Flat-Rolled Stainless Steel Market Overview and Analysis:

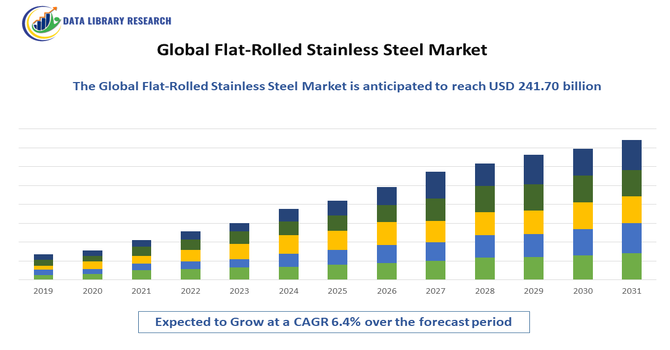

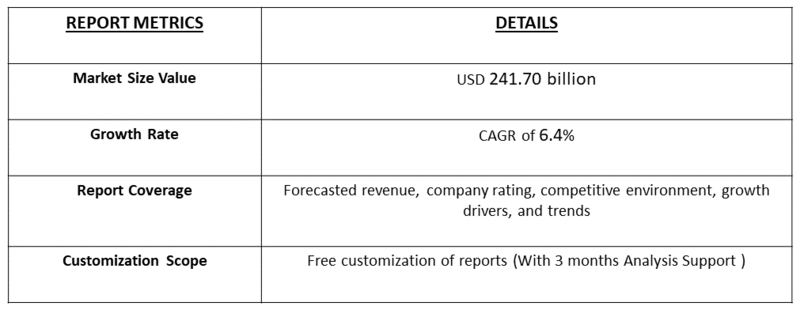

- The global flat-rolled stainless steel market size is calculated at USD 135.71 billion in 2025 and is forecasted to reach around USD 241.70 billion by 2034, growing at a forecast of 6.4%.

Get Complete Analysis Of The Report - Download Updated Free Sample PDF

Flat-rolled stainless steel refers to stainless steel that has been processed into thin, flat forms such as sheets, strips, coils, or plates by passing through rollers. This rolling process—either hot rolling at high temperatures or cold rolling at lower temperatures—reduces the thickness and improves the surface finish and mechanical properties of the steel. It starts from molten stainless steel which is solidified into slabs, then reheated and rolled to precise dimensions. Flat-rolled stainless steel is valued for its corrosion resistance, durability, and aesthetic appeal, making it essential in industries like automotive, construction, appliances, and machinery. Its versatility allows it to be further treated or fabricated into various products.

Flat-Rolled Stainless Steel Market Latest Trends:

The flat-rolled stainless steel market has been experiencing strong growth, driven by rising demand from construction, automotive, infrastructure, and industrial applications. Expansions such as Kametstal’s introduction of new rebar sizes demonstrated the industry’s focus on innovation and customization to optimize material use and meet diverse customer requirements. Increasing urbanization, housing development, and infrastructure projects, particularly in emerging economies, continued to fuel consumption. At the same time, sustainability initiatives and government support for domestic steel production enhanced market confidence. Global trends also emphasized recycling, advanced rolling technologies, and the development of non-standard profiles, all contributing to efficiency, cost-effectiveness, and long-term industry growth.

Segmentation:

The Global Flat-Rolled Stainless Steel Market is Segmented by Product Type (Cold-Rolled Flat-Rolled Stainless Steel and Hot-Rolled Flat-Rolled Stainless Steel), End-Use (Industry (Automotive, Construction, Consumer Goods, Infrastructure Development, and Others (Heavy Equipment, Machinery, etc.)) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The report provides the value (in USD million) for the above segments.

For Detailed Market Segmentation - Get a Free Sample PDF

Market Drivers:

- Growing Demand from the Automotive Industry

The automotive industry is a significant driver of the global flat-rolled stainless steel market. The increasing demand for durable, corrosion-resistant, and lightweight materials in vehicle manufacturing, particularly for body panels, exhaust systems, and engine components, is fueling the market's growth.

Automakers are increasingly adopting stainless steel to improve fuel efficiency, enhance safety features, and meet stringent environmental regulations, driving the demand for flat-rolled stainless steel products For instance, in 2025, investment in automating the European car industry remained strong, with 23,000 industrial robots installed – the second-highest level in five years, according to preliminary figures from the International Federation of Robotics (IFR). Europe had already established itself as a global leader in automotive automation, with six countries ranking among the top ten worldwide in robot density. Switzerland led with 3,876 robots per 10,000 factory workers, followed by Slovenia, Germany, Austria, Finland, and the Benelux nations. This high level of automation positively impacted the flat-rolled stainlesssteel market by driving demand for precision components, lightweight materials, and durable steel products essential for advanced automotive manufacturing.

