Adeno-Associated Virus (AAV) CDMO Services Market Overview and Analysis

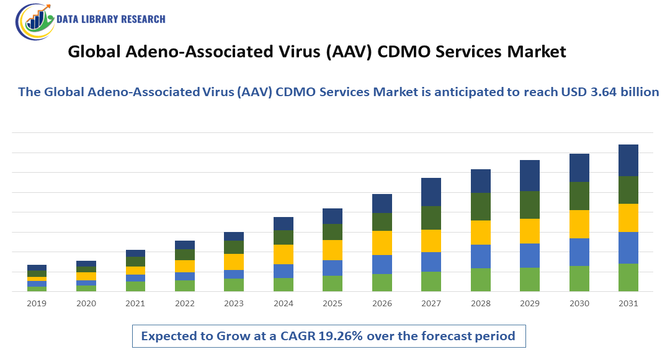

The Global Adeno-Associated Virus (AAV) CDMO Services Market is expected to reach USD 1.63 billion in 2025 and grow at a CAGR of 19.26% to reach USD 3.64 billion in 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Adeno-Associated Virus (AAV) CDMO Services Market refers to the industry providing contract development and manufacturing services for AAV-based gene therapies. These services include viral vector design, production, purification, and analytical testing for pharmaceutical and biotech companies. Growing demand for gene therapies, increasing investment in personalized medicine, and outsourcing trends in biopharmaceutical manufacturing are driving the market, as companies seek specialized expertise to accelerate development and commercialization of AAV-based treatments globally.

Adeno-Associated Virus (AAV) CDMO Services Market Latest Trends

The Global AAV CDMO Services Market is experiencing robust growth due to the rising demand for gene therapies targeting rare and inherited diseases. Increasing R&D investment in AAV-based therapeutics, coupled with the growing prevalence of genetic disorders, drives outsourcing to specialized CDMOs. Technological advancements, such as scalable viral vector production, high-yield purification methods, and analytical testing, are shaping the market. Strategic collaborations between biotech firms and CDMOs, alongside regulatory support for advanced therapies, further fuel growth. Additionally, the adoption of innovative AAV serotypes and next-generation gene therapy platforms is expanding the service scope, enhancing market potential globally.

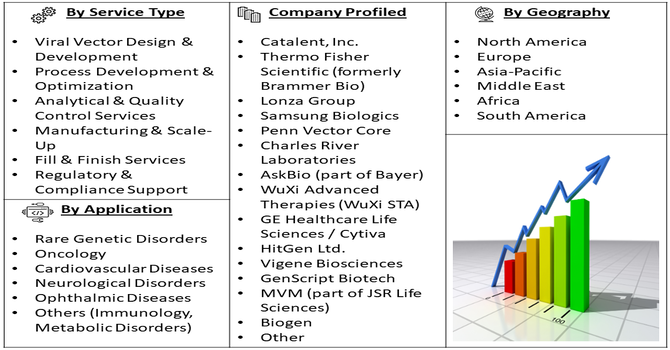

Segmentation: The Global AAV CDMO Services Market is segmented by Service Type (Viral Vector Design & Development, Process Development & Optimization, Analytical & Quality Control Services, Manufacturing & Scale-Up, Fill & Finish Services and Regulatory & Compliance Support), Therapeutic Application (Rare Genetic Disorders, Oncology, Cardiovascular Diseases, Neurological Disorders, Ophthalmic Diseases and Others (Immunology, Metabolic Disorders)), AAV Serotype (AAV2, AAV5, AAV8, AAV9 and Others (Next-generation serotypes)) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Gene Therapies

The Global AAV CDMO Services Market is driven by the growing demand for gene therapies targeting rare, inherited, and chronic diseases. The increasing prevalence of genetic disorders, coupled with advancements in AAV-based therapeutic platforms, has encouraged pharmaceutical and biotech companies to outsource vector development and manufacturing to specialized CDMOs. Outsourcing accelerates time-to-market, ensures compliance with regulatory standards, and provides access to advanced manufacturing expertise. Moreover, the expansion of personalized medicine and cell and gene therapy pipelines globally is fueling the need for reliable, high-quality AAV production services, supporting market growth.

- Technological Advancements in AAV Manufacturing

Technological innovations in AAV production, purification, and analytical testing have significantly boosted the CDMO services market. Development of scalable bioreactor systems, high-yield viral vector platforms, and advanced purification methods allows CDMOs to meet growing clinical and commercial demand efficiently. Next-generation AAV serotypes and improved process controls enhance vector quality and safety, attracting more pharmaceutical clients. Integration of automation, AI-driven process optimization, and regulatory-compliant manufacturing solutions further accelerates adoption. As companies increasingly seek high-quality, end-to-end AAV services to minimize risk and improve therapeutic efficacy, technological advancements continue to be a critical driver of market expansion.

