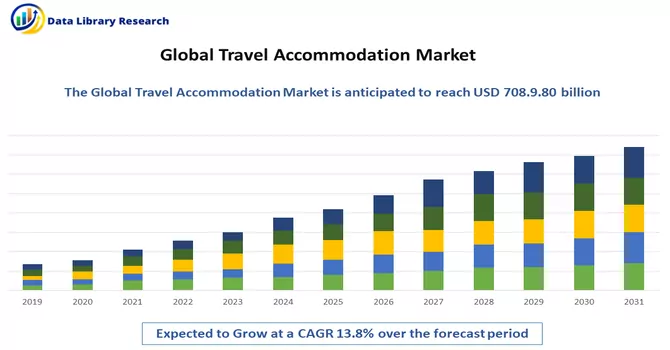

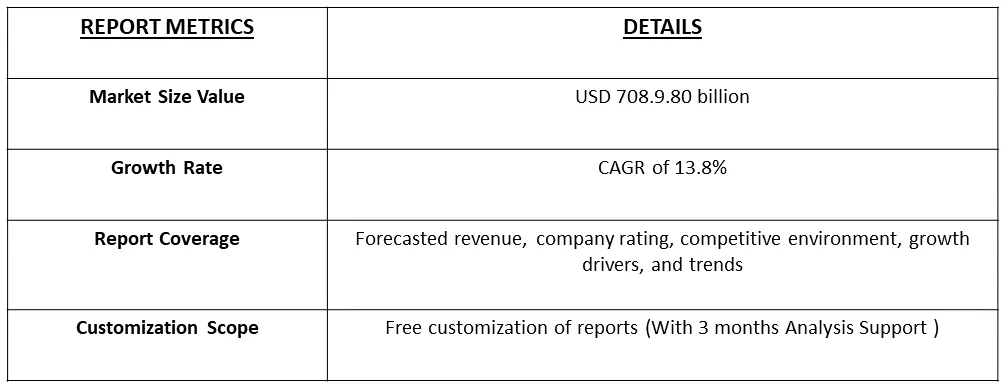

The global online accommodation booking market was valued at USD 708.9.80 billion in 2023 and is projected to a CAGR of 13.8% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Online accommodation booking has transformed the way individuals plan and organize their travels, becoming an integral component of the global travel industry. This burgeoning market, dominated by platforms such as Booking.com, Airbnb, and Expedia, provides users with a convenient and efficient way to secure accommodations, ranging from hotels and resorts to private homes and apartments. The digital shift in the accommodation booking process offers travellers an extensive array of choices, allowing them to tailor their lodging options to personal preferences and budget constraints. With user-friendly interfaces, real-time availability checks, and customer reviews, online accommodation booking platforms offer transparency and reliability.

The market's growth is further propelled by the increasing trend of mobile bookings, the rise of alternative accommodations, and the continuous evolution of technology to enhance user experience, reflecting a dynamic and competitive landscape that reshapes the way people plan their stays during travel. The growth of the online accommodation booking market is propelled by the increasing digitization of travel planning and the rising trend of consumer preference for convenience and flexibility. As more individuals embrace the digital landscape for organizing their trips, online accommodation booking platforms offer a seamless and accessible solution. The ease of browsing, comparing, and securing lodging options from a vast array of choices, coupled with real-time availability updates, empowers travellers to make informed decisions. The proliferation of smartphones and the convenience of mobile apps further contribute to the market's expansion, as users can book accommodations on the go. Additionally, the rise of alternative accommodations, such as vacation rentals and boutique stays, broadens the offerings available on these platforms, catering to diverse preferences. The continuous innovation in technology, including artificial intelligence and personalized recommendations, enhances the overall user experience, making online accommodation booking an integral and growing segment within the dynamic travel industry.

Market Segmentation: Online Hotel Booking Industry Trends and is Segmented by Platform (Mobile Application, Website), Mode of Booking (Third-party online portals, Direct/captive portals), Geographical Region (North America, Asia Pacific, Europe, Latin America, Middle East, and Africa).

For Detailed Market Segmentation - Download Free Sample PDF

Market trends in the online accommodation booking sector reflect a dynamic landscape shaped by evolving consumer behaviours and technological advancements. One prominent trend is the growing emphasis on sustainability and eco-friendly accommodations, with travellers seeking options aligned with their environmental values. Additionally, the rise of "bleisure" travel, combining business and leisure, has influenced booking patterns, leading to extended stays and a demand for diverse accommodation types. The integration of augmented reality (AR) and virtual reality (VR) technologies into booking platforms is enhancing the user experience, allowing potential guests to virtually explore accommodations before making reservations. Furthermore, the industry is witnessing increased collaboration between accommodation providers and online platforms to offer exclusive deals and loyalty programs, fostering customer retention. As the market continues to adapt to changing preferences, the emergence of contactless technologies and enhanced safety measures in response to global events are anticipated trends, shaping the future of the online accommodation booking market.

Market Drivers:

The widespread adoption of smartphones and mobile applications has significantly facilitated the accessibility and convenience of online accommodation booking.

