Alpha Fetoprotein Quantitative Assay Kit Market Overview and Analysis

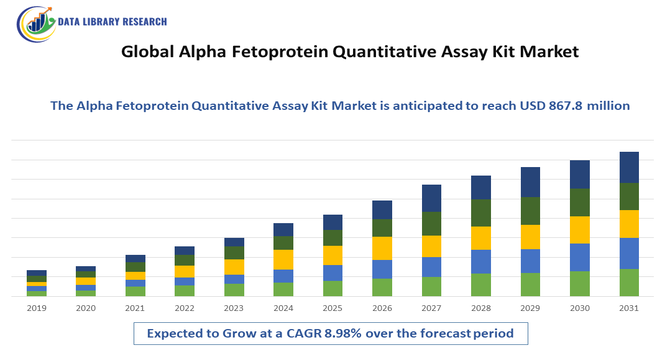

The Global Alpha Fetoprotein (AFP) Quantitative Assay Kit Market is experiencing robust growth, driven by rising cancer cases (especially liver, testicular, ovarian) and prenatal screening needs for birth defects, with projections showing a substantial rise, potentially reaching USD 2.28 billion by 2032, from USD 867.8 million in the year 2025, growing with at a CAGR of around 8.98% from 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Alpha Fetoprotein (AFP) Quantitative Assay Kit Market is experiencing steady growth, primarily driven by the increasing prevalence of liver disorders and cancer, particularly hepatocellular carcinoma (HCC), where AFP serves as a key biomarker for diagnosis and monitoring. The growing awareness about early disease detection and the expanding use of AFP testing in prenatal screening for fetal abnormalities are further boosting market demand.

Alpha Fetoprotein Quantitative Assay Kit Market Latest Trends:

In the Global Alpha Fetoprotein (AFP) Quantitative Assay Kit Market, one prominent trend is the increasing shift toward high-sensitivity chemiluminescence immunoassays and automated platforms, which enhance detection precision and throughput in laboratory diagnostics. Additionally, the rise of multiplexed biomarker panels and point-of-care formats is expanding the use of AFP assays beyond traditional liver-cancer screening to prenatal screening and broader oncology monitoring, enabling more comprehensive diagnostics in diverse clinical settings.

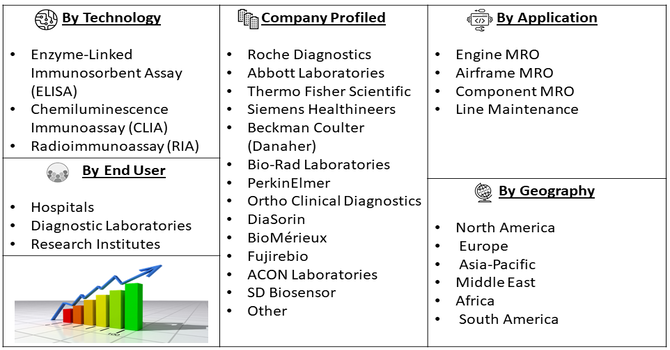

Segmentation: Global Alpha Fetoprotein Quantitative Assay Kit Market is segmented By Technology (Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), Radioimmunoassay (RIA), Application (Liver Cancer Diagnosis, Prenatal Screening), End User (Hospitals, Diagnostic Laboratories, Research Institutes), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Incidence of Liver Cancer and Chronic Liver Diseases

One of the primary drivers of the global Alpha Fetoprotein (AFP) Quantitative Assay Kit market is the increasing prevalence of liver-related diseases, particularly hepatocellular carcinoma (HCC), which is one of the most common and deadly forms of cancer worldwide. AFP is a well-established biomarker used for the early detection, diagnosis, and monitoring of HCC progression and treatment response.

With rising cases of hepatitis B and C infections, alcohol-related liver damage, and non-alcoholic fatty liver disease (NAFLD), the demand for AFP testing continues to grow. For instance, in 2025, CDC reported that new hepatitis B infections held steady at ~20,000 annually (2015–2019), with 14,400 cases in 2023. These persistent infection levels, along with ongoing hepatitis C cases, sustain demand for early liver disease detection, thereby driving growth of the Global Alpha-Fetoprotein Quantitative Assay Kit Market as clinicians rely on AFP testing for monitoring and risk assessment.