- Expanding Construction and Infrastructure Development

The expanding construction and infrastructure development activities worldwide, particularly in emerging economies, are another key driver of the flat-rolled stainless steel market. Stainless steel is widely used in construction projects due to its superior corrosion resistance, aesthetic appeal, and long-lasting durability, making it a preferred choice for building facades, roofing, and various architectural applications. In February 2025, NEC Corporation announced that it had developed a solution to modernize tasks such as planning, design, and construction when installing network infrastructure like base stations. This innovation reduced the time required to build mobile infrastructure, from RAN to core, by nearly 60% compared to traditional methods. For the flat-rolled stainless steel market, this development had a positive impact as faster infrastructure rollout increased demand for durable, corrosion-resistant steel used in telecom towers, enclosures, and structural components. The efficiency gains accelerated project timelines, thereby boosting consumption of flat-rolled stainless steel in the rapidly expanding telecommunications sector. Thus, the growing need for resilient and sustainable infrastructure, such as bridges, railways, and power generation facilities, is also contributing to the market's growth.

Market Restraints

- Volatility in Raw Material Prices

Volatility in raw material prices, particularly for key inputs like nickel, chromium, and iron ore, acts as a significant restraint on the Global Flat-Rolled Stainless Steel Market. Fluctuations driven by geopolitical tensions, supply chain disruptions, and mining regulations can inflate production costs by 10-20%, squeezing profit margins for manufacturers and deterring new investments. For instance, recent global events have led to unpredictable price spikes, making it challenging for companies to maintain stable pricing strategies and competitiveness, especially in price-sensitive regions like Asia-Pacific. This restraint also exacerbates the impact of economic downturns, potentially slowing market growth.

Social Economic Impact On Flat-Rolled Stainless Steel Market

The flat-rolled stainless steel market has played a vital socio-economic role by supporting industries such as construction, automotive, infrastructure, and telecommunications, creating jobs, driving innovation, and enabling sustainable urban development. Pre-COVID-19, the market grew steadily with strong demand from manufacturing and infrastructure projects, while the pandemic caused temporary supply chain disruptions and reduced industrial output. Post-COVID-19, recovery was marked by accelerated investments in automation, telecom infrastructure, and green construction, which reignited demand for stainless steel, strengthened domestic production capabilities, and enhanced resilience in global supply chains, ultimately contributing to economic growth and industrial modernization.

Segmental Analysis

- Cold-Rolled Flat-Rolled Stainless Steel Segment is Expected to Witness Significant Growth Over the Forecasted Period

The cold-rolled flat-rolled stainless steel segment is projected to experience significant growth due to its superior surface finish, precise thickness, and excellent mechanical properties, making it highly desirable for automotive, appliance, and construction applications. Increasing demand for lightweight, high-strength materials in automotive manufacturing to improve fuel efficiency is a key driver. Technological advancements in cold-rolling processes are also enhancing product quality and expanding its use. Additionally, rising urbanization and industrialization, especially in Asia-Pacific, stimulate demand for cold-rolled stainless steel products in infrastructure development and appliance manufacturing. This segment’s growth is further supported by trends emphasizing sustainability and resource efficiency in production.

- Construction Segment is Expected to Witness Significant Growth Over the Forecasted Period

The construction segment is expected to witness robust growth due to increasing infrastructure development, residential, and commercial building activities worldwide. Stainless steel’s durability, corrosion resistance, and aesthetic appeal make it a preferred material for roofing, cladding, wall panels, ceilings, and structural components. Government investments in public infrastructure projects and urbanization in emerging economies enhance demand in this sector. In addition, stainless steel facilitates low maintenance costs and sustainability, aligning with growing regulatory focus on green building practices. The construction sector’s rising use of flat-rolled stainless steel to meet stringent safety and environmental standards drives this segment’s expansion over the forecast period.

- Asia Pacific Region Segment is Expected to Witness Significant Growth Over the Forecasted Period

The Asia-Pacific region is expected to witness significant growth in the global flat-rolled stainless steel market during the forecasted period. This region, particularly countries like China and India, is a major contributor to the market's growth, driven by rapid industrialization, urbanization, and the expansion of key end-use industries, such as automotive, construction, and consumer goods. The region's large population, growing middle-class, and increasing investments in infrastructure development projects are fueling the demand for flat-rolled stainless steel products.

Additionally, the region's favorable economic policies, including incentives and support for domestic manufacturing, are encouraging the establishment of new production facilities and the expansion of existing ones, further boosting the market's growth potential. Manufacturers are strategically positioning themselves in the Asia-Pacific region to capitalize on the growing opportunities and meet the region's increasing demand for high-quality, durable, and corrosion-resistant flat-rolled stainless steel solutions across various industries.

