Technology and Emphasis on Injury Prevention and Rehabilitation.

Q4. What are the factors on which the Sports Medicine market research is based on?

By Product, By Application and Geography are the factors on which the Sports Medicine market research is based.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model