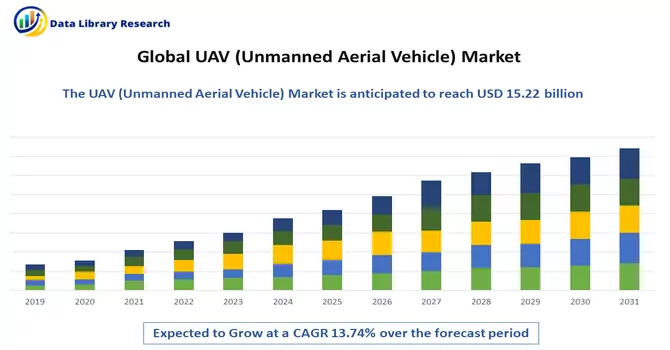

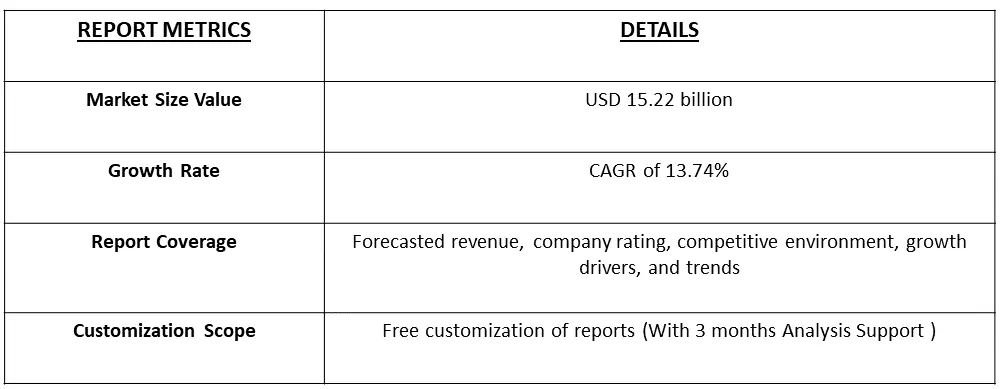

The market size of Unmanned Aerial Vehicles (UAVs) is projected to reach USD 15.22 billion in 2023, with an anticipated Compound Annual Growth Rate (CAGR) of 13.74% during the forecast period from 2023 to 2030.

Get Complete Analysis Of The Report - Download Free Sample PDF

The UAV payload and subsystems market encompass a variety of components, equipment, and technologies integrated into drones to augment their capabilities and functionalities. These essential payloads and subsystems are designed for specific purposes such as surveillance, reconnaissance, communication, payload delivery, mapping, imaging, and data collection. Their significance lies in ensuring the efficient operation of UAVs across a wide range of industries and applications.

Continual advancements in sensor technology, miniaturization, communication systems, and artificial intelligence/machine learning are propelling the evolution of more sophisticated and capable UAV payloads and subsystems. The increasing demand for UAV applications across diverse industries like agriculture, construction, oil and gas, defense, and public safety is driving the requirement for specialized payloads and subsystems tailored to meet the specific needs of these sectors.

Payloads and subsystems are undergoing a trend of miniaturization, reduced weight, and increased power, resulting in enhanced capabilities without compromising the performance of drones. This evolution enables drones to carry a broader range of payloads and operate with increased efficiency. The integration of high-resolution cameras, hyperspectral imaging, LiDAR, and other cutting-edge sensors represents a notable trend. These advanced sensors contribute to improved data collection and analysis capabilities, facilitating applications in diverse fields such as agriculture, environmental monitoring, and infrastructure inspection.

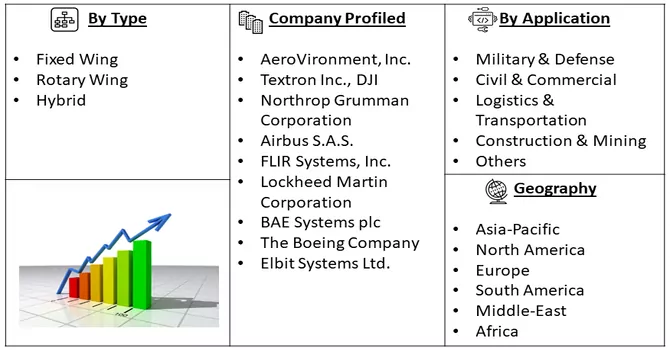

Market Segmentation: Global UAV Payload and Subsystems Market is segmented by Payload (Sensors, Weaponry, Radar and Communications, and Other Payloads) and Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa). The report also covers market sizes and forecasts of different geographical regions. The report provides the market sizes and forecasts in terms of value in USD million.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Technological Advancements

Continuous innovations and technological advancements serve as a key driving force in the UAV payload and subsystems market. Progress in sensor miniaturization, improved data processing capabilities, advancements in communication systems, and the integration of artificial intelligence are propelling the development of increasingly sophisticated and capable UAV payloads and subsystems. These technological enhancements enable more effective data collection, analysis, and transmission, thereby enhancing the overall functionalities of UAVs across various applications, including surveillance, agriculture, and infrastructure inspection.

