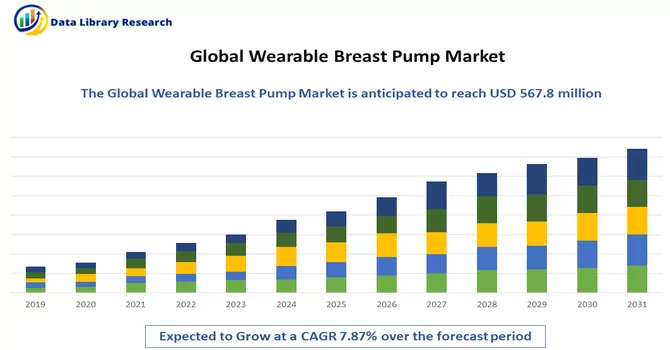

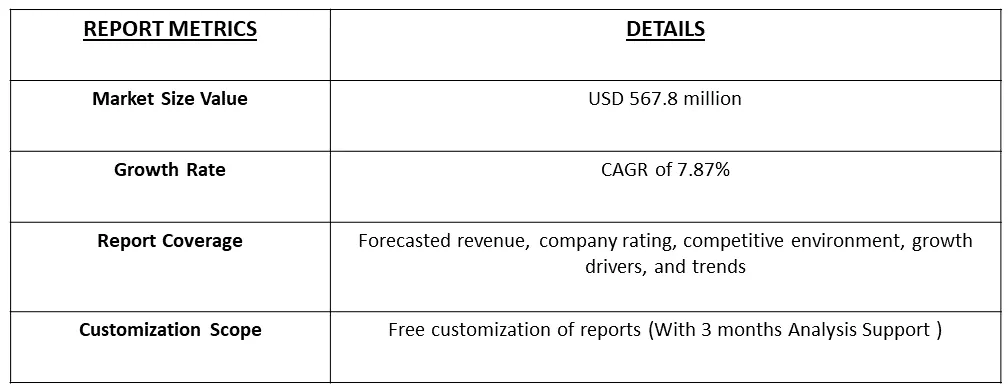

The global wearable breast pump market size was estimated at USD 567.8 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.87% from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

A wearable breast pump is an innovative and convenient solution designed to provide nursing mothers with discreet and hands-free breast milk expression. This compact and portable device is typically worn directly on the user's chest, resembling a bra or discreet attachment, allowing for optimal mobility and flexibility while pumping. It utilizes advanced technology, such as gentle suction and massage modes, to mimic a baby's natural nursing rhythm, promoting efficient milk extraction and comfort for the user. The wearable breast pump is often wireless, leveraging rechargeable batteries or USB connectivity for hassle-free operation. Its inconspicuous design enables mothers to express milk discreetly, whether at work, in public spaces, or during daily activities, without the need for a separate pumping station. Many models also integrate smartphone connectivity, allowing users to monitor pumping sessions and customize settings via dedicated apps. With its user-centric features, the wearable breast pump aims to empower breastfeeding mothers by providing a discreet, efficient, and comfortable solution that seamlessly integrates into their daily lives.

The wearable breast pump market is witnessing significant growth propelled by the increasing emphasis on women's empowerment and breastfeeding, coupled with advancements in technology. The demand for discreet and convenient pumping solutions aligns with the modern, on-the-go lifestyle of women, allowing seamless integration of breastfeeding into daily activities. Improved pump mechanisms, wireless connectivity, and smartphone integration contribute to a user-friendly experience, enhancing adoption rates. The rising number of working mothers and efforts to create breastfeeding-friendly workplaces further drive the market expansion. The global trend of health consciousness and ongoing research and development for innovative features and functionalities also play pivotal roles in fostering the acceptance and growth of wearable breast pumps.