To Learn More About This Report - Request a Free Sample Copy

Flat-Rolled Stainless Steel Market Competitive Landscape:

The competitive landscape of the flat-rolled stainless steel market is dominated by several global steel giants, including ArcelorMittal, Acerinox S.A., Outokumpu Oyj, Nippon Steel Corporation, and POSCO. These companies lead the market by leveraging extensive product portfolios, advanced production technologies, and strong R&D capabilities focused on innovation and sustainability. ArcelorMittal emphasizes diverse stainless steel grades and sustainable processes, while Acerinox is known for operational efficiency and broad global distribution. Outokumpu prioritizes environmentally responsible production, and Nippon Steel excels in technological advancement and alloy development. POSCO invests in modern facilities and joint ventures to expand capacity, particularly in Asia. The market remains highly competitive as companies continuously enhance product quality, production efficiency, and sustainability to capture growing demand driven by infrastructure, automotive, and construction sectors.

Here are the 10 major players in the global flat-rolled stainless steel market:

- ArcelorMittal

- Outokumpu

- Acerinox

- Aperam

- Tsingshan Holding Group

- Nucor Corporation

- ThyssenKrupp AG

- POSCO

- Jindal Stainless

- Hyundai Steel Company

Recent Developments:

- In June 2025, Salem Steel Plant, a unit of SAIL, Hon’ble Union Minister for Steel and Heavy Industries, Shri H.D. Kumaraswamy, was formally welcomed by the district administration and plant officials with a Guard of Honour, followed by a symbolic sapling plantation to emphasize the government’s commitment to sustainable industrial practices. This visit underscored the strategic importance of the Salem facility in strengthening India’s stainless steel ecosystem. For the flat-rolled stainless steel market, the engagement signaled strong policy support for expanding domestic production capacity, driving sustainability, and enhancing global competitiveness. Such government backing positively influenced industry sentiment, encouraging further investments, innovation, and long-term growth in flat-rolled stainless steel manufacturing.

- In November 2024, Kametstal expanded its product range at rolling mill 400/200 by introducing rebar with cross sections of 9.5 mm and 11.5 mm, alongside the standard 10- and 12-mm profiles, catering to the construction of housing and infrastructure in Ukraine. These non-standard sizes allowed customers to optimize metal consumption while maintaining structural strength. This development had a positive impact on the flat-rolled stainless steel market, as it highlighted growing innovation in rolled steel products to meet construction demands. The move reinforced the role of advanced rolling technologies in driving efficiency, strengthening supply chains, and supporting growth in construction-driven stainless steel demand. @@

Frequently Asked Questions (FAQ) :

Q1. What the main growth driving factors for this market?

The flat-rolled stainless steel market growth is driven by rising demand from automotive, construction, and consumer goods industries due to stainless steel’s durability, corrosion resistance, and aesthetic appeal. Technological advancements in production and a growing focus on sustainability further boost market expansion. Increasing vehicle production and infrastructure development in emerging economies also drive demand.

Q2. What are the main restraining factors for this market?

Market growth faces challenges from corrosion issues, relatively high raw material costs, and increasing substitution by lighter alternative materials like aluminum and plastics, especially in automotive manufacturing. Regional supply chain disruptions and fluctuating prices of key raw materials like chromium and nickel pose additional restraints.

Q3. Which segment is expected to witness high growth?

The cold-rolled flat-rolled stainless steel segment is expected to witness the highest growth during the forecast period. The superior surface finish, enhanced mechanical properties, and increased applications in the automotive, consumer goods, and construction industries are driving the demand for cold-rolled stainless steel products.

Q4. Who are the top major players for this market?

The major players in the global flat-rolled stainless steel market include ArcelorMittal, Outokumpu, Acerinox, Aperam, and Tsingshan Holding Group. These companies are known for their extensive production capabilities, technological expertise, and global distribution networks, which allow them to maintain their market dominance.

Q5. Which country is the largest player?

China is the largest player in the global flat-rolled stainless steel market. The country's rapidly growing manufacturing and construction sectors, combined with its significant investments in infrastructure development and the expansion of the automotive industry, have made it a major contributor to the overall market growth.