- Technological Advancements in Immunoassay Platforms

Another major growth driver is the continuous advancement in immunoassay technologies, particularly the development of high-sensitivity and automated detection systems. Modern AFP quantitative assay kits now incorporate techniques such as chemiluminescence immunoassay (CLIA) and enzyme-linked immunosorbent assay (ELISA), which offer greater accuracy, faster results, and improved reproducibility compared to traditional methods. For instance, in 2025, Anbio Biotechnology has introduced the ADL-1000 Dry Chemiluminescence Immunoassay Solution, a next-generation platform engineered to provide rapid, accurate, and affordable diagnostic testing. Designed for a wide range of clinical environments, the system enhances workflow efficiency and supports high-quality performance. Its impact on the Global Alpha-Fetoprotein Quantitative Assay Kit market includes accelerating the shift toward faster, automated CLIA technologies, increasing product adoption, and raising expectations for precision, versatility, and cost-effective biomarker testing.

Market Restraints:

- Limited Specificity and Diagnostic Accuracy of AFP

One of the key restraints for the Global Alpha Fetoprotein (AFP) Quantitative Assay Kit Market is the limited specificity and diagnostic accuracy of AFP as a standalone biomarker. While AFP testing is widely used for the detection of hepatocellular carcinoma (HCC) and certain fetal abnormalities, elevated AFP levels can also occur in benign liver conditions such as hepatitis, cirrhosis, and liver regeneration. This overlap often leads to false positives, reducing diagnostic reliability and leading clinicians to rely on additional imaging or biomarker tests. The need for confirmatory testing increases overall diagnostic costs and limits the use of AFP kits as a primary diagnostic tool, especially in low-resource settings.

Segmental Analysis:

- Enzyme-Linked Immunosorbent Assay segment is expected to witness highest growth over the forecast period

The Enzyme-Linked Immunosorbent Assay (ELISA) segment holds a significant share of the Global Alpha Fetoprotein Quantitative Assay Kit Market owing to its high accuracy, sensitivity, and cost-effectiveness. ELISA is widely used in both clinical and research settings for quantifying AFP levels due to its ability to handle large sample volumes with minimal manual intervention. The growing adoption of automated ELISA analyzers and continuous advancements in assay reagents are further driving this segment’s growth.

- Liver Cancer Diagnosis segment is expected to witness highest growth over the forecast period

The Liver Cancer Diagnosis segment dominates the market as AFP serves as a critical biomarker for the detection and monitoring of hepatocellular carcinoma (HCC). The increasing global incidence of liver cancer, particularly in regions with high hepatitis B and C prevalence, is boosting demand for AFP assay kits. Furthermore, growing awareness about the benefits of early diagnosis and the inclusion of AFP testing in liver disease screening protocols are strengthening market expansion.

- Hospitals segment is expected to witness highest growth over the forecast period

Hospitals represent the largest segment due to the high patient influx and frequent use of AFP tests in routine cancer diagnosis and prenatal screening. Hospitals are increasingly adopting advanced diagnostic technologies and integrated laboratory systems, enhancing testing efficiency and result accuracy. Additionally, the availability of skilled professionals and reimbursement support in developed economies further fuels hospital-based AFP assay testing.

- Asia-Pacific region is expected to witness highest growth over the forecast period

The Asia-Pacific region was expected to see the fastest growth in the forecast period. Its aviation sector was booming, with countries like China, India, and Southeast Asia rapidly expanding their fleets. Governments were investing heavily in airport development and MRO (maintenance, repair & overhaul) infrastructure, while low-cost carriers multiplied. For instance, in December 2024, an article titled, Epidemiology of Hepatocellular Carcinoma in India – An Updated Review for 2024, reported that India’s Hepatocellular Cancer (HCC) incidence (2.15/100,000), prevalence (2.27/100,000), the annual rate of increase is higher, with current rates higher in males and growth trends faster in females. Rising HCC burden across Asia-Pacific intensifies demand for early detection and monitoring tools, thereby boosting the Alpha-Fetoprotein Quantitative Assay Kit Market as AFP testing remains central to HCC screening and management.

Moreover, Southeast Asian countries—like Indonesia, Malaysia, and Thailand—were expanding their MRO capacity, positioning Asia-Pacific as a go-to hub for aircraft services. For instance, In October 2023, Fapon entered a strategic partnership with Halodoc, Indonesia’s leading telehealth platform. By combining Fapon’s strengths in IVD technologies and integrated solutions with Halodoc’s extensive sales network and localized services, the collaboration aims to elevate healthcare quality and advance the nation’s IVD industry. Its impact on the Asia-Pacific Alpha-Fetoprotein Quantitative Assay Kit market includes stronger distribution reach, increased diagnostic accessibility, and accelerated adoption of advanced assay technologies across the region.

Governments across the region ramped up investment in aviation infrastructure, creating jobs and attracting global MRO firms. As the region’s fleet grew rapidly, airlines increasingly outsourced cleaning and maintenance work locally, boosting demand and reinforcing Asia-Pacific’s role as a key driver in the global aircraft cleaning services market.

