Cold Chain Logistics Service in the Pharma Market Overview and Analysis:

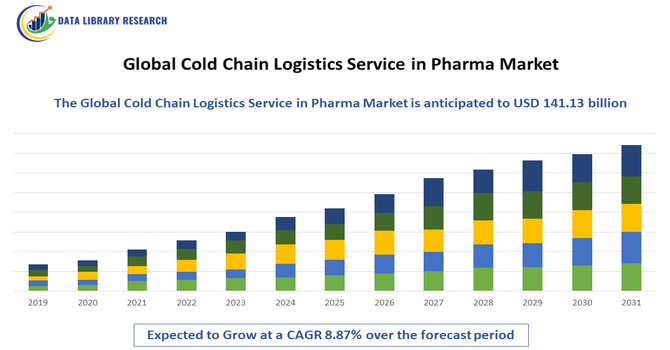

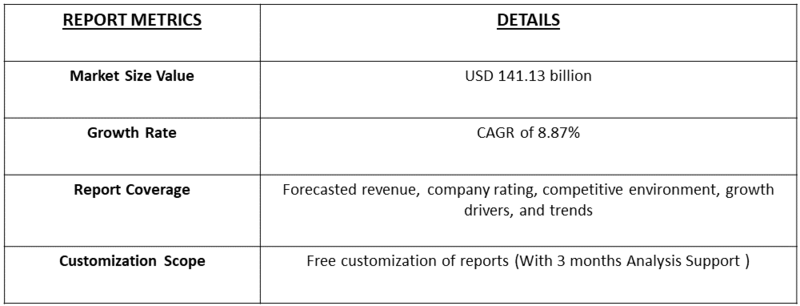

- The Global Fuel Cell Yacht Market is currently valued at USD 61.97 in 2025, and is projected to reach around USD 141.13 billion by 2032. The market is expanding at a CAGR of 8.87% between 2025 and 2032.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

The Global Fuel Cell Yacht Market is experiencing strong growth driven by the rising demand for sustainable, zero-emission marine propulsion systems and the increasing global focus on carbon neutrality. Stricter environmental regulations and the growing preference among luxury yacht owners for quiet, eco-friendly cruising experiences are accelerating the adoption of hydrogen fuel cells as an alternative to diesel engines. Advances in fuel cell technology—such as improved efficiency, lightweight materials, and enhanced hydrogen storage systems—are making integration more practical and cost-effective for yacht builders.

Cold Chain Logistics Service in the Pharma Market: Latest Trends

The latest trends in the Global Cold Chain Logistics Service in Pharma Market reflect a rapid transformation driven by digitalization, sustainability, and advanced temperature-control technologies. Pharmaceutical companies are increasingly adopting IoT-enabled monitoring systems, blockchain-based traceability, and AI-driven predictive analytics to ensure real-time visibility, security, and compliance across the supply chain. The growing demand for biopharmaceuticals, vaccines, and personalized medicines, which require stringent temperature management, is also reshaping logistics strategies.

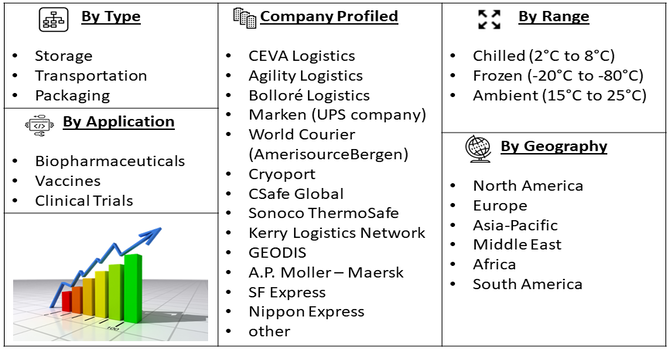

Segmentation: Global Cold Chain Logistics Service in Pharma Market is segmented By Service Type (Storage, Transportation, Packaging), Mode of Transportation (Airways, Roadways, Seaways, Railways), Temperature Range (Chilled (2°C to 8°C), Frozen (-20°C to -80°C), Ambient (15°C to 25°C), Application (Biopharmaceuticals, Vaccines, Clinical Trials), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Rising Demand for Biopharmaceuticals and Vaccines

The rapid expansion of the biopharmaceutical sector is one of the most significant drivers of the global cold chain logistics service market in the pharmaceutical industry. Biopharmaceuticals—including monoclonal antibodies, recombinant proteins, and cell and gene therapies—are highly temperature-sensitive and require precise temperature control throughout production, storage, and distribution.

