A pandemic such as COVID-19 has not only affected the smooth operations of food supply chains but also resulted in food insecurity conditions in several nations. Manufacturers working in the sector are facing challenges in regards to operations, supply chain, training, safety, emergency responses, awareness, incident management, recreating business models, digitalization, and other unanticipated impacts. Alcohol, a major component in the beverage industry is facing a devastating effect of a pandemic. Around 13% to 15% of the craft beer sector in the world is in the process of shutting up shop, and the wine industry is in severe distress. Besides, shortage of raw materials caused to shut down of many small to medium food processing companies around the world.

Beverage Stabilizers Market Overview

Stabilizers are food additive which is used to preserve consistency or maintain a solution and mixture. Beverage stabilizer helps to blend flavors, suspend particulates, stabilize the protein, and increase the mouthfeel of beverages. It helps to prevent degeneration in beverages. Beverage stabilizers also sustain emulsification, which avoids sedimentation by keeping additional ingredients suspended in the beverage.

In the last few years, there has been a huge increase in the consumption of different types of food and beverages which are ready to consume and packed in an easy to access and suitable manner. Food and beverage companies are focusing on steady product delivery with international food safety and quality standards. They expand their business globally brings significant changes in the global food and beverages industry. These changes are also extensively impacting the global beverage stabilizers market.

Owing to the busy lifestyles of people in urban areas, they inclined towards the consumption of preserved foods and beverages for their convenience. This is a key factor for the development of the global beverage stabilizers market. In addition, the rising young population with high purchasing power and increasing popularity of western food will also rise in the uptakes of packaged beverages. These are few other key aspects positively affecting the growth of the market.

On the other hand, health issues related to the increased consumption of preserved products and inclination towards fresh food can hamper the growth of the global beverage stabilizers market in the future. Also, the strict rule for the use of synthetic products and additives in packaged foods and beverages and the changing costs of raw materials may hamper the overall growth of the market.

Beverage Stabilizers Market Segment Overview

Most of the companies are focusing on blended drinks as the beverage menu for the consumers. For example, smoothies are blended beverages with health benefits. So, these are more popular among health-conscious consumers. Hence blended beverages are open several ways for the manufacturers of beverage stabilizers. Ultimately fueling the growth of the market.

Furthermore, some important factors propelling the growth of the market include increasing demand for high nutritional value drinks, less sugar content drinks, and a good preference for natural and organic products.

Beverage Stabilizers Regional Overview

Based on region, North America and Europe have a huge share in the market due to the presence of the well-established alcoholic beverage industries in this region. In addition, the increasing demand for bottled beverages is also driving the growth of the market. Furthermore, the market in the Asia Pacific also holds remarkable potential for growth due to the increasing consumption of processed and packaged alcoholic as well as non-alcoholic beverages.

Beverage Stabilizers Market Competitor overview

Some of the top companies in the global beverage stabilizers market are Ashland, Tate & Lyle, Glanbia Nutritionals, Chemelco International, Palsgaard, DowDuPont, Kerry Group, Advanced Food Systems, and Cargill.

The vendor landscape of the global beverage stabilizers market is competitive and it is expected to remains as it is in the next few years, beholding the rise of many new vendors. Companies are boosting their position in the lucrative market by manufacturing new product varieties and strategic partnerships with F&B manufacturers across regional markets.

Beverage Stabilizers Market, Key Players

· Ashland

· Tate & Lyle

· Glanbia Nutritionals

· Chemelco International

· Palsgaard

· DowDuPont

· Kerry Group

· Advanced Food Systems

· Cargill

· BASF SE

· Glanbia plc

· Tolsa Group

· Koninklijke DSM N.V

· Akzo Nobel N.V.

