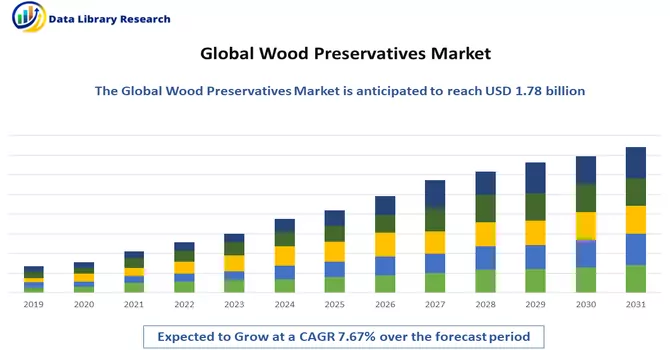

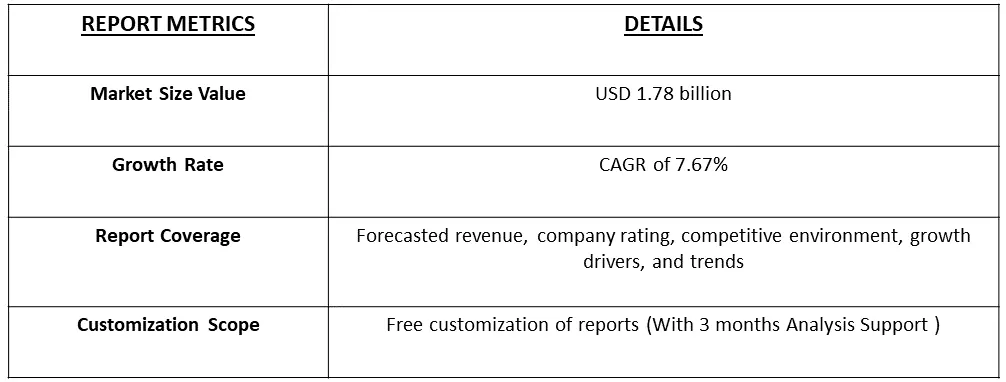

The global wood preservatives market was valued at USD 1.78 billion in 2023 and is expected to register a CAGR of 7.67% over the forecast period, 2024-2031.

Get Complete Analysis Of The Report - Download Free Sample PDF

Wood preservatives are essential in enhancing the longevity and durability of wood products, shielding them from decay, insect infestations, and the damaging effects of weathering. They form a protective barrier against fungi, preventing decay, and act as a deterrent or toxic agent against wood-boring insects and termites. Wood preservatives also mitigate the impact of environmental factors such as sunlight and moisture, reducing the risk of cracks, warping, and discolouration. Various types of preservatives, including oil-based, water-based, pressure-treated wood, and borate preservatives, cater to different applications and environmental considerations. The ongoing development of eco-friendly alternatives underscores a growing commitment to sustainability in wood preservation, aligning with global efforts towards environmentally conscious practices.

The expansion of this global market can be traced back to a substantial upswing in construction endeavours spanning residential, commercial, and industrial sectors. Wood finds extensive application in various structures such as furniture, doors, cabinets, roofs, staircases, and beams. These products are primarily employed to safeguard against decay, insects, and other environmental hazards. Predominantly utilized types of products encompass oil-based preservatives, water-based preservatives, and chemical treatment lumbar. Diverse chemicals incorporated in these products consist of creosote oils, copper-based compounds, and borates.

The wood preservatives market is experiencing significant growth globally, propelled by a notable uptick in construction activities across residential, commercial, and industrial sectors. Increasing awareness of environmental sustainability is driving a shift towards eco-friendly preservative solutions, with a focus on formulations derived from renewable resources. Technological advancements, particularly in nanotechnology and smart coatings, are contributing to the development of innovative and more efficient wood preservatives. Water-based preservatives are gaining preference due to their lower toxicity and ease of application, aligning with stringent environmental regulations. Additionally, the market is witnessing a heightened emphasis on termite resistance, collaboration among industry players, and adaptation to evolving urbanization trends. As regulatory landscapes evolve, and consumer preferences for sustainable solutions persist, the wood preservatives market is poised for continued dynamism and innovation.

Market Segmentation: The Global Wood Preservatives Market is segmented by technology (water-based technologies (micronized copper systems, Chromated Copper Arsenate (CCA), borates, and other water-based technologies), oil-based technologies (pentachlorophenol, creosote, and other Oil-based technologies), and other technologies), end-user industry (residential, commercial, infrastructural, and other end-user industries), and geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The report offers the market size and forecasts for revenue (USD million) for all the above segments.