Pharmaceutical companies and logistics providers are increasingly investing in advanced refrigeration technologies, temperature-controlled packaging, and real-time monitoring systems to ensure product safety and compliance with international standards. For instance, in 2022, As part of its “NX Group Business Plan 2023 - Dynamic Growth,” NX Group prioritized the pharmaceutical industry and enhanced its business infrastructure in line with Good Distribution Practices (GDP). Nippon Express expanded its temperature-controlled distribution, adding ultra-low temperature capabilities (-20°C to -85°C) alongside existing refrigerated and constant-temperature services. These innovations strengthened the global cold chain logistics service in the pharmaceutical market by improving safety, compliance, and the ability to transport sensitive biologics and vaccines worldwide.

- Stringent Regulatory Standards Ensuring Pharmaceutical Quality and Safety

Another major market driver is the stringent regulatory framework governing the transportation and storage of pharmaceutical products worldwide.

Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and World Health Organization (WHO) have established strict Good Distribution Practice (GDP) and Good Manufacturing Practice (GMP) guidelines to ensure the integrity and efficacy of temperature-sensitive products. For instance, in March 2025, NIHFW, in partnership with UNICEF through the National Cold Chain Vaccine Management Resource Centre, oversaw the maintenance, implementation, and monitoring of India’s National Cold Chain Management Information System while supporting end users. This strengthened regulatory compliance, ensuring pharmaceutical quality and safety through stricter temperature-controlled handling. The initiative enhanced the cold chain logistics service in the pharma market by improving oversight, reducing risks of product spoilage, and reinforcing nationwide standards for vaccine and medicine distribution.

Market Restraints:

- High Operational and Infrastructure Costs

One of the major restraints in the global cold chain logistics service market for pharmaceuticals is the high cost of establishing and maintaining temperature-controlled infrastructure. Setting up advanced cold storage warehouses, refrigerated transport vehicles, and ultra-low temperature freezers requires significant capital investment. Additionally, maintaining consistent temperature conditions throughout the supply chain demands continuous energy consumption, specialized equipment, and trained personnel, which further elevate operational expenses.

Socio Economic Impact on Cold Chain Logistics Service in the Pharma Market

The global cold chain logistics service in the pharmaceutical market significantly influenced socioeconomic dynamics by ensuring the safe and efficient transportation of temperature-sensitive drugs, vaccines, and biologics. By maintaining strict temperature controls, these services reduced spoilage, improved patient access to critical medications, and enhanced overall public health outcomes. The sector created numerous skilled jobs in logistics, warehousing, and technology management, while driving investment in innovative refrigeration, IoT monitoring, and real-time tracking solutions. Additionally, it strengthened healthcare supply chains, lowered economic losses from damaged products, and supported the global pharmaceutical industry’s growth, particularly in emerging markets with rising healthcare demands.

Segmental Analysis:

- Storage segment is expected to witness the highest growth over the forecast period

The storage segment holds a significant share of the market and is expected to witness strong growth during the forecast period. The increasing need for specialized cold storage facilities to preserve temperature-sensitive pharmaceuticals, vaccines, and biologics is driving demand. The expansion of ultra-low temperature (ULT) storage and automated warehouses, combined with strict regulatory requirements for temperature compliance, has encouraged pharmaceutical manufacturers and logistics providers to invest heavily in advanced storage infrastructure. Additionally, the growth in biologics and cell and gene therapies, which require highly controlled environments, is further fueling the expansion of the storage segment.

- Airways segment is expected to witness the highest growth over the forecast period

The airways segment dominates the market due to its speed, reliability, and suitability for long-distance transportation of high-value pharmaceutical products. With increasing global distribution of vaccines, particularly during public health emergencies, air freight has become a critical component of the cold chain. Airlines are partnering with pharmaceutical companies to enhance temperature-controlled cargo facilities and implement real-time tracking systems. The rise of global biopharma trade and just-in-time delivery models continues to bolster the adoption of airways as the preferred mode for time-sensitive shipments.

- Chilled (2°C to 8°C) segment is expected to witness the highest growth over the forecast period

The chilled temperature range (2°C to 8°C) segment accounts for a substantial portion of market demand, as many vaccines, insulin, and biopharmaceuticals require storage and transport under these conditions. This range ensures product stability and efficacy, making it a critical focus for logistics providers. The increasing production and global distribution of mRNA vaccines and monoclonal antibodies are strengthening this segment. Continuous innovation in refrigeration technologies and temperature monitoring devices is enhancing the efficiency and reliability of chilled logistics solutions.