As an example, in March 2021, Elbit Systems introduced a new variant of its Advanced Multi-Sensor Payload System (AMPS NG) for UAVs. This innovation incorporated Shortwave Infrared (SWIR) technology alongside existing CCD (Charge-Coupled Device) TV sensors, featuring a unique dual FLIR sensor design. Similarly, Aerovironment introduced a new imaging payload, the MANTIS i23 D, in its range of payloads. Compatible with the Raven B small Unmanned Aircraft System (SUAS), this payload boasts an ultralight imaging system with dual 18 MP electro-optical sensors and 24X digital zoom. The majority of defense Original Equipment Manufacturers (OEMs) are integrating advanced sensors and supporting subsystems into their UAV offerings. This strategic approach minimizes research and development costs associated with cross-integrating communication platforms. The continuous incorporation of cutting-edge technologies by industry players reflects the ongoing commitment to enhancing UAV capabilities and expanding their applications in various domains.

Industry Demand and Applications

The rising demand for Unmanned Aerial Vehicles (UAVs) across a range of industries, including agriculture, construction, defense, oil and gas, and public safety, stands as a major catalyst for market growth. UAVs are increasingly employed for diverse tasks such as crop monitoring, site surveys, security surveillance, and disaster response. As industries pursue more specialized and efficient solutions, there is a corresponding increase in demand for tailored payloads and subsystems designed specifically for these applications. This surge in demand is prompting companies to engage in innovation and develop new technologies to address the unique needs of various industries, thereby fostering the expansion of the UAV payload and subsystems market.

Market Restraints:

Regulatory Constraints and Technological Limitations

Stringent regulations and evolving airspace rules often limit the deployment and operations of UAVs. Restrictions on flight altitudes, operating zones, and privacy concerns can impede the widespread adoption of UAVs, especially for commercial and urban applications. Navigating complex and varying regulatory landscapes across different regions can be challenging for manufacturers and operators. Despite ongoing advancements, certain technological limitations persist. Issues such as limited battery life affecting flight endurance, payload weight restrictions impacting capabilities, and the need for more robust and reliable communication systems for long-range operations remain challenges for UAVs. Overcoming these limitations requires significant research and development efforts.

The global pandemic heightened the demand for contactless and remote solutions across diverse industries. Unmanned Aerial Vehicles (UAVs) equipped with specialized payloads emerged as crucial tools with expanded applications, ranging from delivering medical supplies to monitoring quarantine zones and enforcing social distancing measures. This underscored the invaluable role of UAVs in pandemic response efforts. Similar to numerous other sectors, the UAV market faced disruptions in its supply chain during the pandemic. Factors such as factory closures, logistical challenges, and restrictions on movement contributed to delays in the production and delivery of essential UAV components, including payloads and subsystems. These challenges had a cascading effect on manufacturers and project timelines, emphasizing the broader impact of the pandemic on the UAV industry.

Segmentation Analysis:

Radar and Communications Segment is Expected to Witness Significant growth Over the Forecast Period

Radar systems integrated into Unmanned Aerial Vehicles (UAVs) play a pivotal role in enhancing detection and imaging capabilities. These systems provide critical information about the UAV's surroundings, enabling the detection of obstacles, terrain features, and dynamic objects both on the ground and in the air. Concurrently, communication systems within UAVs facilitate seamless data transmission between the drone and ground control stations. These systems enable real-time streaming of video, telemetry data, and other information captured by the UAV's sensors.