Market Restraints

- High Production Costs and Complexity

The high cost and complexity of AAV vector production restrain market growth. Manufacturing requires specialized facilities, advanced bioreactors, skilled personnel, and stringent quality control to meet regulatory standards, making in-house production expensive. Small and mid-sized biotech companies often face budgetary constraints, limiting widespread adoption. Moreover, the intricate processes of vector purification, characterization, and scale-up contribute to operational challenges and higher unit costs. Limited raw material availability and process variability further complicate manufacturing. These financial and technical barriers slow entry into the market, especially in emerging regions, restraining overall growth of global AAV CDMO services despite increasing demand for gene therapies.

Socioeconomic Impact on Adeno-Associated Virus (AAV) CDMO Services Market

The AAV CDMO Services Market positively impacts socioeconomic factors by enabling faster development and commercialization of life-changing gene therapies for rare and genetic disorders. Outsourcing viral vector production reduces R&D costs, accelerates time-to-market, and increases access to advanced treatments for patients. Growth in this sector creates high-skilled employment opportunities in biotechnology, manufacturing, and quality control. Additionally, improved gene therapy availability enhances patient quality of life and reduces long-term healthcare burdens. Investments in CDMO infrastructure stimulate economic activity in biotechnology hubs. Overall, the market contributes to healthcare innovation, economic growth, and broader societal benefits through improved disease management and treatment accessibility.

Segmental Analysis:

- Viral Vector Design & Development segment is expected to witness highest growth over the forecast period

The Viral Vector Design & Development segment is expected to witness the highest growth over the forecast period due to increasing demand for customized AAV vectors for gene therapy applications. Pharmaceutical and biotech companies prefer outsourcing this highly specialized process to CDMOs with advanced capabilities. Technological advancements in vector engineering, enhanced transduction efficiency, and safety optimization are driving adoption. Additionally, the need for scalable, regulatory-compliant vector production for clinical and commercial use boosts demand. Growing investments in R&D, rising gene therapy pipelines, and collaboration between CDMOs and innovators further propel the segment’s market growth globally.

- Rare Genetic Disorders segment is expected to witness highest growth over the forecast period

The Rare Genetic Disorders segment is projected to witness the highest growth due to the increasing prevalence of inherited diseases and the expanding number of AAV-based gene therapies targeting these conditions. Outsourcing to CDMOs enables efficient development, high-quality vector production, and compliance with stringent regulatory standards. Rising awareness of gene therapy solutions, government support, and orphan drug incentives accelerate adoption. Moreover, technological advancements in vector design and delivery improve therapeutic outcomes, driving market expansion. Companies are increasingly investing in rare disease-focused gene therapy programs, contributing to the growth of this segment within the global AAV CDMO services market.

- AAV2 segment is expected to witness highest growth over the forecast period

The AAV2 segment is expected to witness the highest growth due to its widespread use in clinical gene therapy programs, particularly for ocular, neurological, and metabolic disorders. AAV2’s well-characterized safety profile, strong transduction efficiency, and established regulatory acceptance make it a preferred choice for pharmaceutical companies. Increasing adoption of AAV2 for clinical trials and commercial therapies drives outsourcing to specialized CDMOs for large-scale production. Technological advancements in vector optimization, purification, and quality control further enhance its demand. The segment benefits from growing R&D pipelines and successful therapeutic outcomes, positioning AAV2 as a leading contributor to the global AAV CDMO services market.

- North American Region is expected to witness highest growth over the forecast period

North America is expected to witness the highest growth in the AAV CDMO Services Market due to advanced healthcare infrastructure, high adoption of gene therapies, and strong biopharmaceutical investment. The U.S. and Canada host leading CDMOs, research institutions, and regulatory support for AAV-based therapies, facilitating rapid development and commercialization. For instance, in June 2025, ProBio opened its flagship Cell and Gene Therapy Center of Excellence at Princeton West Innovation Campus, Hopewell, New Jersey. The 128,000 sq. ft. GMP facility utilized advanced technology for manufacturing high-quality plasmid DNA and viral vectors, including AAV, strengthening ProBio’s capabilities in gene therapy production.