To Learn More About This Report - Request a Free Sample Copy

Alpha Fetoprotein Quantitative Assay Kit Market Competitive Landscape

The Global Alpha Fetoprotein (AFP) Quantitative Assay Kit Market is competitive and dominated by established in vitro diagnostics (IVD) manufacturers and specialized reagent providers focusing on assay sensitivity, automation compatibility, and global distribution. Key players compete through product innovation (high-sensitivity CLIA/ELISA kits, multiplex panels), strategic partnerships with clinical laboratories, and expanding presence in emerging markets to capture screening and oncology-monitoring demand.

Key Players:

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific

- Siemens Healthineers

- Beckman Coulter (Danaher)

- Bio-Rad Laboratories

- PerkinElmer

- Ortho Clinical Diagnostics

- DiaSorin

- BioMérieux

- Fujirebio

- ACON Laboratories

- SD Biosensor

- Trinity Biotech

- Sysmex Corporation

- Shenzhen Mindray Bio-Medical Electronics

- Werfen

- ARKRAY, Inc.

- Zhejiang Orient Gene Biotech

- Diasys Diagnostic Systems

Recent Development

- In November 2025, Shanghai Kehua Bio-engineering (KHB) unveiled its Polaris V150 Automatic Chemiluminescence Immunoassay Analyzer at MEDICA 2025, spotlighting its engineering innovation in a compact, desktop-sized platform. The device fit in just 0.36 m² yet handled up to 150 tests per hour. Because the Polaris V150 supports over 60 assays — including tumor markers — it made alpha-fetoprotein (AFP) testing more accessible and efficient. This boosted the adoption of AFP quantitative assay kits globally, helping expand the real-time quantitative PCR and immunoassay market for early cancer screening and diagnosis.

- In October 2025, Immundiagnostik, Inc.’s partnership with Epitope Diagnostics, Inc. introduces the ECL100 automated chemiluminescent analyzer and 50+ CLIA kits to boost laboratory efficiency and accuracy. With high-throughput testing, reduced labor needs, and broad assay compatibility, this collaboration strengthens diagnostic capabilities. Its impact on the Global Alpha-Fetoprotein Quantitative Assay Kit market includes heightened demand for automated, cost-efficient platforms, expanded test menus, and greater adoption of advanced immunoassay systems across clinical laboratories.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The primary driver is the rising global incidence of liver cancer (Hepatocellular Carcinoma), as the AFP assay is a standard tool for both initial screening and monitoring treatment response. Growth is also fueled by the increasing importance of prenatal screening for detecting neural tube defects and Down syndrome. Expanding healthcare access in developing nations also increases the overall volume of clinical testing performed.

Q2. What are the main restraining factors for this market?

A key constraint is the lack of standardization across different assay methods and manufacturers, leading to variable results that can complicate diagnosis and cross-lab comparisons. The market also faces competition from more advanced diagnostic techniques, such as specialized imaging and genetic sequencing, which sometimes offer higher specificity. Cost sensitivity in developing regions limits the adoption of expensive, high-throughput automated platforms.

Q3. Which segment is expected to witness high growth?

The Chemiluminescence Immunoassay (CLIA) Segment is projected to witness the highest growth. CLIA kits offer superior sensitivity, specificity, and a wider dynamic range compared to older methods like ELISA. Driven by the trend toward high-throughput automation in large clinical laboratories and the need for highly precise quantitative results, CLIA technology is rapidly replacing manual and semi-automated techniques.

Q4. Who are the top major players for this market?

The market is dominated by major global in vitro diagnostics (IVD) and clinical chemistry companies. Top major players include F. Hoffmann-La Roche Ltd., Abbott Laboratories, Siemens Healthineers, and Danaher Corporation (Beckman Coulter). Competition centers on obtaining global regulatory approvals, offering integrated platforms that bundle the AFP assay with other common tumor marker tests, and expanding their distribution networks to serve large, centralized reference labs.

Q5. Which country is the largest player?

China is the largest country player. China has the highest prevalence of Hepatocellular Carcinoma (HCC) worldwide, leading to massive demand for AFP screening and monitoring. The government's large-scale public health programs for cancer screening and a rapidly expanding domestic diagnostics industry ensure that China is the largest consumer and a significant producer of AFP quantitative assay kits globally.

List of Figures

Figure 1: Global Alpha Fetoprotein Quantitative Assay Kit Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Alpha Fetoprotein Quantitative Assay Kit Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Alpha Fetoprotein Quantitative Assay Kit Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model