The increasing adoption of small UAVs for intelligence, surveillance, and reconnaissance (ISR) and combat missions, coupled with rising expenditures in the defense sector, is a key driver propelling market growth throughout the forecast period. The surge in the number of startups, coupled with substantial funding from governments and investors aimed at designing and developing small UAVs for diverse commercial and military applications, has further stimulated market expansion. A notable illustration is the October 2023 launch of the latest edition of the Black Hornet nano-drone by Teledyne FLIR LLC. The upgraded Black Hornet 4, measuring less than a foot in length and weighing only a fraction of a pound, boasts an impressive flight endurance of over 30 minutes and a range exceeding 2 kilometers (1.24 miles). Equipped with advanced sensors, including a sensitive daytime camera and a thermal imager capable of capturing videos and images, along with a software-defined data system, such innovations are poised to propel growth within this segment in the coming years.

North America Region is Expected to Witness Significant growth Over the Forecast Period

North America, particularly the United States, stands as a focal point for pioneering technological advancements in Unmanned Aerial Vehicles (UAVs) and their associated payloads and subsystems. The region hosts a multitude of companies, research institutions, and government agencies actively engaged in the continuous development of state-of-the-art technologies for UAVs.

Furthermore, the U.S. Department of Defense (DoD) consistently seeks innovative and cost-effective solutions to bolster its capabilities and counter emerging threats from formidable adversaries such as Russia and China. Notably, in April 2023, the Pentagon unveiled a new program with a primary focus on expanding its fleet of autonomous systems, including UAVs. This strategic move aims to strengthen the U.S.'s ability to counterbalance China's extensive military buildup. Additionally, in March 2023, the U.S. Army awarded future tactical UAV contracts to five companies—AeroVironment, Griffon Aerospace, Northrop Grumman, Sierra Nevada Corporation, and Textron Systems—underscoring the nation's commitment to advancing UAV capabilities.

Meanwhile, the Canadian Defense Forces are making significant investments to enhance their defense capabilities, with a specific emphasis on UAV procurement. The Royal Canadian Air Force's Medium-Altitude Low-Endurance (MALE) UAV project, now known as the Remotely Piloted Aircraft Systems (RPAS) Project, has entered the operational analysis phase. The inclusion of RPAS in Canada's modern military, as outlined in the national defense strategy, marks a pivotal development for conducting military operations. These strategic initiatives and programs are poised to propel market growth across the North American region, reaffirming its position as a key contributor to advancements in UAV technologies and applications.

Get Complete Analysis Of The Report - Download Free Sample PDF

The UAV payload and subsystems market exhibit characteristics of having a few dominant vendors operating on a global scale. The market is marked by high competitiveness, with players actively vying to secure significant market shares. In this intensely competitive environment, it has become increasingly imperative for vendors to deliver cutting-edge systems to Original Equipment Manufacturers (OEMs) to not only survive but also thrive. Vendors in this space primarily engage in competition through various strategic factors, including in-house manufacturing capabilities, the extent of their global footprint, the diversity of their product offerings, investments in Research and Development (R&D), and the strength of their client base. The ability to provide advanced, state-of-the-art solutions is a key determinant for success in the UAV payload and subsystems market.

Some of the key major players working in this domain are:

Recent Developments:

1) In December 2022, the Ministry of Defence awarded an initial contract worth Euro 129 million for the delivery of drones to the Armed Forces. The British Army is set to deploy 99 Stalker and 15 Indago models, both part of the Mini Uncrewed Air Systems (MUAS) produced by Lockheed Martin. These advanced drones will play a crucial role for the British Army and Strategic Command, serving in Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) missions on the front line and deep within enemy territory.

2) In another development, YellowScan introduced Voyager in June 2022, a cutting-edge LiDAR scanning system designed for both fixed-wing and multirotor UAVs (unmanned aerial vehicles). Voyager is equipped to capture complex and vertical targets at an impressive data acquisition rate of up to 1800 kHz, ensuring a high level of precision with an accuracy down to 1 cm. This technology represents a significant leap forward in LiDAR capabilities, offering enhanced versatility and accuracy for unmanned aerial vehicles in various applications, including surveying and mapping. The introduction of Voyager reflects ongoing advancements in drone technology, contributing to the evolution of capabilities for data acquisition and analysis across diverse industries.

Q1. What was the UAV Market size in 2023?

The market size of Unmanned Aerial Vehicles (UAVs) is reached USD 15.22 billion in 2023.

Q2. At what CAGR is the UAV market projected to grow within the forecast period?

UAV market is expected to reach at a Compound Annual Growth Rate (CAGR) of 13.74% during the forecast period.

Q3. What are the Growth Drivers of the UAV Market?

Technological Advancements and Industry Demand and Applications are the Growth Drivers of the UAV Market.

Q4. Who are the key players in UAV market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model