The widespread adoption of smartphones and mobile applications has been a transformative force in the online accommodation booking market, profoundly enhancing accessibility and convenience for travellers. With a majority of the global population relying on smartphones, these devices have become indispensable tools for trip planning. Mobile applications offered by leading booking platforms empower users to effortlessly search for, compare, and reserve accommodations from the palm of their hands, eliminating the constraints of traditional methods. The immediacy of real-time updates, coupled with seamless navigation and secure payment options, has redefined the user experience, allowing individuals to make informed and swift decisions while on the move. This shift towards mobile-centric booking aligns with the dynamic and fast-paced nature of contemporary travel, establishing smartphones as instrumental drivers in the flourishing landscape of online accommodation booking.

The relentless growth of the global travel and tourism industry acts as a fundamental driver for the online accommodation booking market

The relentless growth of the global travel and tourism industry serves as a fundamental driver propelling the expansion of the online accommodation booking market. As the world becomes more interconnected, an increasing number of individuals embark on domestic and international journeys, fostering a surge in demand for convenient and efficient lodging solutions. Online accommodation booking platforms play a pivotal role in meeting this demand by offering a diverse array of options, ranging from hotels to vacation rentals, along with user-friendly interfaces and real-time availability checks. The industry's continuous growth fuels the necessity for centralized and accessible platforms, driving the adoption of online booking services. This symbiotic relationship between the flourishing travel sector and online accommodation booking. platforms underscore the integral role these platforms play in facilitating and shaping the evolving landscape of global travel and hospitality.

Market Restraints:

The online accommodation booking market faces several constraints that impact its dynamics. One significant restraint is the dependency on internet connectivity, which can pose challenges in regions with limited or unreliable access. Additionally, concerns related to data security and privacy may deter some users from engaging in online booking, especially as cyber threats become more sophisticated. The market also contends with the issue of fake reviews and misleading information on some platforms, eroding trust among users. Intense competition among online booking platforms may lead to price wars and reduced profit margins for service providers. Moreover, regulatory uncertainties and compliance issues in certain regions can hinder the seamless operation of online accommodation booking services. As the market evolves, addressing these challenges, such as enhancing cybersecurity measures, ensuring data integrity, and fostering transparent and reliable review systems, will be crucial for sustained growth and customer trust.

The COVID-19 pandemic has exerted a profound impact on the online accommodation booking market, reshaping travel patterns and consumer behaviours. With widespread lockdowns, travel restrictions, and heightened health concerns, the market experienced a significant downturn as global travel came to a virtual standstill. Cancellations and postponements surged, leading to a sharp decline in booking activities. The demand for accommodations plummeted, particularly in urban and tourist-centric areas. However, the pandemic has also accelerated certain trends, such as the adoption of contactless technologies and the prioritization of safety and hygiene measures. Online booking platforms responded with flexible cancellation policies and enhanced cleaning standards to rebuild traveller confidence. As the world gradually recovers and travel resumes, the online accommodation booking market is poised for a resurgence, albeit with a heightened focus on adaptability, safety, and catering to the evolving needs and expectations of travellers in the post-pandemic landscape.

Mobile Application Segment is Expected to Witness Significant Growth Over the Forecast Period

The mobile application online accommodation booking market has experienced significant growth in recent years, driven by the increasing use of smartphones and the convenience they offer in making travel arrangements. These apps allow users to browse, compare, and book accommodations such as hotels, vacation rentals, and hostels directly from their mobile devices, providing a seamless and efficient booking experience. One key factor contributing to the growth of this market is the rise in global travel and tourism, leading to an increased demand for accommodation booking services. Additionally, the ease of use and accessibility of mobile apps have made them a preferred choice for travellers looking to make quick and hassle-free bookings. Another trend driving market growth is the integration of advanced technologies such as artificial intelligence and machine learning, which enhance the user experience by providing personalized recommendations and real-time updates on availability and pricing. Major players in the mobile application online accommodation booking market include established brands like Booking.com, Airbnb, and Expedia, as well as newer entrants offering niche services or targeting specific market segments. As the market continues to evolve, competition is expected to intensify, leading to further innovations and improvements in service offerings.

Direct/captive portals Segment is Expected to Witness Significant Growth Over the Forecast Period

Direct/captive portals play a significant role in the online accommodation booking market, offering a unique channel for hotels and accommodation providers to connect directly with their customers. These portals are websites or platforms owned and operated by individual hotels or hotel chains, allowing them to offer their rooms and services directly to consumers without relying on third-party booking sites. Direct portals provide several benefits to both hotels and consumers. For hotels, they offer greater control over pricing, availability, and branding, leading to increased profitability and brand loyalty. They also enable hotels to collect valuable customer data and feedback, which can be used to improve services and tailor marketing strategies. For consumers, direct portals offer a more personalized booking experience, allowing them to easily access exclusive deals, loyalty programs, and additional services offered by the hotel. Direct booking also provides greater transparency and flexibility, as consumers can communicate directly with the hotel regarding their booking preferences and requirements. However, direct portals face challenges in competing with online travel agencies (OTAs) and other third-party booking sites, which often have larger marketing budgets and greater visibility. To overcome these challenges, hotels must invest in effective digital marketing strategies and customer relationship management to drive traffic to their direct portals and encourage direct bookings. Thus, direct/captive portals are an important component of the online accommodation booking market, offering hotels and consumers a valuable alternative to traditional booking channels.

