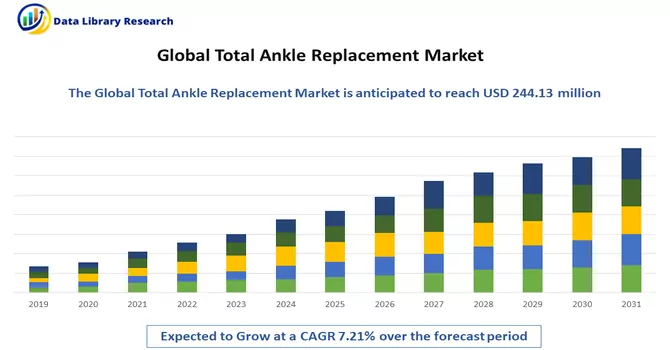

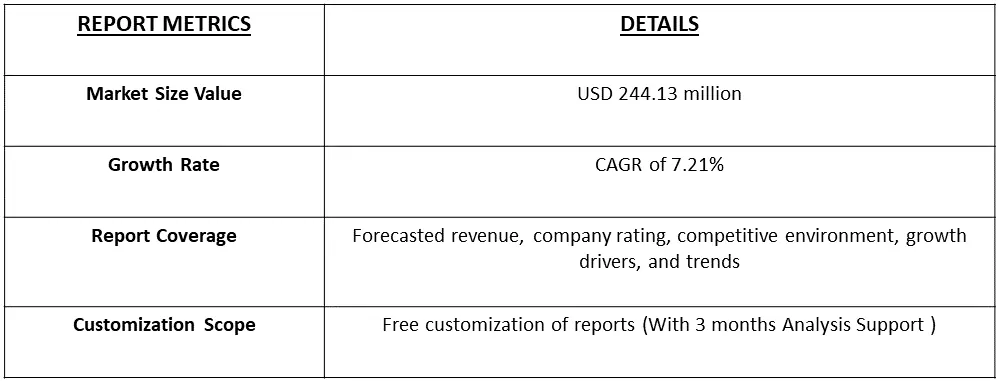

The total ankle replacement market size was valued at USD 244.13 million in 2023 and is expected to expand at a CAGR of 7.21% during the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Total Ankle Replacement (TAR), or total ankle arthroplasty, is a surgical procedure designed to address severe arthritis or other debilitating conditions affecting the ankle joint. In this complex surgery, the damaged surfaces of the ankle joint are replaced with artificial implants made of metal and plastic components. Unlike ankle fusion, TAR aims to preserve joint motion, offering relief from pain, restoring function, and improving mobility for individuals with advanced ankle joint degeneration. Patient selection and preoperative evaluation are crucial factors in determining the suitability of TAR, and its success can vary depending on factors such as overall health and the severity of arthritis. While total ankle replacement represents a valuable option for selected cases, patients are advised to discuss potential outcomes, risks, and alternatives with their orthopaedic surgeon to make informed decisions about the most appropriate treatment for their specific condition.

The growth of the Total Ankle Replacement (TAR) market is propelled by various interconnected factors. An ageing population experiencing a surge in ankle arthritis, coupled with advancements in implant technology, drives the increasing adoption of TAR procedures. Patients' preference for joint-preserving treatments, the expansion of minimally invasive techniques, and growing awareness about ankle-related conditions contribute to the market's expansion. The development of healthcare infrastructure, increased access to specialized orthopaedic care, and favourable reimbursement policies further stimulate the demand for TAR as a viable and reimbursable solution. Overall, the TAR market thrives on a confluence of demographic trends, technological innovations, and supportive healthcare dynamics, positioning it for sustained growth.

Market Segmentation: The Total Ankle Replacement Market is segmented by Design (HINTEGRA Total Ankle Replacement, Scandinavian Total Ankle Replacement, Salto Total Ankle Replacement, BOX Total Ankle Replacement, Zenith Total Ankle Replacement, Mobility Total Ankle Replacement, and Other Designs) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report offers the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

The knee replacement market is witnessing notable trends driven by advancements in technology, increased demand for minimally invasive procedures, and a growing ageing population. Cutting-edge implant designs and materials, coupled with robotic-assisted surgeries, are enhancing precision and patient outcomes. There is a notable shift towards outpatient knee replacements, reflecting a broader trend in ambulatory care. Additionally, a focus on patient-specific implants and personalized approaches, along with a surge in revision knee surgeries, is shaping the landscape. The integration of digital health tools, such as wearables and remote monitoring, further contributes to the evolving paradigm of knee replacement procedures, emphasizing a patient-centric and technologically advanced future for the market.