The wearable breast pump market is marked by several key trends, including a growing demand for discreet and hands-free pumping solutions, particularly driven by the rising population of working mothers seeking seamless integration of breastfeeding into their busy schedules. Technological advancements, such as wireless connectivity and smartphone compatibility, are shaping the market, and enhancing user experiences. Personalization is emerging as a significant trend, with adjustable settings and modes allowing users to tailor their pumping experience. Sustainability is gaining importance, prompting manufacturers to incorporate eco-friendly materials into wearable breast pump designs. Collaborations between technology companies and healthcare providers are fostering more integrated solutions, leveraging data analytics for improved monitoring. Continuous innovation remains a driving force, with a focus on introducing novel features and enhanced comfort, reflecting the market's dynamic response to the evolving needs of breastfeeding mothers.

Market Segmentation: The Global Breast Pumps Market is Segmented by Product (Open System Breast Pump and Closed System Breast Pump), Technology (Manual Breast Pump, Battery Powered Breast Pump, and Electric Breast Pump), Application (Personal Use and Hospital Grade), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The market provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers: Increasing Recognition of the Importance of Breastfeeding, Driven by Rising Awareness of its Health Benefits for Both Mothers and Infants.The promotion of breastfeeding-friendly environments in workplaces, coupled with supportive governmental initiatives, serves as a catalyst for the increased adoption of wearable breast pumps. This emphasis on creating conducive spaces for breastfeeding mothers and the backing of government programs contribute significantly to the growing acceptance and utilization of these innovative breast pumping solutions.

According to the statistics from the International Labor Organization (ILO) updated in February 2022, the current global labor force participation rate for women is under 47%. Many working mothers are opting for breast pumps to pump milk and feed their babies when they are away for work. WHO's fact sheet in 2021 showed that about 44% of infants 0-6 months old are exclusively breastfed. Moreover, as per the same report, exclusive breastfeeding is recommended for the first 6 months of a baby's life. Breast pumps ease the pumping of the milk and save a lot of time. Since the female employment rate is increasing globally, many women find it useful to conserve breast milk after returning to work, travelling, or otherwise when separated from their infant, which might increase the adoption of these devices among working women. Therefore, owing to the aforementioned factors, the market is expected to witness growth over the forecast period. However, higher prices of breast pumps are likely to limit their adoption among women, thereby restraining the market's growth.

Technological Advancements

Revolutionary technological progress is a cornerstone in the evolution of wearable breast pumps, significantly elevating their functionality and user experience. Continuous innovation, marked by features such as wireless connectivity, smartphone integration, and discreet designs, aligns seamlessly with the preferences of contemporary, dynamic mothers, thereby enhancing the market's appeal. In January 2023, Madela AG introduced the Freestyle Hands-free Breast Pump, representing a groundbreaking advancement with ultra-lightweight, comfortable, and discreet collection cups. These cups connect to portable pump motors, affording mothers a truly hands-free and convenient pumping experience. Similarly, Willow Innovations, Inc. made strides in January 2023 by launching the Willow 3.0 breast pumps along with the industry's first breast pump companion app designed specifically for Apple Watch. This innovative app, complementing the Willow 3.0 pumps, empowers breastfeeding parents by providing a convenient platform to track, control, and monitor their pumping sessions effortlessly. These technological innovations not only signify a paradigm shift in the landscape of wearable breast pumps but also reflect a commitment to meeting the evolving needs of modern, on-the-go parents seeking enhanced functionality, comfort, and convenience in their breastfeeding journey.

Market Restraints:

Regulatory Constraints and Compliance Standards

The wearable breast pump market encounters significant challenges related to regulatory constraints and compliance standards, primarily concerning health and safety regulations. Meeting these stringent standards poses a considerable hurdle for market players, impacting various aspects of product development, production, and market competitiveness. Ensuring that wearable breast pumps comply with rigorous health and safety regulations demands meticulous attention to detail and adherence to specific quality control measures. This can extend the product development timelines as companies navigate through the complex process of obtaining regulatory approvals. The rigorous testing and certification processes required to meet these standards can contribute to delays in bringing innovative products to market. Furthermore, the need for adherence to regulatory guidelines may result in increased production costs. Companies are compelled to invest in research, testing, and compliance efforts to meet established standards, contributing to higher expenses. These elevated production costs, combined with the extended development timelines, can impact the overall affordability and pricing strategies of wearable breast pumps, potentially limiting market accessibility.

