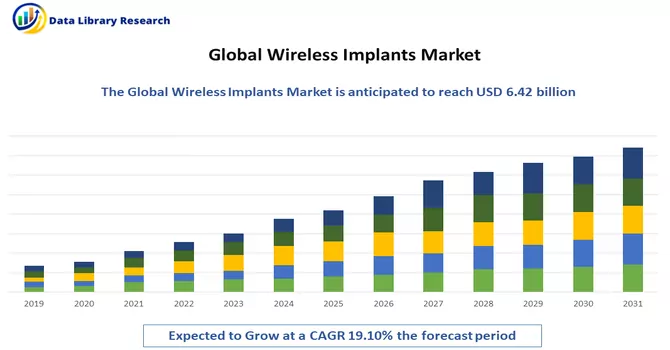

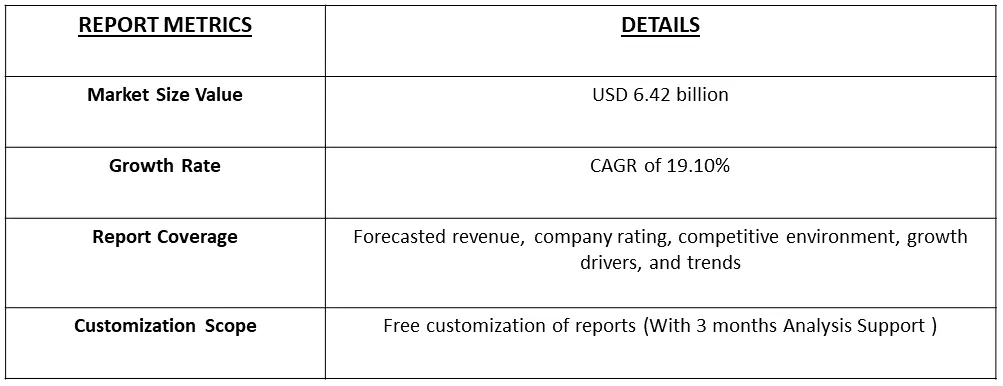

The global wireless implants market size was estimated at USD 6.42 billion in 2023 and is a CAGR of 19.10% during the forecast period from 2024 to 2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Wireless implants refer to medical devices or implants that incorporate wireless communication technology for data transmission and reception. Unlike traditional implants that may require physical connections or wired interfaces, wireless implants utilize radiofrequency (RF) communication or other wireless technologies to transmit information between the implanted device and external systems. These implants are designed to be embedded inside the human body for various medical purposes, such as monitoring physiological parameters, delivering therapeutic interventions, or supporting functionalities like neural stimulation. The wireless capability enables seamless communication between the implant and external devices, allowing for real-time data exchange, remote monitoring, and, in some cases, adjustments or programming without the need for physical connections. Wireless implants have applications in diverse medical fields, including cardiology, neurology, orthopaedics, and more, offering a more flexible and patient-friendly approach to medical interventions and monitoring.

The wireless implant market is propelled by several key factors driving its growth. Advances in wireless technologies, including Bluetooth, Wi-Fi, and RFID, contribute to the development of more efficient and smaller wireless implants, enhancing patient comfort. The increasing prevalence of chronic diseases, particularly among the ageing population, has spurred the demand for continuous monitoring and timely interventions, positioning wireless implants as valuable tools in disease management. The trend towards remote patient monitoring and the integration of wireless implants with technologies like AI and IoT further expand their capabilities and applications. Patient preferences for non-invasive monitoring methods align with the minimally invasive nature of wireless implants, driving adoption. Increased global healthcare expenditure, government support, and initiatives encouraging innovative healthcare technologies contribute to the market's growth. Additionally, the rise of wearable healthcare devices and the exploration of wireless implants in various medical specialities, such as cardiology and neurology, contribute to the market's expansion, shaping the future of implantable medical devices in the healthcare industry.

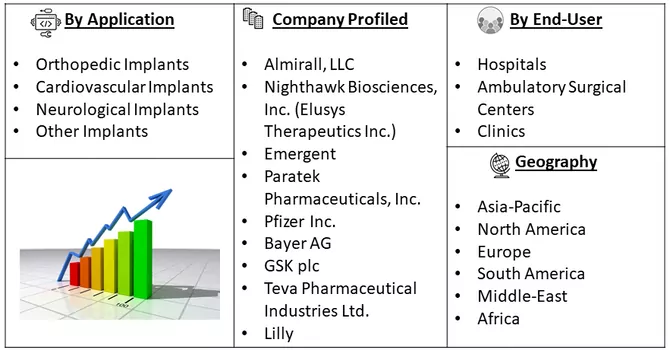

Market Segmentation: Wireless Implants Market By Application (Orthopedic Implants, Cardiovascular Implants, Neurological Implants, Other implants) End-User (Hospitals, Ambulatory Surgical Centers, Clinics) and Geography (North America, Europe, Asia-Pacific, Latin America and Middle East and Africa ).