List of Figures

Figure 1: Global Flat-Rolled Stainless Steel Market Revenue Breakdown (USD Billion, %) by Region, 2023 & 2030

Figure 2: Global Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 3: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 4: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 5: Global Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 6: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 7: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 8: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 9: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 10: Global Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 11: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 12: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 13: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 14: Global Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 15: Global Flat-Rolled Stainless Steel Market Value (USD Billion), by Region, 2023 & 2030

Figure 16: North America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 17: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 18: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 19: North America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 20: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 21: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 22: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 23: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 24: North America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 25: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 26: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 27: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 28: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 29: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by U.S., 2018-2030

Figure 30: North America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Canada, 2018-2030

Figure 31: Latin America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 32: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 33: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 34: Latin America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 35: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 36: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 37: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 38: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 39: Latin America Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 40: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 41: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 42: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 43: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 44: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Brazil, 2018-2030

Figure 45: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Mexico, 2018-2030

Figure 46: Latin America Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Rest of Latin America, 2018-2030

Figure 47: Europe Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 48: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 49: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 50: Europe Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 51: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 52: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 53: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 54: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 55: Europe Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 56: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 57: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 58: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 59: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 60: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by U.K., 2018-2030

Figure 61: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Germany, 2018-2030

Figure 62: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by France, 2018-2030

Figure 63: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Italy, 2018-2030

Figure 64: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Spain, 2018-2030

Figure 65: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Russia, 2018-2030

Figure 66: Europe Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Rest of Europe, 2018-2030

Figure 67: Asia Pacific Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 68: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 69: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 70: Asia Pacific Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 71: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 72: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 73: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 74: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 75: Asia Pacific Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 76: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 77: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 78: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 79: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 80: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by China, 2018-2030

Figure 81: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by India, 2018-2030

Figure 82: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Japan, 2018-2030

Figure 83: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Australia, 2018-2030

Figure 84: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Southeast Asia, 2018-2030

Figure 85: Asia Pacific Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Rest of Asia Pacific, 2018-2030

Figure 86: Middle East & Africa Flat-Rolled Stainless Steel Market Value Share (%), By Segment 1, 2023 & 2030

Figure 87: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 88: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 89: Middle East & Africa Flat-Rolled Stainless Steel Market Value Share (%), By Segment 2, 2023 & 2030

Figure 90: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 91: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 92: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 93: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 94: Middle East & Africa Flat-Rolled Stainless Steel Market Value Share (%), By Segment 3, 2023 & 2030

Figure 95: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 1, 2018-2030

Figure 96: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 2, 2018-2030

Figure 97: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Sub-Segment 3, 2018-2030

Figure 98: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Others, 2018-2030

Figure 99: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by GCC, 2018-2030

Figure 100: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by South Africa, 2018-2030

Figure 101: Middle East & Africa Flat-Rolled Stainless Steel Market Forecast (USD Billion), by Rest of Middle East & Africa, 2018-2030

List of Tables

Table 1: Global Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 2: Global Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 3: Global Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 4: Global Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Region, 2018-2030

Table 5: North America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 6: North America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 7: North America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 8: North America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 9: Europe Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 10: Europe Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 11: Europe Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 12: Europe Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 13: Latin America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 14: Latin America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 15: Latin America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 16: Latin America Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 17: Asia Pacific Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 18: Asia Pacific Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 19: Asia Pacific Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 20: Asia Pacific Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Table 21: Middle East & Africa Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 1, 2018-2030

Table 22: Middle East & Africa Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 2, 2018-2030

Table 23: Middle East & Africa Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Segment 3, 2018-2030

Table 24: Middle East & Africa Flat-Rolled Stainless Steel Market Revenue (USD Billion) Forecast, by Country, 2018-2030

Research Process

Data Library Research are conducted by industry experts who offer insight on

industry structure, market segmentations technology assessment and competitive landscape (CL), and penetration, as well as on emerging trends. Their analysis is based on primary interviews (~ 80%) and secondary research (~ 20%) as well as years of professional expertise in their respective industries. Adding to this, by analysing historical trends and current market positions, our analysts predict where the market will be headed for the next five years. Furthermore, the varying trends of segment & categories geographically presented are also studied and the estimated based on the primary & secondary research.

In this particular report from the supply side Data Library Research has conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager

and SOFT) of the companies that active & prominent as well as the midsized organization

FIGURE 1: DLR RESEARH PROCESS

Primary Research

Extensive primary research was conducted to gain a deeper insight of the market and industry performance. The analysis is based on both primary and secondary research as well as years of professional expertise in the respective industries.

In addition to analysing current and historical trends, our analysts predict where the market is headed over the next five years.

It varies by segment for these categories geographically presented in the list of market tables. Speaking about this particular report we have conducted primary surveys (interviews) with the key level executives (VP, CEO’s, Marketing Director, Business Development Manager and many more) of the major players active in the market.

Secondary Research

Secondary research was mainly used to collect and identify information useful for the extensive, technical, market-oriented, and Friend’s study of the Global Extra Neutral Alcohol. It was also used to obtain key information about major players, market classification and segmentation according to the industry trends, geographical markets, and developments related to the market and technology perspectives. For this study, analysts have gathered information from various credible sources, such as annual reports, sec filings, journals, white papers, SOFT presentations, and company web sites.

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the size of the Global market and to estimate the size of various other dependent submarkets in the overall Extra Neutral Alcohol. The key players in the market were identified through secondary research and their market contributions in the respective geographies were determined through primary and secondary research.

Forecast Model