Automation Equipment Maintenance Service Market Overview and Analysis

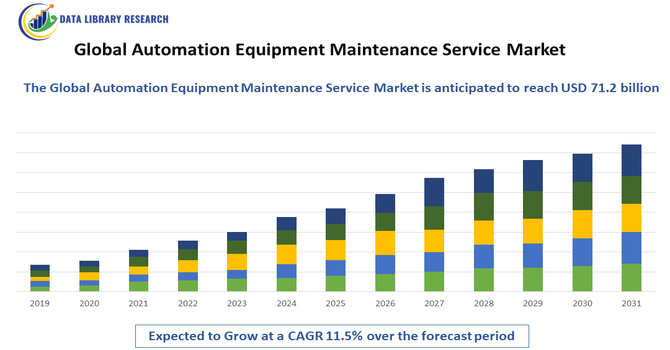

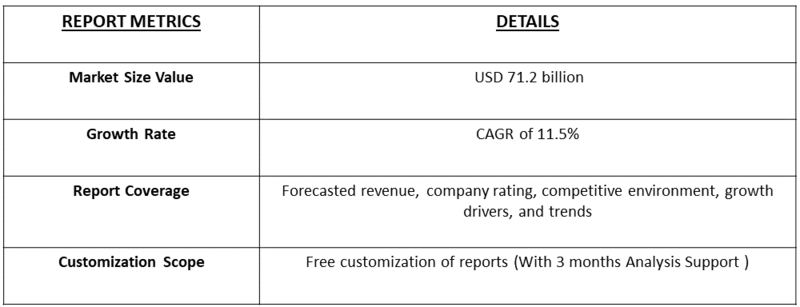

- The market is projected to reach an estimated value of USD 35.5 Billion in 2025, reaching USD 71.2 billion, with a Compound Annual Growth Rate (CAGR) of approximately 11.5% anticipated through 2025-2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Growth in the Global Automation Equipment Maintenance Service Market is driven by the accelerating adoption of industrial automation across manufacturing, logistics, automotive, energy, and process industries, creating a rising need for reliable maintenance to minimize downtime and protect high-value automated assets. As factories transition toward smart manufacturing and IoT-integrated systems, demand is increasing for predictive and condition-based maintenance solutions that enhance equipment performance and extend lifecycle.

Automation Equipment Maintenance Service Market Latest Trends

Global Automation Equipment Maintenance Service Market highlight the rapid shift toward digital, data-driven maintenance models that enhance equipment reliability and reduce operational downtime. Predictive maintenance powered by IoT sensors, AI, and machine learning has become a key focus, enabling real-time condition monitoring and early failure detection. Companies are increasingly adopting cloud-based and remote maintenance solutions, allowing service providers to perform diagnostics and updates without being physically present on-site. The use of augmented reality (AR) and virtual reality (VR) is also rising, offering remote expert guidance and immersive technician training.

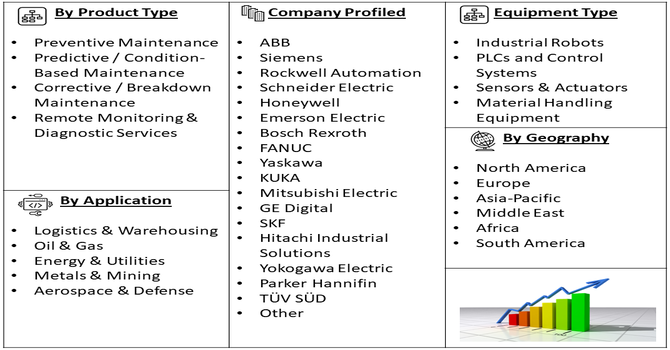

Segmentation: Global Automation Equipment Maintenance Service Market is segmented By Service Type (Preventive Maintenance, Predictive / Condition-Based Maintenance, Corrective / Breakdown Maintenance, Remote Monitoring & Diagnostic Services), Equipment Type (Industrial Robots, PLCs and Control Systems, Sensors & Actuators, Material Handling Equipment), Maintenance Approach (In-House Maintenance, Outsourced / Third-Party Maintenance, OEM-Based Maintenance Services), Application (Logistics & Warehousing, Oil & Gas, Energy & Utilities, Metals & Mining, Aerospace & Defense), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Adoption of Industrial Automation Across Key Industries

A major driver of the automation equipment maintenance service market is the rapid expansion of industrial automation across manufacturing, logistics, automotive, pharmaceuticals, electronics, and energy sectors. As industries shift toward smart factories and Industry 4.0 practices, automated systems—such as robots, PLCs, CNC machines, and material-handling equipment—are becoming central to production operations.

These advanced systems require continuous monitoring and specialized maintenance to avoid breakdowns and ensure consistent output. The high cost of automation machinery makes maintenance even more critical, as unplanned downtime can lead to substantial financial losses. As factories become more interconnected and reliant on high-performance automated equipment, the demand for structured, reliable, and technologically advanced maintenance services continues to accelerate.