For Detailed Market Segmentation - Download Free Sample PDF

The wireless implant market is witnessing dynamic trends that are reshaping its landscape. Notable among these is the rapid evolution of wireless technologies, with continuous advancements in data transmission, connectivity, and energy efficiency. The growing adoption of remote patient monitoring, particularly in chronic disease management, is a prominent trend, aided by the seamless integration of wireless implants with wearable devices. The emphasis on cybersecurity has heightened, reflecting the increased connectivity of these implants and the need to safeguard patient data. Miniaturization remains a key focus, enhancing patient comfort, and expanding implantation possibilities. Advances in power sources, including energy harvesting and long-lasting batteries, are extending the lifespan of wireless implants. The convergence of wireless technology with bioelectronic medicine is emerging as a significant trend, paving the way for innovative neural modulation therapies. Applications in neurostimulation, implantable sensors, and enhanced data analytics underscore the versatility of wireless implants. Moreover, the evolution of regulatory frameworks is influencing compliance standards and approvals, ensuring a balance between innovation and patient safety. Collectively, these trends highlight the ongoing transformation and diversification of the wireless implant market, driven by technological breakthroughs and a commitment to personalized healthcare solutions.

Market Drivers:

The Rising Prevalence of Chronic Diseases Coupled with a Growing Elderly Population

The rising prevalence of chronic diseases, coupled with a growing elderly population, represents a significant and intertwined healthcare challenge that has far-reaching implications for global health systems. As populations age worldwide, there is a corresponding increase in the incidence of chronic conditions such as cardiovascular diseases, diabetes, respiratory disorders, and neurodegenerative conditions. This demographic shift places a substantial burden on healthcare infrastructure and resources, necessitating a comprehensive and strategic approach to disease management and healthcare delivery.

An article released by the National Center of Biotechnology Information in April 2023 presented findings on the behavioural and socio-demographic characteristics of 65,258 individuals aged 45 years and above in India. The study categorized adults and the elderly into three distinct age groups: 23,005 participants in the 45–54 age bracket, 19,631 in the 55–64 age group, and 22,622 individuals aged 65 years and above. The prevalence of at least one chronic disease was estimated to be 41.73% (95% CI: 40.59 to 42.87) among this demographic in India. Notably, among the seven specified diseases, self-reported diagnosed hypertension exhibited the highest prevalence at 26.82%, followed by diabetes at 12.24%, arthritis at 9.01%, lung disease at 6.43%, heart disease or stroke at 5.34%, neurological diseases at 2.17%, and cancer at 0.63%. Thus, nexus of the rising prevalence of chronic diseases and a growing elderly population underscores the urgent need for a comprehensive and proactive healthcare strategy. This involves not only addressing the immediate healthcare needs of individuals but also implementing measures that promote healthy aging, prevent the onset of chronic conditions, and enhance the overall resilience of healthcare systems in the face of demographic changes. The collaborative efforts of healthcare professionals, policymakers, and the community are essential to navigate the complex landscape of chronic disease management within an aging global population. Thus, such factors are expected to contribute to the growth of the studied market over the forecast period.

The Shift Towards Remote Healthcare Management and Technological Advancements

The paradigm shift towards remote healthcare management has been accelerated by technological advancements, prominently featuring the integration and use of wireless implants. In recent years, the healthcare landscape has witnessed a transformative change, driven by the convergence of healthcare and technology. Remote healthcare management, facilitated by wireless implants, has emerged as a pivotal strategy to enhance patient care, especially in the context of chronic diseases and long-term conditions. Technological advancements, particularly in the field of wireless implants, have played a crucial role in enabling real-time monitoring, data collection, and communication between implanted devices and external healthcare systems. These implants, equipped with wireless connectivity, offer healthcare providers the capability to remotely monitor patients' vital signs, adherence to medication, and overall health status. This not only enhances the efficiency of healthcare delivery but also allows for timely interventions and personalized treatment plans.