For Detailed Market Segmentation - Download Free Sample PDF

Market Drivers:

Increasing Demand for Wood in Different Applications

The escalating demand for wood across diverse applications has emerged as a significant driver for the wood preservatives market. With wood being extensively used in construction, furniture manufacturing, doors, cabinets, roofs, staircases, and beams, the need for effective preservation solutions has become paramount. As construction activities surge globally in residential, commercial, and industrial sectors, the demand for wood preservation technologies has witnessed a parallel rise to ensure the durability and longevity of wooden structures. This increasing reliance on wood, coupled with a growing awareness of the environmental impact and the necessity for sustainable practices, has propelled the demand for wood preservatives. These products play a crucial role in protecting wood from decay, insect infestations, and other environmental threats, thereby reinforcing the structural integrity of wood-based products. As the trend of incorporating wood in various applications continues to grow, the wood preservatives market is poised for sustained expansion to meet the evolving needs of industries and consumers alike.

Increasing Furniture Production

The surging demand for furniture production worldwide has become a significant catalyst for the wood preservatives market. As the global population grows and urbanizes, there is an increasing need for residential and commercial furniture, driving the demand for wood as a primary material. Wood, being a versatile and aesthetically pleasing choice for furniture, faces challenges related to decay, insects, and environmental factors that can compromise its quality and longevity. This has led to a heightened reliance on wood preservatives to ensure the durability and protection of wooden furniture. Manufacturers are increasingly incorporating preservative treatments into their production processes to meet the rising consumer expectations for long-lasting, resilient, and sustainable furniture. The wood preservatives market, in response to the expanding furniture industry, is witnessing a parallel growth trajectory as it continues to play a pivotal role in maintaining and enhancing the quality of wood used in furniture production. This symbiotic relationship between the increasing demand for furniture and the necessity for effective wood preservation solutions underscores the vital role of wood preservatives in sustaining the longevity and aesthetic appeal of wooden furniture products.

Market Restraints:

Stringent Environmental Regulations

The growth trajectory of the wood preservatives market is encountering potential deceleration due to increasingly stringent environmental regulations. As global awareness of environmental sustainability rises, regulatory bodies are imposing stricter standards on the chemicals and formulations used in wood preservatives. Restrictions on certain preservative ingredients, driven by concerns over toxicity and environmental impact, pose challenges for manufacturers in meeting compliance requirements. This has prompted the industry to explore alternative, eco-friendly formulations, leading to increased research and development costs. Moreover, the evolving regulatory landscape may influence the availability and approval of specific wood preservatives, impacting market dynamics. While the focus on environmentally conscious practices is commendable, the stringent regulations may introduce complexities for businesses in the wood preservatives sector, potentially impeding the pace of market growth as companies navigate the balance between efficacy and environmental responsibility.

The wood preservatives market, like many industries, has been significantly impacted by the global COVID-19 pandemic. The initial disruption in supply chains, labor shortages, and construction slowdowns during lockdowns in various regions resulted in a temporary setback for the market. The construction sector, a primary consumer of wood preservatives, faced delays and uncertainties, affecting the demand for these products. However, as the world adapted to the new normal, the market demonstrated resilience, with a gradual recovery observed in tandem with the easing of restrictions and resumption of construction activities. The increased focus on home improvements during lockdowns also contributed to a rebound in demand for wood preservatives, particularly in the residential sector. Moreover, the pandemic underscored the importance of durable and long-lasting construction materials, driving awareness about wood preservation as an essential component in ensuring the longevity of wooden structures. While challenges persist, the wood preservatives market is showing signs of recovery and adaptation to the evolving dynamics in a post-COVID landscape.

Segmental Analysis:

Micronized Copper Systems Segment is Expected to Witness Significant Growth Over the Forecast Period

Micronized Copper Systems (MCS) have emerged as a notable innovation in the wood preservatives market, offering enhanced efficacy and environmental benefits. Traditionally, copper-based chemicals have been extensively used in wood preservation due to their effectiveness against decay and insects. However, the micronization process involves reducing the particle size of copper compounds, leading to improved penetration into wood fibers and a more uniform distribution. The adoption of Micronized Copper Systems in the wood preservatives market addresses several key concerns. Firstly, it enhances the performance of copper-based preservatives, resulting in better protection against fungi, insects, and other environmental threats. This innovation is particularly significant in outdoor applications where wood is exposed to harsh weather conditions. Secondly, the micronization process allows for the use of lower concentrations of copper, reducing the overall environmental impact and toxicity. This aligns with the industry's increasing focus on sustainable and eco-friendly wood preservation methods. The use of micronized copper systems reflects a commitment to maintaining efficacy while minimizing adverse effects on the environment. Furthermore, Micronized Copper Systems contribute to extending the service life of wood, making it a preferred choice for various applications, including construction, decking, and fencing. As the demand for long-lasting and durable wood products continues to rise, the adoption of micronized copper-based preservatives is expected to grow, driving innovation in the wood preservatives market. In conclusion, the integration of Micronized Copper Systems represents a positive trend in the wood preservatives market, providing a balance between effectiveness, sustainability, and environmental responsibility. As the industry embraces these innovations, it is poised for continued growth and adaptation to evolving market dynamics.

