Aircraft Exterior/Interior Cleaning Service Market Overview and Analysis

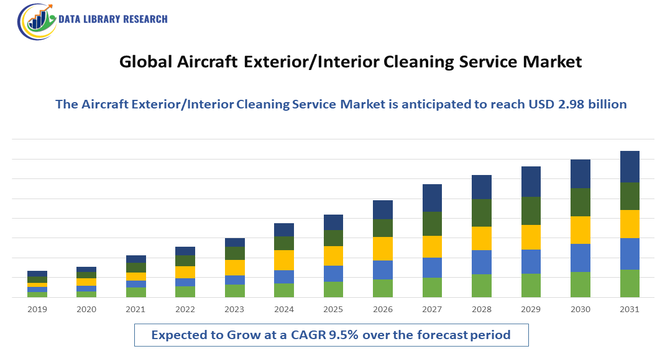

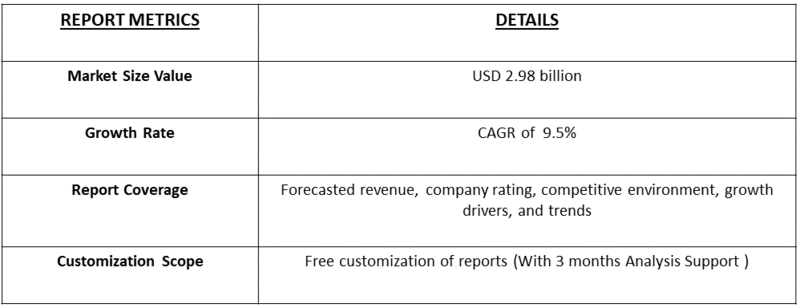

- The market is projected to reach around USD 8.9 billion by 2033 from USD 2.98 billion in 2025. The market is forecast to expand steadily, with a CAGR ranging from 9.5% over the forecast period 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Aircraft Exterior/Interior Cleaning Service Market is experiencing steady growth, driven primarily by the increasing air passenger traffic, rising aircraft fleet sizes, and the stringent emphasis on aircraft hygiene and maintenance standards by aviation authorities. Airlines are prioritizing enhanced cabin cleanliness and exterior upkeep to improve passenger safety, comfort, and brand perception, especially as post-pandemic hygiene expectations remain high. Additionally, the shift toward outsourcing cleaning operations to specialized service providers, the adoption of advanced eco-friendly cleaning technologies, and the need to reduce aircraft downtime are further propelling market expansion.

Aircraft Exterior/Interior Cleaning Service Market Latest Trends:

The latest trends in the Global Aircraft Exterior/Interior Cleaning Service Market highlight a strong shift toward automation, sustainability, and digital optimization, with airlines increasingly adopting robotic cleaning systems, UV-C disinfection technologies, and electrostatic spraying for faster and more efficient turnaround. Eco-friendly and waterless cleaning solutions are gaining traction as carriers commit to reducing environmental impact, while data-driven maintenance platforms and IoT-enabled cleaning equipment are enhancing operational transparency and service quality. Additionally, the integration of antimicrobial coatings, smart scheduling tools, and AI-driven cleanliness monitoring is shaping a more technologically advanced and safety-focused aircraft cleaning ecosystem.

Segmentation: Global Aircraft Exterior/Interior Cleaning Service is segmented by Service Type (wet washing, dry washing, polishing, and paint brightening), Application (commercial aviation, general aviation, and military aviation, each with distinct cleaning frequency and regulatory requirements), Aircraft Type (narrow-body aircraft, wide-body aircraft, regional jets, and business jets), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Air Passenger Traffic and Expanding Aircraft Fleets

The continuous increase in global air passenger traffic is driving airlines to expand their fleets and increase aircraft utilization rates. For instance, in 2024, The International Air Transport Association (IATA) global air travel surged, revenue passenger kilometers (RPKs) climbed 10.4% year-on year, while capacity (ASK) rose 8.7%, and the average load factor hit a record 83.5%. International traffic jumped 13.6%, with capacity up 12.8%, and domestic travel grew 5.7% with capacity rising 2.5%. In December, demand spiked 8.6%, capacity by 5.6%, and the monthly load factor reached a high of 84%. As more aircraft operate more frequently, the need for regular and intensive cleaning—both interior and exterior—rises significantly to ensure safety, comfort, and operational reliability. Higher flight frequency and quick turnarounds also demand efficient cleaning services, directly boosting the market for specialized aircraft cleaning providers.

