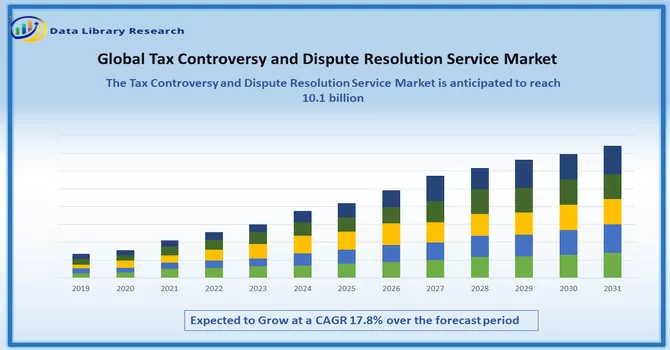

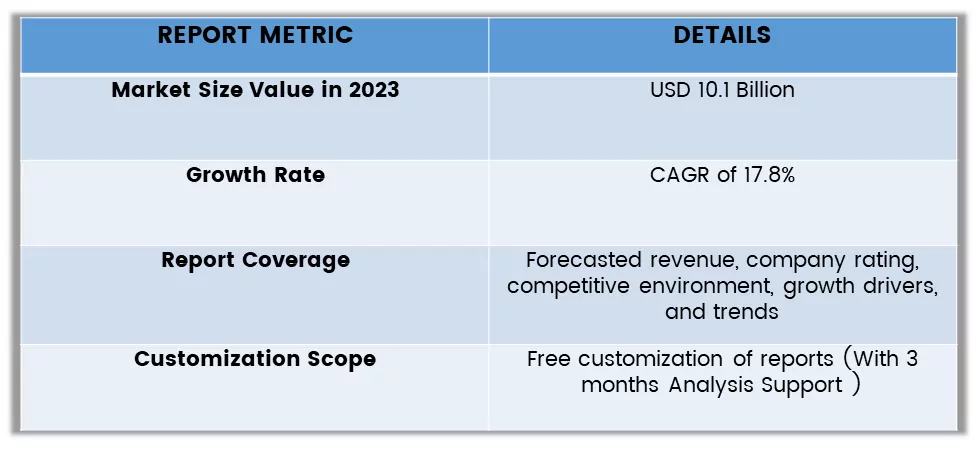

The Global Tax Controversy and Dispute Resolution Service Market is currently valued at USD 10.1 billion in the year 2023 and is expected to register a CAGR of 17.8% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Tax Controversy and Dispute Resolution Services encompass a specialized set of professional offerings aimed at assisting businesses and individuals in managing and resolving disagreements with tax authorities. These services are designed to address challenges arising from audits, examinations, or disputes related to the interpretation, application, or enforcement of tax laws. Tax professionals providing these services, including tax attorneys, accountants, and consultants, work to represent clients during investigations, provide strategic advice on compliance, and engage in negotiations or legal proceedings to achieve a resolution with tax authorities. The goal of these services is to navigate the complexities of tax controversies efficiently, ensuring that clients comply with regulations while minimizing financial and reputational risks associated with tax disputes.

The market for Tax Controversy and Dispute Resolution Services is driven by several key factors. Ongoing regulatory changes, both domestically and internationally, contribute to increased complexity in tax laws, prompting businesses to seek specialized guidance to ensure compliance and navigate evolving standards. The globalization of commerce has intensified cross-border transactions, leading to a surge in complex tax issues and disputes, further emphasizing the need for expert resolution services. Additionally, heightened scrutiny by tax authorities and the growing intricacy of financial transactions propel the demand for skilled professionals who can provide strategic advice, representation during audits, and effective dispute-resolution strategies. The continuous evolution of tax regulations, coupled with the potential financial and reputational risks associated with unresolved tax controversies, positions Tax Controversy and Dispute Resolution Services as essential in the ever-changing landscape of tax compliance.