The global COVID-19 pandemic has exerted a substantial influence on breastfeeding and lactation practices worldwide, introducing anti-breastfeeding clinical measures early on, which posed health risks for infants. Amid concerns about the potential separation of breastfeeding mothers and infants, the use of breast pumps emerged as a valuable solution during the pandemic. A 2022 report from the University of Idaho highlighted that breast milk from COVID-infected mothers carries antibodies that can aid infants in combating COVID-19. Governments, recognizing the importance of breastfeeding during the pandemic, provided support and guidance to mothers. Notably, the Centers for Disease Control and Prevention (CDC) issued updates in 2022, offering information on the proper cleaning and sanitization of breast pumps to ensure infant safety. Consequently, the multifaceted impact of COVID-19, encompassing health concerns, the importance of breastfeeding, and regulatory guidance, has significantly influenced the dynamics of the breast pumps market. The pandemic underscored the pivotal role of breast pumps in facilitating breastfeeding practices while addressing health and safety considerations for both mothers and infants.

Segmental Analysis:

Closed System Breast Pump Segment is Expected to Witness Significant Growth Over the Forecast Period

The closed system breast pump has emerged as a notable segment within the breast pump market, offering enhanced hygiene and safety features. Distinguished by a barrier between the pumping mechanism and the collected milk, a closed system prevents potential contamination and ensures a sterile environment during expression. This design not only promotes the health and safety of infants but also simplifies the cleaning process for mothers. The breast pump market, as a whole, has experienced considerable growth driven by factors such as increased awareness of breastfeeding benefits, greater women's participation in the workforce, and continuous innovations in pump technologies. Closed-system breast pumps, with their emphasis on hygiene, have gained popularity among mothers seeking a secure and efficient pumping experience. The market evolution includes ongoing advancements, such as improved suction power, customizable settings, and compatibility with wearable and hands-free options, reflecting the industry's commitment to meeting the diverse needs of breastfeeding mothers worldwide.

Battery Powered Breast Pump Segment is Expected to Witness Significant Growth Over the Forecast Period

The battery-powered breast pump segment has become a pivotal component of the broader breast pump market, offering breastfeeding mothers a convenient and portable solution. Fueled by technological advancements, these pumps provide flexibility and mobility, allowing users to express milk without being tethered to a power source. The breast pump market, in general, has witnessed substantial growth driven by increased awareness of breastfeeding benefits, rising employment rates among women, and advancements in pump design and functionality. Wearable and hands-free options, coupled with features like wireless connectivity and smartphone integration, cater to the preferences of modern, on-the-go mothers. Additionally, the COVID-19 pandemic has underscored the importance of breast pumps in ensuring infant nutrition and maternal well-being, further boosting market demand. As innovation continues to drive product development, the breast pump market, including battery-powered options, is expected to evolve to meet the evolving needs of breastfeeding mothers worldwide.

Wearable Breast Pumps Segment is Expected to Witness Significant Growth Over the Forecast Period

The breast pump market encompasses two distinctive segments – hospital-grade and wearable pumps – each addressing the specific needs of breastfeeding mothers. Hospital-grade pumps, characterized by their robustness and efficiency, find utility in clinical settings and NICUs, ensuring optimal milk supply in medically complex situations. Conversely, wearable pumps, compact and discreet, offer on-the-go mothers hands-free and portable solutions, aligning with modern lifestyles. The hospital-grade market is driven by healthcare emphasis on breastfeeding, while wearables thrive on technological innovation and changing maternal preferences. Challenges include the high cost of hospital-grade pumps and potential limitations in suction power for wearables. However, both segments present opportunities for advancements to meet evolving consumer demands, promising a diverse array of breastfeeding solutions.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