· Galactic SA

Beverage Stabilizers Market Segmentation

Beverage Stabilizers Market, By Stabilizing agent

· Sulfur dioxide

· Bentonite

· Mixing Alcoholic Spirit

· Tartaric Acid

Beverage Stabilizers Market, By Stabilizers type

· Filtration

· Gravitation

· Gel

Beverage Stabilizers Market, By Application

· Emulsifier

· Acidified dairy drinks

· Flavor syrups

· Reduced Sugar

· Neutralizing dairy drinks

· Cultured drinkable Yogurt

Beverage Stabilizers Market, By Beverages type

· Alcoholic

· Beer

· Wine

· Non-Alcoholic

· Fruit Juice

· Dairy Products

Beverage Stabilizers market, By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East and Africa

- GCC

- South Africa

- Rest of Middle East and Africa

1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

2. Executive Summary

3. Market Dynamics

- 3.1. Market Drivers

- 3.2. Market Restraints

- 3.3. Market Opportunities

4. Key Insights

- 4.1. Key Emerging Trends – For Major Countries

- 4.2. Latest Technological Advancement

- 4.3. Regulatory Landscape

- 4.4. Industry SWOT Analysis

- 4.5. Porters Five Forces Analysis

5. Global Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 5.1. Key Findings / Summary

- 5.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 5.2.1. Sulfur dioxide

- 5.2.2. Bentonite

- 5.2.3. Mixing Alcoholic Spirit

- 5.2.4. Tartaric Acid

- 5.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 5.3.1. Filtration

- 5.3.2. Gravitation

- 5.3.3. Gel

- 5.4. Market Analysis, Insights and Forecast – By Application

- 5.4.1. Emulsifier

- 5.4.2. Acidified dairy drinks

- 5.4.3. Flavor syrups

- 5.4.4. Reduced Sugar

- 5.4.5. Neutralizing dairy drinks

- 5.4.6. Cultured drinkable Yogurt

- 5.5. Market Analysis, Insights and Forecast – By Beverages type

- 5.5.1. Alcoholic

- 5.5.2. Beer

- 5.5.3. Wine

- 5.5.4. Non-Alcoholic

- 5.5.5. Fruit Juice

- 5.5.6. Dairy Products

- 5.6. Market Analysis, Insights and Forecast – By Region

- 5.6.1. North America

- 5.6.2. Latin America

- 5.6.3. Europe

- 5.6.4. Asia Pacific

- 5.6.5. Middle East and Africa

6. North America Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 6.1. Key Findings / Summary

- 6.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 6.2.1. Sulfur dioxide

- 6.2.2. Bentonite

- 6.2.3. Mixing Alcoholic Spirit

- 6.2.4. Tartaric Acid

- 6.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 6.3.1. Filtration

- 6.3.2. Gravitation

- 6.3.3. Gel

- 6.4. Market Analysis, Insights and Forecast – By Application

- 6.4.1. Emulsifier

- 6.4.2. Acidified dairy drinks

- 6.4.3. Flavor syrups

- 6.4.4. Reduced Sugar

- 6.4.5. Neutralizing dairy drinks

- 6.4.6. Cultured drinkable Yogurt

- 6.5. Market Analysis, Insights and Forecast – By Beverages type

- 6.5.1. Alcoholic

- 6.5.2. Beer

- 6.5.3. Wine

- 6.5.4. Non-Alcoholic

- 6.5.5. Fruit Juice

- 6.5.6. Dairy Products

- 6.6. Market Analysis, Insights and Forecast – By Country

- 6.6.1. U.S.