Market Drivers:

Rising Geriatric Population

The increasing global geriatric population is a major driver propelling the expansion of the total ankle replacement market. With advancing age, individuals become more susceptible to conditions like severe ankle arthritis, creating a heightened demand for effective and long-lasting orthopedic solutions such as total ankle replacement. Elderly individuals actively seek interventions that can improve mobility, alleviate pain, and enhance overall quality of life. Total ankle replacement, with its emphasis on preserving joint motion and offering a more natural gait, aligns seamlessly with the needs of the ageing population grappling with ankle-related issues. The prevalence of ankle disorders among the elderly, combined with ongoing advancements in total ankle replacement technologies, positions the market to address the escalating healthcare needs of this demographic. Moreover, the growing segment of the elderly population, particularly those prone to developing joint-related disorders, reinforces the recommendation for ankle replacement surgeries in individuals aged 60 and above who do not engage in high-impact activities and are not overweight. For example, according to 2022 statistics from the United Nations Population Fund, in the United States, 65% of the living population falls within the 15-64 age group, while 17% are aged 65 and above. This demographic shift is anticipated to drive an increased demand for ankle replacement surgeries, consequently fueling the growth of the total ankle replacement market.

Growing Prevalence of Osteoarthritis and Rheumatoid Arthritis

An article published in January 2021 by the Oxford Journals of Rheumatology, titled 'Ankle Arthritis - An Important Signpost in Rheumatologic Practice,' highlighted that 15% of individuals worldwide experience symptomatic osteoarthritis in any joint, with 6% to 10% suffering from symptomatic knee osteoarthritis and only 1-4.4% affected by symptomatic ankle osteoarthritis. Additionally, a study in the Sage Journal of Cartilage, published in December 2021 under the title 'Health-Related Quality of Life in Ankle Osteoarthritis: A Case-Control Study,' reported a prevalence of ankle osteoarthritis ranging from 9% to 19% in professional foot players and 4.6% in rugby players. The study also revealed that 70%-78% of ankle osteoarthritis cases were post-traumatic effects in younger patients with an extended projected lifespan, unlike hip and knee osteoarthritis. Furthermore, 22% were attributed to secondary causes such as rheumatoid arthritis (5%-12%), haemophilia (1%-2%), septic conditions (1%-2%), congenital factors (2%), and others. Patients with ankle osteoarthritis exhibited a diminished physical and mental quality of life. Consequently, the escalating burden of ankle osteoarthritis within the population is anticipated to drive the demand for ankle replacements. These replacements aim to alleviate ankle pain, enhance joint stability, and improve overall mobility, thereby fostering growth in the market throughout the forecast period.

Market Restraints:

Risks Associated with Total Ankle Replacement Surgery

The Total Ankle Replacement (TAR) Surgery Market, while experiencing growth, is not without its challenges, as certain risks associated with the procedure may impede its expansion. Complications related to total ankle replacement surgery include infection, blood clots, nerve injury, and issues with wound healing. Additionally, patients may face the risk of implant failure, which could necessitate revision surgeries. The complexity of ankle anatomy and the potential for limited bone stock further contribute to surgical complexities. Moreover, patient-specific factors, such as underlying health conditions, may increase the likelihood of postoperative complications. The need for careful patient selection, thorough preoperative assessment, and meticulous surgical technique is crucial to mitigate these risks. The awareness of potential complications and the proactive management of associated challenges are imperative for sustaining the growth trajectory of the Total Ankle Replacement Surgery Market.

The market for joint replacement procedures has been significantly hindered by the repercussions of the COVID-19 pandemic, leading to the cancellation or delay of scheduled treatments and a notable decline in new diagnoses and procedures. The National Joint Registry's 18th Annual Report in 2021 highlighted a substantial deficit in joint replacement provision, with 106,922 (48.8%) fewer procedures performed in 2020 compared to 2019. Knee replacement procedures saw a reduction of 52%, and ankle replacements experienced a decrease of 53%. Wales and Northern Ireland were particularly affected, with a 67% and 64% reduction in joint replacement procedures, respectively. This decline has had a tangible impact on the quality of life for individuals grappling with joint-related disorders and chronic pain in England, Wales, and Northern Ireland. A survey conducted in Louisiana, as reported in a November 2020 article by the National Library of Medicine, revealed that 81 out of 97 respondents experienced delays in receiving routine care for orthopaedic injuries during the pandemic, further underscoring the substantial impact of COVID-19 on the growth of the studied market.