- Growing Demand for Predictive and Condition-Based Maintenance Solutions

Another strong growth driver is the increasing industry shift from reactive and preventive maintenance toward predictive and condition-based maintenance models. Enabled by IoT sensors, cloud platforms, and AI-driven analytics, predictive maintenance allows companies to monitor equipment health in real time and detect potential failures before they occur.

This reduces unplanned downtime, extends equipment lifespan, and lowers overall maintenance costs. Organizations are adopting these systems to optimize operations, improve safety, and enhance productivity. Furthermore, advancements in remote diagnostics, digital twins, and machine-learning algorithms are strengthening the effectiveness of predictive maintenance tools. As more industries embrace data-driven operations, the adoption of predictive maintenance services is rising sharply, driving significant growth across the global automation equipment maintenance service market.

Market Restraints:

- High Cost of Implementing Advanced Maintenance Solutions

The key challenge is the high cost of implementing advanced maintenance solutions, including IoT sensors, predictive analytics platforms, and skilled technical support systems, which can be prohibitive for small and medium-sized enterprises. Additionally, shortage of skilled maintenance professionals capable of handling complex automated machinery, robotics, and AI-driven systems poses a significant operational barrier. Many industries struggle with training and retaining qualified technicians, leading to inconsistent service quality.

Socio-Economic Impact on Automation Equipment Maintenance Service Market

The socioeconomic impact of the Global Automation Equipment Maintenance Service Market centers on its ability to enhance industrial productivity, reduce operational downtime, and support increasingly automated manufacturing environments, thereby boosting economic output and global competitiveness. As companies rely more on automation, demand for skilled technicians, predictive maintenance services, and advanced diagnostic tools rises, creating new high-skill job opportunities while reducing reliance on traditional manual labor. This shift promotes safer workplaces, higher efficiency, and cost savings for businesses, yet also intensifies the need for workforce upskilling and investment in digital maintenance capabilities. Overall, the market contributes to economic modernization but may widen skill and technology gaps between advanced and developing economies.

Segmental Analysis:

- Predictive / Condition-Based Maintenance segment is expected to witness the highest growth over the forecast period

Predictive and condition-based maintenance is emerging as the most rapidly growing service type due to its ability to minimize unplanned downtime and optimize equipment performance. Leveraging IoT sensors, AI-driven analytics, and real-time monitoring, this approach detects early signs of equipment wear or malfunction before they escalate into failures. Industries increasingly prefer predictive maintenance because it reduces long-term maintenance costs, extends equipment lifespan, and ensures continuity in highly automated environments. As smart factories and connected machinery proliferate, the adoption of predictive maintenance services continues to accelerate across sectors.

- Industrial Robots segment is expected to witness the highest growth over the forecast period

Industrial robots represent a key equipment segment requiring specialized maintenance due to their widespread use in automotive manufacturing, electronics, metal fabrication, and logistics automation. These robots operate at high speeds and perform repetitive tasks with precision, making proactive maintenance essential to prevent breakdowns and maintain operational efficiency. The increasing integration of robots for welding, assembly, packaging, and material handling has amplified the need for expert service providers capable of handling mechanical, electrical, and software-level diagnostics. As robotics adoption grows globally, maintenance services for industrial robots are becoming increasingly critical and lucrative.

- Outsourced / Third-Party Maintenance segment is expected to witness the highest growth over the forecast period

Outsourced or third-party maintenance services are gaining prominence as industries prefer cost-effective, flexible, and specialized support over maintaining large in-house teams. Third-party service providers offer expertise across multiple automation systems, reducing dependency on OEM-exclusive services while enabling faster troubleshooting and broader technical capabilities. This approach is particularly attractive to small and medium-sized enterprises seeking to optimize operational costs. Additionally, outsourcing provides scalability, allowing companies to adjust service levels based on production demand, which is driving strong growth in this segment.

- Logistics & Warehousing segment is expected to witness the highest growth over the forecast period

Logistics and warehousing is a leading application segment driven by the rapid expansion of automated systems such as conveyors, AS/RS units, sorting machines, and guided vehicles. With the rise of e-commerce, 3PL providers, and high-speed order fulfillment requirements, maintaining uninterrupted warehouse automation has become essential. Maintenance services ensure optimal performance of equipment handling large volumes of goods with strict timelines. The sector increasingly relies on predictive analytics and remote monitoring to minimize downtime and maintain supply chain continuity, reinforcing strong demand for automation maintenance services in warehouses and distribution centers.

- Asia-Pacific segment is expected to witness the highest growth over the forecast period

The Asia-Pacific segment is expected to witness the highest growth in the Global Automation Equipment Maintenance Service Market over the forecast period due to rapid industrialization, expanding manufacturing hubs, and increasing adoption of advanced automation technologies across sectors such as automotive, electronics, pharmaceuticals, and food processing.