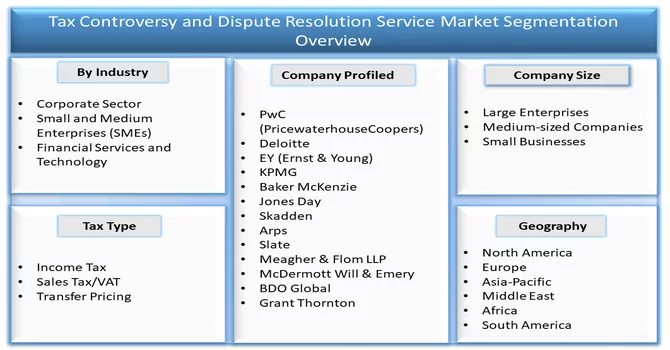

Market Segmentation: The Global Tax Controversy and Dispute Resolution Services Market is Segmented by Industry Segmentation (Corporate Sector, Small and Medium Enterprises (SMEs), Financial Services and Technology), Company Size (Large Enterprises, Medium-sized Companies and Small Businesses), Tax Type (Income Tax, Sales Tax/VAT and Transfer Pricing), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The market size and forecast are provided in terms of value (USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The Tax Controversy and Dispute Resolution Services market are witnessing notable trends as businesses respond to evolving global tax landscapes. Increasing regulatory scrutiny and frequent changes in tax laws are prompting a growing demand for proactive dispute resolution strategies and compliance advisory services. Technology integration, including artificial intelligence and data analytics, is emerging as a prominent trend, enhancing the efficiency of dispute resolution processes. The market is also experiencing a shift towards alternative dispute resolution methods, such as mediation and arbitration, providing quicker and cost-effective solutions. Moreover, industry-specific expertise is becoming more critical as businesses seek tailored services to address unique tax challenges within their sectors. Overall, the market trends reflect a dynamic landscape where technological advancements, regulatory changes, and a focus on specialized solutions are shaping the future of Tax Controversy and Dispute Resolution Services.

Market Drivers:

Complex Tax Regulations and Compliance Demands

The dynamic and intricate nature of global tax regulations poses a continual challenge for businesses striving to maintain compliance. With tax laws evolving and growing in complexity, companies find themselves in need of specialized services to adeptly navigate this intricate landscape, effectively manage associated risks, and tackle potential disputes with tax authorities. The escalating demand for expert guidance stems from the imperative to interpret and align with sophisticated tax codes. This not only mitigates the likelihood of controversies but also ensures that businesses adhere to the ever-changing regulatory frameworks, providing a proactive approach to compliance within the evolving tax environment.

Globalization and Cross-Border Transactions

The increasing integration of businesses on a global scale and the upsurge in cross-border transactions have given rise to intricate international tax challenges. Multinational corporations frequently encounter difficulties concerning transfer pricing, double taxation, and the diverse tax regulations prevalent across various jurisdictions. This phenomenon propels a heightened demand for Tax Controversy and Dispute Resolution Services, as businesses actively seek support in effectively handling and resolving disputes with tax authorities at an international level. This assistance becomes essential for ensuring adherence to a spectrum of tax regulations while optimizing global operations, thereby navigating the complexities associated with conducting business on a multinational scale.

Market Restraints:

Limited Skilled Professionals

The scarcity of professionals possessing comprehensive expertise in both tax and legal domains constitutes a notable constraint within the Tax Controversy and Dispute Resolution Service Market. This shortage implies a deficiency in professionals capable of seamlessly navigating the intricate intersection of tax laws and legal complexities. As the demand for specialized services in tax dispute resolution continues to grow, there is a risk that the available talent pool may not keep pace with the rising requirements. This scenario can have several repercussions. Firstly, it may lead to increased competition for the limited number of skilled professionals in this niche, potentially resulting in elevated costs for securing their services. The heightened demand may also strain the existing workforce, affecting the quality and timeliness of services provided. Service providers may face challenges in scaling up their operations to meet the growing client needs, potentially causing delays in addressing tax controversies and disputes. Furthermore, the shortage of skilled professionals may limit the diversity of expertise available in the market. Given the multifaceted nature of tax issues, having professionals with diverse skills and backgrounds is crucial for offering comprehensive solutions to clients. The constraint on talent may hinder the market's ability to provide tailored and nuanced services, impacting the overall effectiveness of Tax Controversy and Dispute Resolution offerings. To address this constraint, industry stakeholders may need to invest in training programs, educational initiatives, and talent development strategies to enhance the pool of professionals with expertise in both tax and legal domains. Additionally, leveraging technology and process efficiencies could help service providers optimize their existing workforce, mitigating the impact of the talent shortage on meeting the increasing demands of clients in the Tax Controversy and Dispute Resolution Service Market.

The COVID-19 pandemic has profoundly affected the Tax Controversy and Dispute Resolution offerings market. Remote work challenges, delayed dispute resolution processes, and increased demand for advisory services have characterized this impact. Government stimulus programs and regulatory changes, coupled with financial strains on businesses, have intensified the need for expert guidance. The emphasis on digital transformation has accelerated, prompting service providers to adopt virtual hearings and data analytics. Despite economic uncertainties, Tax Controversy and Dispute Resolution services remain crucial for businesses, helping them navigate evolving tax regulations, mitigate risks, and optimize financial positions amidst the dynamic post-pandemic landscape.

Segmental Analysis:

Financial Services and Technology Segment is Expected to Witness Significant Growth over the Forecast Period

The intersection of Financial Services and Technology is revolutionizing the industry, ushering in an era of unprecedented innovation and efficiency. Fintech solutions are reshaping traditional banking, investment, and payment systems, offering streamlined processes, enhanced security, and improved customer experiences. From mobile banking apps to blockchain-based transactions, technology is not only optimizing operational workflows but also creating new avenues for financial inclusion and personalized services. The collaboration between financial institutions and technology firms is increasingly pivotal, driving digital transformation, data analytics, and the adoption of artificial intelligence to meet the evolving demands of a rapidly changing financial landscape.