Asia-Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia-Pacific region is a key player in the global online accommodation booking market, accounting for a significant share of both supply and demand. This region includes diverse markets such as China, Japan, India, Australia, and Southeast Asia, each with its own unique characteristics and trends in the accommodation booking industry. One of the driving factors behind the growth of online accommodation booking in the Asia-Pacific region is the rapid expansion of the middle class and increasing disposable incomes. This has led to a surge in domestic and international travel, creating a growing demand for online booking services. Additionally, the widespread adoption of smartphones and internet connectivity has made it easier for consumers in the Asia-Pacific region to research and book accommodation online. Mobile booking apps have become particularly popular, offering users convenience and flexibility in booking accommodations while on the go. In recent years, there has also been a rise in alternative accommodation options such as vacation rentals and homestays, driven by changing consumer preferences and the desire for more authentic travel experiences. Online platforms that offer these alternative accommodations have gained popularity in the Asia-Pacific region, further fueling the growth of the online accommodation booking market. Despite the significant growth opportunities, the Asia-Pacific region also presents challenges for online accommodation booking providers, including diverse market regulations, cultural differences, and competition from local and international players. However, with the right strategies and local partnerships, online accommodation booking companies can capitalize on the region's growing travel market and establish a strong presence in this dynamic and diverse region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The analyzed market exhibits a high degree of fragmentation, primarily attributable to the presence of numerous players operating on both a global and regional scale. The competitive landscape is characterized by a diverse array of companies, each contributing to the overall market dynamics. This fragmentation arises from the existence of specialized solution providers, established industry players, and emerging entrants, all vying for market share. The diversity in market participants is underscored by the adoption of various strategies aimed at expanding the company presence. On a global scale, companies within the studied market are strategically positioning themselves through aggressive expansion initiatives. This often involves entering new geographical regions, targeting untapped markets, and establishing a robust global footprint. The pursuit of global expansion is driven by the recognition of diverse market opportunities and the desire to capitalize on emerging trends and demands across different regions. Simultaneously, at the regional level, companies are tailoring their approaches to align with local market dynamics. Regional players are leveraging their understanding of specific market nuances, regulatory environments, and consumer preferences to gain a competitive edge. This regional focus allows companies to cater to the unique needs of local clientele, fostering stronger market penetration. To navigate the complexities of the fragmented market, companies are implementing a range of strategies. These strategies include investments in research and development to stay at the forefront of technological advancements, mergers and acquisitions to consolidate market share, strategic partnerships for synergies, and innovation to differentiate products and services. The adoption of such multifaceted strategies reflects the competitive nature of the market, with participants continually seeking avenues for growth and sustainability. In essence, the high fragmentation in the studied market not only signifies the diversity of players but also underscores the dynamism and competitiveness that drive ongoing strategic manoeuvres. As companies explore various avenues for expansion, the market continues to evolve, presenting both challenges and opportunities for industry stakeholders. Some of the key market players are:

Recent Development:

1) In July 2023, Fliggy, the online travel platform owned by Alibaba Group, announced an extended collaboration with Agoda, the online travel agency, to enhance hotel options for Chinese outbound travellers. This partnership aims to improve digital marketing, overseas hotel supply chains, and accommodation innovation. Through this alliance, Fliggy users will gain access to Agoda and Booking.com's international portfolio of 3.6 million hotels, apartments, and homes, providing better deals and more stay options. This move is expected to significantly boost the online booking accommodation market by offering Chinese travellers a wider range of choices and improving visibility for Chinese accommodation partners, ultimately driving revenue growth and enhancing the travel experience.

2) In May 2023, Yatra Online, Inc. (NASDAQ: YTRA) strengthened its corporate presence in India through its subsidiary Yatra Online Limited, by partnering with IDFC FIRST Bank, a leading private sector bank. This collaboration designates Yatra as the exclusive corporate travel partner for IDFC FIRST Bank, with Yatra providing comprehensive travel services including flight, hotel, and cab bookings. Utilizing advanced technology and exceptional customer service, Yatra aims to optimize travel management for IDFC FIRST Bank while ensuring a seamless travel experience for its employees, thus contributing to the growth of the online booking accommodation market through enhanced corporate travel solutions.

Q1. What was the Travel Accommodation Market size in 2023?

As per Data Library Research the global oTravel Accommodation Market was valued at USD 708.9.80 billion in 2023.

Q2. At what CAGR is the Travel Accommodation Market projected to grow within the forecast period?

Travel Accommodation Market is projected to a CAGR of 13.8% over the forecast period.

Q3. Which Region is expected to hold the highest Market share ?

Asia-Pacific region is expected to hold the highest Market share.

Q4. Who are the key players in Travel Accommodation Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model