- Increased Focus on Hygiene, Safety, and Regulatory Compliance

Post-pandemic, airlines and aviation authorities have adopted more stringent hygiene and sanitation requirements to ensure passenger safety. Regulatory bodies mandate regular cleaning cycles, disinfection procedures, and maintenance of exterior surfaces to ensure flight-worthiness and reduce contamination risks. For instance, in 2025, The DGCA held a high level review with Air India and Air India Express over safety concerns, citing maintenance delays, airspace restrictions, and coordination issues. It pressed the airlines to improve communication and spare part management, and told them to adopt real time defect reporting. After inspecting 24 of 33 Boeing 787s, the DGCA found no major safety flaws. This stricter regulatory oversight increased the focus on safety and compliance across airlines. As a result, demand grew for professional, certified aircraft cleaning services—including interior and exterior sanitization—to help carriers meet more rigorous hygiene standards.

Market Restraints:

The major challenges is the high operational cost associated with advanced cleaning technologies, aviation-safe chemicals, and skilled labor, which can limit adoption, especially among smaller airlines and service providers. Additionally, short turnaround times at busy airports create pressure on cleaning teams, often restricting the depth of cleaning that can be performed and impacting service quality. The market is also restrained by stringent regulatory standards, which, while necessary, increase compliance costs and slow the integration of new cleaning methods. Furthermore, fluctuations in air traffic, driven by economic downturns, geopolitical instability, or health crises, directly reduce demand for cleaning services as airlines scale back operations.

Socio Economic Impact on Aircraft Exterior/Interior Cleaning Service Market

The global aircraft exterior/interior cleaning service market has had significant positive social and economic impacts. By ensuring clean, hygienic planes, these services boost passenger trust, airline reputation, and safety standards. They also drive job creation—both for ground cleaners and tech workers using green or automated cleaning tools. With airlines investing in regular, professional cleaning, fuel efficiency improves, maintenance costs drop, and environmental footprints shrink, helping support a cleaner and more sustainable aviation industry worldwide.

Segmental Analysis:

- Expanding Aircraft Fleets segment is expected to witness highest growth over the forecast period

Airlines are continuously adding new aircraft to meet growing route networks and rising travel demand. A larger fleet size directly raises the volume of cleaning tasks required, from turnaround cleaning to periodic exterior washing and interior deep-cleaning cycles, thereby boosting the overall service market.

- Stricter Hygiene Regulations segment is expected to witness highest growth over the forecast period

Aviation authorities worldwide have strengthened hygiene and sanitation guidelines, especially after the pandemic. Compliance now requires more frequent cleaning intervals, enhanced disinfection processes, and documentation, which increases reliance on professional cleaning service providers and drives market growth.

Furthermore, aviation regulators around the world tightened their hygiene and sanitation rules after the pandemic. Authorities like the ICAO and other national bodies required more frequent deep cleanings, stronger disinfection protocols, and documentation of every cleaning event. This regulatory pressure pushed airlines to rely more heavily on specialized third party cleaning providers and significantly boosted demand in the professional aircraft cleaning services market.

- Adoption of Advanced Cleaning Technologies segment is expected to witness highest growth over the forecast period

The integration of robotic cleaning systems, UV-C disinfection, eco-friendly chemicals, and automated washing equipment is transforming aircraft cleaning operations. These technologies improve cleaning speed, accuracy, and safety, making them increasingly attractive to airlines and fueling demand for specialized service providers.

In addition, the growing use of robotic cleaners, UV C disinfection, eco friendly chemicals, and automated wash systems has transformed aircraft sanitization. These smart technologies accelerate cleaning processes, improve consistency, and boost safety for both crew and passengers. As airlines look to cut turnaround times and support sustainability goals, demand for specialized cleaning providers using these innovations has soared — driving rapid growth in the global aircraft cleaning services market.

- North America region is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, supported by a large and expanding commercial aircraft fleet, strong presence of major airlines, stringent aviation hygiene standards, rapid adoption of advanced cleaning technologies, and ongoing investments in airport modernization projects that enhance demand for professional aircraft exterior and interior cleaning services.

In September 2025, Lufthansa Technik expanded its Cyclean Engine Wash across Europe by partnering with ACC Columbia Jet Service. From August, ACC Columbia began providing on site core wash services with certified mobile teams in Germany and other European locations. Lufthansa managed sales and orders, while ACC handled the execution. The collaboration increased access to environmentally efficient engine cleaning for narrow and wide body aircraft, strengthening demand in the global aircraft cleaning services market.