Medium-sized Companies and Small Businesses Segment is Expected to Witness Significant Growth over the Forecast Period

In the realm of Tax Controversy and Dispute Resolution Services, medium-sized companies and small businesses are recognizing the imperative of specialized assistance in navigating intricate tax landscapes. Faced with the complexities of tax laws, audits, and potential disputes, these enterprises increasingly seek tailored solutions to ensure compliance and mitigate risks. The demand for expert guidance is pronounced among medium-sized companies and small businesses, as they often lack in-house resources dedicated to handling tax controversies. The evolving regulatory environment further underscores the significance of these services, positioning them as essential tools for enhancing financial resilience and sustaining smooth operations for businesses of varying sizes in an ever-changing tax landscape.

Transfer Pricing Segment is Expected to Witness Significant Growth over the Forecast Period

The Sales Tax/VAT segment plays a pivotal role in the Tax Controversy and Dispute Resolution Service Market, with businesses grappling with intricate compliance issues and disputes arising from diverse regulatory frameworks. As governments globally intensify their focus on revenue collection, the complexity of Sales Tax/VAT regulations increases, necessitating specialized services to ensure compliance and navigate potential controversies. Service providers in this sector are witnessing a growing demand for expertise in resolving disputes related to sales tax and VAT, as businesses seek strategic guidance to manage risks, adhere to evolving tax laws, and optimize their financial positions amidst the intricacies of indirect taxation. The Sales Tax/VAT and Tax Controversy and Dispute Resolution Service Market thus stand as a critical facilitator in fostering compliance and resolving disputes for businesses facing the complexities of indirect taxation.

North America Region is Expected to Witness Significant Growth over the Forecast Period

The North America Tax Controversy and Dispute Resolution Service Market exhibit a dynamic landscape shaped by the evolving regulatory environment and the intricate nature of tax laws across the region. As businesses face increased scrutiny from tax authorities, the demand for specialized services in navigating controversies and resolving disputes continues to rise. The market in North America is characterized by a blend of traditional legal processes and an increasing adoption of advanced technologies to streamline dispute resolution. Professional service providers, including law firms and consultancy firms, play a pivotal role in assisting businesses in managing tax audits, offering strategic counsel, and facilitating resolutions with tax authorities. With the ongoing evolution of tax regulations and heightened complexity in cross-border transactions, the North America Tax Controversy and Dispute Resolution Service Market stand as a crucial element in aiding businesses to ensure compliance, mitigate risks, and navigate the intricate terrain of tax controversies effectively.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders.

Key Market Players in the Studied Market are:

Recent Development:

1) In 2023, a published research study emphasized the increasing significance of Financial Technology (FinTech) and financial inclusion as powerful tools for alleviating poverty, reducing income inequality, and fostering economic growth. This comprehensive bibliometric analysis, spanning from 2010 to 2023 and based on 695 selected documents from the Scopus database, reveals a burgeoning interdisciplinary interest in the role of digital financial services. Utilizing Biblioshiny and VOSviewer software for analysis, the study identified growing research production since 2016, highlighting the pivotal role of digital financial services in overcoming limitations posed by traditional financial institutions. The implications of this research extend to the Tax Controversy and Dispute Resolution Service Market, as the heightened understanding and emphasis on FinTech underscore its potential to reshape financial landscapes. The integration of digital financial services in addressing economic challenges may contribute to increased demand for specialized tax dispute resolution services, offering businesses enhanced tools and strategies to navigate evolving financial paradigms and regulatory complexities.

2) In 2023, a comprehensive global tax overhaul is in progress, marked by ongoing advancements in Pillars 1 and 2, alongside various initiatives led by the OECD. This transformative landscape is witnessing substantial modifications to tax regulations, as jurisdictions worldwide announce policy reforms. These changes are designed not only to safeguard their sovereign taxing rights but also to align with international tax standards. The evolving global tax environment creates a significant impact on the tax market, prompting increased demand for specialized services. As businesses navigate the complexities arising from these policy shifts and seek compliance with the new standards, the Tax Controversy and Dispute Resolution market stands to benefit from the growing need for expert guidance and strategic solutions in adapting to this rapidly changing tax landscape.

Q1. What is the current Tax Controversy and Dispute Resolution Service Market size?

Tax Controversy and Dispute Resolution Service Market is currently valued at USD 10.1 billion.

Q2. What is the Growth Rate of the Tax Controversy and Dispute Resolution Service Market?

Tax Controversy and Dispute Resolution Service Market is expected to register a CAGR of 17.8% over the forecast period.

Q3. What are the Growth Drivers of the Tax Controversy and Dispute Resolution Service Market?

Complex Tax Regulations and Compliance Demands and Globalization and Cross-Border Transactions are the Growth Drivers of the Tax Controversy and Dispute Resolution Service Market.

Q4. Which region has the largest share of the Tax Controversy and Dispute Resolution Service market? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model