- 6.6.2. Canada

7. Latin America Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 7.1. Key Findings / Summary

- 7.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 7.2.1. Sulfur dioxide

- 7.2.2. Bentonite

- 7.2.3. Mixing Alcoholic Spirit

- 7.2.4. Tartaric Acid

- 7.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 7.3.1. Filtration

- 7.3.2. Gravitation

- 7.3.3. Gel

- 7.4. Market Analysis, Insights and Forecast – By Application

- 7.4.1. Emulsifier

- 7.4.2. Acidified dairy drinks

- 7.4.3. Flavor syrups

- 7.4.4. Reduced Sugar

- 7.4.5. Neutralizing dairy drinks

- 7.4.6. Cultured drinkable Yogurt

- 7.5. Market Analysis, Insights and Forecast – By Beverages type

- 7.5.1. Alcoholic

- 7.5.2. Beer

- 7.5.3. Wine

- 7.5.4. Non-Alcoholic

- 7.5.5. Fruit Juice

- 7.5.6. Dairy Products

- 7.6. Insights and Forecast – By Country

- 7.6.1. Brazil

- 7.6.2. Mexico

- 7.6.3. Rest of Latin America

8. Europe Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 8.1. Key Findings / Summary

- 8.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 8.2.1. Sulfur dioxide

- 8.2.2. Bentonite

- 8.2.3. Mixing Alcoholic Spirit

- 8.2.4. Tartaric Acid

- 8.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 8.3.1. Filtration

- 8.3.2. Gravitation

- 8.3.3. Gel

- 8.4. Market Analysis, Insights and Forecast – By Application

- 8.4.1. Emulsifier

- 8.4.2. Acidified dairy drinks

- 8.4.3. Flavor syrups

- 8.4.4. Reduced Sugar

- 8.4.5. Neutralizing dairy drinks

- 8.4.6. Cultured drinkable Yogurt

- 8.5. Market Analysis, Insights and Forecast – By Beverages type

- 8.5.1. Alcoholic

- 8.5.2. Beer

- 8.5.3. Wine

- 8.5.4. Non-Alcoholic

- 8.5.5. Fruit Juice

- 8.5.6. Dairy Products

- 8.6. Market Analysis, Insights and Forecast – By Country

- 8.6.1. UK

- 8.6.2. Germany

- 8.6.3. France

- 8.6.4. Italy

- 8.6.5. Spain

- 8.6.6. Russia

- 8.6.7. Rest of Europe

9. Asia Pacific Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 9.1. Key Findings / Summary

- 9.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 9.2.1. Sulfur dioxide

- 9.2.2. Bentonite

- 9.2.3. Mixing Alcoholic Spirit

- 9.2.4. Tartaric Acid

- 9.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 9.3.1. Filtration

- 9.3.2. Gravitation

- 9.3.3. Gel

- 9.4. Market Analysis, Insights and Forecast – By Application

- 9.4.1. Emulsifier

- 9.4.2. Acidified dairy drinks

- 9.4.3. Flavor syrups

- 9.4.4. Reduced Sugar

- 9.4.5. Neutralizing dairy drinks

- 9.4.6. Cultured drinkable Yogurt