Commercial Segment is Expected to Witness Significant Growth Over the Forecast Period

The commercial segment stands out as a pivotal driver in the wood preservatives market, playing a crucial role in shaping industry dynamics. The escalating demand for wood preservatives in commercial applications is propelled by diverse factors, primarily centered around construction activities, interior design, and infrastructure projects. Commercial spaces, including offices, retail outlets, hospitality establishments, and educational institutions, extensively utilize wood in various structural and decorative elements such as flooring, furniture, and fixtures. Wood preservatives in the commercial sector serve as a safeguard against decay, insects, and environmental stresses, ensuring the longevity and structural integrity of wooden components. The preservation of wooden elements not only contributes to the aesthetics and durability of commercial spaces but also aligns with the imperative for sustainable and long-lasting construction materials. The commercial segment's influence on the wood preservatives market is underscored by the growing emphasis on eco-friendly formulations and environmentally conscious building practices. As businesses increasingly prioritize sustainability and environmental responsibility, the demand for wood preservatives that meet stringent environmental standards continues to rise. Moreover, the commercial sector's contribution to the wood preservatives market is notable in the context of stringent building codes and regulations. Compliance with these regulations necessitates the incorporation of effective wood preservation solutions to meet safety and durability requirements. In summary, the commercial segment serves as a key driver for the wood preservatives market, fueled by the expanding commercial construction landscape and the industry's shift towards sustainable building practices. As commercial spaces continue to evolve in design and functionality, the demand for high-performance wood preservatives is expected to persist, shaping the trajectory of the market and encouraging further innovations in wood protection technologies.

Asia Pacific Region is Expected to Witness Significant Growth Over the Forecast Period

The Asia Pacific region emerges as a promising market for wood preservatives, driven by the dynamic growth of the construction industry in countries such as China, India, Japan, and South Korea. A report by Oxford Economics in May 2023 forecasts that India's construction sector is poised to exhibit the fastest growth globally by 2030, contributing significantly to the overall expansion of the global construction industry with an estimated addition of USD 1 trillion. This remarkable growth is attributed to proactive government policies in India aimed at fortifying urban infrastructure to meet the demands of a rapidly urbanizing population. The emphasis on urban development and infrastructure enhancement aligns with the surge in construction activities, making the region a key driver for the wood preservatives market. The favourable market conditions in the Asia Pacific region underscore the pivotal role of the construction industry in propelling the demand for wood preservatives, positioning the region as a noteworthy player in the global landscape.

Get Complete Analysis Of The Report - Download Free Sample PDF

The global wood preservatives market is characterized by a state of partial fragmentation, indicating that the industry is composed of numerous players, each holding relatively modest market shares. In this scenario, there is no dominant market leader, and the market is distributed among various companies, contributing to a diverse competitive landscape. This fragmentation can be attributed to several factors, including the presence of a wide range of wood preservatives, diverse applications, and regional variations in demand. Additionally, the industry may witness the participation of both established companies and emerging players, further contributing to the dispersion of market shares. While this fragmentation presents opportunities for smaller players to carve out niche markets and innovate, it also signifies a dynamic and competitive environment where companies must continually adapt to changing market trends and consumer preferences. Overall, the partial fragmentation in the global wood preservatives market underscores the diversity and complexity within the industry, with various players contributing to its overall growth and development. Key Wood Preservatives Companies:

Recent Development:

1) In October 2022, Koppers Performance Chemicals Inc. declared a noteworthy increase in its market presence within the industrial and commercial sectors for wood preservation technology.

2) In January 2022, LANXESS and Matrìca, a collaborative effort between Versalis (Eni) and Novamont, joined forces to manufacture eco-friendly biocide preservatives derived from renewable resources. Through this collaboration, both companies aspire to make substantial strides in the production of sustainable preservatives and meet the escalating demand in the markets.

Q1. What was the Wood Preservatives Market size in 2023?

As per Data Library Research the global wood preservatives market was valued at USD 1.78 billion in 2023.

Q2. What are the factors driving the Wood Preservatives Market?

Key factors that are driving the growth include the Increasing Demand for Wood in Different Applications and Increasing Furniture Production.

Q3. At what CAGR is the Wood Preservatives Market projected to grow within the forecast period?

Wood Preservatives Market is expected to register a CAGR of 7.67% over the forecast period.

Q4. Which region has the largest share of the Wood Preservatives market? What are the largest region's market size and growth rate?

Asia-Pacific regoin has the largest share of the market . For detailed insights on the largest region's market size and growth rate request a sample here.

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model