Similarly, in April 2025, AGC Biologics formed a new Cell and Gene Technologies Division to enhance its CDMO capabilities. The division featured ProntoLVV and BravoAAV viral vector platforms, which accelerated GMP phase timelines and significantly reduced costs, reinforcing AGC Biologics’ position as a trusted and experienced partner in cell and gene therapy manufacturing.

Rising prevalence of genetic disorders, increased funding for gene therapy R&D, and supportive government policies further accelerate market expansion. Strategic collaborations, mergers, and acquisitions between biotech companies and CDMOs strengthen market presence. North America’s established ecosystem, skilled workforce, and early adoption of advanced AAV technologies make it the largest and fastest-growing regional market globally.

To Learn More About This Report - Request a Free Sample Copy

Adeno-Associated Virus (AAV) CDMO Services Market Competitive Landscape

The Global AAV CDMO Services Market is highly competitive, featuring specialized biopharmaceutical manufacturing firms and global contract service providers. Key players focus on technological innovation, capacity expansion, and strategic partnerships to attract biotech and pharmaceutical clients. Companies compete on production efficiency, vector quality, scalability, and regulatory compliance. Mergers, acquisitions, and collaborations strengthen market presence and accelerate development timelines. Service differentiation through end-to-end solutions, including viral vector design, process optimization, and analytical testing, is critical. Major market participants continuously invest in state-of-the-art manufacturing facilities and proprietary technologies to maintain leadership in the rapidly growing AAV gene therapy sector.

The major players for this market are:

- Catalent, Inc.

- Thermo Fisher Scientific (formerly Brammer Bio)

- Lonza Group

- Samsung Biologics

- Penn Vector Core

- Charles River Laboratories

- AskBio (part of Bayer)

- WuXi Advanced Therapies (WuXi STA)

- GE Healthcare Life Sciences / Cytiva

- HitGen Ltd.

- Vigene Biosciences

- GenScript Biotech

- MVM (part of JSR Life Sciences)

- Biogen

- ReiThera Srl

- Oxford Biomedica

- BioMarin Pharmaceutical (manufacturing services)

- Novasep

- Cobra Biologics

Recent Development

- In February 2025, Avid Bioservices completed the sale of its business for USD 1.1 billion to GHO Capital Partners and Ampersand Capital Partners. This strategic acquisition marked a significant shift in ownership, enabling the involved parties to expand their presence and capabilities in the biopharmaceutical contract development and manufacturing sector.

- In November 2024, the FDA approved Kebildi, the first brain-delivered AAV gene therapy, to treat Aromatic L-Amino Acid Decarboxylase (AADC) deficiency. This landmark approval represented a major advancement in gene therapy for rare neurological disorders, offering a novel treatment option and setting a precedent for brain-targeted viral vector therapies.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the explosion of gene therapy research, where AAV is the preferred "delivery truck" for transporting healthy genes into patients. Because manufacturing these viruses is incredibly complex and expensive, most biotech companies outsource production to specialized CDMOs. Increasing FDA approvals for gene-based medicines are creating a massive backlog and high demand for large-scale manufacturing capacity.

Q2. What are the main restraining factors for this market?

Growth is limited by the "manufacturing bottleneck"—there is a global shortage of facilities and experts capable of producing high-quality AAV at scale. High production costs and complex purification processes make these therapies extremely expensive. Additionally, strict regulatory requirements and the risk of immune responses in patients mean that any manufacturing error can lead to a total project failure.

Q3. Which segment is expected to witness high growth?

The Rare Genetic Disorders segment is also expected to witness the highest growth over the forecast period. This surge is fueled by a critical unmet medical need, as nearly 80% of rare diseases have a genetic origin. Favorable orphan drug designations, increased R&D funding, and advancements in personalized medicine are accelerating the development of targeted AAV-based curative therapies.

Q4. Who are the top major players for this market?

The market is led by giant science-service providers with specialized viral vector facilities. Key players include Thermo Fisher Scientific (Brammer Bio), Lonza, Catalent, and Charles River Laboratories. These companies dominate by offering "end-to-end" services, helping drug developers move from the initial design of the virus all the way to final bottling and global distribution.

Q5. Which country is the largest player?

The United States is the largest player in the AAV CDMO market. It is home to the majority of gene therapy developers and the world's most advanced viral manufacturing hubs. Significant venture capital investment and a favorable regulatory environment for "orphan drugs" (treatments for rare diseases) ensure that the U.S. remains the central global hub for AAV production and innovation.

List of Figures

Figure 1: Global Adeno-Associated Virus (AAV) CDMO Services Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Adeno-Associated Virus (AAV) CDMO Services Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Adeno-Associated Virus (AAV) CDMO Services Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model