- 9.5. Market Analysis, Insights and Forecast – By Beverages type

- 9.5.1. Alcoholic

- 9.5.2. Beer

- 9.5.3. Wine

- 9.5.4. Non-Alcoholic

- 9.5.5. Fruit Juice

- 9.5.6. Dairy Products

- 9.6. Market Analysis, Insights and Forecast – By Country

- 9.6.1. China

- 9.6.2. India

- 9.6.3. Japan

- 9.6.4. Australia

- 9.6.5. South East Asia

- 9.6.6. Rest of Asia Pacific

10. Middle East & Africa Beverage Stabilizers Market Analysis (USD Billion), Insights and Forecast, 2020-2027

- 10.1. Key Findings / Summary

- 10.2. Market Analysis, Insights and Forecast – By Stabilizing agent

- 10.2.1. Sulfur dioxide

- 10.2.2. Bentonite

- 10.2.3. Mixing Alcoholic Spirit

- 10.2.4. Tartaric Acid

- 10.3. Market Analysis, Insights and Forecast – By Stabilizers type

- 10.3.1. Filtration

- 10.3.2. Gravitation

- 10.3.3. Gel

- 10.4. Market Analysis, Insights and Forecast – By Application

- 10.4.1. Emulsifier

- 10.4.2. Acidified dairy drinks

- 10.4.3. Flavor syrups

- 10.4.4. Reduced Sugar

- 10.4.5. Neutralizing dairy drinks

- 10.4.6. Cultured drinkable Yogurt

- 10.5. Market Analysis, Insights and Forecast – By Beverages type

- 10.5.1. Alcoholic

- 10.5.2. Beer

- 10.5.3. Wine

- 10.5.4. Non-Alcoholic

- 10.5.5. Fruit Juice

- 10.5.6. Dairy Products

- 10.6. Market Analysis, Insights and Forecast – By Country

- 10.6.1. GCC

- 10.6.2. South Africa

- 10.6.3. Rest of Middle East & Africa

11. Competitive Analysis

- 11.1. Company Market Share Analysis, 2018

- 11.2. Key Industry Developments

- 11.3. Company Profile

- 11.4. Ashland

- 11.4.1. Business Overview

- 11.4.2. Segment 1 & Service Offering

- 11.4.3. Overall Revenue

- 11.4.4. Geographic Presence

- 11.4.5. Recent Development

- 11.5. Tate & Lyle

- 11.6. Glanbia Nutritionals

- 11.7. Chemelco International

- 11.8. Palsgaard

- 11.9. DowDuPont

- 11.10. Kerry Group

- 11.11. Advanced Food Systems

- 11.12. Cargill

- 11.13. BASF SE

- 11.14. Glanbia plc

- 11.15. Tolsa Group

- 11.16. Koninklijke DSM N.V

- 11.17. Akzo Nobel N.V.

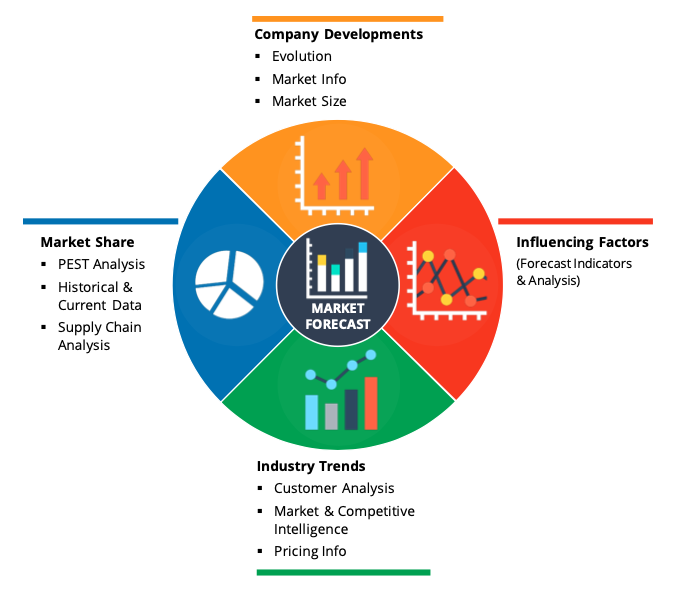

Data Library Research are conducted by industry experts who offer insight on industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and SOFT) of the companies that active & prominent as well as the midsized organization

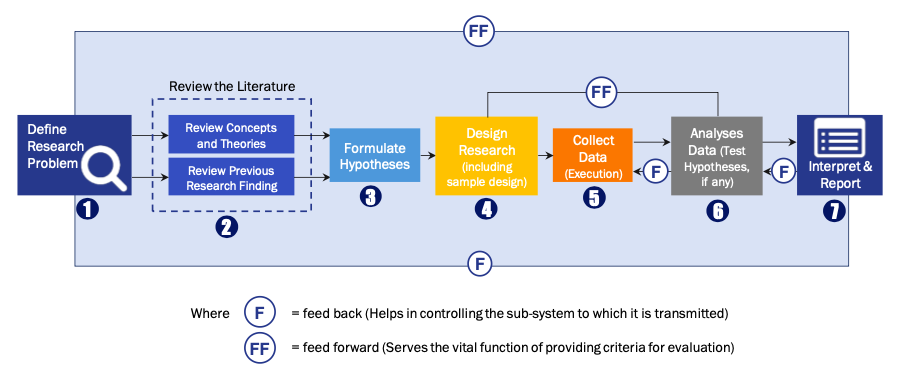

FIGURE 1: DLR RESEARH PROCESS

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary ResearchSecondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size EstimationBoth, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model