Moreover, the expansion of North America’s aviation infrastructure — including terminal upgrades and MRO (maintenance, repair, and overhaul) hubs — has fueled demand for professional cleaning services. Modern airports increasingly require automated and eco friendly cleaning systems to maintain hygiene amid high-traffic operations. Combined with regulatory pressure and sustainability goals, this has driven rapid adoption of advanced aircraft cleaning technologies across the region.

To Learn More About This Report - Request a Free Sample Copy

Aircraft Exterior/Interior Cleaning Service Market Competitive Landscape:

The Global Aircraft Exterior/Interior Cleaning Service Market is highly competitive with a mix of global ground-handling giants, specialist aviation cleaning firms, and facilities-service companies offering aircraft cleaning as part of broader airport and maintenance services.

Key players include:

- Swissport International

- Dnata

- Menzies Aviation

- SATS Ltd.

- Gategroup

- Celebi Aviation Holding

- ABM Industries

- ISS World Services

- Sodexo (Airport & Aviation Services)

- AviClean Services

- Aero Clean Technologies

- Clean Harbors

- Skycare Aviation Services

- Aviation Cleaning Solutions (ACS)

- Aeroex Cleaning Services

- Hangar Cleaning Services Ltd.

- Global Ground Services (GGS)

- RapidClean Aviation

- Jetway Cleaning Services

- EcoAero Cleaning Solutions

Recent Development

- In February 2025, JFK Millennium Partners released RFPs for guest services, security, and maintenance/janitorial work at the new Terminal 6 ahead of its 2026 opening. These include interior and exterior cleaning tasks, boosting opportunities for firms in high quality cleaning services. This expansion at one of the U.S.’s busiest airports could significantly increase demand in the global aircraft exterior/interior cleaning market, especially in North America.

- In December 2023, Air India rolled out an automated, eco friendly cleaning system called Aerowash, featuring a robotic micro fibre brush drum and a nearly waterless process. It saved up to 30,000 L per narrow body aircraft and 75,000 L per wide body annually. This innovation boosted the global aircraft exterior/interior cleaning market by raising the bar for water efficient, automated cleaning, pushing providers to adopt greener, more cost effective systems with less environmental impact.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the massive increase in global passenger traffic and fleet size, which demands frequent cabin turnover and high standards of cleanliness. Growth is also fueled by stricter airline branding and aesthetic requirements, where a clean exterior is vital for public image. Furthermore, regulatory bodies are increasing focus on cabin hygiene and sanitation, especially post-pandemic, ensuring consistent demand for specialized deep-cleaning services.

Q2. What are the main restraining factors for this market?

A key constraint is the intense pressure from airlines to minimize ground time (turnaround time), making thorough cleaning difficult. The market also struggles with the high cost of specialized, aviation-approved cleaning chemicals and equipment, particularly those required for waterless exterior cleaning methods. Labor issues, including the difficulty of finding staff willing to work overnight shifts at airports, also limit market expansion.

Q3. Which segment is expected to witness high growth?

The Aircraft Exterior Wet Wash Segment is projected to witness the highest growth. While waterless cleaning is gaining popularity, the traditional wet wash remains crucial for deep, scheduled cleaning required to maintain the aerodynamic efficiency of the aircraft body. This comprehensive service removes grime and contaminants that affect fuel consumption, making it an essential, value-driven service for all major airlines globally.

Q4. Who are the top major players for this market?

The market is fragmented but features large global ground handling and MRO (Maintenance, Repair, and Overhaul) companies. Top major players include Menzies Aviation, SFS Aviation, GCG Ground Services, and various in-house airline MRO divisions. Competition focuses on offering 24/7 service availability across multiple international hubs and deploying efficient, high-tech methods like robotic cleaning systems to guarantee quick and consistent quality.

Q5. Which country is the largest player?

The United States is the largest country player. This dominance is due to the highest volume of domestic and international air traffic in the world, creating unparalleled daily demand for cabin cleaning services at major hub airports. The presence of numerous large airlines and ground handling companies, combined with strong standards for customer service and hygiene, ensures the U.S. remains the biggest revenue generator.

List of Figures

Figure 1: Global Aircraft Exterior/Interior Cleaning Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Aircraft Exterior/Interior Cleaning Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Aircraft Exterior/Interior Cleaning Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model