Segmental Analysis:

The HINTEGRA total ankle replacement segment anticipates a robust Compound Annual Growth Rate (CAGR) in the total ankle replacement market over the forecast period. Total ankle replacement involves the use of prosthetics to replace damaged ankle parts, with the HINTEGRA prosthesis being a notable three-component system comprising a mobile bearing composed of ultra-high molecular weight polyethylene, a talar component, and a tibial component that provides axial rotation and normal flexion-extension mobility. This particular segment is poised for significant growth in the overall market, driven by factors such as the increasing adoption of ankle replacement surgery as a preferred treatment option for various ankle-related issues, including chronic pain, arthritis, and end-stage ankle osteoarthritis. Additionally, the surging aging population, which exhibits a higher preference for these devices, contributes to the segment's anticipated growth. Total ankle replacement, particularly with advanced designs like HINTEGRA, has emerged as a leading solution for managing end-stage ankle osteoarthritis. A report published in the Journal of Bone and Joint Surgery in May 2022, titled 'Long-Term Survival of HINTEGRA Total Ankle Replacement in 683 Patients: A Concise 20-Year Follow-up of a Previous Report,' highlighted the impressive long-term survival rates. The study reported a cumulative survival rate of 95% at 5 years, 86% at 10 years, and 82% at 15 years for patients with the HINTEGRA implant. The robust survival rate of the HINTEGRA total ankle replacement design is expected to be a key driver of market growth over the forecast period.

North America is poised to maintain a substantial share in the total ankle replacement market, a trend expected to persist throughout the forecast period. The region's market dominance can be attributed to factors such as the increasing prevalence of rheumatoid arthritis and osteoarthritis, heightened awareness among the populace about ankle treatment options, a robust healthcare infrastructure, the availability of reimbursements, and substantial healthcare spending. The growing burden of joint-related disorders, exemplified by statistics from sources like Statistics Canada and the Centers for Disease Control and Prevention (CDC), underscores the demand for ankle replacements. For instance, approximately 5.9 million adult Canadians had arthritis in 2020, and about 58.5 million people in the United States had doctor-diagnosed arthritis. Additionally, the aging population, susceptible to joint-related issues, is expected to drive the demand for ankle replacement surgeries. According to the United Nations Population Fund, a significant proportion of the U.S. population is aged 15-64 years, accounting for 65% in 2022, while 17% are aged 65 and above. This demographic shift is anticipated to contribute to increased demand for ankle replacements. The market growth is further fueled by strategic business initiatives such as mergers, acquisitions, and product launches. Notable examples include DJO, LLC's acquisition of Trilliant Surgical in January 2021, expanding its foot and ankle replacement portfolio, and Vilex, LLC's acquisition of DT MedTech, LLC in July 2020, enhancing its product offerings with the Hintermann Series System Total Ankle Replacement. These factors collectively position North America for sustained growth in the total ankle replacement market over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players working in this segment are:

Recent Development:

1) In November 2021, Stryker introduced the Prophecy Infinity Resect-Through Guides designed for total ankle replacement surgeries. These guides streamline the surgical process by requiring fewer steps compared to the Prophecy standard pin-through technique. The innovation enhances orthopaedic efficiency by consolidating drilling and cutting into a single guide, simplifying the surgical plan for patients.

2) Furthermore, in August 2021, Smith+Nephew expanded its Extremities portfolio at the American Academy of Orthopaedic Surgeons 2021 Annual Meeting in San Diego. The company unveiled the CADENCE Total Ankle Flat Cut Talar Dome System and the ATLASplan Shoulder 3D Planning, along with a patient-specific instrument (PSI) System, targeting the total ankle and total shoulder replacement segments. This strategic expansion reflects a commitment to advancing orthopedic solutions, offering improved tools and options for surgeons in ankle and shoulder replacement

Q1. What was the Total Ankle Replacement Market size in 2023?

As per Data Library Research the total ankle replacement market size was valued at USD 244.13 million in 2023.

Q2. At what CAGR is the market projected to grow within the forecast period?

Total Ankle Replacement Market is expected to expand at a CAGR of 7.21% during the forecast period.

Q3. What are the factors driving the Total Ankle Replacement market?

Key factors that are driving the growth include the Rising Geriatric Population and Growing Prevalence of Osteoarthritis and Rheumatoid Arthritis.

Q4. Who are the key players in Total Ankle Replacement market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model