The North American region is poised to play a pivotal role in driving substantial market growth during the study period, attributed to various factors that collectively contribute to the region's prominence. The prevalence and adoption of breast pumps are notably high, propelled by factors such as elevated women's employment rates, robust healthcare expenditure, and a well-established healthcare infrastructure. The United States, in particular, emerges as a key contributor to regional market expansion, fueled by increased product launches and proactive government initiatives aimed at fostering market growth. The initiatives by organizations and governments are pivotal in creating awareness and promoting market growth. An illustrative example is the awareness program conducted by the American Society for Biochemistry and Molecular Biology in 2021, focusing on educating the public about breastfeeding benefits, emphasizing the emotional and psychological advantages for both mothers and infants. Such initiatives contribute significantly to market growth by fostering awareness within the population.

Moreover, product launches and strategic collaborations in North America exert a profound impact on breast pump market dynamics. The convenience provided by electric and automated breast pumps, particularly favored by working mothers for expressing and storing milk while at work, has driven market demand. In January 2022, Medela, a North American company, introduced the "Solo," a single electric breast pump in Canada, catering to breastfeeding moms and working women at an affordable rate. Similarly, in November 2020, the collaboration between Medela and Aeroflow Breastpumps resulted in the launch of a dream at-home breastfeeding and pump room makeover initiative in the United States. These instances underscore the continuous innovation and market responsiveness within the region. Thus, the North American breast pump market is anticipated to witness robust growth, driven by a confluence of factors, including societal trends, supportive government initiatives, and strategic industry developments, all contributing to an increased adoption of breast pumps in the region.

Get Complete Analysis Of The Report - Download Free Sample PDF

The wearable breast pump market is predominantly shaped by key industry players that collectively wield significant market share and influence overarching trends. An in-depth analysis of the financials, strategic roadmaps, and product portfolios of these leading companies is conducted to chart the intricate supply network within the industry. These companies serve as pivotal players, holding sway over market dynamics, and their strategic decisions and product innovations often set the tone for the entire wearable breast pump sector. By delving into the financial performances, strategic initiatives, and product offerings of these industry leaders, a comprehensive understanding of the supply chain and market dynamics is gained. The examination of these key players offers valuable insights into the competitive landscape, enabling stakeholders to make informed decisions and stay abreast of the evolving trends in the wearable breast pump market. Some of the market players working in this market domain are:

Recent Development:

1) In a move demonstrating their dedication to supporting mothers, Lansinoh unveiled the Lansinoh Wearable Pump in August 2023. This product release aligns with their commitment to "Stand with the Mothers," aiming to provide new moms with simplified solutions through both innovative products and comprehensive resources, enhancing their overall breastfeeding journey.

2) In February 2023, a collaboration between Madela AG and Sarah Wells resulted in the launch of the Allie sling bag. This addition to Madela's Freestyle Hands-free Breast Pump portfolio offers a practical and stylish solution for breastfeeding parents. The partnership highlights a shared commitment to addressing the diverse needs of breastfeeding individuals, combining Madela's expertise in hands-free pumping technology with Sarah Wells' focus on fashion-forward and functional accessories. The Allie sling bag stands as a testament to their joint effort in providing convenience and ease for parents navigating the challenges of breastfeeding.

Q1. What was the Wearable Breast Pump Market size in 2023?

As per Data Library Research the global wearable breast pump market size was estimated at USD 567.8 million in 2023.

Q2. At what CAGR is the wearable breast pump market projected to grow within the forecast period?

Wearable Breast Pump Market is projected to grow at a compound annual growth rate (CAGR) of 7.87% over the forecast period.

Q3. What segments are covered in the Wearable Breast Pump Market Report?

By Product, By Technology, By Application and Geography these segments are covered in the Wearable Breast Pump Market Report.

Q4. Who are the key players in Wearable Breast Pump Market?

Some key players operating in the market include

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model