In February 2022, The successful surgical implantation of the Intracortical Visual Prosthesis (ICVP) marks a significant milestone in the Phase I Feasibility Study at Rush University Medical Center. Developed by a collaborative team led by Philip R. Troyk, the executive director of the Pritzker Institute of Biomedical Science and Engineering at the Illinois Institute of Technology, the ICVP system represents the culmination of nearly thirty years of dedicated research. This innovative implant directly connects to the brain's visual cortex, bypassing the retina and optic nerves to potentially restore artificial sight in individuals facing blindness due to eye disease or trauma. The groundbreaking surgery at Rush University Medical Center signifies a crucial step forward in advancing medical technology to address visual impairment and offer new possibilities for those with vision-related challenges. Thus, such developments are expected to witness significant growth over the forecast period.

Market Restraints:

Security Concerns and Regulatory Challenges

The wireless nature of implants introduces cybersecurity risks, raising concerns about the potential unauthorized access, data breaches, and tampering. Ensuring the security and privacy of patient data remains a critical challenge for the widespread acceptance of wireless implants. Also, the regulatory landscape for medical devices, including wireless implants, is complex and subject to frequent changes. Navigating regulatory requirements and obtaining approvals can be time-consuming and costly, acting as a barrier to the rapid introduction of new wireless implant technologies to the market. Thus, such factors are expected to slow down the growth of the studied market over the forecast period.

The COVID-19 pandemic has exerted a multifaceted impact on the Wireless Implant Market. Disruptions in global supply chains and delays in clinical trials due to the pandemic have impeded the manufacturing and introduction of wireless implants. The shift in healthcare priorities towards addressing immediate pandemic challenges has redirected resources, potentially slowing down investments in wireless implant technologies. Financial constraints, reduced elective procedures, and economic uncertainties have raised affordability concerns and impacted the adoption of certain wireless implants. However, the increased focus on remote monitoring accelerated digital transformation in healthcare and heightened emphasis on healthcare resilience present opportunities for the market. The adoption of telehealth services during the pandemic has created a favourable environment for remote monitoring technologies, including wireless implants. Additionally, the pandemic has led to regulatory adjustments, with expedited review processes and potential implications for approval timelines and market entry. Despite challenges, the long-term acceptance and growth of wireless implant technologies may benefit from the evolving healthcare landscape shaped by the pandemic.

Segmental Analysis:

Neurological Implants Segment is Expected to Witness Significant Growth Over the Forecast Period

Neurological implants represent a groundbreaking field at the intersection of neuroscience and technology, offering innovative solutions for addressing various neurological disorders and conditions. These implants are designed to interact directly with the nervous system, providing therapeutic benefits and, in some cases, restoring lost functionalities. Deep Brain Stimulation (DBS) implants, for instance, involve the insertion of electrodes into specific regions of the brain to modulate abnormal neural activity, effectively treating conditions such as Parkinson's disease, essential tremor, and dystonia. Another notable category is Spinal Cord Stimulators (SCS), which deliver electrical impulses to the spinal cord, offering pain relief for individuals suffering from chronic pain conditions. Neurological implants hold immense promise for conditions that were previously challenging to treat effectively. In epilepsy management, responsive neurostimulation implants can detect abnormal brain activity and deliver targeted stimulation to prevent seizures. Cochlear implants, a well-established form of neurological implant, provide aural stimulation to individuals with hearing impairments, transforming sound waves into electrical signals that the brain can interpret.

Emerging technologies are pushing the boundaries of neurological implants, with advancements like Brain-Computer Interfaces (BCIs) enabling direct communication between the brain and external devices. BCIs hold the potential for assisting individuals with paralysis, allowing them to control prosthetic limbs or even interact with computers through neural signals.

In September 2023, the brain-chip startup founded by billionaire entrepreneur Elon Musk, revealed that it has obtained approval from an independent review board to commence the recruitment process for the inaugural human trial of its brain implant aimed at individuals dealing with paralysis. The trial will target those with paralysis resulting from cervical spinal cord injury or amyotrophic lateral sclerosis. Although the precise number of participants has not been disclosed, the trial is anticipated to extend over approximately six years. Neuralink detailed that a robotic system will be utilized to surgically implant a brain-computer interface (BCI) in a brain region linked to the intention to move. The primary goal of the study is to empower individuals to manipulate a computer cursor or keyboard solely through their thoughts. Thus such ongoing research and development in neurological implants underscore a commitment to improving the quality of life for individuals with neurological conditions. As technology continues to advance, neurological implants are poised to play an increasingly integral role in providing tailored and effective solutions for a wide range of neurological disorders, fostering hope for enhanced patient outcomes and expanded applications in the years to come.