- Vaccines segment is expected to witness the highest growth over the forecast period

The vaccine segment is projected to register the highest growth over the forecast period. Rising immunization programs across developing nations, coupled with the global focus on infectious disease prevention, have created immense demand for reliable cold chain logistics. Maintaining vaccine potency requires precise temperature control throughout the supply chain, driving innovation in packaging, storage, and tracking systems. The growing demand for mRNA-based and combination vaccines further accelerates the need for advanced cold chain capabilities, making this one of the most critical application areas.

- North America segment is expected to witness highest growth over the forecast period

The North America region is expected to witness the highest growth over the forecast period, driven by a well-established pharmaceutical industry, strong regulatory framework, and increasing adoption of advanced cold chain technologies. The presence of major pharmaceutical manufacturers, biotech firms, and third-party logistics providers, along with growing investments in temperature-controlled infrastructure, supports regional market expansion.

Additionally, the rise of biologics and specialty drugs in the U.S. and Canada continues to create high demand for efficient and compliant cold chain logistics services. For instance, in June 2025, UPS completed the acquisition of Frigo-Trans and BPL, enhancing its healthcare logistics capabilities across Europe. Frigo-Trans provided temperature-controlled warehousing from cryopreservation (-196°C) to ambient (+15° to +25°C) and Pan-European cold chain transport, while BPL contributed time-critical freight forwarding solutions. This expansion strengthened North America’s cold chain logistics service in the pharmaceutical market by improving global distribution capabilities, ensuring temperature-sensitive product integrity, and supporting the growing demand for reliable, end-to-end healthcare supply chains.

Thus, such factors are driving the growth of above market in this region.

To Learn More About This Report - Request a Free Sample Copy

Cold Chain Logistics Service in the Pharma Market Competitive Landscape:

The competitive landscape is led by a mix of global third-party logistics (3PL) providers, specialized pharma cold-chain specialists, packaging and cryogenic service firms, and integrators offering end-to-end temperature-controlled solutions. Key dynamics include investments in ultra-low-temperature storage, IoT-based real-time monitoring, regional cold hubs for vaccine distribution, and strategic partnerships with biopharma companies. Market players compete on compliance with GDP/GMP standards, speed/reliability for time-sensitive shipments, geographic reach, and value-added services (packaging validation, clinical-trial logistics, door-to-door cold transport).

Key Players:

- DHL Global Forwarding

- Kuehne + Nagel

- DB Schenker

- UPS Healthcare

- FedEx (Life Sciences & Healthcare)

- DSV

- CEVA Logistics

- Agility Logistics

- Bolloré Logistics

- Marken (UPS company)

- World Courier (AmerisourceBergen)

- Cryoport

- CSafe Global

- Sonoco ThermoSafe

- Kerry Logistics Network

- GEODIS

- A.P. Moller – Maersk

- SF Express

- Nippon Express

- Expeditors International

Recent Development

- In June 2024, Overhaul launched its advanced Cold Chain Quality Solution, offering enhanced risk and quality management for time- and temperature-sensitive cargo across pharmaceuticals, healthcare, and high-value food sectors. The software ensured optimal conditions throughout the supply chain, reducing spoilage and compliance risks. This innovation strengthened the global cold chain logistics service in the pharmaceutical market by improving efficiency, reliability, and safety, while driving wider adoption of digital monitoring and risk management technologies.

- In December 2023, Sanofi Australia partnered with Mediport to launch an active cold chain distribution service in Tasmania, enhancing reliable delivery of medicines and vaccines while reducing carbon emissions from alternative transport methods. Using dual temperature zone vehicles with real-time monitoring and remote control, the service ensured optimal conditions during transit. This initiative strengthened the global cold chain logistics service in the pharmaceutical market by improving supply reliability, product safety, and environmentally sustainable distribution practices.

Frequently Asked Questions (FAQ) :

Q1. What are the main growth-driving factors for this market?

The main factor is the huge growth in temperature-sensitive drugs, such as vaccines, biologics, and cell and gene therapies. These complex medicines require strict temperature control to stay effective and safe for patients. Stricter government rules, known as Good Distribution Practices (GDP), and advances in real-time tracking technology also force logistics companies to improve their services, which further drives market expansion.

Q2. What are the main restraining factors for this market?

The primary limitation is the high operational cost of maintaining cold chain integrity, including specialized packaging, storage, and transport equipment. Additionally, the lack of consistent regulatory standards and complex rules across different countries make it hard to manage global shipments. Any small temperature failure can lead to the loss of expensive pharmaceutical products.