Countries like China, Japan, South Korea, and India are heavily investing in smart factories, robotics, and digital infrastructure, driving strong demand for predictive and preventive maintenance services to ensure continuous, efficient operations. For instance, July 2025, ABB’s launch of three new robot families manufactured in its Shanghai Mega Factory had strengthened China’s advanced manufacturing push. By supporting high-growth sectors with AI-enabled, OmniCore-powered automation, the expansion had accelerated regional robot adoption, driving increased reliance on specialized upkeep and boosting demand in the Asia-Pacific Automation Equipment Maintenance Service Market.

Additionally, the region’s growing focus on minimizing downtime, improving productivity, and enhancing workplace safety has accelerated reliance on outsourced maintenance solutions and technologically advanced service providers. Government initiatives supporting Industry 4.0 adoption further strengthened the region’s dominant growth trajectory.

To Learn More About This Report - Request a Free Sample Copy

Automation Equipment Maintenance Service Market Competitive Landscape

The competitive landscape of the Global Automation Equipment Maintenance Service Market is characterized by the presence of major automation and industrial technology companies that offer comprehensive maintenance solutions across diverse industries. Leading players such as ABB, Siemens, Rockwell Automation, Schneider Electric, Honeywell, and Emerson Electric dominate the market with extensive service portfolios, strong global networks, and advanced diagnostic technologies.

Key Players:

- ABB

- Siemens

- Rockwell Automation

- Schneider Electric

- Honeywell

- Emerson Electric

- Bosch Rexroth

- FANUC

- Yaskawa

- KUKA

- Mitsubishi Electric

- GE Digital

- SKF

- Hitachi Industrial Solutions

- Yokogawa Electric

- Parker Hannifin

- TÜV SÜD

- UL Solutions

- Cognizant

- Wipro

Recent Development

- In June 2025, ABB Robotics’ launch of the IRB 6730S, IRB 6750S and IRB 6760, along with its broader next-generation lineup, had expanded its industrial robot portfolio and enhanced customer flexibility. This broader range had increased global robot deployments, driving higher demand for specialized maintenance services and supporting growth in the Global Automation Equipment Maintenance Service Market.

- In April 2025, Accenture’s collaboration with Schaeffler to reinvent industrial automation using physical AI and advanced robotics had showcased new possibilities for optimized human–robot workflows. Demonstrations of AMRs, cobots, and humanoid robots had accelerated industry interest in complex automation systems, driving greater demand for predictive upkeep and boosting growth in the Global Automation Equipment Maintenance Service Market.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The widespread adoption of Industry 4.0 and the integration of smart factory technologies, like IoT and AI, are key drivers. As industrial equipment becomes more complex and interconnected, the demand for specialized maintenance services—especially predictive and remote monitoring—rises dramatically. Businesses need these services to reduce costly downtime, improve operational efficiency, and ensure their sophisticated machinery lasts longer.

Q2. What are the main restraining factors for this market?

The market faces two primary restraints: the high initial investment and the shortage of skilled labor. Sophisticated automation equipment and the tools required for advanced diagnostics carry significant upfront costs, which can deter smaller companies. Furthermore, there is a global scarcity of technicians with the specialized skills needed to operate, service, and repair these increasingly complex and high-tech automated systems.

Q3. Which segment is expected to witness high growth?

The highest growth is expected in the Maintenance and Support segment, particularly within service types like Predictive Maintenance. Companies are quickly moving away from reactive fixes toward data-driven maintenance models that use sensors and AI to predict equipment failure before it happens. This shift maximizes uptime and significantly reduces unexpected repair costs, driving demand for these advanced services.

Q4. Who are the top major players for this market?

The market is dominated by global industrial automation giants who offer comprehensive service portfolios alongside their equipment. Major players include Siemens AG, ABB Ltd., Rockwell Automation Inc., Emerson Electric Company, and Schneider Electric SE. These companies compete by leveraging their existing install base, expanding their digital service offerings, and building strategic partnerships.

Q5. Which country is the largest player?

Based on recent market insights for industrial automation services, the Asia-Pacific (APAC) region holds the largest market share in terms of revenue. This dominance is driven by massive investment in manufacturing infrastructure, rapid industrialization, and the rapid adoption of smart factory concepts across key countries like China, Japan, and India.

List of Figures

Figure 1: Global Automation Equipment Maintenance Service Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Automation Equipment Maintenance Service Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Automation Equipment Maintenance Service Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Automation Equipment Maintenance Service Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Automation Equipment Maintenance Service Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Automation Equipment Maintenance Service Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Automation Equipment Maintenance Service Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Automation Equipment Maintenance Service Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Automation Equipment Maintenance Service Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Automation Equipment Maintenance Service Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model