Hospitals Segment is Expected to Witness Significant Growth Over the Forecast Period

Hospitals are embracing the integration of wireless implants into their medical practices, ushering in a transformative era in patient care. These innovative devices, equipped with wireless connectivity, are particularly instrumental in remote patient monitoring, allowing healthcare providers to continuously track vital signs and treatment responses in real-time, benefiting patients with chronic conditions. In post-surgical scenarios, wireless implants, especially in orthopaedics, facilitate the seamless transmission of healing process data to healthcare professionals, enabling timely interventions and personalized care. Neurological implants, addressing conditions like epilepsy and Parkinson's disease, offer insights into neural activities, guiding precise adjustments to treatment strategies. This adoption of wireless implants enhances data-driven decision-making, contributing to the broader digital transformation of healthcare in hospitals. However, challenges such as ensuring data security and privacy necessitate robust cybersecurity measures, and healthcare professionals require adequate training to interpret wireless implant data effectively. The ongoing collaboration between medical device manufacturers, healthcare providers, and regulatory bodies is pivotal for the safe and effective integration of wireless implants, promising improved patient outcomes and elevated healthcare quality.

North America Region is Expected to Witness Significant Growth Over the Forecast Period

North America stands at the forefront of adopting and advancing the use of wireless implants in the field of healthcare. The region has witnessed a surge in the integration of these innovative devices into medical practices, contributing to improved patient care and treatment methodologies. In the United States and Canada, healthcare providers are increasingly leveraging wireless implants for various applications, ranging from remote patient monitoring to post-surgical management. The use of wireless implants in neurology, orthopedics, and other medical specialties has become more prevalent, reflecting the region's commitment to embracing cutting-edge technologies to enhance healthcare outcomes. One significant trend in North America is the growing emphasis on remote patient monitoring facilitated by wireless implants. These devices allow healthcare professionals to remotely track patients' health metrics, enabling early intervention and personalized care, especially for individuals with chronic conditions. The region's well-established healthcare infrastructure and the presence of leading medical device manufacturers contribute to the rapid adoption and integration of wireless implants in clinical settings. The regulatory environment in North America plays a crucial role in shaping the landscape for wireless implants. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and Health Canada, set standards and guidelines to ensure the safety and efficacy of these devices. This regulatory oversight fosters a balance between innovation and patient safety, instilling confidence in healthcare professionals and the public regarding the use of wireless implants. Thus, such factors are expected to witness significant growth over the forecast period.

Get Complete Analysis Of The Report - Download Free Sample PDF

The wireless implant market is characterized by a fragmented landscape attributed to the presence of numerous market players operating on both global and regional scales. This fragmentation is a result of the diverse applications and specialized nature of wireless implants, leading to the participation of various companies offering a range of products. Globally recognized players, alongside regional and niche-focused entities, contribute to the market's diversity. This fragmented structure fosters healthy competition, encouraging continuous innovation and technological advancements as companies strive to carve out their niche. Each player often brings unique expertise and focuses on specific applications within the wireless implant sector, contributing to the overall dynamism and versatility of the market. Wireless Implants Market Players:

Recent Development:

1) In May 2023, Medtronic strategically bolstered its position in the cardiovascular implant market through the acquisition of Ablation Frontiers, a trailblazer in minimally invasive ablation technologies for treating atrial fibrillation. This move is expected to enhance Medtronic's product portfolio by integrating Ablation Frontiers' innovative solutions, offering advanced treatments for a prevalent heart condition.

2) In April 2023, Abbott Laboratories expanded its presence in the healthcare sector by acquiring Verifi Medical, a specialist in developing neuromodulation devices tailored for chronic pain management. Abbott's acquisition of Verifi Medical is poised to diversify its array of pain management solutions and strengthen its position in the competitive neuromodulation market. This strategic move underscores Abbott's commitment to advancing medical technologies for the improved care of patients.

Q1. What was the Wireless Implants Market size in 2023?

As per Data Library Research the global wireless implants market size was estimated at USD 6.42 billion in 2023.

Q2. What is the Growth Rate of the Wireless Implants Market?

Wireless Implants Market is expected to grow at a CAGR of 19.10% during the forecast period.

Q3. Which factor is Limiting the growth of Wireless Implants Market?

Security Concerns and Regulatory Challenges is Limiting the growth of Wireless Implants Market.

Q4. Which region has the largest share of the Wireless Implants Market.? What are the largest region's market size and growth rate?

North America has the largest share of the market. For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model