Q3. Which segment is expected to witness high growth?

The transportation service segment is expected to see the fastest growth. As more temperature-sensitive medicines need to travel long distances, the demand for specialized, monitored transport options (air, sea, and road) increases significantly. Furthermore, the market for ultra-low temperature (cryogenic) transportation, needed for advanced therapies, is a rapidly expanding niche area.

Q4. Who are the top major players for this market?

The market is led by major global logistics companies that have invested heavily in specialized pharma services. Key players include large freight forwarders like DHL, FedEx, and Kuehne+Nagel. Specialized cold storage providers like Lineage Logistics and Americold Logistics also hold significant influence. These firms offer comprehensive, temperature-controlled, end-to-end supply chain solutions.

Q5. Which country is the largest player?

North America, primarily the United States, is currently the largest regional player in the pharmaceutical cold chain logistics market. This dominance is due to the region's highly developed healthcare system, the strong presence of major pharmaceutical companies, and the high demand for advanced, temperature-sensitive biologics and specialized vaccines.

List of Figures

Figure 1: Global Cold Chain Logistics Service in Pharma Market Revenue Breakdown (USD Billion, %) by Region, 2022 & 2029

Figure 2: Global Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 3: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 4: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 5: Global Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 6: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 7: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 8: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 9: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 10: Global Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 11: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 12: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 13: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 14: Global Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 15: Global Cold Chain Logistics Service in Pharma Market Value (USD Billion), by Region, 2022 & 2029

Figure 16: North America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 17: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 18: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 19: North America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 20: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 21: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 22: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 23: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 24: North America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 25: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 26: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 27: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 28: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 29: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by U.S., 2018-2029

Figure 30: North America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Canada, 2018-2029

Figure 31: Latin America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 32: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 33: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 34: Latin America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 35: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 36: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 37: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 38: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 39: Latin America Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 40: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 41: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 42: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 43: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 44: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Brazil, 2018-2029

Figure 45: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Mexico, 2018-2029

Figure 46: Latin America Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Rest of Latin America, 2018-2029

Figure 47: Europe Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 48: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 49: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 50: Europe Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 51: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 52: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 53: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 54: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 55: Europe Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 56: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 57: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 58: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 59: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 60: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by U.K., 2018-2029

Figure 61: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Germany, 2018-2029

Figure 62: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by France, 2018-2029

Figure 63: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Italy, 2018-2029

Figure 64: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Spain, 2018-2029

Figure 65: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Russia, 2018-2029

Figure 66: Europe Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Rest of Europe, 2018-2029

Figure 67: Asia Pacific Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 68: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 69: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 70: Asia Pacific Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 71: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 72: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 73: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 74: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 75: Asia Pacific Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 76: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 77: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 78: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 79: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 80: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by China, 2018-2029

Figure 81: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by India, 2018-2029

Figure 82: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Japan, 2018-2029

Figure 83: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Australia, 2018-2029

Figure 84: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Southeast Asia, 2018-2029

Figure 85: Asia Pacific Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2029

Figure 86: Middle East & Africa Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 1, 2022 & 2029

Figure 87: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 88: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 89: Middle East & Africa Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 2, 2022 & 2029

Figure 90: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 91: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 92: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 93: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 94: Middle East & Africa Cold Chain Logistics Service in Pharma Market Value Share (%), By Segment 3, 2022 & 2029

Figure 95: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 1, 2018-2029

Figure 96: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 2, 2018-2029

Figure 97: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Sub-Segment 3, 2018-2029

Figure 98: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Others, 2018-2029

Figure 99: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by GCC, 2018-2029

Figure 100: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by South Africa, 2018-2029

Figure 101: Middle East & Africa Cold Chain Logistics Service in Pharma Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2029

List of Tables

Table 1: Global Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 2: Global Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 3: Global Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 4: Global Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Region, 2018-2029

Table 5: North America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 6: North America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 7: North America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 8: North America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 9: Europe Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 10: Europe Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 11: Europe Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 12: Europe Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 13: Latin America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 14: Latin America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 15: Latin America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 16: Latin America Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 17: Asia Pacific Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 18: Asia Pacific Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 19: Asia Pacific Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 20: Asia Pacific Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Table 21: Middle East & Africa Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2029

Table 22: Middle East & Africa Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2029

Table 23: Middle East & Africa Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2029

Table 24: Middle East & Africa Cold Chain Logistics Service in Pharma Market Revenue (USD Billion) Forecast, by Country, 2018-2029

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model